TLDR

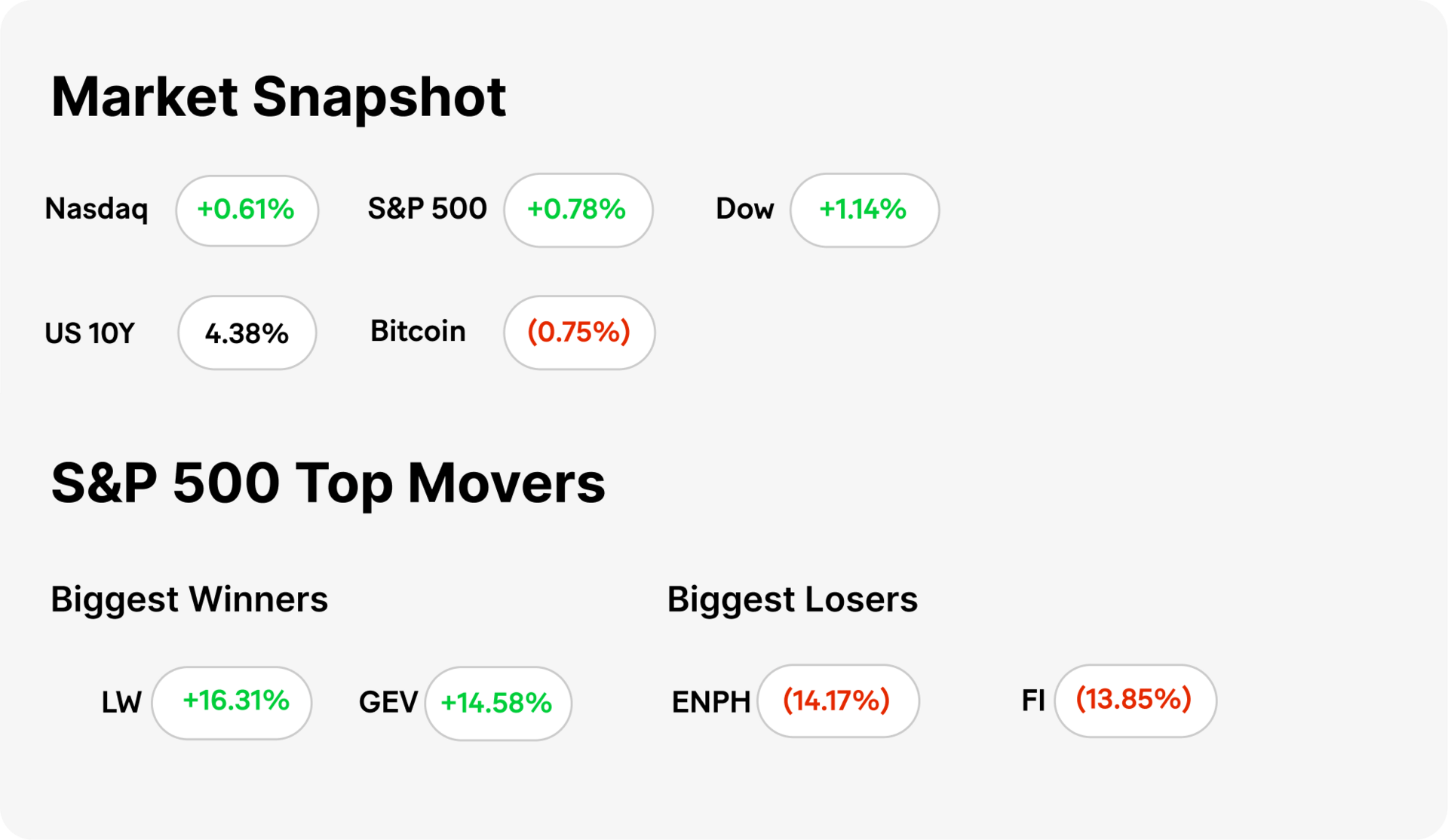

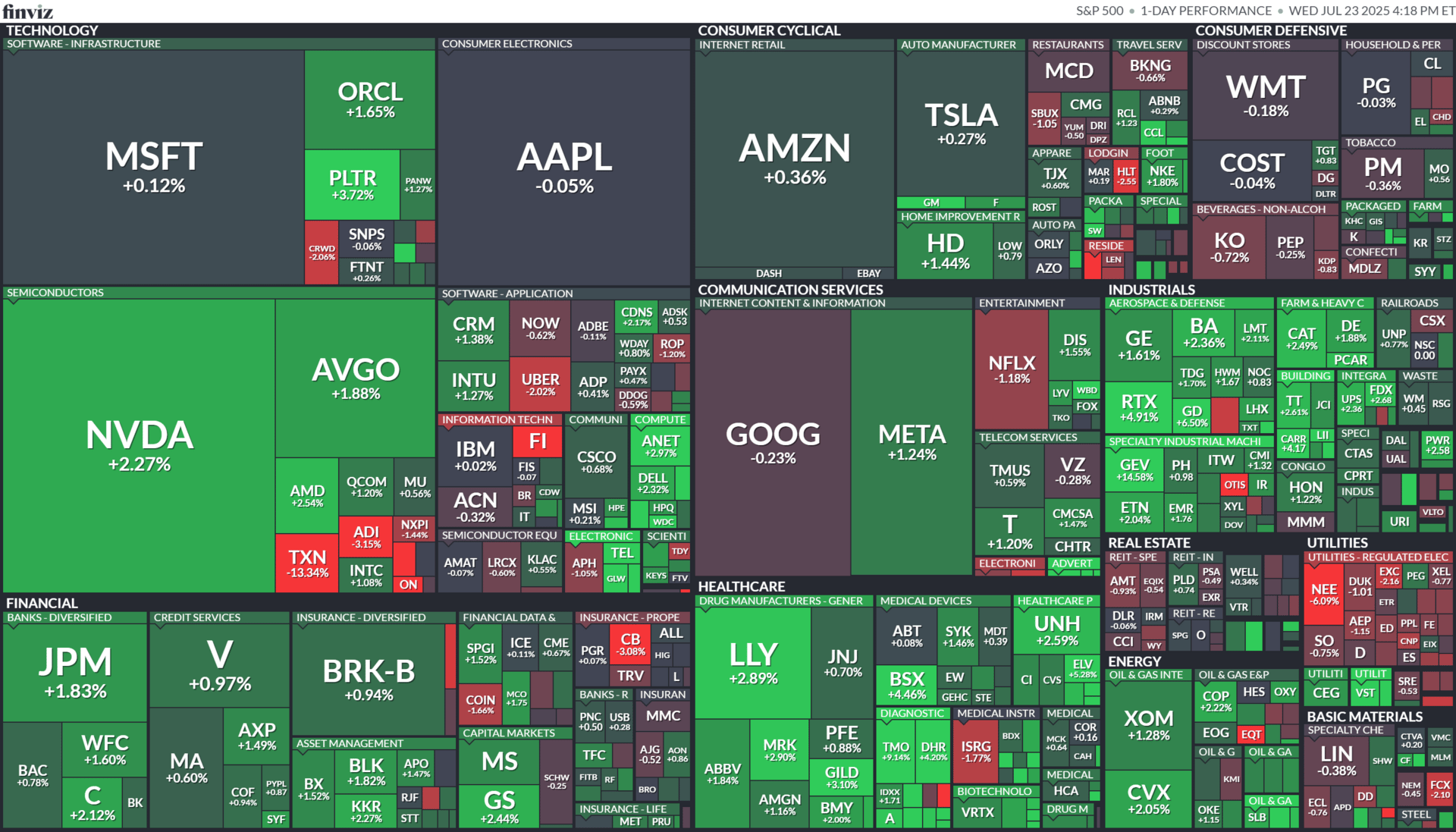

MARKET RECAP → Stock gained on Wednesday as the latest trade developments granted investors optimism that the U.S. will be able to achieve more deals before the tariff deadline arrives. All three major indexes rose with the S&P 500 (VOO) hitting another intraday all time high.

