TLDR

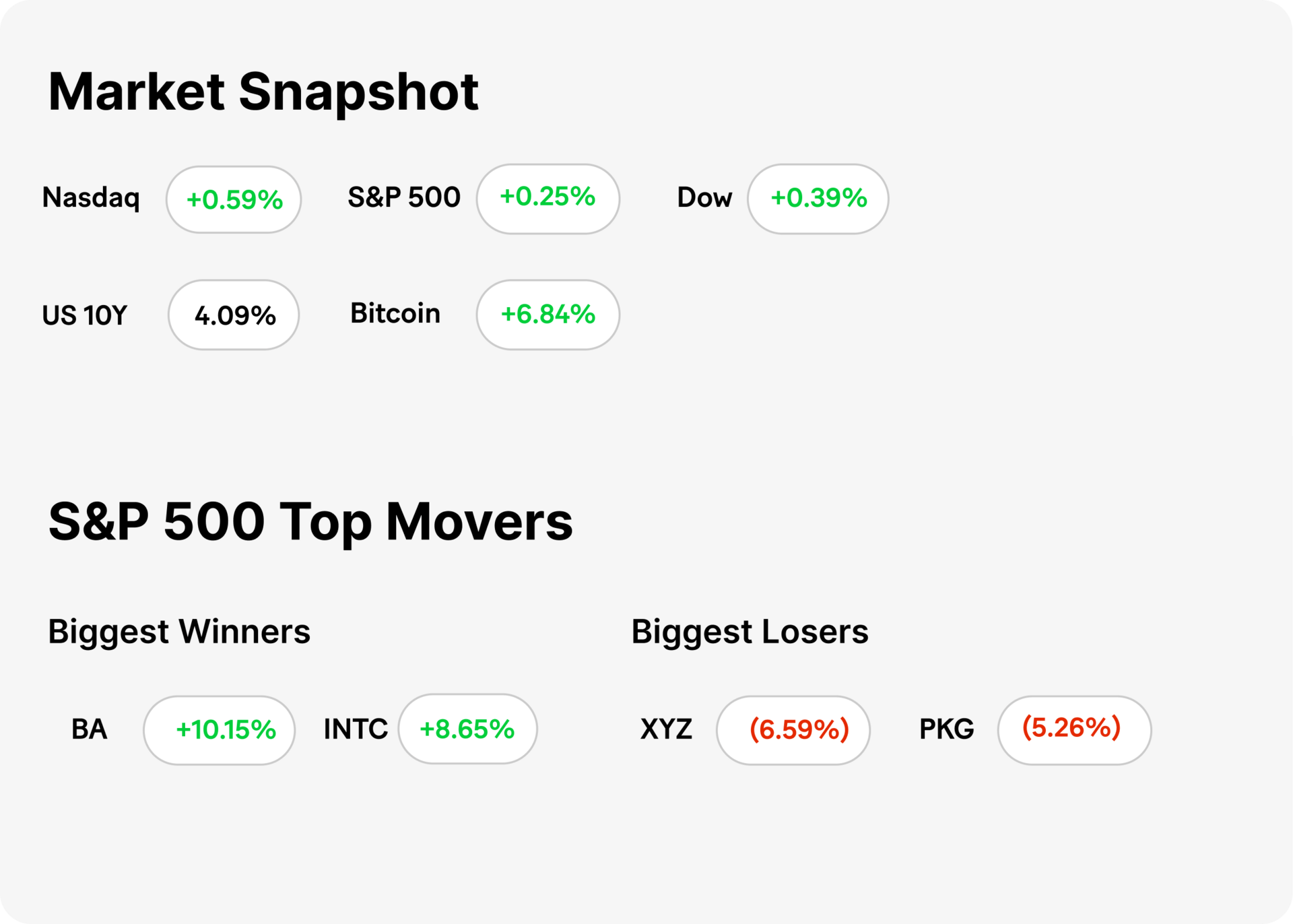

🧾MARKET RECAP → Stocks closed higher on Tuesday as technology stocks moved higher and bitcoin (BTC) rallied back past $90,000.

⚠️ BURRY SOUNDS ALARM ON TESLA → Tesla’s (TSLA) lofty valuation + heavy dilution + a jumbo Musk pay deal make it a speculative swing, not a safe anchor, according to “The Big Short” legendary investor Michael Burry.

⏱️ OPENAI SOUNDS ALARM → OpenAI shifts to wartime mode, shelving side quests to fortify ChatGPT as rivals close the gap.

Was this email forwarded to you? Sign up for free here.

