TLDR

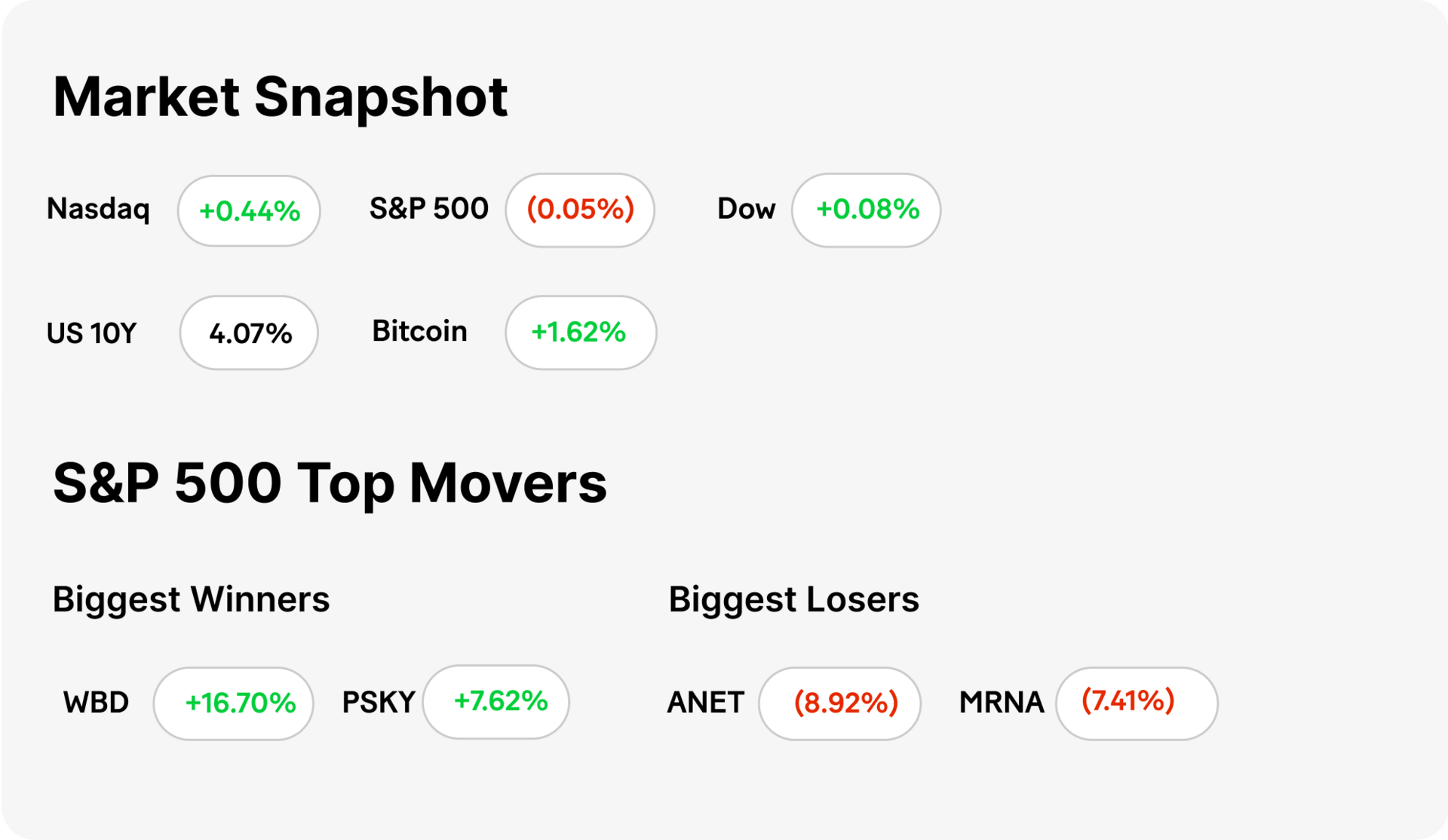

🟢 MARKET RECAP → The tech-heavy Nasdaq (QQQ) closed a perfect week of all-time highs as markets shook off inflation data, AI continued to drive investor optimism, and traders bet a quarter-point rate cut is nearly certain at next week’s FOMC meeting.

