TLDR

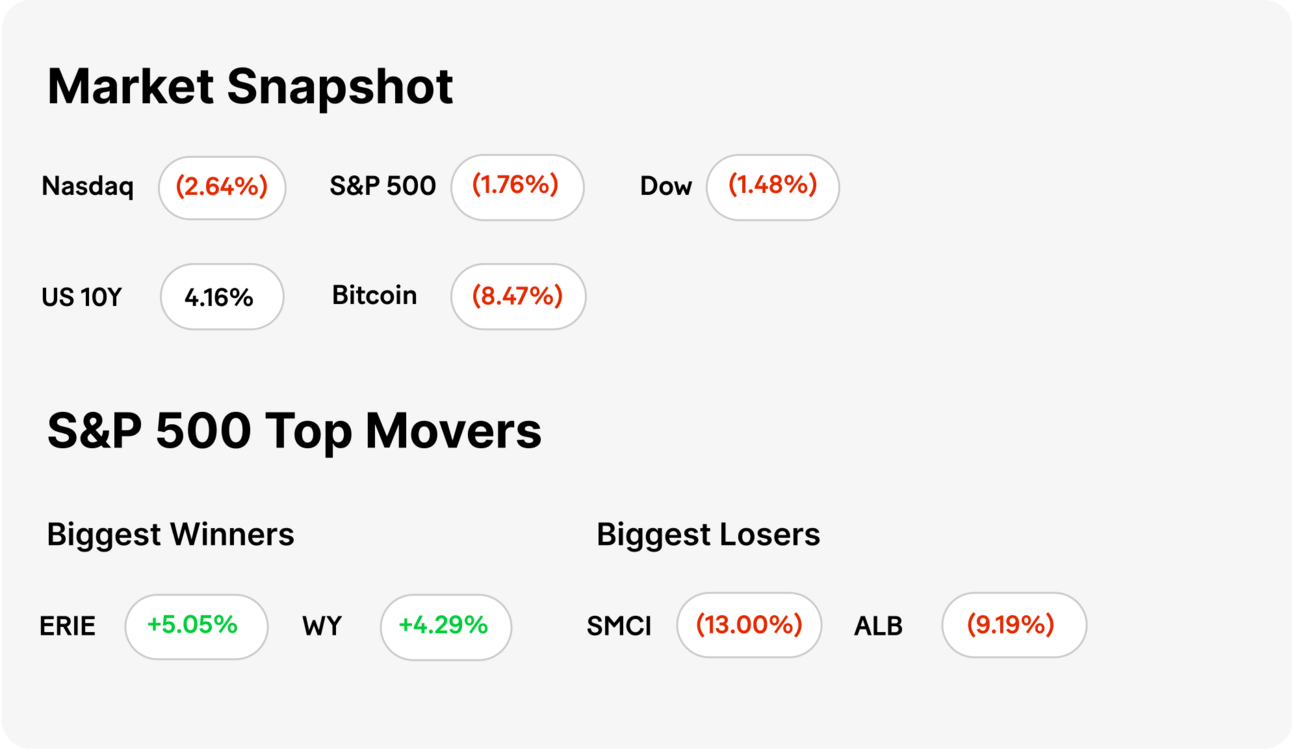

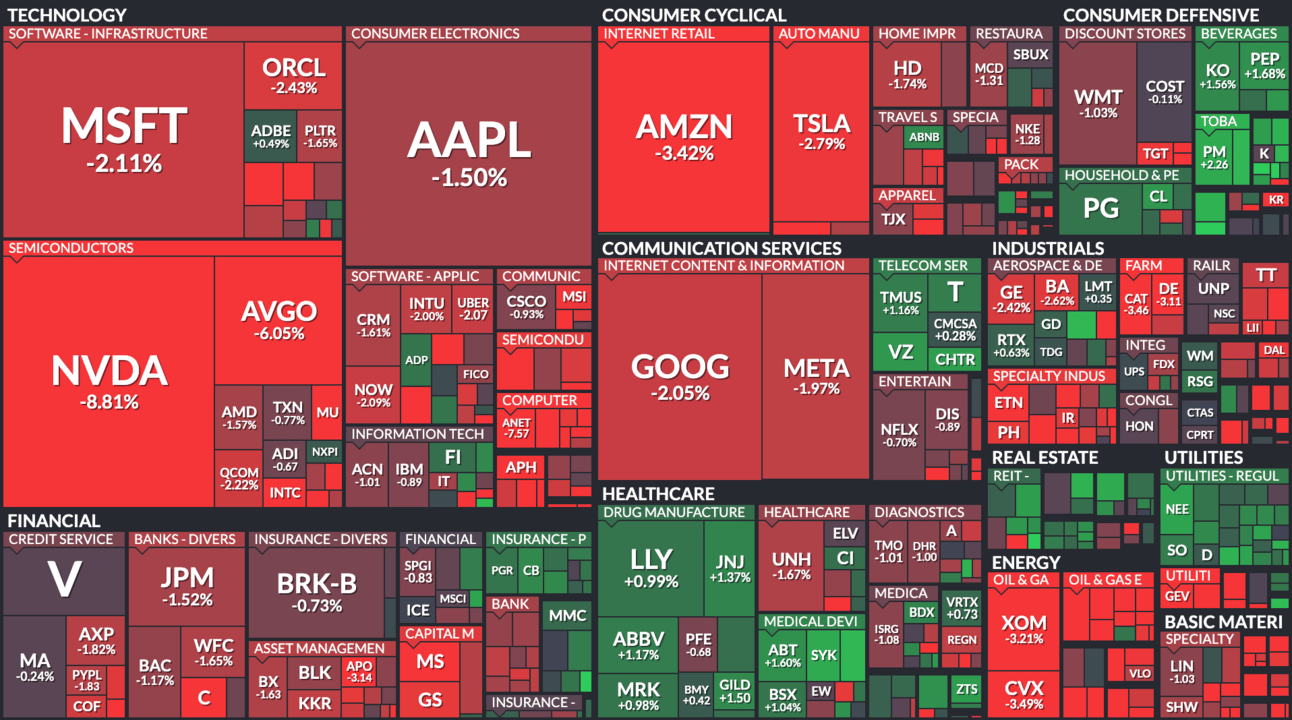

MARKET RECAP → The S&P 500 (VOO) dropped Monday, extending February’s slump and turning negative for the year as Trump’s tariff confirmation heightened economic worries.

KROGER CEO RESIGNS AFTER CONDUCT PROBE → CEO Rodney McMullen resigned over a personal conduct investigation, unrelated to business operations. Meanwhile, Kroger is still reeling from its failed Albertsons merger. 🏪

RAMP HITS $13B VALUATION IN EMPLOYEE CASH-OUT DEAL → Ramp secured a $150M deal, letting employees cash out as its valuation rebounded to $13B—because who needs an IPO when private investors keep the checks coming? 💰

Was this email forwarded to you? Sign up for free here.

TODAY’S TOP NEWS

Kroger CEO Resigns After Conduct Probe

🏪 Kroger Chairman and CEO Rodney McMullen resigned following an internal investigation into his personal conduct, which the company said violated its ethics policy but was unrelated to business operations. Ronald Sargent, a longtime board member, stepped in as interim CEO.

🔎 The investigation, initiated on Feb. 21, was led by an independent counsel and overseen by a special board committee. Kroger emphasized that the issue did not involve financial performance, operations, or company employees.

📉 McMullen’s departure came as Kroger reeled from the failed $24.6B merger with Albertsons, which was blocked due to antitrust concerns. Kroger’s stock dropped more than 3.5% in pre-market trading following the announcement.

TODAY’S TOP NEWS

Ramp Hits $13B Valuation in Employee Cash-Out Deal

💰 Ramp secured a $150M secondary deal, allowing employees and early investors to sell shares at a $13B valuation. The fintech firm's value rebounded sharply from its 2023 down round of $5.8B, signaling renewed investor appetite for high-growth startups.

📉 The move followed a trend of private companies offering liquidity while avoiding IPO pressures. Similar deals from Stripe, DataBricks, and OpenAI highlighted a shift toward private funding as startups navigate high interest rates and uncertain public markets.

