TLDR

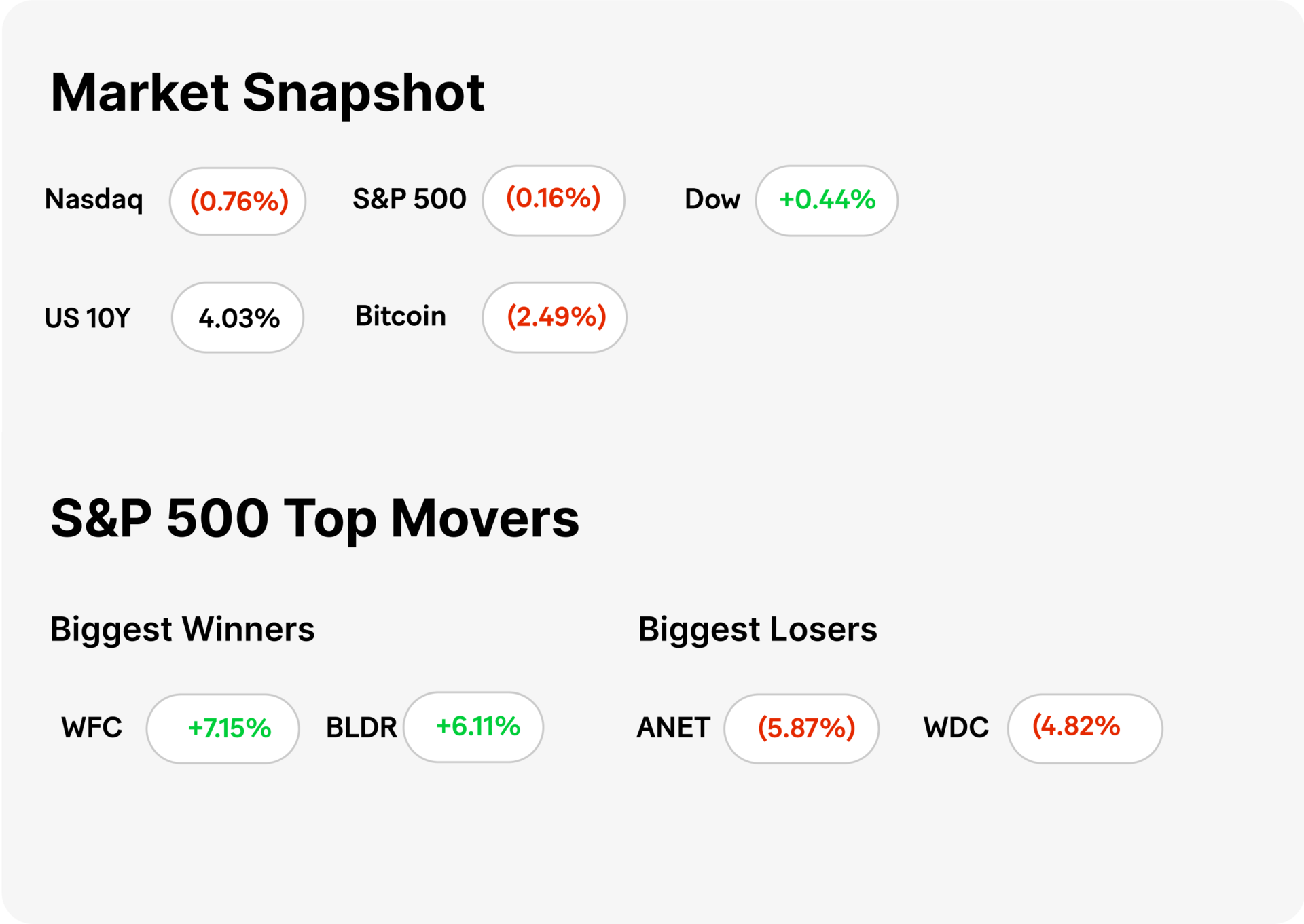

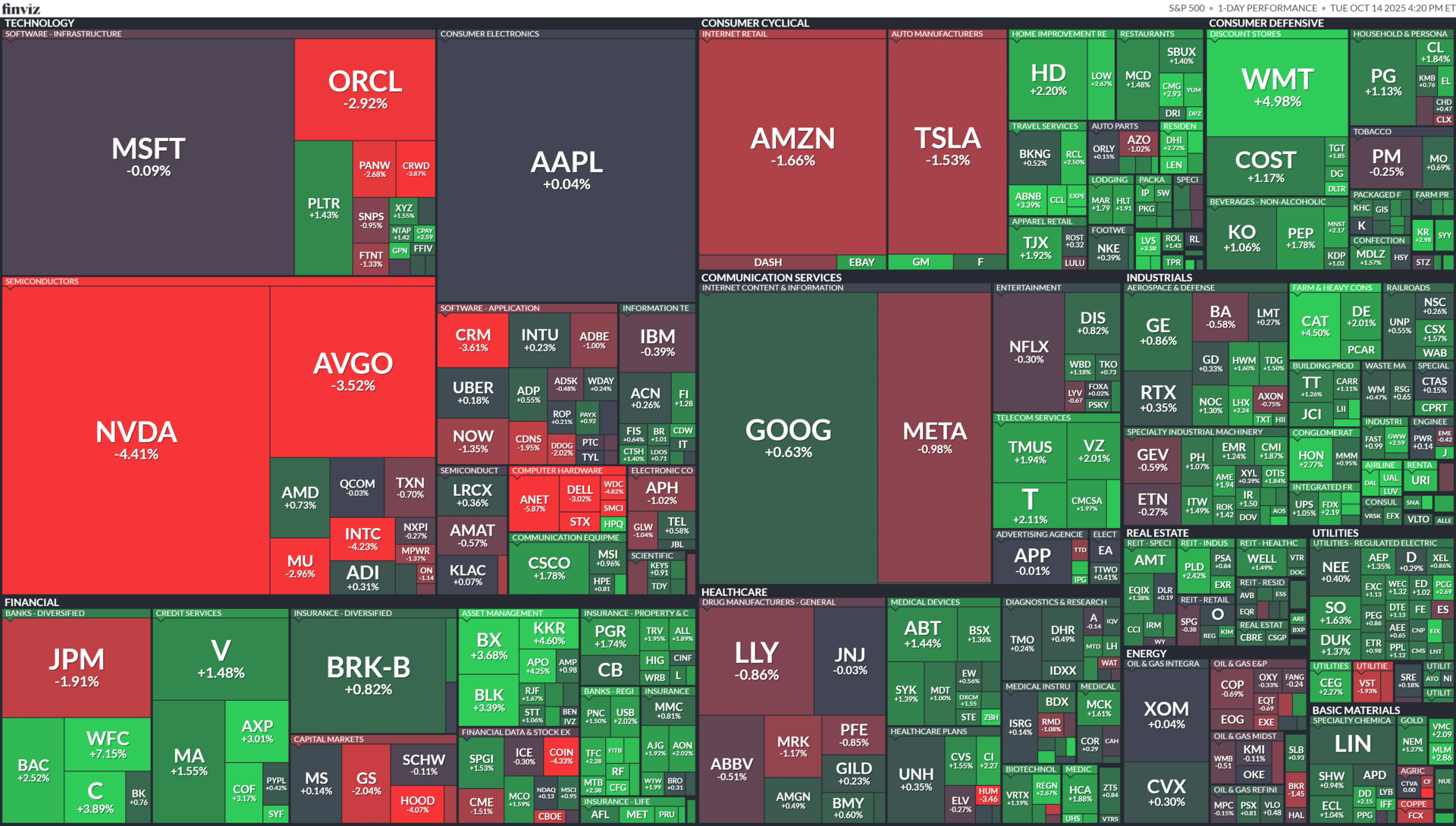

MARKET RECAP → Stocks closed mixed on Tuesday as Trump knocked China again, a swift reversal from yesterday’s nod!

🏦 POWELL HINTS AT A PAUSE → Fed Chair Jerome Powell said the central bank’s balance-sheet tightening may end soon but gave no rate clues, easing markets as traders eye potential cuts ahead.

💰 ECONOMIC MOOD GAP → A new survey finds wealthy Americans feeling upbeat while low-income households struggle with costs—showing how inflation and inequality split the nation’s economic outlook.

Was this email forwarded to you? Sign up for free here.

ECONOMICS

Powell Hints at a Pause

Gemini

🏦 Tightening nearly done. Federal Reserve Chair Jerome Powell signaled the central bank’s balance-sheet reduction program may end “relatively soon,” suggesting quantitative tightening (QT) is nearing its final stretch after two years of runoff.

💬 Rates still in limbo. Powell offered no explicit guidance on the path of interest rates, emphasizing data dependence while noting inflation has cooled and labor markets are “normalizing.” Futures now price in higher odds of a December rate cut.

📉 Markets breathe easier. Treasury yields dipped and equities rose modestly after Powell’s remarks, as investors interpreted them as dovish—an early sign the Fed could soon shift from tightening to steadying.

ECONOMICS

Economic Mood Gap

Gemini

💰 Two economies, one country. A new survey shows a huge divide between how high- and low-income Americans view the economy. While 68% of high earners (making over $100K) say their finances are in good shape, only 27% of low earners feel the same.

📉 Inflation scars linger. Lower-income households report that rising rent, groceries, and credit card debt have erased wage gains. Meanwhile, wealthier Americans benefited from higher asset prices, stock market gains, and cheaper borrowing access.

