TLDR

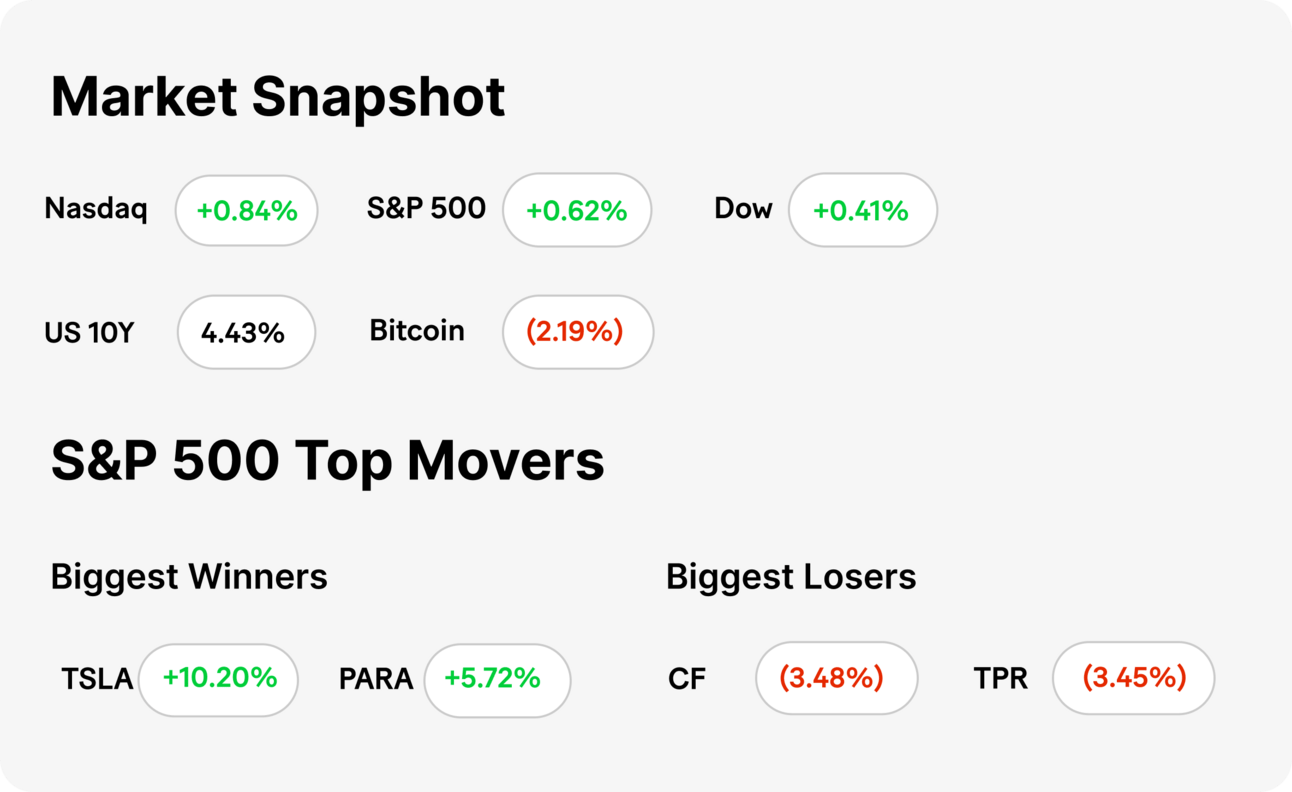

MARKET RECAP → Stocks climbed on Tuesday after Federal Reserve Chair Jerome Powell acknowledged progress on inflation but emphasized that the central bank is not yet ready to cut rates.

EUROZONE INFLATION UPDATE → 📈 Eurozone inflation hit 2.6% in June 2024, up from 2.4% in May, driven by rising food and service prices, hinting at a cautious stance from the European Central Bank on interest rates.

TREASURY YIELDS TAKE CENTER STAGE →📊 Investors saw U.S. Treasury yields rise as Powell’s hawkish tone hinted no rate cuts soon, sending stocks and futures on a rollercoaster.

Was this email forwarded to you? Sign up for free here.

TODAY’S TOP NEWS

Eurozone Inflation Update

📈 Inflation Edges Up: Eurozone inflation reached 2.6% in June 2024, slightly higher than May's 2.4%. This was a modest increase but enough to stir the economic pot, keeping analysts on their toes.

🍞 Food and Services Drive Costs: Key contributors to the inflation uptick included food, alcohol, tobacco, and services. These categories saw the highest price rises, indicating consumers felt the pinch more acutely at the grocery store and in service-related expenses.

🏦 Interest Rate Implications: The persistent inflation rate suggested that the European Central Bank might maintain its cautious stance on interest rate adjustments. This indicated a watchful approach to ensure inflation didn't spiral while keeping an eye on economic stability

TODAY’S TOP NEWS

Treasury Yields Take Center Stage

📈 Yields on the Rise: Investors watched U.S. Treasury yields increase, influenced by economic data and Federal Reserve Chair Jerome Powell's hawkish stance on interest rates. The 10-year note climbed to 4.125%, signaling market expectations of higher rates ahead.

📉 Powell's Impact: Powell's recent remarks suggested no immediate rate cuts, reinforcing the Fed's commitment to controlling inflation. This stance drove short-term yields up, reflecting cautious investor sentiment.

📊 Market Reactions: The rise in yields affected stock market dynamics, with futures dipping and investors reassessing their strategies. The interplay between economic indicators and Fed policy continued to shape market movements.

NOTABLE POSTS

KEEP READING

History suggests bitcoin will likely hit a new all-time high this year, report says (CNBC)

NFL, RedBird joint venture EverPass lines up ‘Sunday Ticket’ streaming in bars, restaurants (CNBC)

Greece becomes first EU country to introduce a six-day working week (CNBC)

Inside the school that teaches big name brands how to make ice cream (CNBC)

Thousands of homeowners are about to get slammed with higher monthly payments (CNN)

WHAT WE’RE WATCHING

OUR FAVORITE TOOLS & RESOURCES

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

CME FedWatch Tool — Market-implied probabilities of future levels of interest rates

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

ChatGPT — Large language model-based chatbot powered by generative AI

Notion AI — Notion AI is a writing assistant that can help you write, brainstorm, edit, summarize, and more

Vimcal — Lightning-fast calendar and AI scheduling assistant

The Bull vs. Bear Merchandise Promotion is a limited time campaign that begins on December 1, 2023 at 12:00 AM ET and ends on the date that there are no more Rewards. This Promotion is available to any registered MoneyLion user who is a legal resident of the 50 United States or the District of Columbia and who has reached the age of majority in their state as of the beginning of the Promotional Period. See terms and conditions here.

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.