TLDR

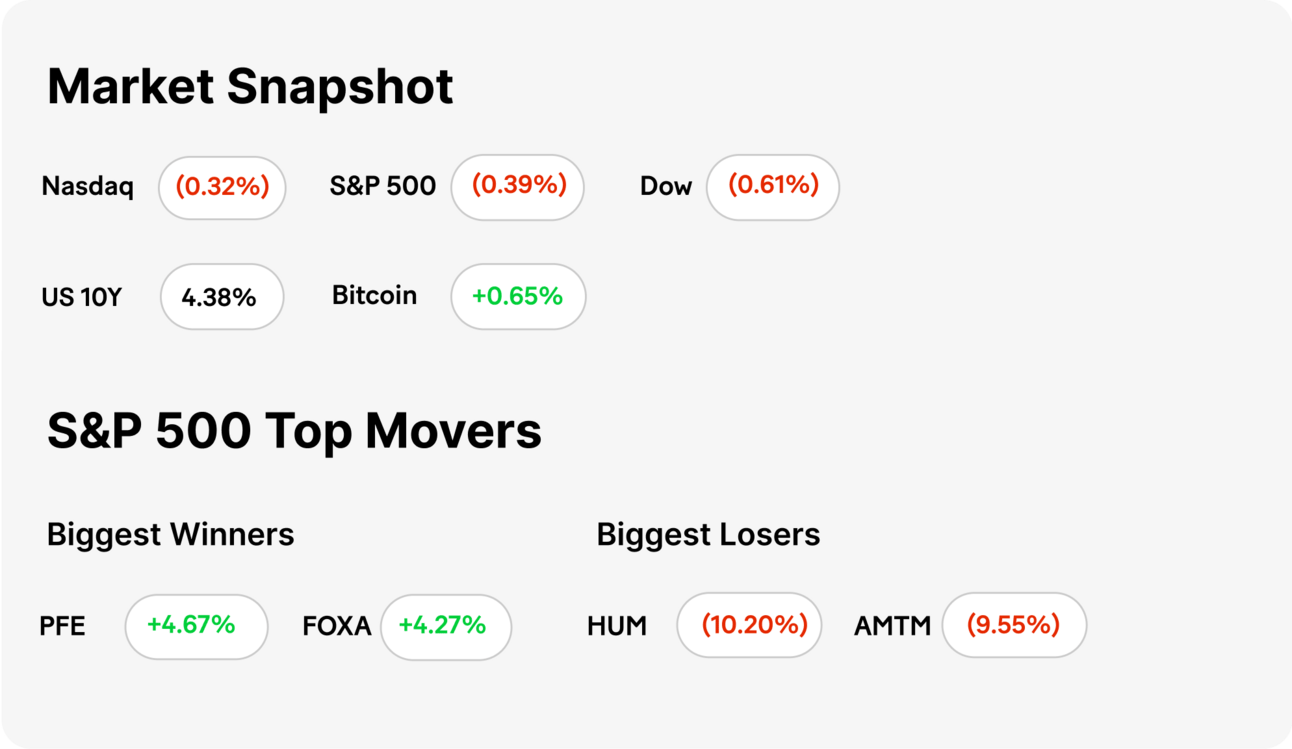

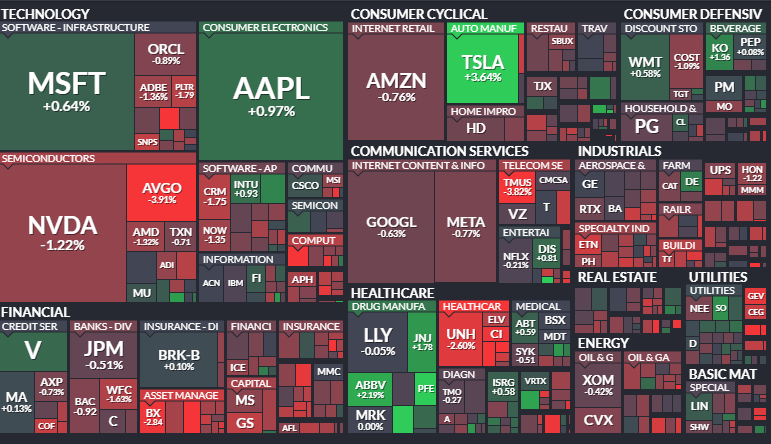

MARKET RECAP → The Dow (DIA) hit a new record losing streak Tuesday, marking its ninth consecutive day of losses for the first time since 1978.

