TLDR

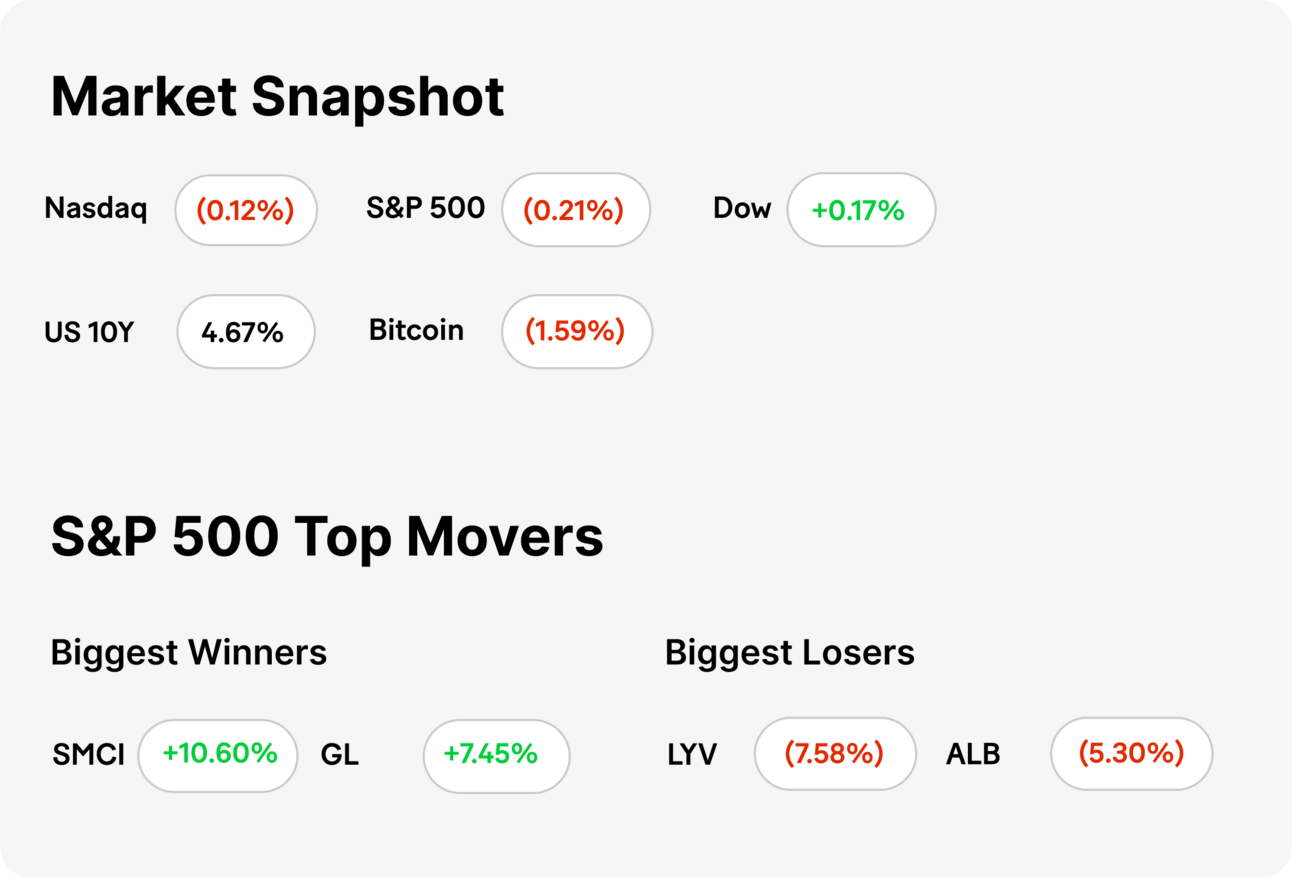

MARKET RECAP → Stocks moved lower Tuesday after Fed Chair Jerome Powell said rates might need to stay high for longer due to a “lack of further progress” this year on inflation.

