TLDR

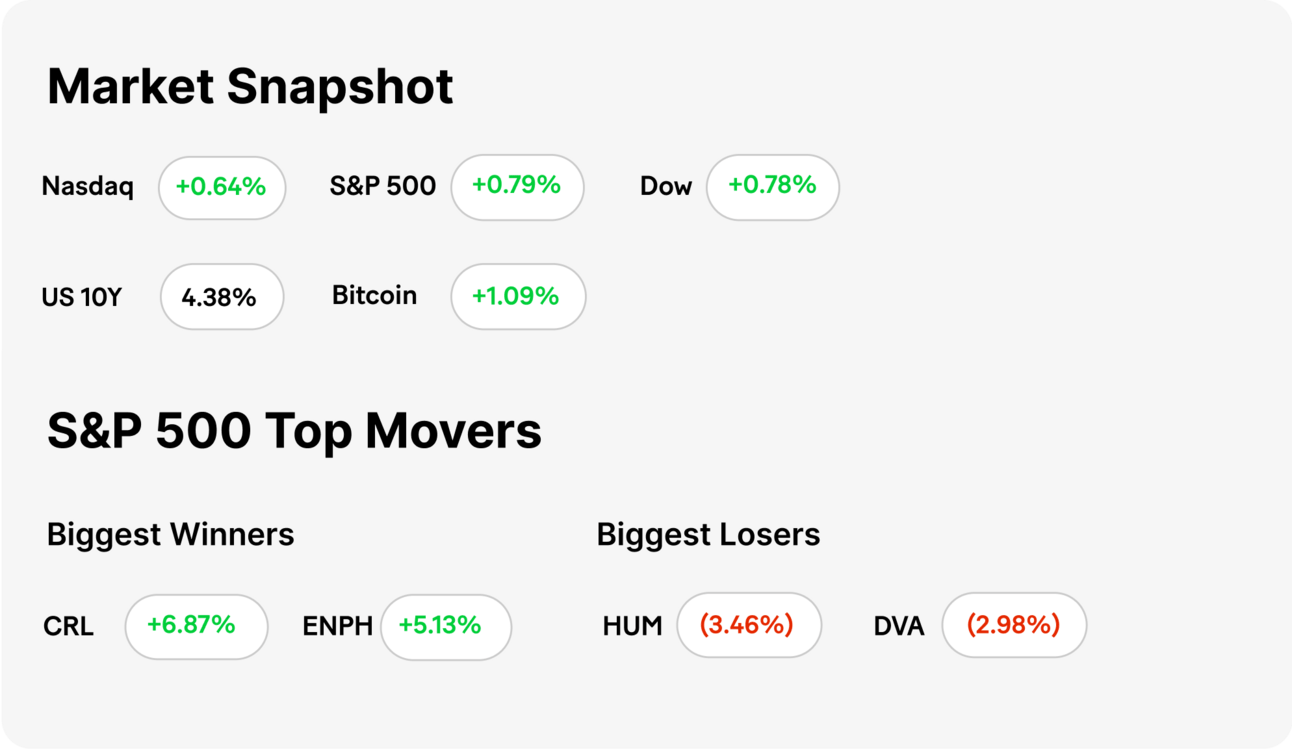

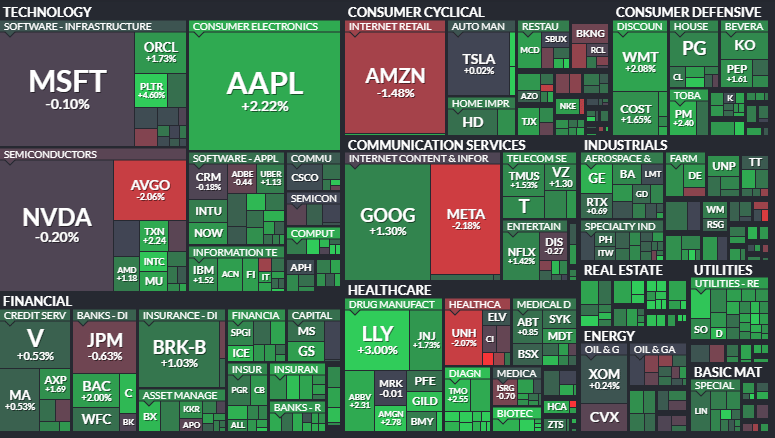

MARKET RECAP → Stocks ticked higher in a volatile Monday session, lifted by a tech rally after President Donald Trump unexpectedly granted a tariff exemption.

MORE THAN 60% OF CEOS EXPECT A RECESSION IN THE NEXT 6 MONTHS →📉 CEOs sounded the alarm, with 62% now bracing for a recession—thanks to tariff chaos, rising costs, and profit expectations that just fell off a cliff.

BILLIONAIRE RAY DALIO: ‘I’M WORRIED ABOUT SOMETHING WORSE THAN A RECESSION’ → 📉 Ray Dalio said Trump’s tariff chaos and rising U.S. debt could spark a breakdown in the global monetary system—something far messier than a plain old recession.

Was this email forwarded to you? Sign up for free here.

Earn rewards by referring friends. Scroll to the bottom to learn more! 👇

TODAY’S TOP NEWS

More Than 60% Of CEOs Expect A Recession In The Next 6 Months

📉 Recession radar was flashing red: A new Chief Executive survey showed 62% of CEOs expected a recession within six months, up sharply from 48% in March—fueled by Trump’s tariff drama and market volatility.

💸 Tariffs spooked the C-suite: Around 75% of surveyed execs said Trump’s import duties would hurt their business this year, with half expecting double-digit cost hikes. Only 37% expected profits to rise—a steep fall from 76% in January.

📊 Outlook hit pandemic-era lows: CEO confidence in current business conditions dropped 9% in April to levels not seen since 2020. A slim majority still expected conditions to improve over the next year, boosted by temporary tariff exemptions for some tech imports.

TODAY’S TOP NEWS

Billionaire Ray Dalio: ‘I’m Worried About Something Worse Than A Recession’

📉 Sounding the alarm: Ray Dalio warned that Trump’s tariff policies, rising U.S. debt, and a shift from multilateralism could spark a breakdown in the global monetary system, not just a recession. He stressed the world is moving toward a “unilateral order” marked by greater conflict and instability.

🧨 Policy problems piling up: While Dalio agreed with the need to address trade imbalances, he criticized the execution, saying Trump’s aggressive approach has been “very disruptive.” The patchy rollout of tariffs — including a last-minute partial exemption for Chinese electronics — only added to the uncertainty.

💣 Bigger than '08?: Dalio argued the U.S. is approaching a tipping point — with debt outpacing demand and trust in money eroding. If Congress doesn’t cut the deficit and policymakers fail to coordinate globally, he said the next shock could make the 2008 financial crisis look tame.

KEEP READING

Pfizer scraps daily weight loss pill after liver injury in one patient (CNBC)

Webull Shares Jump 375% in Second Session After SPAC Merger (Bloomberg - Paywall)

Suspect charged in overnight arson at Pennsylvania Gov. Josh Shapiro’s residence (CNBC)

Why Trump’s nuclear talks with Iran could be far more successful than Biden’s (CNBC)

Will You Get a $1,400 Tax Stimulus Check? Here’s What You Need to Know (ML)

Trump Tariffs Explained: Your Complete 2025 Guide (ML)

Why You’ll Love the Money Master Challenge – Your Daily Finance Game! (ML)

WHAT WE’RE WATCHING

OUR FAVORITE TOOLS & RESOURCES

Polymarket — The world’s largest prediction market

Unusual Whales — Companion for uncovering unusual market activity

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

CME FedWatch Tool — Market-implied probabilities of future levels of interest rates

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

ChatGPT — Large language model-based chatbot powered by generative AI

Vimcal — Lightning-fast calendar and AI scheduling assistant

REFERRAL PROGRAM

WE WANT YOUR FEEDBACK

How would you rate today's newsletter?

Investment advisory services provided by ML Wealth LLC. Investment Accounts Are Not FDIC Insured • No Bank Guarantee • Investments May Lose Value. For important information and disclosures relating to the MoneyLion Investment Account, see Investment FAQs, Form ADV Brochure, and moneylion.com/investing. Funded managed investing accounts are subject to a monthly account fee of $1 (for accounts valued up to $5,000), $3 (for accounts valued over $5,000, and up to $25,000), or $5 (for accounts valued over $25,000).

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.