TLDR

MARKET RECAP → The S&P 500 (VOO) finished slightly down on Friday and had a losing week as traders considered President Donald Trump's recent remarks about the Federal Reserve and global politics.

⚖️ TARIFF FIGHT OVER GREENLAND GRAB → Trump floated tariffs on countries that refuse to back U.S. control of Greenland, pushing geopolitical strategy into trade policy and risking broader fallout.

💥 TRUMP DEALS BANKS A BAD HAND → The White House’s idea to cap credit card rates has evolved into a buzzword push (“Trump cards”) and a simmering confrontation with banks and lawmakers, spotlighting the political risk facing financials and credit markets today.

Was this email forwarded to you? Sign up for free here.

MARKETS

Market Snapshot

Today’s S&P 500 Heatmap

Notable Earnings

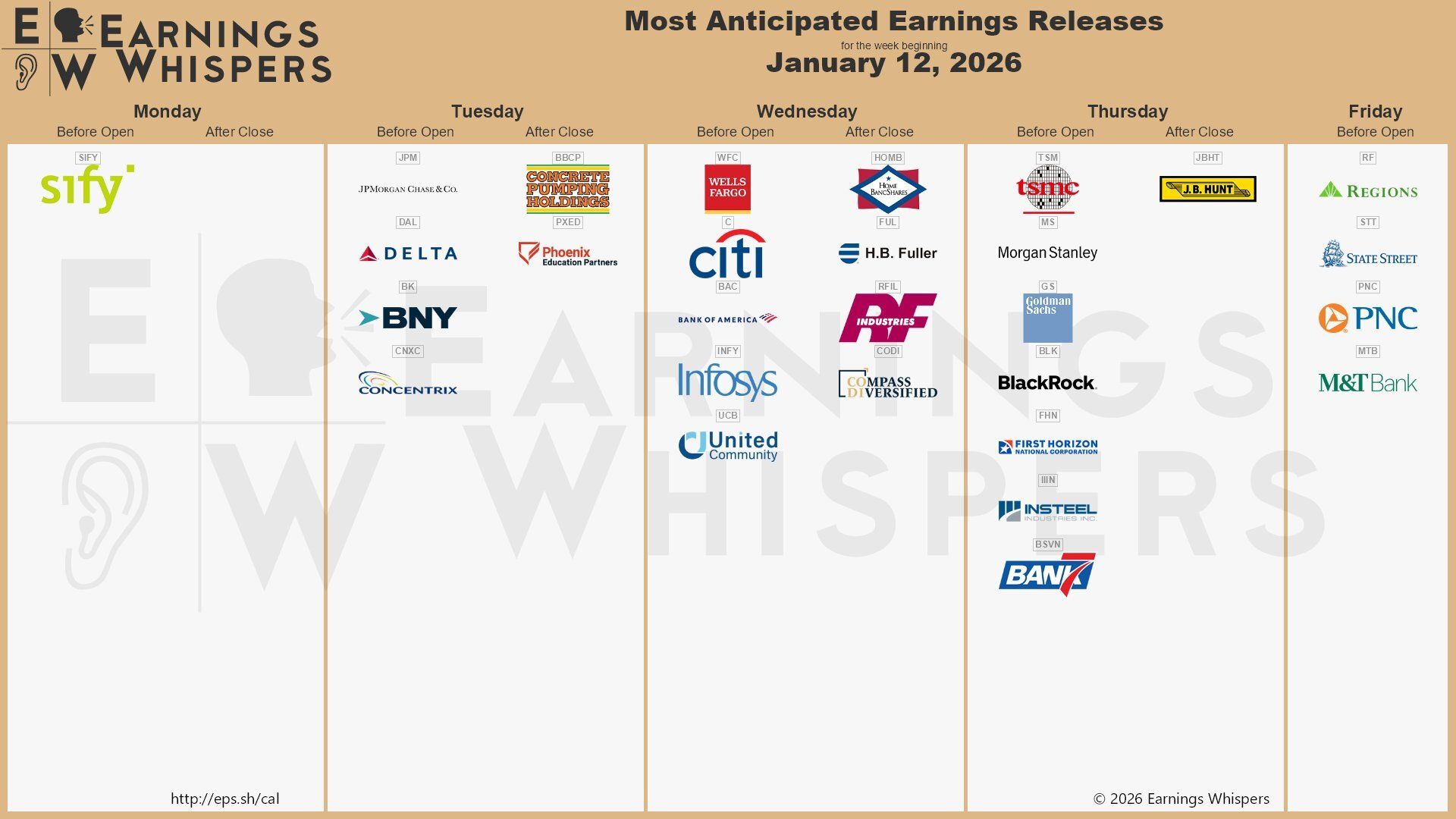

For the week beginning January 12, 2026

FINANCE

White House Shifts Tactics on Credit Cards

Gemini

💳 “Trump Cards” enters the political lexicon: White House economic adviser Kevin Hassett rolled out a nickname — “Trump cards” — for a proposed initiative tied to President Trump’s push to cap credit card interest rates at 10 %. Initially pitched as a direct reform, the plan has faced fierce pushback from major lenders who warn it could force them to close accounts or sharply reduce credit access. In response, the administration is now talking about voluntary bank programs to extend lower-cost cards to underserved Americans.

🏦 Banks and lawmakers push back: Industry groups have been publicly resistant. Banks argue that a mandatory cap would shrink lending and limit consumer borrowing — concerns echoed by lawmakers including Speaker Mike Johnson, who says such a policy would need legislation to be implemented and could carry “negative secondary effects.”

📊 Wall Street nerves and market watch points: The broader financial sector has felt the tremors: credit card issuer stocks have slid as investors price in regulatory risks tied to the proposed cap. Some alternative lenders — like Klarna — have voiced support for the idea, framing it as consumer protection, but most of Wall Street sees potential fallout for credit availability and banking profitability if Trump’s agenda takes shape.

POLITICS

Trump Threatens Tariffs in Greenland Power Play

Gemini

