TLDR

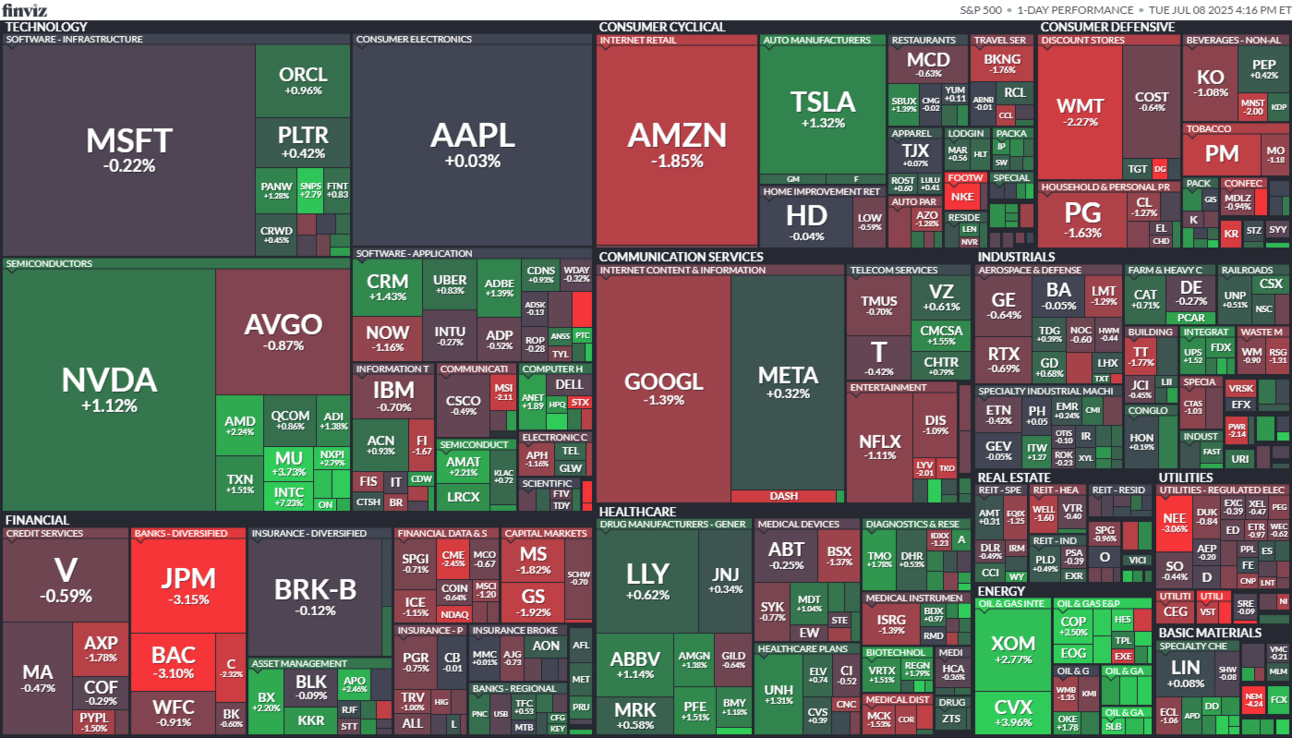

MARKET RECAP → Markets were mixed, seeing little movement on Tuesday, as investors had trouble deciphering recent signals from President Trump on trade. Investors are waiting for further clarification as many expect the finalized tariffs to not be as strict as initially threatened.

COPPER TARIFF SHOCKWAVE → Trump plans a 50% copper tariff, spiking prices and aiming to boost U.S. mines, though benefits are expected to be delayed and potentially inflationary.

TOKENIZED STOCKS, NOT A THREAT → Robinhood’s CEO shrugged off concerns about OpenAI disrupting the brokerage model, calling tokenized stocks more buzz than threat. The firm believes it's already offering most of the same benefits, and with clearer regulation.

