TLDR

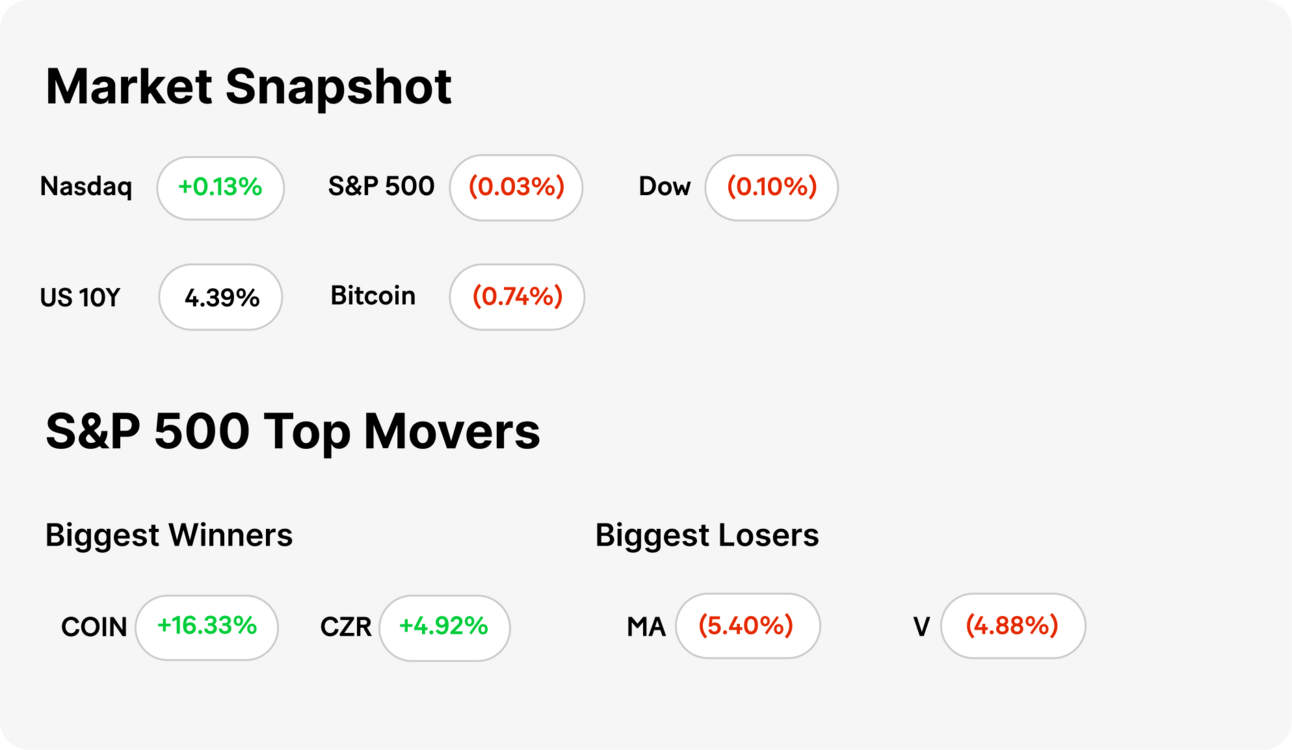

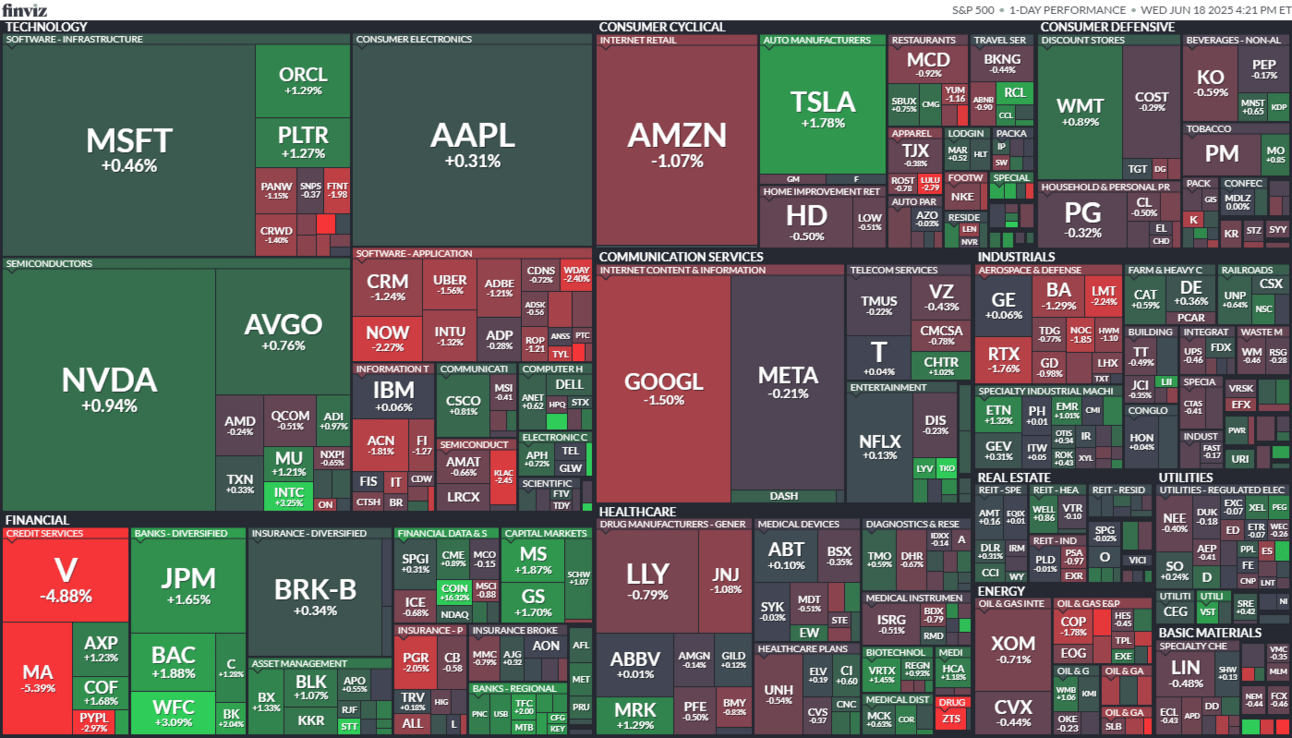

MARKET RECAP → Stocks ended up just about flat on Wednesday after the U.S. central bank left rates unchanged following expectations, however Fed chair Jerome Powell said monetary policy still has to find a way to restrain the economy.

POWELL HITS THE PAUSE BUTTON → The Fed kept rates steady and trimmed its 2025 cut outlook to one. Powell played it safe, stressing data dependence as inflation cools—slowly. Markets adjusted, eyeing fewer and later cuts.

STABLECOIN BILL LIFT-OFF → Congress just gave stablecoins the green light—Circle (CRCL) soared nearly 500%, Coinbase (COIN) jumped double digits, and Wall Street’s betting big on a $2 trillion crypto payment future.

Was this email forwarded to you? Sign up for free here.

Finance

Powell Hits the Pause Button

source DALL-E

The Federal Reserve kept its benchmark interest rate unchanged, as widely expected, marking the seventh straight meeting without a cut: Chair Jerome Powell signaled that while inflation has cooled slightly, it’s not enough to warrant a rate reduction just yet. The Fed’s updated projections now point to only one rate cut in 2025, down from the three cuts forecast in March.

Powell struck a cautious tone, emphasizing the need for more data before loosening policy: He acknowledged “modest further progress” on inflation but warned that price stability isn’t locked in. Markets wobbled initially but recovered as investors digested the Fed’s commitment to a data-dependent path.

