TLDR

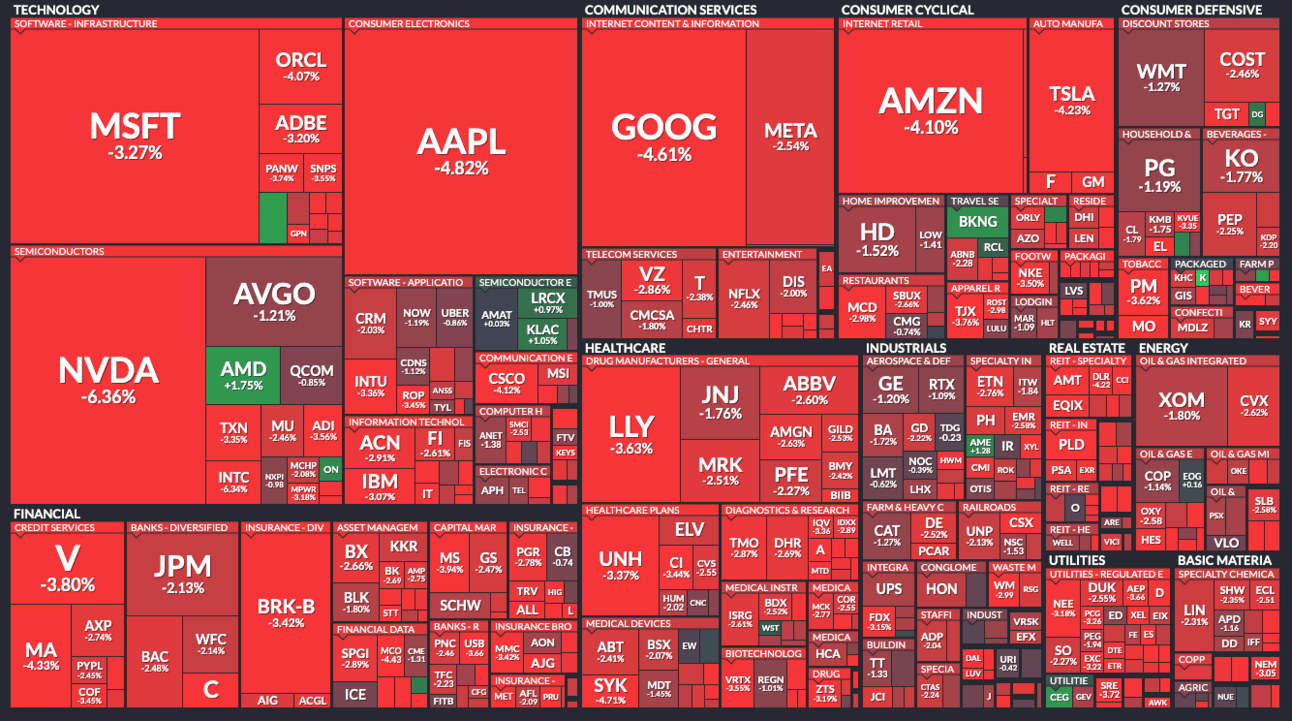

MARKET RECAP → On Monday, stocks experienced a significant drop, with the Dow Jones (DIA) suffering its steepest decline in almost two years. Concerns about the U.S. economy's health triggered a global market sell-off.

FEAR GAUGE SPIKES AGAIN → 📉 The VIX, Wall Street’s “fear gauge,” skyrocketed to its highest since 2020 due to disappointing economic data and COVID-19 fears, reflecting investor anxiety and predicting potential turbulence ahead.

FED'S EMERGENCY RATE CUT CALL → 🚨 Jeremy Siegel predicted value stocks would finally shine once the Fed cut rates, driven by cooling inflation and a looming September rate reduction.

Was this email forwarded to you? Sign up for free here.

TODAY’S TOP NEWS

Fear Gauge Spikes Again

📈 VIX Surge to 2020 Levels: The VIX, Wall Street's famed "fear gauge," surged over 50%, hitting its highest level since June 2020. This spike mirrored the widespread panic across global markets, with significant drops in U.S., European, and Japanese indices.

🌍 Economic Indicators Trigger Volatility: The volatility was driven by disappointing economic indicators, including a weak July payroll report, stoking fears of an impending recession. Analysts from Goldman Sachs and JPMorgan raised their recession odds, anticipating substantial interest rate cuts by the Federal Reserve to counteract the downturn.

💼 Rising Investor Anxiety: The VIX’s leap highlighted investor anxiety over stalled fiscal stimulus measures and rising COVID-19 cases. This increased volatility suggested heightened market uncertainty and potential economic turbulence ahead.

TODAY’S TOP NEWS

Fed's Emergency Rate Cut Call

📉 Market Shift Incoming: Jeremy Siegel believed the stock market was on the brink of a major change, with value stocks set to outperform growth stocks once the Federal Reserve cut rates.

