TLDR

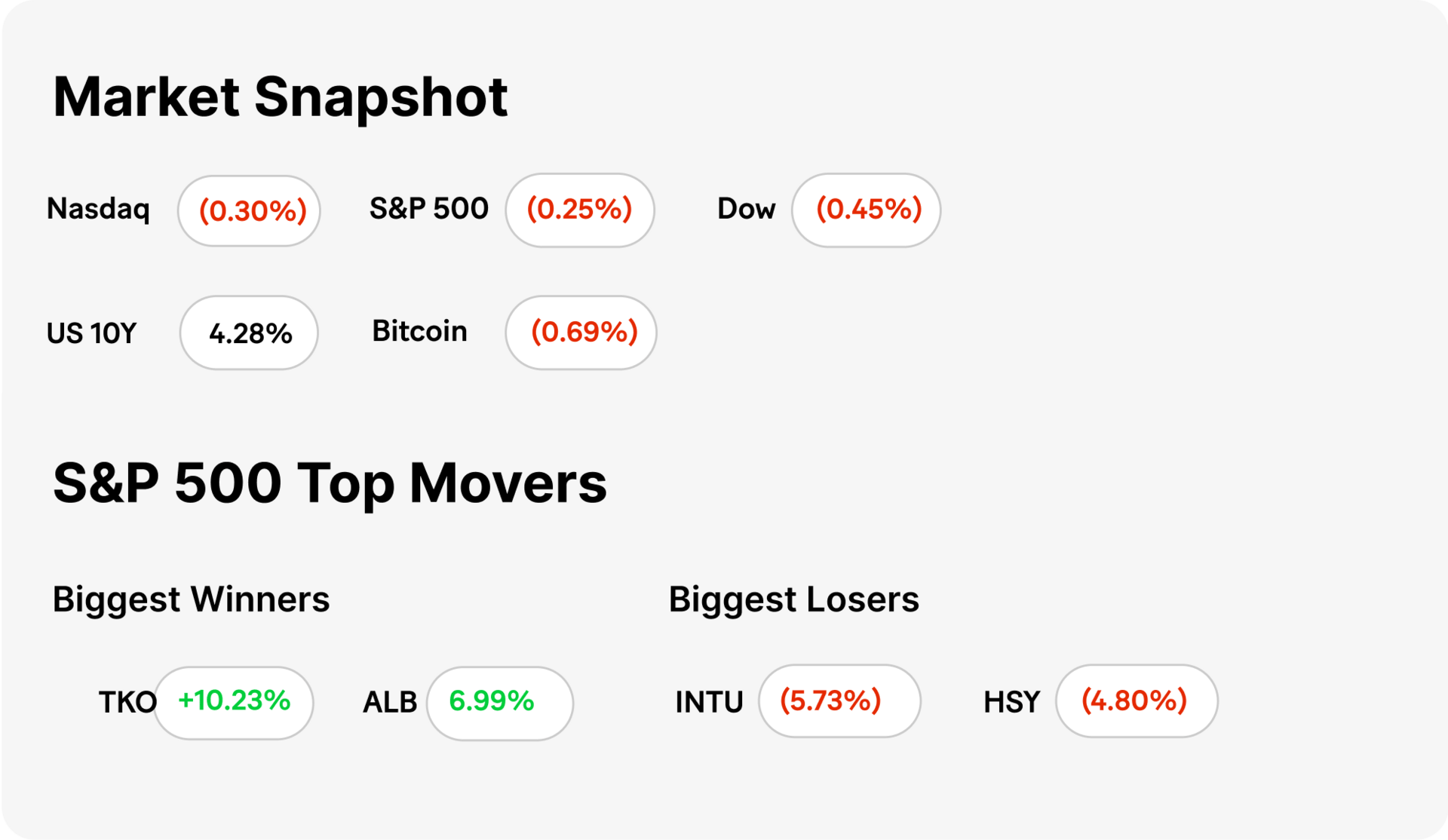

MARKET RECAP → Stocks fell Monday ahead of key US inflation data due out later this week. Bitcoin (BTC) continued to hover around all-time highs, ending the day around ~$118K.

🚀 BULLISH UPS THE ANTE → Crypto exchange boosts IPO to $1.5B for a $5B valuation, betting its volatility-fueled revenue and institutional focus will win over investors.

⚠ MARKETS DON’T TRUST THE MATH → Wall Street is questioning CPI data accuracy, fearing flawed numbers could push the Fed into policy missteps and spark market whiplash.

Was this email forwarded to you? Sign up for free here.

POLL OF THE DAY

CRYPTO

Bullish Gets Even Bolder

ChatGPT

Crypto exchange Bullish is upping its IPO raise to $1.5 billion, seeking a near-$5 billion valuation. The move signals confidence despite choppy digital asset markets and comes ahead of an anticipated Nasdaq debut.

📈 Revenue Riding Volatility: Bullish says trading activity surged in 2024, boosting revenue as crypto price swings drew more institutional and retail traders. The platform touts its deep liquidity and proprietary matching engine as competitive edges.

🌐 Positioning for Mainstream: CEO Tom Farley frames the IPO as a credibility play, pitching Bullish as a regulated, institution-friendly venue that can thrive through market cycles—setting it apart from more chaotic crypto rivals.

ECONOMICS

Wall Street Loses Faith in Data

ChatGPT

📉 Confidence in CPI Wavers: Ahead of Tuesday’s inflation report, investors are questioning the reliability of government data, citing frequent revisions and methodology changes that muddy economic signals. Analysts warn that inaccurate CPI readings could mislead the Fed and markets, raising volatility.

🏦 Fed in the Fog: Traders fear the Fed may be flying blind—policy decisions could be based on flawed inflation snapshots, potentially leading to rate moves that overshoot or undershoot economic reality. That uncertainty has kept bond markets jittery and risk appetite in check.

📊 Markets Brace for Whiplash: Any CPI surprise could swing markets hard—stocks, bonds, and currencies are all poised for sharp moves if inflation comes in hotter or cooler than forecasts. With trust in the data eroding, the reaction could be even more extreme.

KEEP READING

Cannabis stocks rally after Trump says he is weighing drug reclassification (CNBC)

At least 1 person killed in Pennsylvania steel factory explosions, dozens injured (CNBC)

How to Change Your Money Mindset: 9 Tips for Abundance Thinking (ML)

WHAT WE’RE WATCHING

OUR FAVORITE TOOLS & RESOURCES

Deribit — Crypto Futures and Options Exchange

Generated Assets — Turn any idea into an investable index

Polymarket — The world’s largest prediction market

Unusual Whales — Companion for uncovering unusual market activity

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

CME FedWatch Tool — Market-implied probabilities of future levels of interest rates

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

ChatGPT — Large language model-based chatbot powered by generative AI

Vimcal — Lightning-fast calendar and AI scheduling assistant

AltIndex — Alternative datasets to uncover unique insights

GFR Smart Stock Selector — Filters stocks to help investor choices

WE WANT YOUR FEEDBACK

How would you rate today's newsletter?

Investment advisory services provided by ML Wealth LLC. Investment Accounts Are Not FDIC Insured • No Bank Guarantee • Investments May Lose Value. For important information and disclosures relating to the MoneyLion Investment Account, see Investment FAQs, Form ADV Brochure, and moneylion.com/investing. Funded managed investing accounts are subject to a monthly account fee of $1 (for accounts valued up to $5,000), $3 (for accounts valued over $5,000, and up to $25,000), or $5 (for accounts valued over $25,000).

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.