TLDR

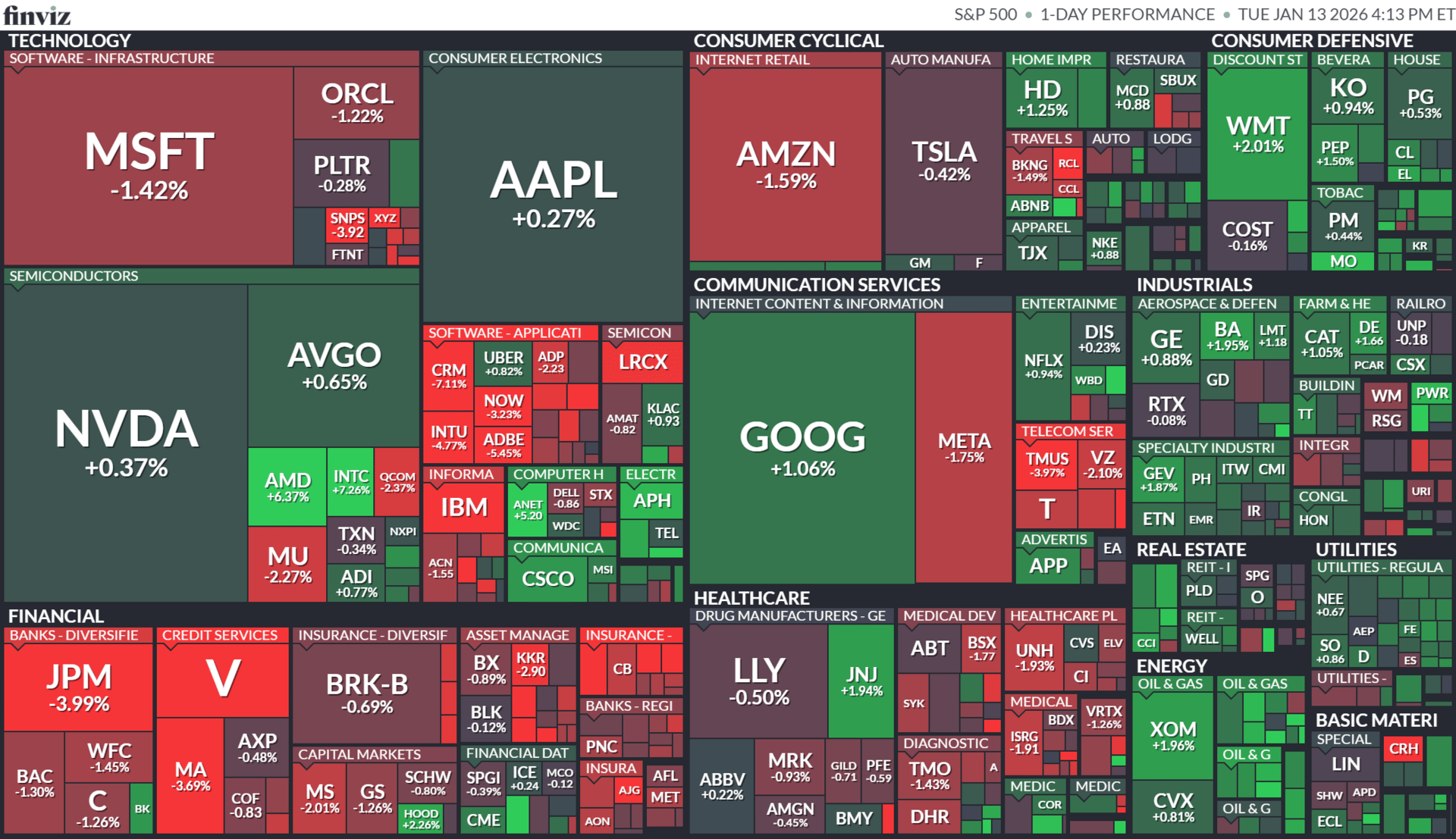

MARKET RECAP → Major U.S. indexes pulled back from record highs as the earnings season kicked off. Financials were a drag, notably JPMorgan Chase shares sliding after earnings disappointment, while other sectors showed pockets of strength.

📊 INFLATION HOLDS STEADY → December CPI confirms inflation is moderating from earlier highs but remains above the Fed’s target, reinforcing a cautious policy path while keeping price pressures visible across key spending categories.

🔍 HOW BARRY DILLER SPOTLIGHTS GREAT IDEAS → Reject cynicism, embrace open conflict, and build confidence by doing — that’s how Diller separates good ideas from bad and keeps innovation alive.

Was this email forwarded to you? Sign up for free here.

MARKETS

Market Snapshot

Today’s S&P 500 Heatmap

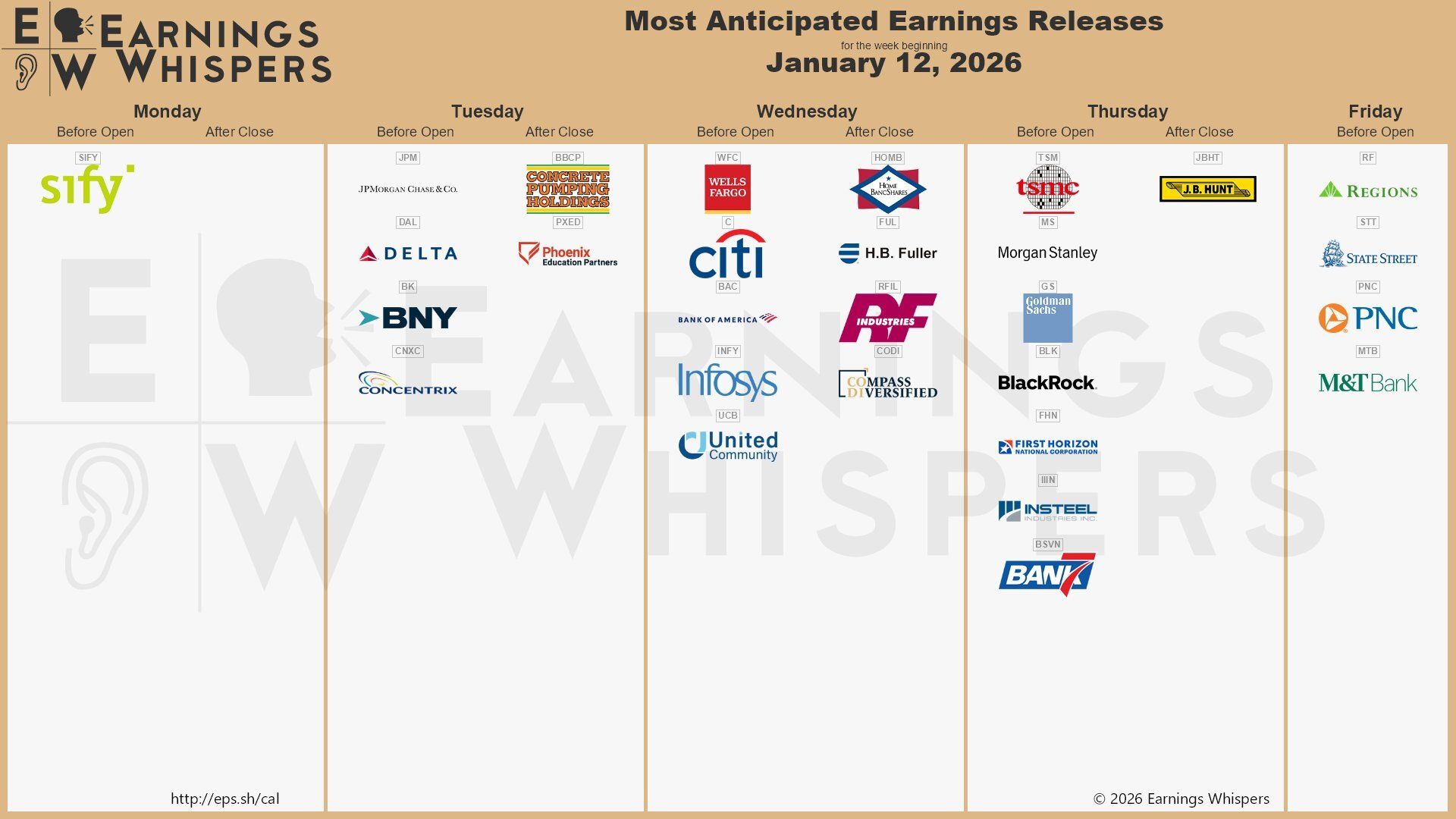

Notable Earnings

For the week beginning January 12, 2026

ECONOMICS

Inflation Holds Steady in December

Gemini

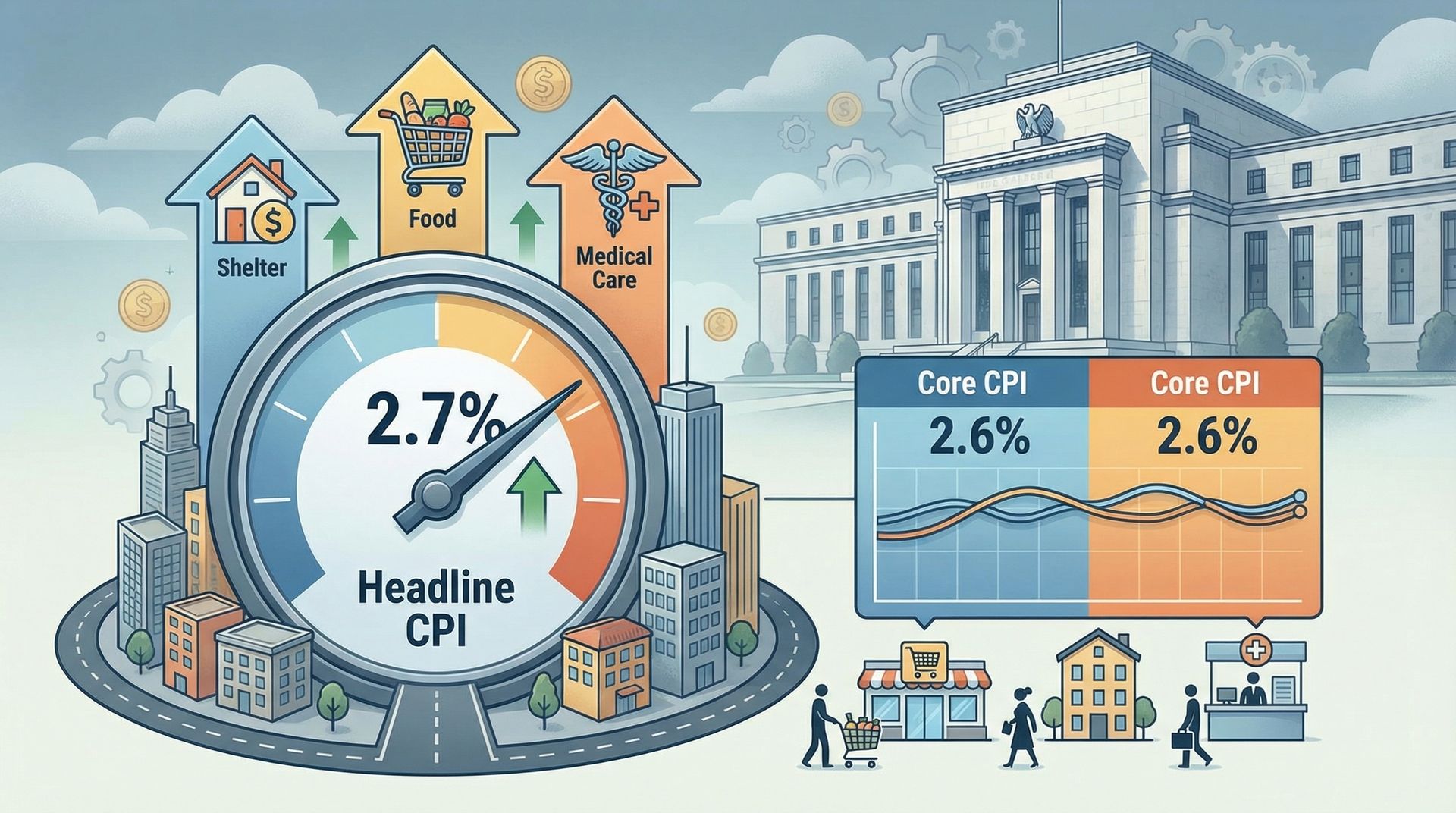

📈 Headline CPI stays at 2.7% — U.S. consumer prices rose 2.7% year-over-year in December 2025, unchanged from November and roughly in line with economists’ expectations. On a monthly basis, the Consumer Price Index increased about 0.3%, reflecting persistent but contained inflation pressures.

🍔 Food, shelter and services lead core strength — Core inflation (excluding volatile food and energy) also held firm at around 2.6% annually, with categories like shelter, housing and medical care continuing to contribute upward momentum. Food prices climbed notably, while some energy components — like gasoline — showed mixed movement.

🏦 What it means for policy and markets — While the inflation picture is cooler than peaks earlier in 2025, it remains above the Federal Reserve’s 2% target, supporting expectations that the Fed will hold interest rates steady at its upcoming meeting rather than cutting further immediately. Markets interpreted the data as confirming stability rather than dramatic disinflation.

STOCK PICKS

How Barry Diller Spotlights Great Ideas

Gemini

💡 Cynicism kills creativity, says Diller: Billionaire media executive Barry Diller told CNBC that the biggest mistake leaders make when judging ideas is bringing a cynical mindset to the table. According to Diller, skepticism that dismisses ideas early cuts off innovation before it has a chance to breathe.

🗣️ Creative conflict over quiet consensus: Rather than shying away from disagreement, Diller champions loud, passionate debate among teams. He says “creative conflict,” where colleagues hash out differences openly and argue over ideas until they are genuinely vetted, produces better decisions and stronger concepts.

🔥 Confidence grows by doing: Diller also underscored a broader leadership truth he’s learned over decades: confidence seldom arrives fully formed — it often builds through execution. Jumping in, testing, iterating and refining, he says, beats waiting to feel “ready” before acting.

KEEP READING

Uber CEO: ‘If you think you can plan 5 years into the future, you’re kidding yourself’—what to do instead (CNBC)

Bigger tax refunds are coming for 2026 — what it could mean for the economy (CNBC)

JPMorgan Chase says banks could fight Trump credit card rate cap: ‘Everything’s on the table’ (CNBC)

NOTABLE POSTS

WHAT WE’RE WATCHING

Tools & Resources

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

AltIndex — Alternative datasets to uncover unique insights

GFR Smart Stock Selector — Filters stocks to help investor choices

WE WANT YOUR FEEDBACK

How would you rate today's newsletter?

Investment advisory services provided by ML Wealth LLC. Investment Accounts Are Not FDIC Insured • No Bank Guarantee • Investments May Lose Value. For important information and disclosures relating to the MoneyLion Investment Account, see Investment FAQs, Form ADV Brochure, and moneylion.com/investing. Funded managed investing accounts are subject to a monthly account fee of $1 (for accounts valued up to $5,000), $3 (for accounts valued over $5,000, and up to $25,000), or $5 (for accounts valued over $25,000).

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.