🎢 OPENDOOR SLASHES STAFF → Opendoor (OPEN) stock rose nearly 80% during Friday’s trading session as it is set to fire ~85% of its 1,400 employees, leaving ~200, as new leadership, including Kaz Nejatian and returning co-founder Eric Wu aim to trim costs and restore mission focus. However, shares gave up the initial boost and closed ~14% lower.

🌕 GEMINI SKYROCKETS → Gemini (GEMI) IPO’d at $28, then rocketed over 30% in its Nasdaq debut, raising $425M and landing at a ~$4.4B valuation — strong demand but heavy losses remain. GEMI ultimately closed at $32/share, up ~14% on its first day of trading.

Was this email forwarded to you? Sign up for free here.

MARKETS

Market Snapshot

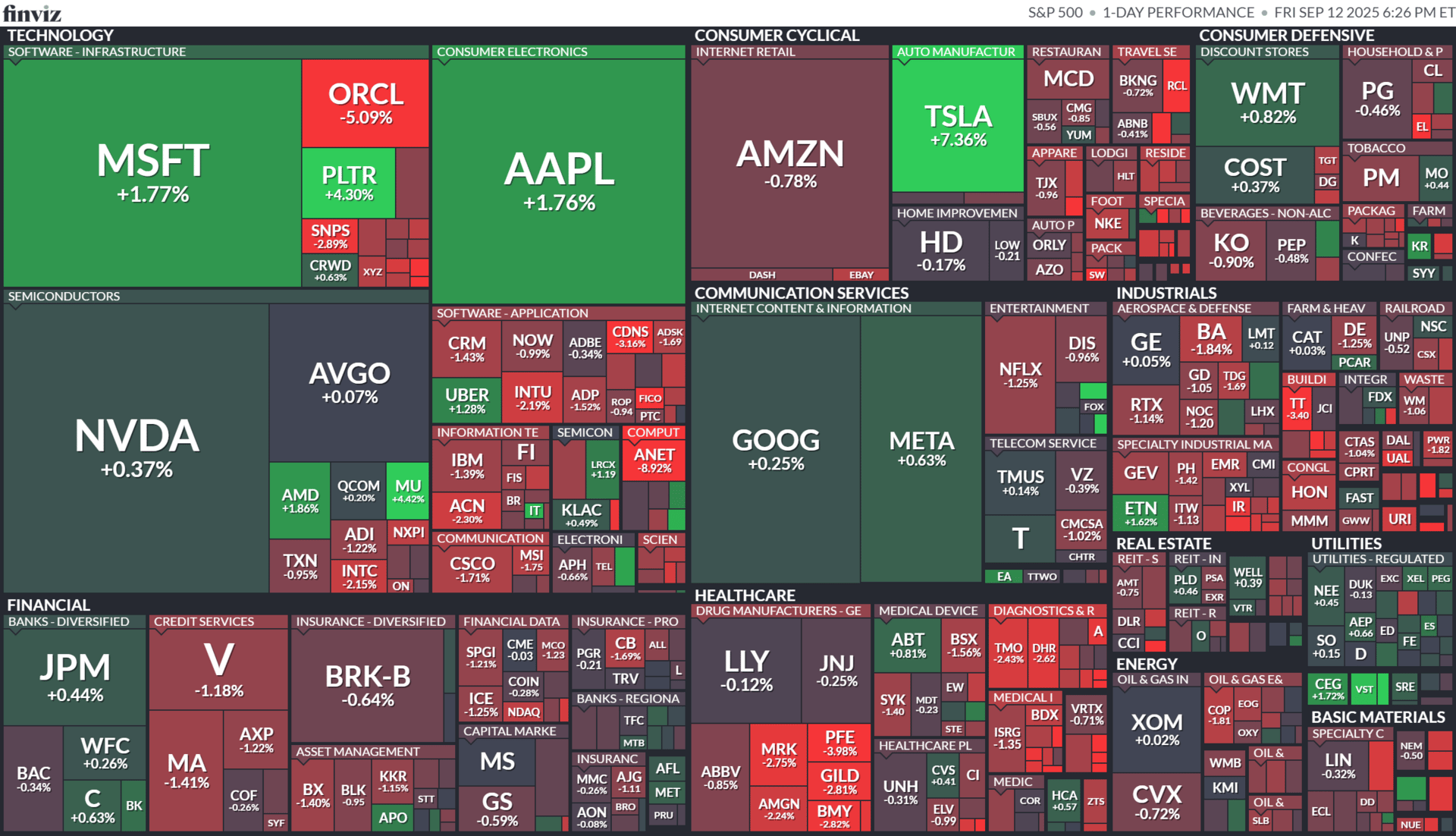

Today’s S&P 500 Heatmap

Notable Earnings:

Week Beginning September 15, 2025

Chart of The Day

MarketDesk

REAL ESTATE

Opendoor Slashes Staff

Gemini

🪓 Massive layoff ahead. Opendoor (OPEN) board chair Keith Rabois says he plans to reduce the company’s workforce by about 85%, cutting from roughly 1,400 employees to just 200, calling the current team “bloated.”

📉 Board shake-up plus CEO return. Alongside his elevation, former Shopify exec Kaz Nejatian is now Opendoor’s CEO, and co-founder Eric Wu is returning as a board member. Rabois criticizes remote work and says the company has drifted from its original mission.

🔥 Burning cash blamed. The cuts are positioned as necessary to stem Opendoor’s cash burn and refocus on core operations. The move follows investor pressure and concerns over operational inefficiency.

IPO

Gemini Skyrockets

Gemini

📈 IPO pops big. Gemini Space Station (GEMI) shares surged as much as 32.2% in their Nasdaq debut, opening at $37.01 — well above the $28 IPO price. The spike valued the company at ~$4.4 billion.

💰 Strong demand, high price. The IPO raised $425 million through the sale of ~15.2 million shares at $28 each — slightly fewer shares than initially planned, but the raised trading price range (above the original $24–$26) marked strong investor interest.

