TLDR

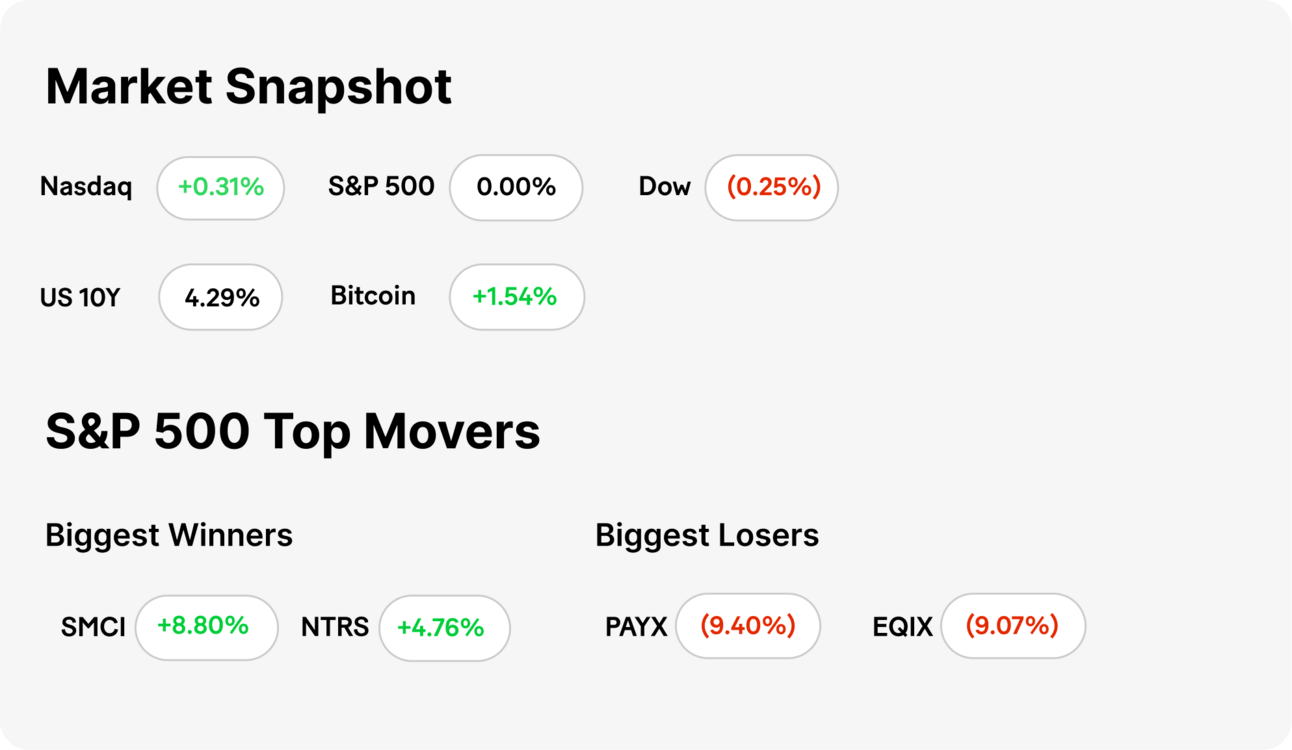

MARKET RECAP → Markets were mixed today as the S&P and Dow slightly pulled back while the Nasdaq edged higher, staying near record levels. Oil prices stabilized after this week’s sharp drop, helping ease some inflation concerns. Bitcoin (BTC) extended its rally, reflecting continued risk-on sentiment as geopolitical tensions remain subdued.

RENT FREEZE RIPPLES → Flagstar Bank fell 6% after a pro-rent-freeze progressive won a key NYC primary, sparking fears over tighter rent laws and pressure on landlords—and the banks that finance them.

TOKENIZED SPACEX HITS MAIN STREET → Blockchain startup Republic lets investors buy tokens tied to SpaceX shares. It’s a bold move for private market access—but with big risks and no voting rights.

Was this email forwarded to you? Sign up for free here.

POLL OF THE DAY

Do you think the Fed should cut rates next month?

Finance

Rent Freeze Ripples

source DALL-E

Flagstar takes a hit on NYC fears: Shares of Flagstar Bank dropped over 6% after New York Assembly member Zohran Mamdani, a vocal advocate of rent freezes and tenant protections, won his primary. Investors are worried that his win signals broader support for progressive housing policies that could dent landlords' rental income—and thus banks' mortgage portfolios.

Real estate exposure gets political: Flagstar’s heavy involvement in New York City’s multifamily lending market makes it especially sensitive to regulatory shifts. Analysts flagged the potential risk of lower rent growth, which would threaten landlords' debt service coverage and the bank’s bottom line.

Broader signal for rent policy impact: While Mamdani’s primary win doesn’t directly change state housing policy, it’s seen as a bellwether for growing momentum behind tenant-friendly legislation. For banks like Flagstar with concentrated exposure to rent-regulated markets, that trend is now priced in with a sharp re-rating.

Crypto

Tokenized SpaceX Hits Main Street

source DALL-E

Blockchain Meets SpaceX: Investing platform Republic is letting everyday investors buy tokenized shares of SpaceX via blockchain. The offering taps shares held by insiders and private funds, breaking a major barrier to one of the most sought-after private companies in the world.

How It Works: The token represents indirect ownership—investors don’t get voting rights or direct equity but own a piece of a fund that holds SpaceX shares. Republic uses blockchain for transaction transparency, fractional ownership, and faster settlement.

Big Risks, Big Dreams: While this democratizes access to private markets, liquidity remains limited. Tokens are tradable on certain secondary markets, but pricing can be volatile, and regulatory scrutiny could intensify. Still, it’s a step toward opening up private equity for retail.

KEEP READING

Nvidia shares hit record as Wall Street shrugs off China concerns (CNBC)

Trump fumes over U.S. intelligence report on Iran strikes at NATO presser (CNBC)

Sales of new homes tanked in May, pushing supply up to a 3-year high (CNBC)

Why BlackRock’s Rick Rieder is confident in equites in the second half as S&P 500 nears high (CNBC)

BP shares rise on takeover speculation; Shell denies (CNBC)

What is a Money Order? How a Money Order Works (ML)

WHAT WE’RE WATCHING

OUR FAVORITE TOOLS & RESOURCES

Deribit — Crypto Futures and Options Exchange

Generated Assets — Turn any idea into an investable index

Polymarket — The world’s largest prediction market

Unusual Whales — Companion for uncovering unusual market activity

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

CME FedWatch Tool — Market-implied probabilities of future levels of interest rates

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

ChatGPT — Large language model-based chatbot powered by generative AI

Vimcal — Lightning-fast calendar and AI scheduling assistant

AltIndex — Alternative datasets to uncover unique insights

WE WANT YOUR FEEDBACK

How would you rate today's newsletter?

Investment advisory services provided by ML Wealth LLC. Investment Accounts Are Not FDIC Insured • No Bank Guarantee • Investments May Lose Value. For important information and disclosures relating to the MoneyLion Investment Account, see Investment FAQs, Form ADV Brochure, and moneylion.com/investing. Funded managed investing accounts are subject to a monthly account fee of $1 (for accounts valued up to $5,000), $3 (for accounts valued over $5,000, and up to $25,000), or $5 (for accounts valued over $25,000).

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.