TLDR

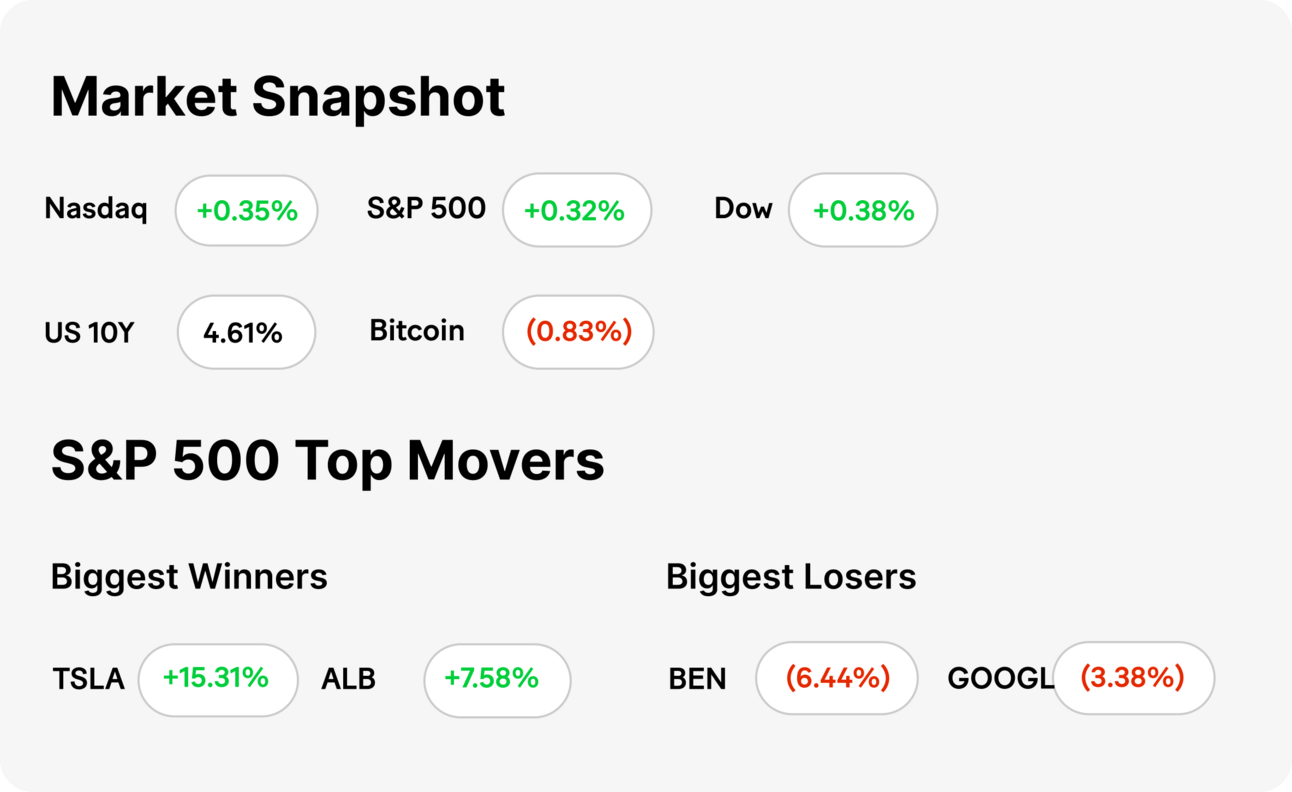

MARKET RECAP → On Monday, the Dow (DIA) surged over 100 points and the Nasdaq (QQQ) closed higher, aided by a 15% rally in Tesla (TSLA) shares after the company cleared a major regulatory hurdle. This boost came as investors braced for a busy week filled with corporate earnings reports and a Federal Reserve meeting, setting a positive tone for the market.

MUSK LOSES SUPREME COURT BID → 🏛️ The Supreme Court dismissed Elon Musk’s challenge to an SEC settlement requiring legal review of his tweets, affirming previous rulings that keep the "Twitter sitter" oversight intact.

PHILIPS SETTLES CASE → 📈 Philips shares rose 29% as the company settled U.S. litigation over its recalled sleep apnea devices for $1.1 billion, far below the dire financial forecasts, sparking renewed investor confidence.

Was this email forwarded to you? Sign up for free here.

TODAY’S TOP NEWS

Musk Loses Supreme Court Bid

👨⚖️ Supreme Rejection: The U.S. Supreme Court declined to consider Elon Musk's challenge against an SEC enforcement action that necessitated his social media posts be vetted by legal counsel. This decision upholds a previous ruling by the 2nd U.S. Circuit Court of Appeals, affirming the requirement often referred to as the "Twitter sitter" provision.

📱 Background of the Dispute: The SEC regulation came after Musk's 2018 tweets about potentially taking Tesla private, which the SEC deemed "materially false and misleading." Although Musk settled with the SEC at the time, agreeing to the vetting of his posts, he later contested this agreement, claiming it was an unconstitutional restriction on his free speech.

🚗 Ongoing Legal Wrangles: Despite his efforts, lower courts have consistently rejected Musk's claims, stating he waived his right to object by agreeing to the settlement. Musk's lawyers argued that the SEC has continued to target him unfairly, but the Supreme Court's refusal to hear the case leaves the vetting requirement firmly in place.

TODAY’S TOP NEWS

Philips Settles Case

🚀 Share Price Skyrockets: Philips' shares surged 29%, reaching a two-year high, after the company settled a major U.S. lawsuit for $1.1 billion concerning personal injury claims related to its recalled sleep apnea devices. This settlement came as a relief to investors, substantially lower than the worst-case scenario projected costs.

📜 Legal Resolution: By settling, Philips aims to eliminate the uncertainties surrounding the litigation, although the company admitted no fault or liability for any injuries claimed to be caused by its Respironics devices. This proactive financial provision aims to close the chapter on this litigation, freeing up the company to focus on future initiatives.

🔍 Future Outlook and Performance: Despite the significant financial hit, Philips is optimistic about its recovery, reaffirming its full-year sales growth targets and raising cash flow projections. However, the company still reported a loss for the quarter, and analysts note that order intakes have been declining, suggesting ongoing challenges in its operational recovery.

KEEP READING

DJT: Trump Media shares soar more than 12% in afternoon trading (CNBC)

Amazon says more packages are arriving in a day or less after hefty investment in speedy fulfillment (CNBC)

Lawyers for Hunter Biden plan to sue Fox News ‘imminently’ (CNBC)

Oil prices fall more than 1% as Secretary of State Blinken pushes for Gaza cease-fire (CNBC)

Shari Redstone is playing M&A war games with removal of Paramount CEO Bob Bakish (CNBC)

How to Turn $100 Into $1,000 (ML)

Landscaping Loans and Alternative Financing Options (ML)

How to Finance a Refrigerator (ML)

WHAT WE’RE WATCHING

OUR FAVORITE TOOLS & RESOURCES

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

CME FedWatch Tool — Market-implied probabilities of future levels of interest rates

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

ChatGPT — Large language model-based chatbot powered by generative AI

Vimcal — Lightning-fast calendar and AI scheduling assistant

Notion AI — Notion AI is a writing assistant that can help you write, brainstorm, edit, summarize, and more

How would you rate today's newsletter?

The Bull vs. Bear Merchandise Promotion is a limited time campaign that begins on December 1, 2023 at 12:00 AM ET and ends on the date that there are no more Rewards. This Promotion is available to any registered MoneyLion user who is a legal resident of the 50 United States or the District of Columbia and who has reached the age of majority in their state as of the beginning of the Promotional Period. See terms and conditions here.

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice.