TLDR

MARKET RECAP → The S&P 500 (VOO) fell for a third day in a row as traders digested a delayed November jobs report.

🌱 TRUMP EYES MAJOR MARIJUANA CHANGE → Trump is weighing a federal move to downgrade marijuana’s drug classification, a step that could benefit research and the cannabis industry without fully legalizing the drug.

🚀 TESLA RALLIES ON ROBOTAXI DREAMS → Tesla (TSLA) hits record highs on autonomy optimism even as EV sales soften, turning the stock into a high-conviction bet on robotaxis rather than cars.

Was this email forwarded to you? Sign up for free here.

MARKETS

Market Snapshot

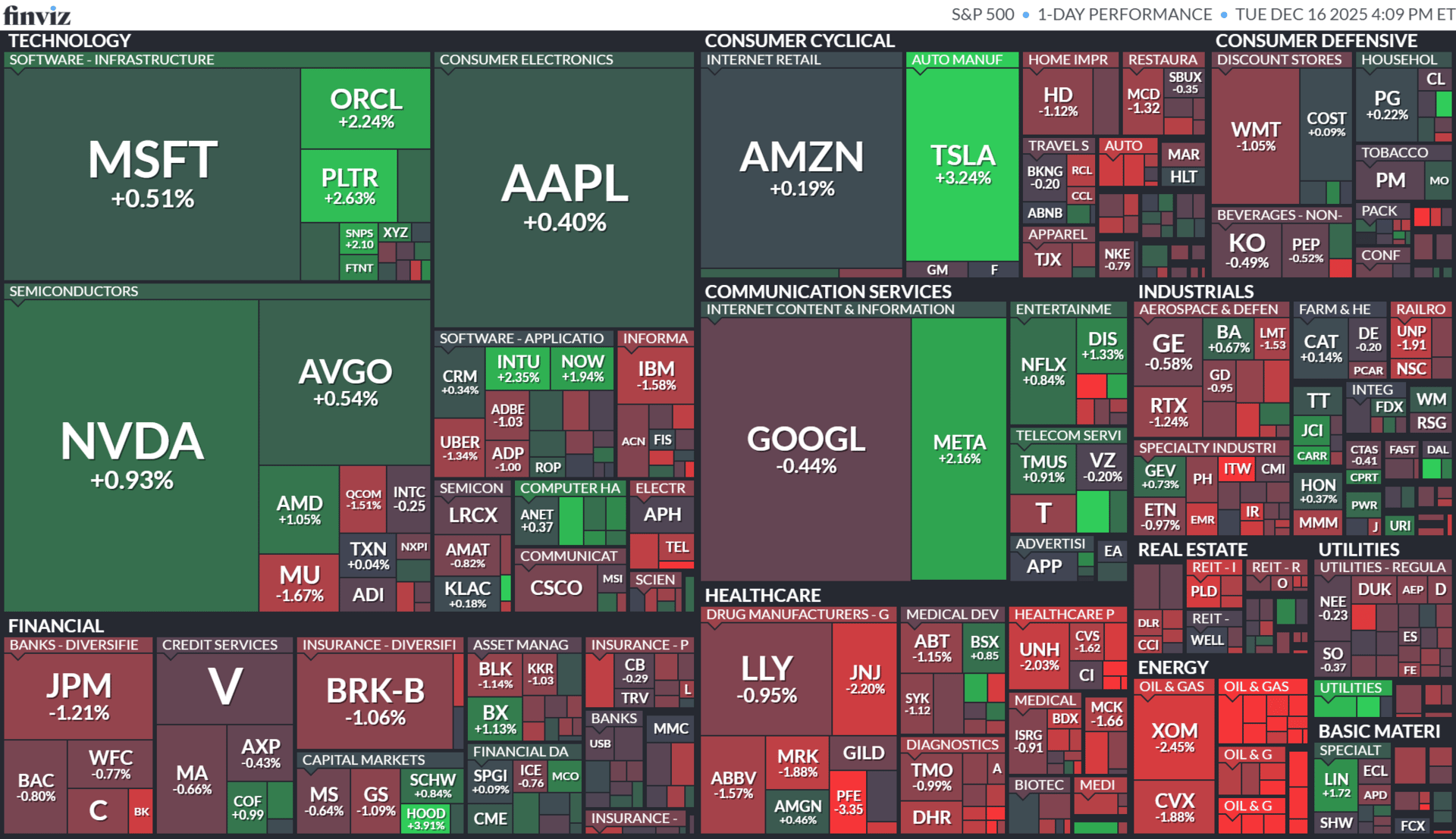

Today’s S&P 500 Heatmap

Notable Earnings

For the week beginning December 15, 2025

POLICY

Trump Eyes Major Marijuana Change

Gemini

🌿 Federal reclassification in play: President Donald Trump is seriously considering an executive order to reclassify marijuana from a Schedule I drug (currently treated like heroin with no accepted medical use) to a Schedule III substance — a category that includes common prescription drugs with accepted medical use and lower potential for abuse. This shift would be one of the biggest changes in federal cannabis policy in decades and could reshape how marijuana is regulated nationwide.

📊 Why it matters: Moving cannabis to Schedule III wouldn’t legalize it outright, but it would ease federal restrictions significantly. It could unlock research opportunities, expand medical acceptance, and reduce tax burdens on plant-touching businesses by lifting some barriers tied to federal illegality.

💡 Industry & political dynamics: The proposal has energized cannabis markets and advocates, but it isn’t finalized — the White House says no decision has been made yet and the Drug Enforcement Administration would still need to act to formalize any rescheduling. Lawmakers and regulators remain split, and critics warn that change could create new legal complexities even as it loosens some restrictions.

TECH

Tesla Rallies On Robotaxi Dreams

Gemini

