TLDR

MARKET RECAP → The Dow Jones Industrial Average (DIA) rose on Monday as investors speculated that the failed assassination attempt on former President Donald Trump would boost the Republican presidential candidate and the GOP's prospects in the upcoming November elections.

GOLDMAN SACHS SURGES IN Q2 2024→📈 Goldman Sachs (GS) smashed Q2 2024 expectations with a 17% revenue jump to $12.73B, EPS of $8.62, and hiked its dividend by 9%—classic overachiever move.

MACY'S ENDS BUYOUT TALKS → 🛑 Macy’s (M) ended buyout talks with Arkhouse and Brigade after rejecting multiple revised offers. Citing financing concerns and strategic misalignments, the company ultimately found the deals "less than compelling" for shareholders.

Was this email forwarded to you? Sign up for free here.

TODAY’S TOP NEWS

Goldman Sachs Surges in Q2 2024

📈 Revenue and Profit Spike: Goldman Sachs reported a Q2 2024 revenue of $12.73 billion, a 17% increase year-over-year, surpassing the consensus estimate of $12.46 billion. Net profit surged to $2.89 billion, with earnings per share at $8.62, significantly beating analyst expectations.

💼 Investment Banking Boost: The investment banking division saw a 21% rise in fees, driven by higher revenues from debt and equity underwriting, including IPOs. Asset & Wealth Management also performed robustly, with revenues up 27% to $3.88 billion.

💸 Dividend Increase: Reflecting its strong financial performance, Goldman Sachs announced a 9% increase in its quarterly dividend to $3.00 per share. The bank also significantly reduced its provisions for credit losses to $282 million from $615 million the previous year.

TODAY’S TOP NEWS

Macy's Ends Buyout Talks

🛑 Negotiations Ended: After months of negotiations, Macy's terminated buyout talks with Arkhouse and Brigade, concluding the potential $6.6 billion acquisition was not in its best interest.

📉 Concerns Cited: Macy's cited concerns over financing details and the strategic focus on real estate assets as reasons for rejecting the proposals despite multiple revised offers.

🔍 Decision Process: The decision followed a back-and-forth where Macy's reviewed confidential information but ultimately found the offers "less than compelling" for shareholders.

KEEP READING

Cleveland-Cliffs to buy Canadian steelmaker Stelco for $2.8 billion (CNBC)

Google reportedly in advanced talks to acquire cyber startup Wiz for $23 billion, its largest-ever deal (CNBC)

Burberry shares drop 16% after the luxury giant issues profit warning and replaces CEO (CNBC)

The housing market, explained in 6 charts (CNBC)

Amazon sellers lose coveted buy box ahead of Prime Day after Target discount snafu (CNBC)

Nearly all AT&T cell customers’ call and text records exposed in a massive breach (CNN)

Unexpected bad news for inflation: Wholesale prices rose in June (CNN)

US markets are steady following assassination attempt on Trump (CNN)

WHAT WE’RE WATCHING

OUR FAVORITE TOOLS & RESOURCES

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

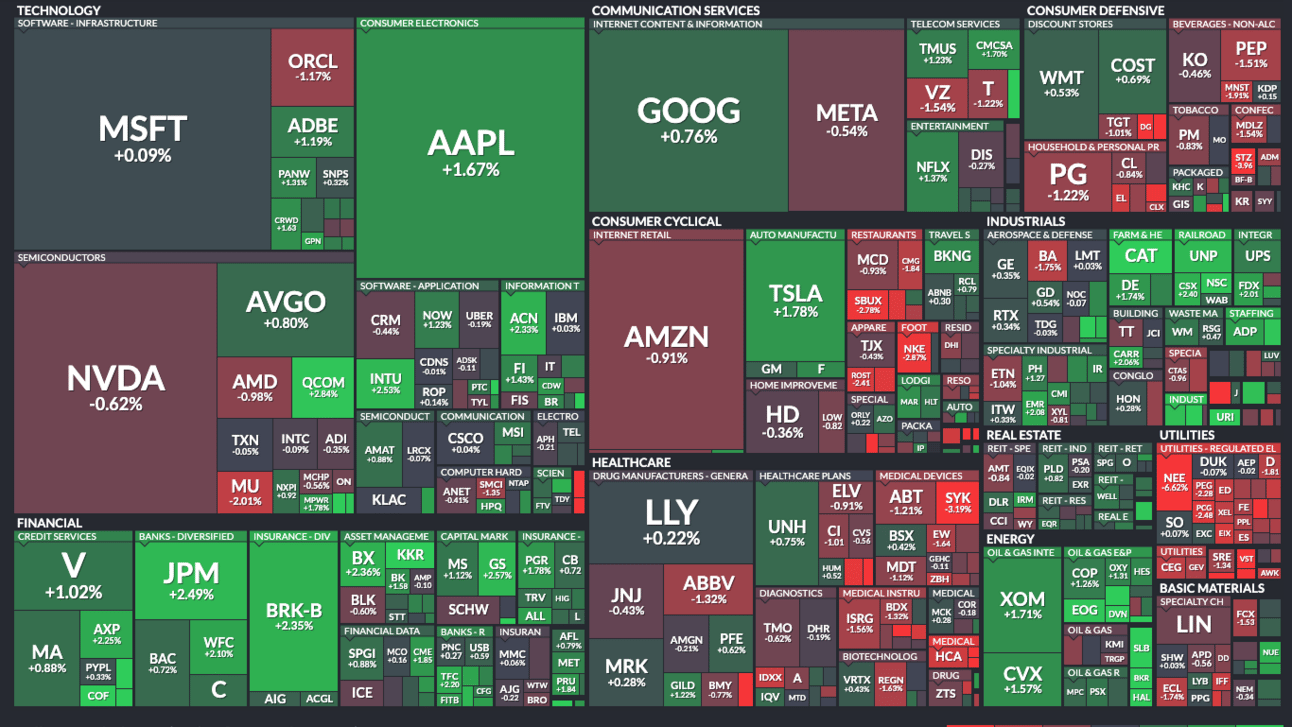

Finviz — Financial visualizations

Trading Economics — Economic calendar

CME FedWatch Tool — Market-implied probabilities of future levels of interest rates

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

ChatGPT — Large language model-based chatbot powered by generative AI

Notion AI — Notion AI is a writing assistant that can help you write, brainstorm, edit, summarize, and more

Vimcal — Lightning-fast calendar and AI scheduling assistant

The Bull vs. Bear Merchandise Promotion is a limited time campaign that begins on December 1, 2023 at 12:00 AM ET and ends on the date that there are no more Rewards. This Promotion is available to any registered MoneyLion user who is a legal resident of the 50 United States or the District of Columbia and who has reached the age of majority in their state as of the beginning of the Promotional Period. See terms and conditions here.

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.