TLDR

MARKET RECAP → The S&P 500 posted a slight gain on Thursday as Wall Street anticipated new inflation data, seeking hints on when the Federal Reserve might start lowering interest rates.

WALGREENS BOOTS ALLIANCE Q3 2024 RESULTS→ 📉 Walgreens' Q3 earnings dipped to $0.71 per share due to rising costs, despite a slight sales boost to $36B, as they aim for $1B in savings with a strategic overhaul.

JPMorgan Chase Stress Test Glitch → 🔧 JPMorgan Chase stumbled in the Fed's stress tests, resulting in a capital buffer hike that might cramp their stock buyback plans, especially with commercial real estate losses looming larger than a CFO’s worst nightmare.

Was this email forwarded to you? Sign up for free here.

TODAY’S TOP NEWS

Walgreens Boots Alliance Q3 2024 Results

📉 Profit Squeeze: Walgreens reported a decline in adjusted earnings to $0.71 per share, down from $1.00 the previous year. This was attributed to rising operating costs and increased competition, reflecting ongoing pressures in the retail pharmacy sector.

📈 Sales Stability: Despite the earnings drop, sales saw a modest increase to approximately $36 billion, demonstrating resilience amidst a challenging retail environment. The company's focus on expanding its e-commerce platform and improving customer experience played a crucial role in maintaining sales.

🛠️ Strategic Overhaul: Walgreens is undergoing a strategic review aimed at streamlining operations and boosting efficiency, with a target of $1 billion in cost savings for the fiscal year. This includes initiatives to enhance omnichannel capabilities and introduce more private brands, positioning the company for long-term growth.

TODAY’S TOP NEWS

JPMorgan Chase Stress Test Glitch

🛠️ Stress Test Snafu: JPMorgan Chase faced unexpected difficulties in the recent Fed stress tests, resulting in a higher-than-anticipated increase in their stress capital buffer (SCB). Analysts noted a 90 to 100 basis point rise, impacting the bank's capital planning and possibly constraining stock buybacks.

📉 Impact on Buybacks: The increased SCB means JPMorgan, along with Bank of America and Citigroup, might need to curb stock buybacks to maintain their common equity Tier 1 ratios. This move is crucial to meet regulatory capital requirements despite the projected higher loan loss rates under the severe adverse scenario.

💼 Sector-Specific Losses: The stress test highlighted significant potential losses in commercial real estate (CRE), particularly in office spaces affected by remote work trends. Despite these challenges, large banks, including JPMorgan, maintained sufficient capital to operate above minimum regulatory levels.

NOTABLE POSTS

KEEP READING

SpaceX is building a NASA craft to intentionally destroy the International Space Station after retiring (CNBC)

U.S. FDA declines to approve Merck-Daiichi’s ‘guided missile’ cancer drug (CNBC)

AI pioneer Illia Polosukhin, one of Google’s ‘Transformer 8,’ wants to democratize artificial intelligence (CNBC)

Japanese yen hits weakest level against dollar since 1986, reigniting intervention speculation (CNBC)

Americans are finding it harder to get a new job (CNN)

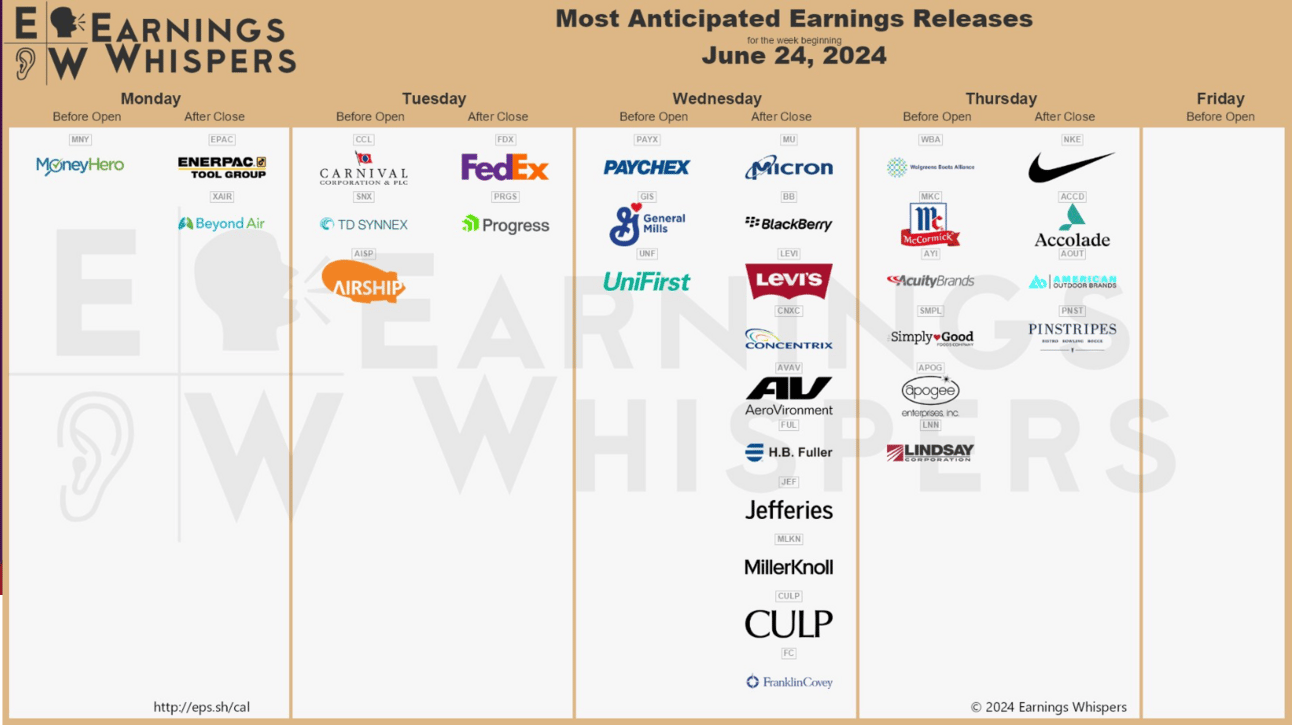

WHAT WE’RE WATCHING

OUR FAVORITE TOOLS & RESOURCES

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

CME FedWatch Tool — Market-implied probabilities of future levels of interest rates

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

ChatGPT — Large language model-based chatbot powered by generative AI

Notion AI — Notion AI is a writing assistant that can help you write, brainstorm, edit, summarize, and more

Vimcal — Lightning-fast calendar and AI scheduling assistant

The Bull vs. Bear Merchandise Promotion is a limited time campaign that begins on December 1, 2023 at 12:00 AM ET and ends on the date that there are no more Rewards. This Promotion is available to any registered MoneyLion user who is a legal resident of the 50 United States or the District of Columbia and who has reached the age of majority in their state as of the beginning of the Promotional Period. See terms and conditions here.

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.