Wall Street recalibrated its rate-cut bets, while Treasury yields rose and stocks churned: Traders now see a slim chance of a September cut, pushing expectations further into the year. The Fed’s message: lower rates are coming—but not on autopilot.

Crypto

Stablecoin Bill Lift-Off

source DALL-E

Federal Framework Breakthrough: The Senate passed the GENIUS Act on June 18, 2025, with a 68–30 bipartisan vote. That clears the way for federal regulation of U.S. dollar-backed stablecoins—mandating full reserves, monthly disclosures, and anti‑money‑laundering controls—marking a milestone in crypto oversight.

Stocks Skyrocket: Circle (CRCL) stock has leapt nearly 480% since its June 5 IPO, trading around $180–190 after a roughly 20–27% surge. As USDC’s issuer, Circle directly benefits . Coinbase (COIN) shares gained ~11–14%, buoyed by its 50% share of USDC revenue.

POLL OF THE DAY

KEEP READING

Coinbase seeking U.S. SEC approval to offer blockchain-based stocks (Reuters)

Trump says he gave Iran ‘ultimate ultimatum,’ as U.S. prepares to evacuate citizens from Israel (CNBC)

Trump deploys 2,000 additional National Guard troops to Los Angeles (CNBC)

How Steve Jobs Wrote the Greatest Commencement Speech Ever (Wired)

Employees are imprisoned in an ‘infinite workday’ (Morning Brew)

TSA PreCheck Cost Guide: Benefits & Is It Worth It? (ML)

WHAT WE’RE WATCHING

OUR FAVORITE TOOLS & RESOURCES

Deribit — Crypto Futures and Options Exchange

Generated Assets — Turn any idea into an investable index

Polymarket — The world’s largest prediction market

Unusual Whales — Companion for uncovering unusual market activity

OpenBB — AI-powered research and analytics workspace

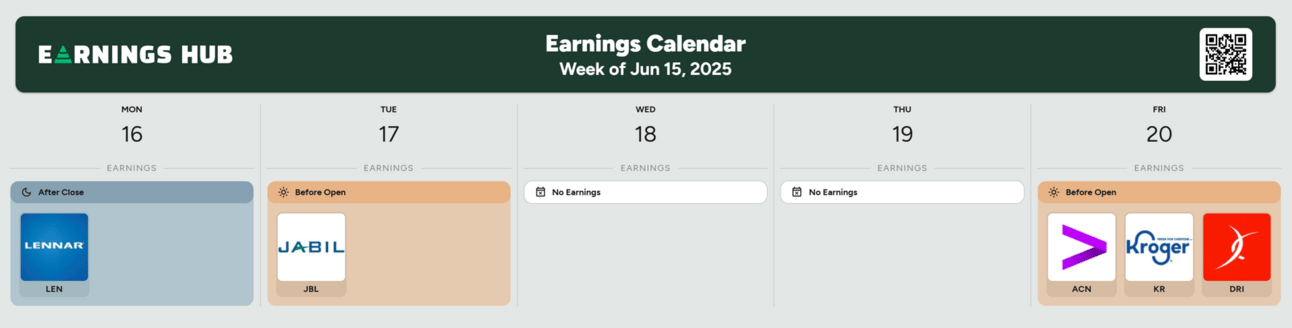

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

CME FedWatch Tool — Market-implied probabilities of future levels of interest rates

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

ChatGPT — Large language model-based chatbot powered by generative AI

Vimcal — Lightning-fast calendar and AI scheduling assistant

WE WANT YOUR FEEDBACK

How would you rate today's newsletter?

Investment advisory services provided by ML Wealth LLC. Investment Accounts Are Not FDIC Insured • No Bank Guarantee • Investments May Lose Value. For important information and disclosures relating to the MoneyLion Investment Account, see Investment FAQs, Form ADV Brochure, and moneylion.com/investing. Funded managed investing accounts are subject to a monthly account fee of $1 (for accounts valued up to $5,000), $3 (for accounts valued over $5,000, and up to $25,000), or $5 (for accounts valued over $25,000).

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.