💼 Inflation's Role: Siegel pointed out that cooling inflation data supported an emergency rate cut by September, predicting a 75 basis point reduction to stimulate the economy.

🏛️ Fed's Next Move: With recent inflation trends favoring a cut, Siegel expected the Fed to initiate the rate reduction soon, potentially reversing a long-standing trend of growth stocks leading the market.

KEEP READING

Nvidia, Super Micro Computer lead AI trade carnage with both stocks down more than 12% (CNBC)

Apple shares drop 7% after Warren Buffett’s Berkshire Hathaway slashes stake by half (CNBC)

The Fed is trying to ‘fight a ghost’ as recession fears mount, investor says (CNBC)

Bitcoin drops below $50,000 for the first time since February (CNBC)

Google pulls Olympics ad that showed AI writing a little girl’s letter for her (CNN)

Japanese stocks crash in biggest one-day drop ever as global market rout intensifies (CNN)

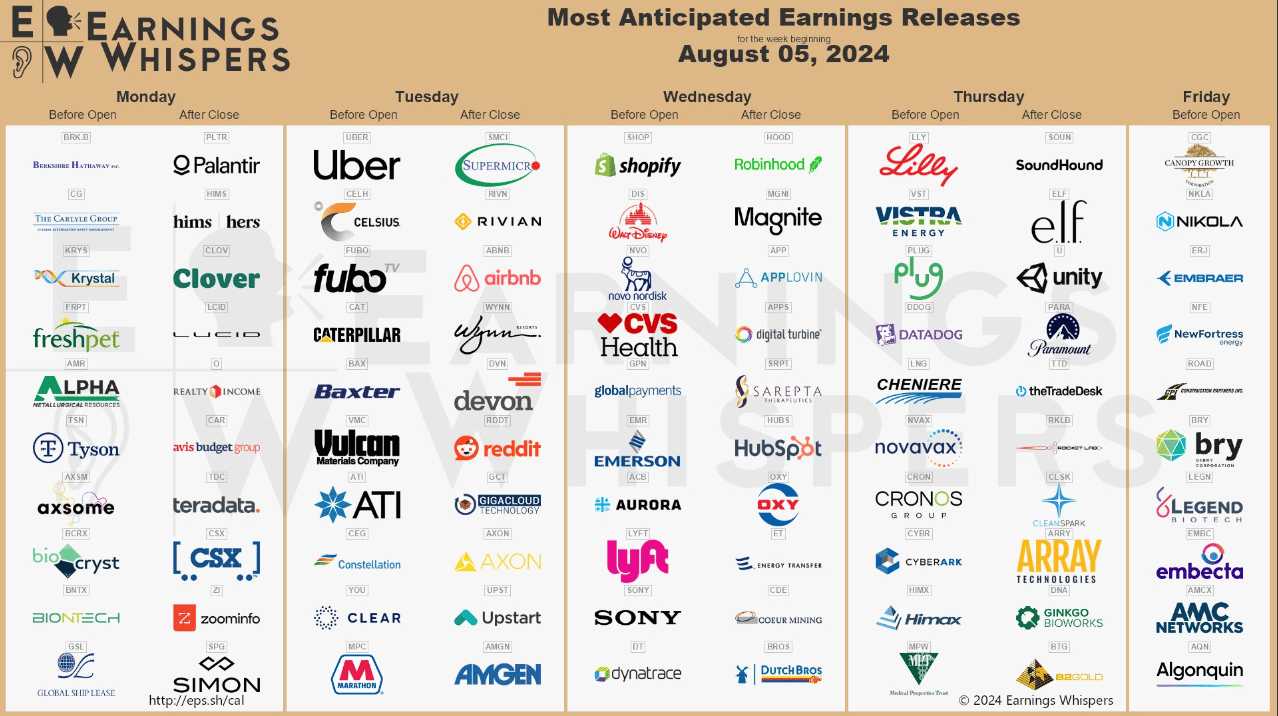

WHAT WE’RE WATCHING

OUR FAVORITE TOOLS & RESOURCES

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

CME FedWatch Tool — Market-implied probabilities of future levels of interest rates

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

ChatGPT — Large language model-based chatbot powered by generative AI

Notion AI — Notion AI is a writing assistant that can help you write, brainstorm, edit, summarize, and more

Vimcal — Lightning-fast calendar and AI scheduling assistant

The Bull vs. Bear Merchandise Promotion is a limited time campaign that begins on December 1, 2023 at 12:00 AM ET and ends on the date that there are no more Rewards. This Promotion is available to any registered MoneyLion user who is a legal resident of the 50 United States or the District of Columbia and who has reached the age of majority in their state as of the beginning of the Promotional Period. See terms and conditions here.

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.