TLDR

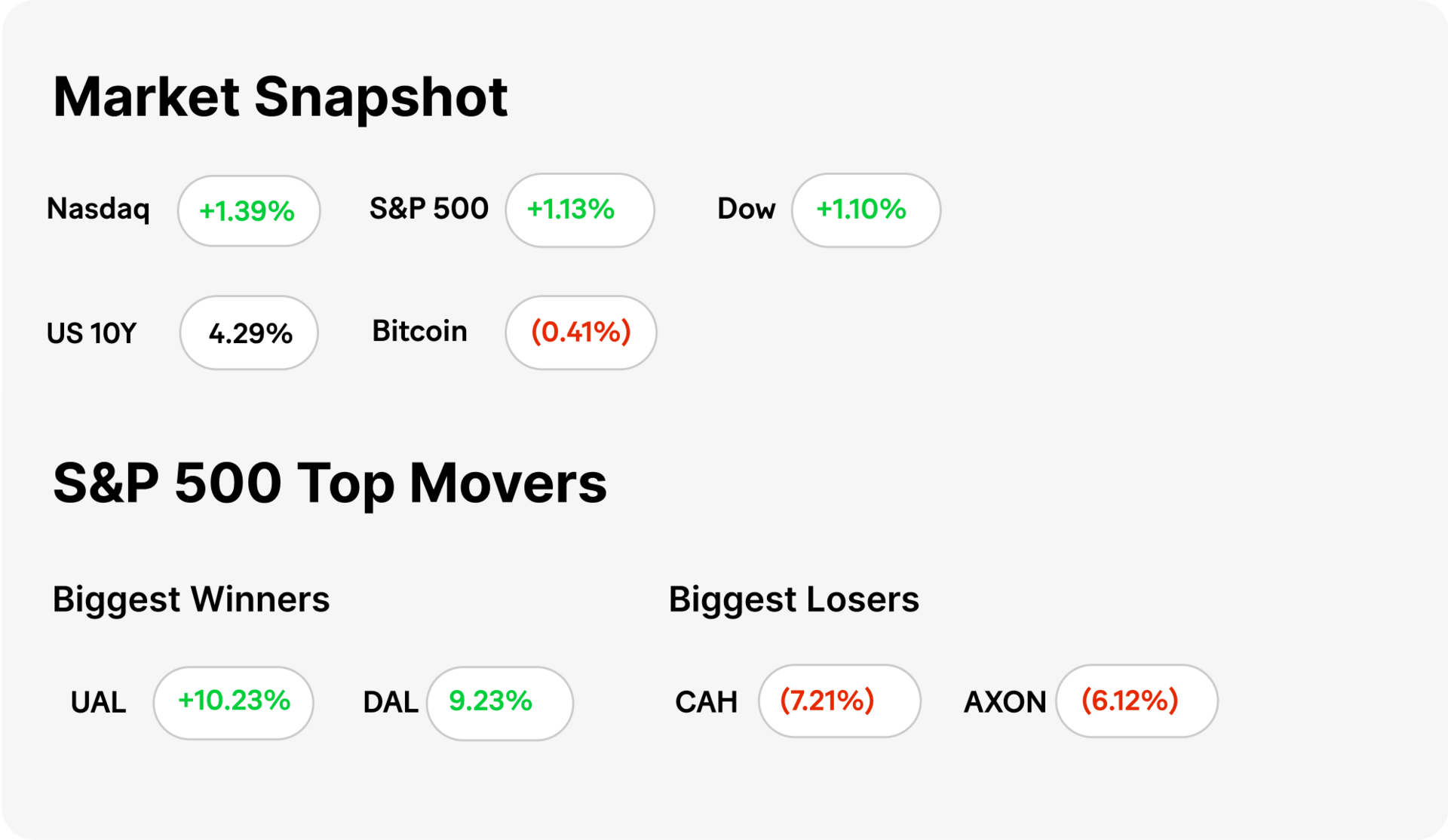

MARKET RECAP → The S&P 500 rose 1.13% (VOO) and NASDAQ (QQQ) gained 1.33%, both touching new highs after July CPI data came in at 2.7% annually, slightly below forecasts. Market participants boosted bets on a September Fed rate cut, with odds nearing 94%.