🚀 Ramp, which automates corporate expenses and accounting, processed $55B in transactions last year. While CEO Eric Glyman acknowledged IPO discussions, he emphasized that Ramp remains cash-efficient, reducing the urgency for a public offering.

KEEP READING

Domino’s Pizza finally launches stuffed crust to keep customers away from rivals (CNBC)

EU leaders prepare ‘concrete’ measures on defense financing, sources say (CNBC)

Microsoft unveils new voice-activated AI assistant for doctors (CNBC)

Half of U.S. workers don’t know their state’s paid sick leave laws—this tool can help (CNBC)

Ready to Take 2025 by Storm? (ML)

How to Financially Prosper this Chinese New Year: Year of the Wood Snake (ML)

WHAT WE’RE WATCHING

OUR FAVORITE TOOLS & RESOURCES

RiskReversal Media — Expert-led content redefining financial media

Unusual Whales — Companion for uncovering unusual market activity

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

CME FedWatch Tool — Market-implied probabilities of future levels of interest rates

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

ChatGPT — Large language model-based chatbot powered by generative AI

Vimcal — Lightning-fast calendar and AI scheduling assistant

WE WANT YOUR FEEDBACK

How would you rate today's newsletter?

REFERRAL PROGRAM

Investment advisory services provided by ML Wealth LLC. Investment Accounts Are Not FDIC Insured • No Bank Guarantee • Investments May Lose Value. For important information and disclosures relating to the MoneyLion Investment Account, see Investment FAQs, Form ADV Brochure, and moneylion.com/investing. Funded managed investing accounts are subject to a monthly account fee of $1 (for accounts valued up to $5,000), $3 (for accounts valued over $5,000, and up to $25,000), or $5 (for accounts valued over $25,000).

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.