🚕 Robotaxi hype beats weak EV sales: Tesla (TSLA) stock hit a fresh record as investors piled into the company’s robotaxi narrative, shrugging off a reported drop in vehicle sales. The market is increasingly valuing Tesla less like an automaker and more like a future autonomous-mobility platform.

📉 Core business still under pressure: Beneath the rally, Tesla’s traditional EV business is showing strain from slowing demand, price cuts, and rising competition — especially in China and Europe. That disconnect highlights how much of today’s valuation rests on expectations for autonomy rather than current fundamentals.

🤖 Valuation rides on execution: Robotaxis remain unproven at scale, with regulatory hurdles, technical challenges, and timelines still uncertain. For investors, the trade is clear but risky: Tesla’s upside hinges on autonomy breakthroughs, while any delay could expose how stretched expectations have become relative to near-term earnings power.

KEEP READING

U.S. crude oil drops below $55 a barrel, hits lowest level since early 2021 (CNBC)

Instagram TV app coming to Amazon Fire streaming device (CNBC)

Stocks fall after delayed jobs figures paint weak picture of economy: Live updates (CNBC)

Kraft Heinz taps former Kellanova CEO Steve Cahillane to lead company ahead of breakup (CNBC)

WHAT WE’RE WATCHING

Tools & Resources

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

AltIndex — Alternative datasets to uncover unique insights

GFR Smart Stock Selector — Filters stocks to help investor choices

WE WANT YOUR FEEDBACK

How would you rate today's newsletter?

Investment advisory services provided by ML Wealth LLC. Investment Accounts Are Not FDIC Insured • No Bank Guarantee • Investments May Lose Value. For important information and disclosures relating to the MoneyLion Investment Account, see Investment FAQs, Form ADV Brochure, and moneylion.com/investing. Funded managed investing accounts are subject to a monthly account fee of $1 (for accounts valued up to $5,000), $3 (for accounts valued over $5,000, and up to $25,000), or $5 (for accounts valued over $25,000).

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.