🚀 CIRCLE’S REVENUE POPS, PROFIT FIZZLES → Q2 sales jumped 38% on USDC growth, but earnings lagged as costs climbed, sending shares lower despite global adoption momentum.

🔥 INFLATION HEATS UP AGAIN → July inflation hit 3.3% YoY, driven by stubborn shelter costs, forcing markets to dial back expectations for big Fed cuts next month.

Was this email forwarded to you? Sign up for free here.

POLL OF THE DAY

Price of a dozen eggs in August?

CRYPTO

Circle’s Revenue Pops, Profit Fizzles

ChatGPT

📈 Top Line Surges: Circle (CRCL) posted Q2 revenue of $596.9 million, up 38% year over year, driven by higher interest income from USDC reserves and increased blockchain activity. The results topped analyst expectations.

💸 Earnings Miss the Mark: Adjusted EPS came in at $0.08, below the $0.12 consensus, as rising expenses—particularly in compliance and product development—offset revenue gains. Shares fell about 7% in after-hours trading.

🌐 USDC’s Global Reach Expands: CEO Jeremy Allaire highlighted USDC’s growing role in cross-border payments and stablecoin settlements, noting adoption gains in Asia and Latin America as Circle pushes for regulatory clarity worldwide.

ECONOMICS

Inflation Heats Up Again

ChatGPT

📊 Prices Outpace Forecasts: July CPI rose 3.3% year over year, up from June’s 3.0% and just above estimates. On a monthly basis, prices climbed 0.2%, with housing and energy the main offenders.

🏠 Shelter Stays Sticky: Shelter costs rose 0.4% in July, keeping inflation elevated despite cooling in goods prices. Economists say this persistent housing pressure is making it harder for the Fed to claim victory.

🏦 Markets Rethink Fed Cuts: A hotter CPI print dented hopes for aggressive rate cuts, with traders now betting on a smaller September move. Bond yields jumped, stocks wobbled, and the dollar found fresh strength.

SHARE OUR NEWSLETTER FOR SWAG!

KEEP READING

Perplexity offers to buy Google’s Chrome browser for $34.5 billion (CNBC)

Uber Freight CEO joins self-driving truck company Waabi, says era of autonomous big rigs on U.S. roads is here (CNBC)

How to Change Your Money Mindset: 9 Tips for Abundance Thinking (ML)