BIG DATA, BIG POLITICS → Trump’s “UAI” plan would create government-run data centers to power U.S. AI dominance, potentially displacing Big Tech's cloud grip. While aimed at boosting national security and innovation, the proposal stirs fresh debate over federal control, efficiency, and who gets to steer the future of artificial intelligence.

GOLDMAN AND BNY TOKENIZE CASH → Goldman Sachs (GS) and BNY Mellon (BK) are piloting tokenized money market fund shares for instant trade settlement on a private blockchain. The move could streamline transactions, but broader adoption still depends on regulatory approval.

Was this email forwarded to you? Sign up for free here.

POLL OF THE DAY

Is XRP Just Catching Its Breath?

Politics

Big Data, Big Politics

source DALL-E

Trump Wants U.S. to Own the Cloud: President Donald Trump unveiled a sweeping plan to centralize America’s data infrastructure through a government-run “Universal Artificial Intelligence” (UAI) system. It would create a national network of data centers on federal land, serving as the backbone of both AI innovation and citizen data storage, under the pretense of reducing foreign influence and boosting American dominance.

Privacy Trade-Offs and Surveillance Fears: While pitched as a way to reclaim data sovereignty from China, critics say the proposal echoes state-run surveillance systems. Under the plan, government-backed data centers would store massive amounts of private and public information, raising alarm among civil liberties advocates who see this as a potential Trojan horse for digital overreach.

Big Tech Could Be Cut Out: Trump’s plan would effectively sideline cloud giants like Amazon (AMZN), Microsoft (MSFT), and Google (GOOG), who currently power much of the nation’s AI infrastructure. With “public ownership” as the goal, Trump’s proposal threatens to upend the business model of hyperscalers, while raising big questions about efficiency, innovation, and who gets to train tomorrow’s AI.

Finance

Goldman and BNY Tokenize Cash

source DALL-E

Big banks quietly go digital: Goldman Sachs (GS) and BNY Mellon (BK) have launched a pilot letting clients tokenize shares of a Goldman money market fund to settle trades on a private blockchain. The program, which began in May, is part of efforts to modernize finance using blockchain infrastructure.

Faster, cheaper, smarter settlement: The tokens allow real-time settlement without relying on stablecoins or bank deposits. By using fund shares as a cash equivalent, the system could cut costs and free up capital tied in slow-moving transactions.

Regulation is still the bottleneck: The tokens are fully backed by fund shares and available only to select clients. Expansion hinges on regulatory approval, as broader adoption would require a green light from the SEC.

KEEP READING

AI startups raised $104 billion in first half of year, but exits tell a different story (CNBC)

Judge denies Trump admin bid to unseal Jeffrey Epstein grand jury transcripts in Florida (CNBC)

Altcoin Season Takes Breather With SOL, XRP, TON Among Those Posting Heavy Losses (Yahoo Finance)

Bryan Johnson Is Going to Die (Wired)

Trump’s AI strategy trades guardrails for growth in race against China (TechCrunch)

How to Change Your Money Mindset: 9 Tips for Abundance Thinking (ML)

WHAT WE’RE WATCHING

OUR FAVORITE TOOLS & RESOURCES

Deribit — Crypto Futures and Options Exchange

Generated Assets — Turn any idea into an investable index

Polymarket — The world’s largest prediction market

Unusual Whales — Companion for uncovering unusual market activity

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

CME FedWatch Tool — Market-implied probabilities of future levels of interest rates

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

ChatGPT — Large language model-based chatbot powered by generative AI

Vimcal — Lightning-fast calendar and AI scheduling assistant

AltIndex — Alternative datasets to uncover unique insights

GFR Smart Stock Selector — Filters stocks to help investor choices

WE WANT YOUR FEEDBACK

How would you rate today's newsletter?

Investment advisory services provided by ML Wealth LLC. Investment Accounts Are Not FDIC Insured • No Bank Guarantee • Investments May Lose Value. For important information and disclosures relating to the MoneyLion Investment Account, see Investment FAQs, Form ADV Brochure, and moneylion.com/investing. Funded managed investing accounts are subject to a monthly account fee of $1 (for accounts valued up to $5,000), $3 (for accounts valued over $5,000, and up to $25,000), or $5 (for accounts valued over $25,000).

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.