DR. MARTENS TUMBLES → 👟 Dr. Martens' shares nosedived 30% amid forecasts of falling sales and operational woes, with CEO stepping down as the company braces for a tough 2025 and battles new legal challenges over brand protection.

J&J BEATS ESTIMATES → 📊 Johnson & Johnson (JNJ) outperformed expectations with Q1 earnings of $2.71/share thanks to booming medical device sales, amidst strong demand for nonurgent surgeries and strategic acquisitions boosting its healthcare reach.

Was this email forwarded to you? Sign up for free here.

Sean Horgan

Head of Investor Relations at MoneyLion

TODAY’S TOP NEWS

Dr. Martens Tumbles

📉 Sharp Decline in Share Value: Dr. Martens' shares dropped by 30% to a record low, prompting a temporary trading halt on the London Stock Exchange. This steep fall was triggered by the company's bleak forecast for 2025, revealing expectations of a significant drop in U.S. wholesale revenue and overall weaker revenues due to declining order books for the upcoming autumn and winter seasons.

🏭 Operational Challenges and Leadership Changes: The company admitted to facing operational difficulties as it prepared for a bigger business scale that didn't materialize, leading to earnings challenges. CEO Kenny Wilson announced his resignation effective March 2025, with Chief Brand Officer Ije Nwokorie set to take over, adding to the corporate upheaval.

🔍 Market and Legal Struggles: Analysts expressed concerns over Dr. Martens' short-term prospects, particularly regarding its performance in the U.S. market amid ongoing inflation pressures. Additionally, Dr. Martens has engaged in legal battles, including a recent lawsuit against Temu for manipulating Google search results to favor similar-looking products, underscoring the brand's defensive actions against market challenges.

TODAY’S TOP NEWS

J&J Beats Estimates

📈 Earnings Surpass Expectations: Johnson & Johnson (JNJ) reported a strong first quarter with adjusted earnings of $2.71 per share, beating the anticipated $2.64, fueled by a surge in its medical devices sector due to increased demand for nonurgent surgeries.

🚑 Healthcare Demand Drives Growth: The rebound in elective medical procedures post-pandemic significantly boosted J&J's MedTech division, highlighting consumer prioritization of health and mobility. CFO Joseph Wolk noted a persistently high level of medical procedures, underscoring ongoing consumer commitment to healthcare.

📉 Financial and Operational Highlights: J&J's total revenue reached $21.38 billion, with major contributions from its medical devices. The firm also adjusted its full-year revenue forecast slightly upwards amid operational challenges, including a high-profile $13.1 billion acquisition aimed at expanding its cardiovascular technology offerings.

KEEP READING

AMD rolls out its latest chips for AI PCs as competition with Nvidia and Intel heats up (CNBC)

IMF upgrades global growth forecast as economy proves ‘surprisingly resilient’ despite downside risks (CNBC)

Morgan Stanley tops expectations on wealth management, trading and investment banking results (CNBC)

China’s economy expands by a surprisingly strong pace in the first quarter of 2024 (CNN)

‘We have reached the limit.’ Clash with Elon Musk prompts calls for social media controls in Brazil (CNN)

19 Best Side Hustle Jobs in 2024 (ML)

Can You Have More Than One Bank Account? (ML)

Are Personal Loans Fixed or Variable? (ML)

WHAT WE’RE WATCHING

OUR FAVORITE TOOLS & RESOURCES

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

CME FedWatch Tool — Market-implied probabilities of future levels of interest rates

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

ChatGPT — Large language model-based chatbot powered by generative AI

Vimcal — Lightning-fast calendar and AI scheduling assistant

Notion AI — Notion AI is a writing assistant that can help you write, brainstorm, edit, summarize, and more

How would you rate today's newsletter?

The Bull vs. Bear Merchandise Promotion is a limited time campaign that begins on December 1, 2023 at 12:00 AM ET and ends on the date that there are no more Rewards. This Promotion is available to any registered MoneyLion user who is a legal resident of the 50 United States or the District of Columbia and who has reached the age of majority in their state as of the beginning of the Promotional Period. See terms and conditions here.

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice.