TLDR

MARKET RECAP → The major averages climbed Thursday, bouncing back after two consecutive days of losses as chip and bank stocks rallied.

💥 AMAZON SAYS ITS SAKS BET IS WORTHLESS → Amazon is fighting Saks Global’s bankruptcy financing, arguing its nearly half-billion-dollar equity stake will be wiped out under the proposed plan, underscoring risks in high-profile retail investments.

🇺🇸 U.S. & TAIWAN SEAL MASSIVE CHIP DEAL → A landmark U.S.–Taiwan semiconductor agreement unlocks roughly $500 B in investment and tariff cuts to build advanced chipmaking in America, reinforcing economic competitiveness and supply-chain strategy amid China’s rise.

Was this email forwarded to you? Sign up for free here.

MARKETS

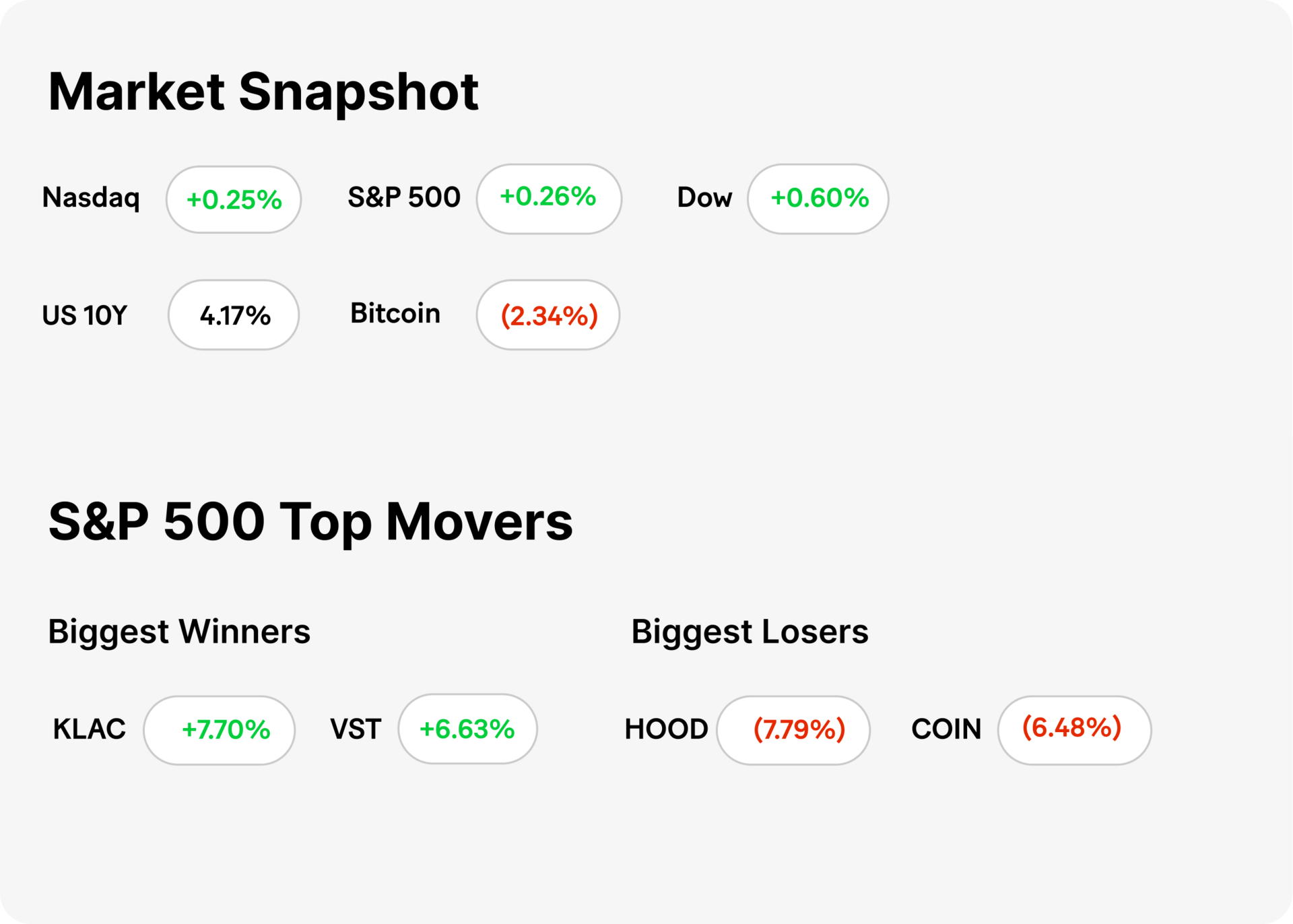

Market Snapshot

Today’s S&P 500 Heatmap

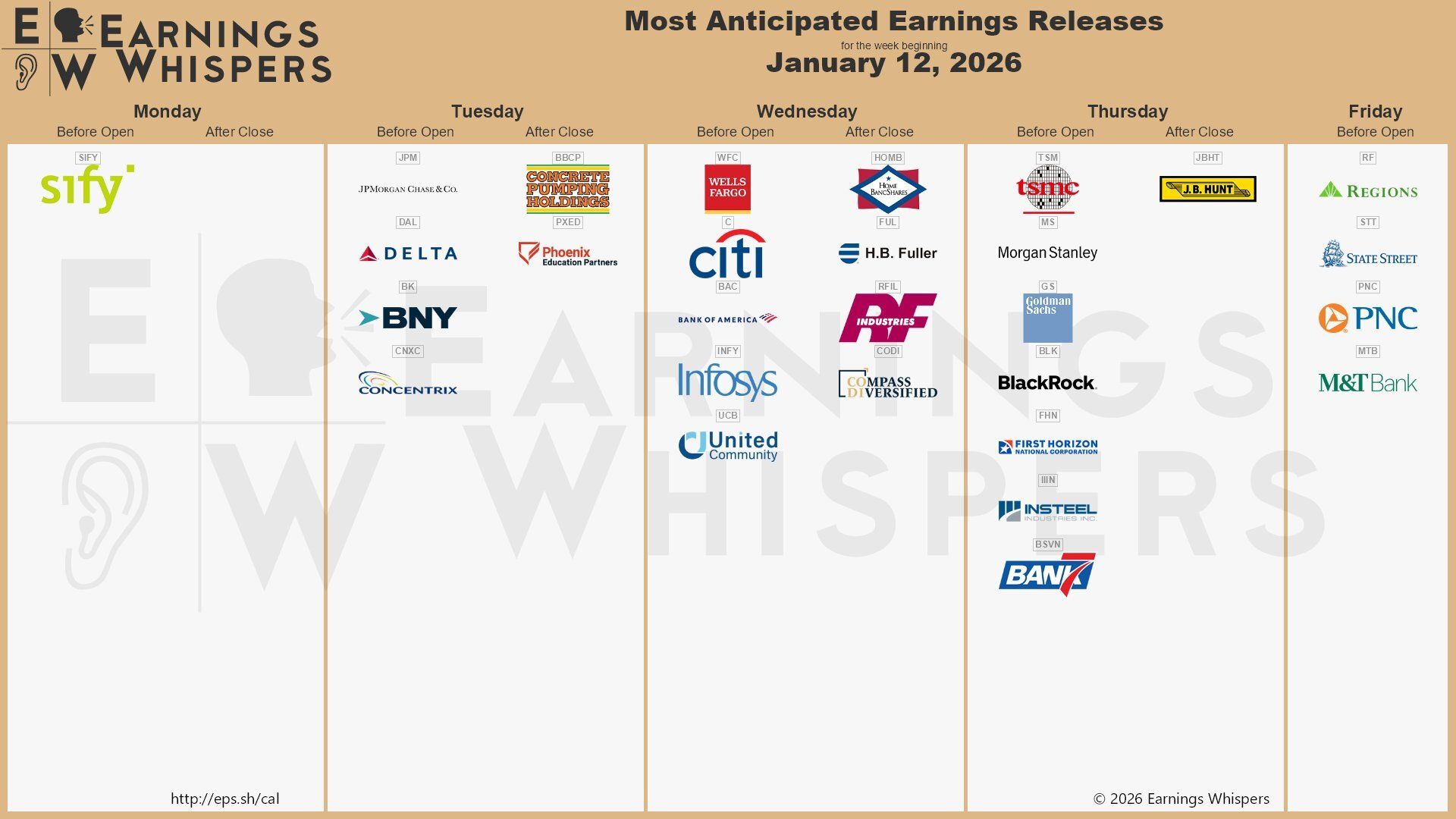

Notable Earnings

For the week beginning January 12, 2026

TECH

Amazon Says Its $475M Saks Stake Is Worthless

Gemini

💼 Amazon blasts Saks bankruptcy plan: Amazon filed an objection in U.S. Bankruptcy Court to Saks Global’s Chapter 11 financing plan, warning that the proposed restructuring would hurt creditors and **render its roughly $475 million investment in the company “presumptively worthless.” The tech and retail giant says the luxury retailer’s strategy has collapsed after years of financial struggle and failed execution.