MARKETS

Market Snapshot

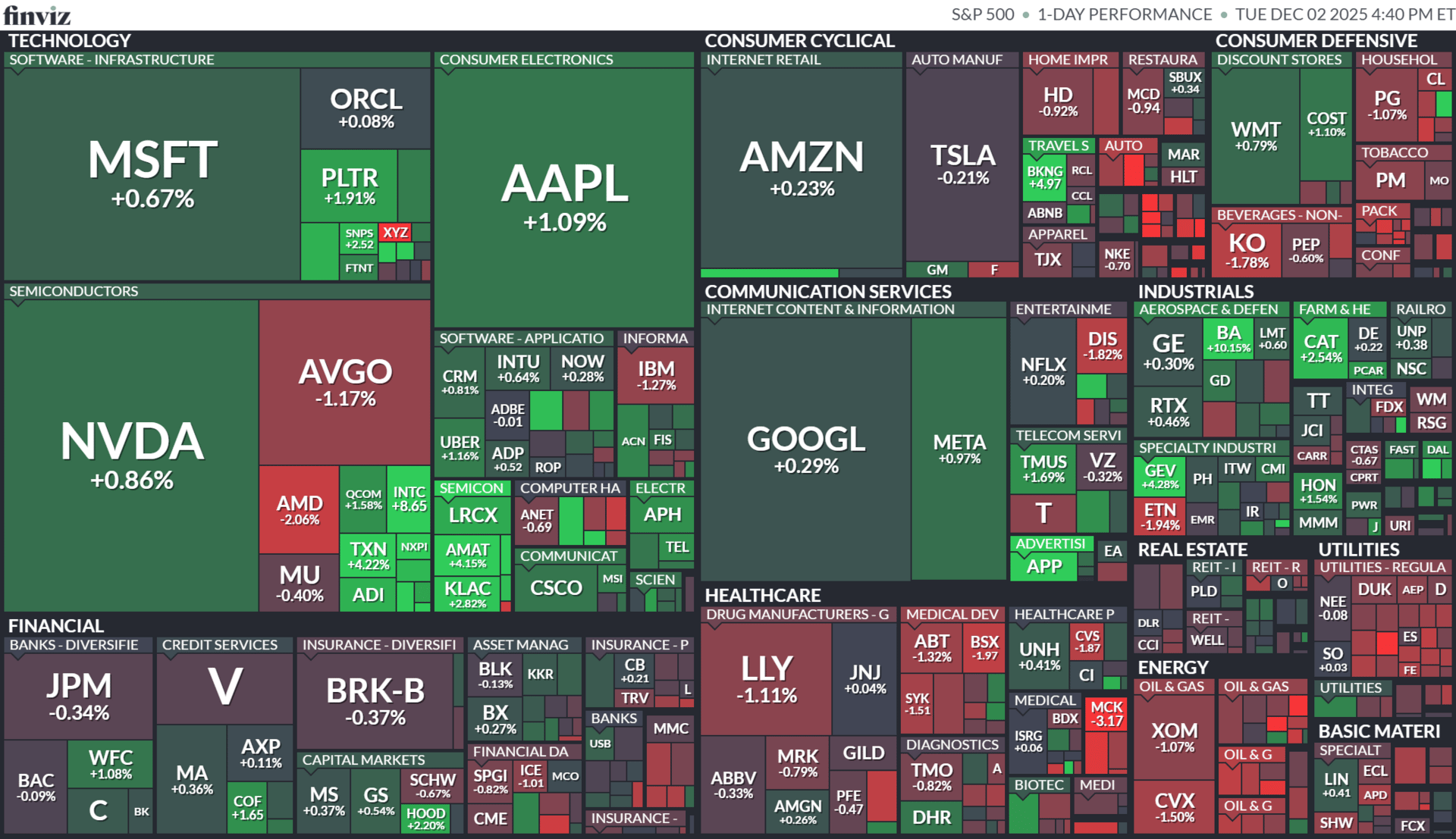

Today’s S&P 500 Heatmap

Notable Earnings

For the week beginning December 01, 2025

AUTO

Burry’s Tesla Warning

Gemini

🚗 Bubbly valuation, loud alarm bells: Investor Michael Burry called Tesla (TSLA) “ridiculously overvalued,” arguing the EV maker’s market cap has been disconnected from fundamentals for a long time. He pointed to ongoing shareholder dilution and warned that Elon Musk’s newly approved pay package — potentially worth up to $1 trillion — would make things worse.

⚠️ Dilution + lofty multiples = risk: Burry estimates Tesla dilutes its shares by roughly 3.6% per year via stock-based compensation — and with no buybacks in sight, that dilutive effect compounds over time. He also warned that TSLA trades at valuations far richer than peers, which leaves little margin for execution misses.

🔎 Why this matters now: As appetite for high-growth EV and tech stocks cools, Burry’s thesis is a warning shot: if Tesla fails to deliver—or if sentiment sours—the downside could be steep. For investors, this underscores the need to treat TSLA as a high-beta, high-risk bet rather than a long-term stable core holding.

AI

OpenAI Sounds Alarm

Gemini

🚨 “Code red” at OpenAI: CEO Sam Altman reportedly told staff that rising competition from Google and Anthropic has triggered a full internal “code red.” The mandate: prioritize improving ChatGPT’s speed, reliability, and overall user experience above every other initiative.

⏳ Big side projects get paused: To redirect resources, OpenAI is shelving or slowing several business efforts — including ads, AI shopping and health agents, and its personal-assistant project “Pulse.” The company is effectively reallocating its entire bench toward reinforcing ChatGPT’s core strength.

⚔️ The AI race tightens: Competitors have recently rolled out major upgrades, pressuring OpenAI’s lead. With compute costs rising and questions building around profitability, the company appears to be consolidating focus and returning to fundamentals rather than pursuing expansionary bets.

KEEP READING

Apartment rents drop further, with vacancies at record high (CNBC)

These dividend stocks are cheap and have high payout growth, says Wolfe (CNBC)

Delayed tariff impact starting to hit, could cause companies to reduce head count in 2026 (CNBC)

Mistral closes in on Big AI rivals with new open-weight frontier and small models (TechCrunch)

WHAT WE’RE WATCHING

Tools & Resources

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

AltIndex — Alternative datasets to uncover unique insights

GFR Smart Stock Selector — Filters stocks to help investor choices

WE WANT YOUR FEEDBACK

How would you rate today's newsletter?

Investment advisory services provided by ML Wealth LLC. Investment Accounts Are Not FDIC Insured • No Bank Guarantee • Investments May Lose Value. For important information and disclosures relating to the MoneyLion Investment Account, see Investment FAQs, Form ADV Brochure, and moneylion.com/investing. Funded managed investing accounts are subject to a monthly account fee of $1 (for accounts valued up to $5,000), $3 (for accounts valued over $5,000, and up to $25,000), or $5 (for accounts valued over $25,000).

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.