IN SEARCH OF YIELD → 📉 With the Fed expected to cut interest rates tomorrow, investors face shrinking yields on their cash. Some suggest pivoting to money-market funds, short-term bonds, or some combination with high-yield savings accounts to keep returns afloat.

RIPPLE LAUNCHES RLUSD STABLECOIN → 💰 Ripple introduced RLUSD, a dollar-backed stablecoin aiming to challenge Tether and USD Coin, with full asset backing and availability on major global trading platforms.

Was this email forwarded to you? Sign up for free here.

On the move? Subscribe to our daily podcast here.

TODAY’S TOP NEWS

In Search of Yield

📉 Rate Cut Concerns: If the Federal Reserve continues to cut interest rates, investors are wary of shrinking cash yields as banks and brokerage firms receive lower payouts on uninvested balances.

💰 Falling Sweep-Account Returns: Investors face shrinking returns on sweep accounts, with rates at major firms like Charles Schwab (SCHW) dropping to as low as 0.1%, forcing savers to rethink their cash strategies.

🚀 Higher-Yield Alternatives: Some financial analysts recommend shifting into higher-yield options like money-market funds, short-term bonds, or high-yield savings accounts to maximize returns as rates decline.

TODAY’S TOP NEWS

Ripple Launches RLUSD Stablecoin

💰 New Stablecoin Introduction: Ripple has launched RLUSD, a stablecoin pegged to the U.S. dollar, aiming to compete with market leaders like Tether and USD Coin.

🔗 Backing and Availability: Each RLUSD token is fully backed by U.S. dollar deposits, U.S. government bonds, and cash equivalents, ensuring stability and liquidity. The stablecoin will be available globally on platforms including Uphold, Bitstamp, Bitso, MoonPay, Independent Reserve, CoinMENA, and Bullish.

🏛️ Advisory Board Composition: Ripple has appointed Sheila Bair, former chair of the U.S. Federal Deposit Insurance Corp, to the advisory board of RLUSD, alongside Ripple co-founder Chris Larsen and former CENTRE Consortium CEO David Puth.

KEEP READING

Databricks announces $10 billion financing at $62 billion valuation (CNBC)

Walmart employees are now wearing body cameras in some stores (CNBC)

Germany’s auto giants were already reeling. Now Trump wants to turn them into American companies (CNBC)

Dexcom’s over-the-counter glucose monitor now offers users an AI summary of how sleep, meals and more impact sugar levels (CNBC)

Cocoa prices climb to new record high, prompting fresh warnings about extreme volatility (CNBC)

When Were Credit Cards Invented? Unpacking The History (ML)

How to Retire Early: 10 Steps to Achieve Financial Independence (ML)

Is a 900 Credit Score Possible? (ML)

WHAT WE’RE WATCHING

OUR FAVORITE TOOLS & RESOURCES

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

CME FedWatch Tool — Market-implied probabilities of future levels of interest rates

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

ChatGPT — Large language model-based chatbot powered by generative AI

Vimcal — Lightning-fast calendar and AI scheduling assistant

The Bull vs. Bear Merchandise Promotion is a limited time campaign that begins on December 1, 2023 at 12:00 AM ET and ends on the date that there are no more Rewards. This Promotion is available to any registered MoneyLion user who is a legal resident of the 50 United States or the District of Columbia and who has reached the age of majority in their state as of the beginning of the Promotional Period. See terms and conditions here.

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.