⚖️ What Amazon objects to: In court filings, Amazon’s legal team argued that the financing arrangement saddles parts of the Saks enterprise with new debt and improperly handles collateral, reducing the recovery value for existing stakeholders that invested in the retailer’s turnaround — including Amazon itself. The objected plan still received initial financing approval from the judge, but legal friction continues.

📉 Broader context for luxury retail: Saks Global — formed after the 2024 acquisition of Neiman Marcus and owner of Saks Fifth Avenue and related luxury banners — has struggled amid debt, inventory issues, and declining sales, ultimately leading to its bankruptcy filing. Amazon’s warning signals how even strategic partnerships with big tech can evaporate when underlying businesses falter.

TECH

U.S. & Taiwan Seal Massive Chip Deal

Gemini

🤝 A $500 B semiconductor pact: The United States and Taiwan reached a sweeping trade and investment agreement focused on semiconductors, under which Taiwanese companies will commit roughly $250 billion in investments in U.S. chipmaking and Taiwan’s government will back another $250 billion in credit. The deal aims to supercharge domestic manufacturing of advanced chips and make the U.S. a more competitive center of AI semiconductor production.

📉 Tariffs cut to cement cooperation: As part of the agreement, tariffs on Taiwanese goods — including chips and related technology products — will be lowered (from around 20 % to 15 %), aligning with recent U.S. trade deals with other major economies. The tariff reduction is designed to encourage long-term capital deployment and incentivize Taiwanese manufacturers to build and expand facilities on American soil.