⚖️ Confidence split widens. The gap highlights an uneven recovery: consumer sentiment among lower-income groups has fallen to near post-pandemic lows, even as GDP growth and unemployment data paint a healthier macro picture.

SHARE OUR NEWSLETTER FOR SWAG!

KEEP READING

DOJ seizes $15 billion in bitcoin from massive ‘pig butchering’ scam based in Cambodia (CNBC)

Jamie Dimon says auto company bankruptcies reveal ‘early signs’ of excess in corporate lending (CNBC)

WHAT WE’RE WATCHING

OUR FAVORITE TOOLS & RESOURCES

Fiscal.ai — Investment research platform combining institutional-grade financial data, analytics, and conversational AI.

Generated Assets — Turn any idea into an investable index

Polymarket — The world’s largest prediction market

Unusual Whales — Companion for uncovering unusual market activity

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

CME FedWatch Tool — Market-implied probabilities of future levels of interest rates

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

ChatGPT — Large language model-based chatbot powered by generative AI

Vimcal — Lightning-fast calendar and AI scheduling assistant

AltIndex — Alternative datasets to uncover unique insights

GFR Smart Stock Selector — Filters stocks to help investor choices

WE WANT YOUR FEEDBACK

How would you rate today's newsletter?

Investment advisory services provided by ML Wealth LLC. Investment Accounts Are Not FDIC Insured • No Bank Guarantee • Investments May Lose Value. For important information and disclosures relating to the MoneyLion Investment Account, see Investment FAQs, Form ADV Brochure, and moneylion.com/investing. Funded managed investing accounts are subject to a monthly account fee of $1 (for accounts valued up to $5,000), $3 (for accounts valued over $5,000, and up to $25,000), or $5 (for accounts valued over $25,000).

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.