Was this email forwarded to you? Sign up for free here.

A MESSAGE FROM OUR PARTNER

Learn AI in 5 minutes a day

This is the easiest way for a busy person wanting to learn AI in as little time as possible:

Sign up for The Rundown AI newsletter

They send you 5-minute email updates on the latest AI news and how to use it

You learn how to become 2x more productive by leveraging AI

POLL OF THE DAY

Market Forecast: Summer Volatility

Politics

Copper Tariff Shockwave

source DALL-E

Boost to U.S. Copper Market: President Trump has proposed imposing a hefty 50% tariff on copper imports, aiming to boost domestic production and protect national security, variants of his ongoing Section 232 trade reviews. Copper futures surged approximately 10–12%, reflecting investor expectations.

Market Impact & Price Surge: Copper prices have already hit record highs in 2025, up roughly 26% year‑to‑date, as markets braced for tariff action. The prospect of a 50% tariff further tightens supply, inflating costs for industries reliant on the metal.

Long Game for Domestic Production: Tariffs may accelerate U.S. copper output but not quickly or cheaply. New mines take years to develop, and higher prices may lead to inflation elsewhere. Analysts warn benefits could take “years” and come with economic trade‑offs.

Tech

Tokenized Stocks, Not a Threat

source DALL-E

Robinhood’s CEO isn’t sweating OpenAI: Vlad Tenev dismissed speculation that OpenAI-backed startups could disrupt retail investing via tokenized stocks, saying the technology doesn’t pose an “existential threat” to Robinhood (HOOD). He also downplayed concerns over legal gray areas, noting any real-world impact is “overhyped.”

Tokenization is already baked in: Tenev said Robinhood is already ahead of the curve, with features like 24/5 trading and fractional shares simulating the benefits of tokenization. He emphasized that regulatory clarity is still lacking, implying that crypto-like stock trading platforms face more hype than traction.

OpenAI’s name looms large, but softly: While media buzz links OpenAI to disruptive fintech ambitions, Tenev pointed out that so far, any activity remains experimental. The idea of tokenized equity living on crypto rails may be flashy, but Robinhood sees it as a niche, not a full-fledged revolution.

KEEP READING

Trump threatens to impose up to 200% tariff on pharmaceuticals ‘very soon’ (CNBC)

White House: Odds of tariff-related inflation are low, like ‘pandemics or meteors’ (CNBC)

Here’s what the endowment tax in Trump’s ‘big beautiful bill’ may mean for your college tuition (CNBC)

The Teens Are Taking Waymos Now (Wired)

Circle Stock Has Rallied Hard, But This Analyst Says It’s Now Time to ‘Sell’ (Yahoo Finance)

What is a Money Order? How a Money Order Works (ML)

WHAT WE’RE WATCHING

OUR FAVORITE TOOLS & RESOURCES

Deribit — Crypto Futures and Options Exchange

Generated Assets — Turn any idea into an investable index

Polymarket — The world’s largest prediction market

Unusual Whales — Companion for uncovering unusual market activity

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

CME FedWatch Tool — Market-implied probabilities of future levels of interest rates

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

ChatGPT — Large language model-based chatbot powered by generative AI

Vimcal — Lightning-fast calendar and AI scheduling assistant

AltIndex — Alternative datasets to uncover unique insights

GFR Smart Stock Selector — Filters stocks to help investor choices

WE WANT YOUR FEEDBACK

How would you rate today's newsletter?

Investment advisory services provided by ML Wealth LLC. Investment Accounts Are Not FDIC Insured • No Bank Guarantee • Investments May Lose Value. For important information and disclosures relating to the MoneyLion Investment Account, see Investment FAQs, Form ADV Brochure, and moneylion.com/investing. Funded managed investing accounts are subject to a monthly account fee of $1 (for accounts valued up to $5,000), $3 (for accounts valued over $5,000, and up to $25,000), or $5 (for accounts valued over $25,000).

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.