🌍 Trump may punish countries that “don’t go along” with Greenland acquisition push: President Donald Trump said he is considering imposing tariffs on nations that oppose U.S. efforts to control Greenland, framing the Arctic territory as vital for national security and saying he could retaliate against governments that “don’t go along” with Washington’s ambitions. His comments came during a White House event unrelated to trade policy, where he drew parallels with past tariff threats on pharmaceuticals.

🇩🇰 Tensions with Denmark and NATO allies escalate: Trump’s remarks arrive as bipartisan Congressional delegations visit Copenhagen to ease diplomatic tensions. Denmark and Greenland have repeatedly rejected U.S. attempts to assert ownership or sovereignty over the semi-autonomous territory. Danish officials have increased NATO military cooperation in Greenland, underlining the strategic but contentious geopolitics.

📊 Global trade risks and market signals: The suggestion of using tariffs as leverage over sovereign nations introduces fresh geopolitical uncertainty into global trade. Such a move could provoke retaliatory responses, complicate existing trade agreements, and rattle markets that are sensitive to sudden trade policy shifts. Analysts note that invoking tariffs for geopolitical ends — especially on allies — could strain economic relationships and supply chains.

KEEP READING

AI chip trade, Saks’ bankruptcy woes, Trump’s health-care plan and more in Morning Squawk (CNBC)

South Korea’s ex-president Yoon given 5-year jail term in first ruling over martial law (CNBC)

NOTABLE POSTS

WHAT WE’RE WATCHING

Tools & Resources

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

AltIndex — Alternative datasets to uncover unique insights

GFR Smart Stock Selector — Filters stocks to help investor choices

WE WANT YOUR FEEDBACK

How would you rate today's newsletter?

Investment advisory services provided by ML Wealth LLC. Investment Accounts Are Not FDIC Insured • No Bank Guarantee • Investments May Lose Value. For important information and disclosures relating to the MoneyLion Investment Account, see Investment FAQs, Form ADV Brochure, and moneylion.com/investing. Funded managed investing accounts are subject to a monthly account fee of $1 (for accounts valued up to $5,000), $3 (for accounts valued over $5,000, and up to $25,000), or $5 (for accounts valued over $25,000).

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.