🌏 Strategic context and China in view: The pact comes amid rising geopolitical tensions with China, which has its own ambitions in semiconductors and AI. Strengthening U.S.–Taiwan chip production is seen by policymakers as both economic strategy and a security move, reinforcing supply-chain resilience and reducing dependence on China-linked routes into key technology markets.

KEEP READING

This pharma stock just got whacked — there’s still a major catalyst ahead (CNBC)

We’re raising our price target on Goldman Sachs after strong but noisy quarter (CNBC)

Taiwan will invest $250 billion in U.S. chipmaking under new trade deal (CNBC)

WHAT WE’RE WATCHING

Tools & Resources

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

AltIndex — Alternative datasets to uncover unique insights

GFR Smart Stock Selector — Filters stocks to help investor choices

WE WANT YOUR FEEDBACK

How would you rate today's newsletter?

Investment advisory services provided by ML Wealth LLC. Investment Accounts Are Not FDIC Insured • No Bank Guarantee • Investments May Lose Value. For important information and disclosures relating to the MoneyLion Investment Account, see Investment FAQs, Form ADV Brochure, and moneylion.com/investing. Funded managed investing accounts are subject to a monthly account fee of $1 (for accounts valued up to $5,000), $3 (for accounts valued over $5,000, and up to $25,000), or $5 (for accounts valued over $25,000).

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.