📉 Still growing fast, still losing. Gemini reported a net loss of $282.5 million in the first half of 2025, with revenue declining year-over-year even as user base, trading volume, and assets under management rose.

SHARE OUR NEWSLETTER FOR SWAG!

KEEP READING

$7 trillion ‘wall of cash’ worry is looming for investors once Fed interest rate cuts start (CNBC)

Pfizer, Moderna shares fall on report that Trump officials will link child deaths to Covid shots (CNBC)

Ram cancels plans for all-electric pickup truck (CNBC)

NOTABLE POSTS

WHAT WE’RE WATCHING

OUR FAVORITE TOOLS & RESOURCES

Generated Assets — Turn any idea into an investable index

Polymarket — The world’s largest prediction market

Unusual Whales — Companion for uncovering unusual market activity

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

CME FedWatch Tool — Market-implied probabilities of future levels of interest rates

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

ChatGPT — Large language model-based chatbot powered by generative AI

Vimcal — Lightning-fast calendar and AI scheduling assistant

AltIndex — Alternative datasets to uncover unique insights

GFR Smart Stock Selector — Filters stocks to help investor choices

WE WANT YOUR FEEDBACK

How would you rate today's newsletter?

Investment advisory services provided by ML Wealth LLC. Investment Accounts Are Not FDIC Insured • No Bank Guarantee • Investments May Lose Value. For important information and disclosures relating to the MoneyLion Investment Account, see Investment FAQs, Form ADV Brochure, and moneylion.com/investing. Funded managed investing accounts are subject to a monthly account fee of $1 (for accounts valued up to $5,000), $3 (for accounts valued over $5,000, and up to $25,000), or $5 (for accounts valued over $25,000).

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.