WHAT WE’RE WATCHING

OUR FAVORITE TOOLS & RESOURCES

Deribit — Crypto Futures and Options Exchange

Generated Assets — Turn any idea into an investable index

Polymarket — The world’s largest prediction market

Unusual Whales — Companion for uncovering unusual market activity

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

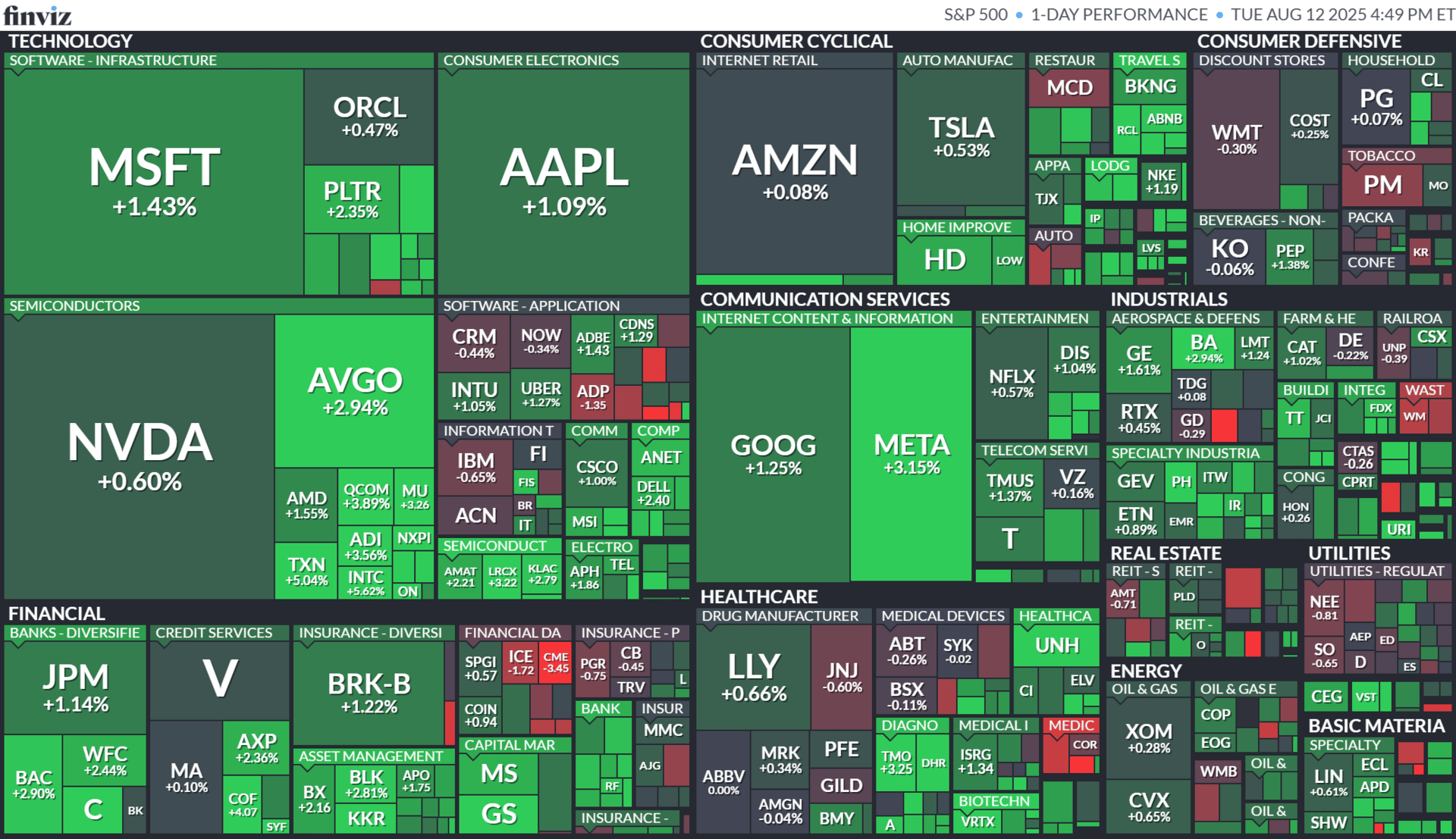

Finviz — Financial visualizations

Trading Economics — Economic calendar

CME FedWatch Tool — Market-implied probabilities of future levels of interest rates

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

ChatGPT — Large language model-based chatbot powered by generative AI

Vimcal — Lightning-fast calendar and AI scheduling assistant

AltIndex — Alternative datasets to uncover unique insights

GFR Smart Stock Selector — Filters stocks to help investor choices

WE WANT YOUR FEEDBACK

How would you rate today's newsletter?

Investment advisory services provided by ML Wealth LLC. Investment Accounts Are Not FDIC Insured • No Bank Guarantee • Investments May Lose Value. For important information and disclosures relating to the MoneyLion Investment Account, see Investment FAQs, Form ADV Brochure, and moneylion.com/investing. Funded managed investing accounts are subject to a monthly account fee of $1 (for accounts valued up to $5,000), $3 (for accounts valued over $5,000, and up to $25,000), or $5 (for accounts valued over $25,000).

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.