TLDR

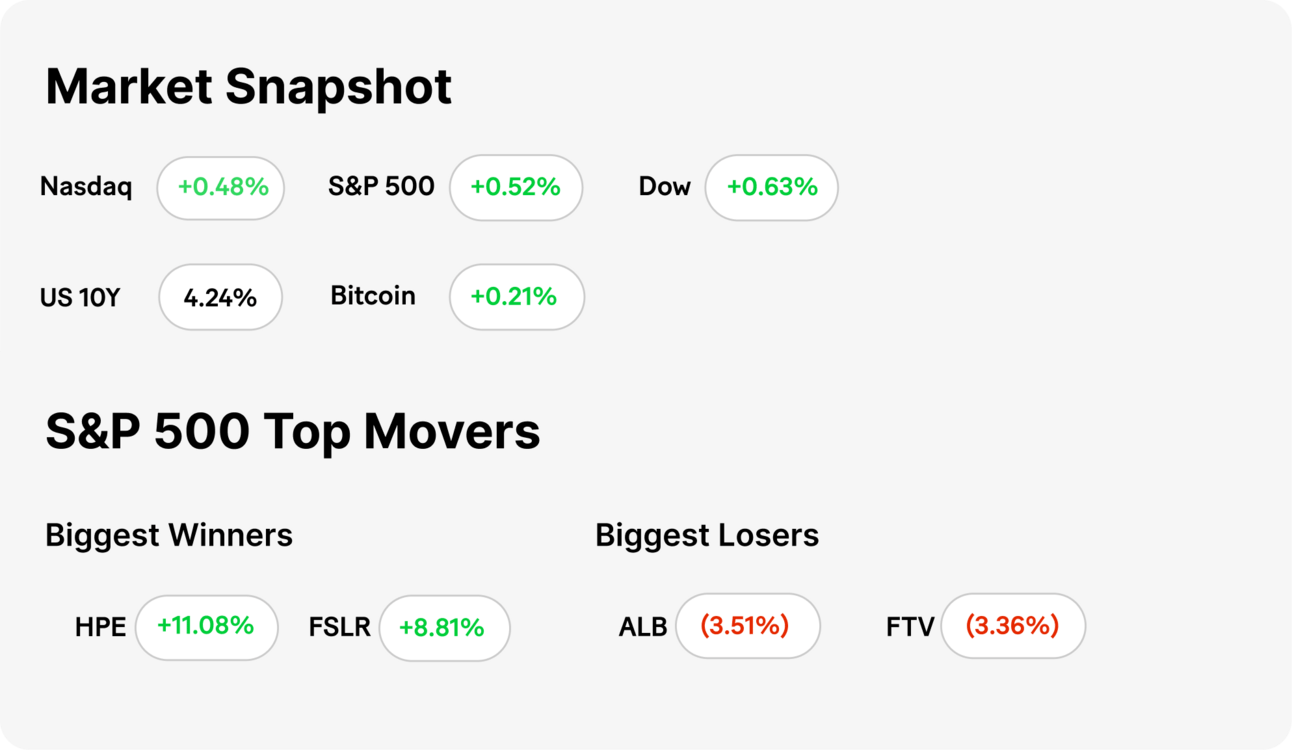

MARKET RECAP → Stocks on Monday kept rising as investors looked to close out the month with fireworks, hitting more record highs in the S&P 500 and the Nasdaq Composite.

CANADA DROPS DIGITAL TAX→ Facing U.S. pressure, Canada repealed its digital services tax on American tech firms, leading to the resumption of trade talks with the U.S. The move aims to secure a new trade deal by July 21 but has sparked backlash domestically over Ottawa’s handling of the issue.

META’S MARKET MIND MELD → Meta (META) hit record highs as investors rallied behind Zuckerberg’s aggressive AI expansion, including plans to spend up to $65 billion on infrastructure in 2025. The company is being revalued as a serious AI and data center player—not just a social network.

Was this email forwarded to you? Sign up for free here.

POLL OF THE DAY

How are you responding to the clean energy tax proposal in your investments?

Politics

Canada Drops Digital Tax

source DALL-E

Canada Backs Down to Restart Talks: Canada has scrapped its 3% digital services tax targeting U.S. tech giants like Amazon (AMZN) and Google (GOOG), just hours before it was set to take effect. The move follows intense pressure from President Trump, who had halted trade negotiations and threatened new tariffs, calling the tax a “blatant attack” on American firms.

Trade Talks Back On: With the tax repealed, trade negotiations between the U.S. and Canada are resuming immediately, aiming for a deal by July 21. White House economic adviser Kevin Hassett confirmed the restart, noting that digital taxes will remain a key issue in U.S. talks with other countries as well.

Domestic Fallout in Canada: Canada's reversal drew praise from U.S. officials and business groups but sparked criticism at home. Critics argue the government mishandled the tax issue, alienating allies and misreading the tech sector. The tax was expected to raise over $7 billion over five years, but its retroactive nature and potential impact on consumers and businesses led to its downfall.

Tech

Meta’s Market Mind Meld

source DALL-E

Meta’s AI pivot sends stock soaring: Meta (META) hit a fresh all-time high after CEO Mark Zuckerberg doubled down on AI infrastructure and Wall Street cheered the bet. Shares are up about 27% year-to-date, lifted by optimism around Meta’s buildout of custom data centers and plans to deploy 1.3 million GPUs by year-end. Analysts increasingly view Meta as a serious AI infrastructure player, not just a social media giant.

CapEx explosion fuels optimism: Zuckerberg is going all-in on AI spending, with Meta projecting up to $65 billion in capital expenditures for 2025—far above its 2024 estimate of $40 billion. Much of that will fund AI infrastructure, including massive training clusters and silicon investments. While not all chip details are public, Meta’s ambition to control the full AI stack echoes Amazon’s cloud strategy.

Wall Street likes the transformation: Analysts are raising price targets, highlighting Meta’s strong ad business and leaner operations as tailwinds. Reels monetization is improving, and the AI narrative gives Meta a compelling story alongside rivals like Alphabet (GOOG) and Microsoft (MSFT). Even the metaverse is on the back burner for now—AI is clearly the main character.

KEEP READING

Oracle stock jumps after $30 billion annual cloud deal revealed in filing (CNBC)

Solar and wind industry faces up to $7 billion tax hike under Trump’s big bill, trade group says (CNBC)

First Solana ETF to Hit the Market This Week; SOL Price Jumps 5% (CoinDesk)

Musk says tax bill will ‘destroy’ jobs as it advances in Senate (Morning Brew)

AI is making everyone sound the same (Morning Brew)

What is a Money Order? How a Money Order Works (ML)

WHAT WE’RE WATCHING

OUR FAVORITE TOOLS & RESOURCES

Deribit — Crypto Futures and Options Exchange

Generated Assets — Turn any idea into an investable index

Polymarket — The world’s largest prediction market

Unusual Whales — Companion for uncovering unusual market activity

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

CME FedWatch Tool — Market-implied probabilities of future levels of interest rates

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

ChatGPT — Large language model-based chatbot powered by generative AI

Vimcal — Lightning-fast calendar and AI scheduling assistant

AltIndex — Alternative datasets to uncover unique insights

GFR Smart Stock Selector — Filters stocks to help investor choices

WE WANT YOUR FEEDBACK

How would you rate today's newsletter?

Investment advisory services provided by ML Wealth LLC. Investment Accounts Are Not FDIC Insured • No Bank Guarantee • Investments May Lose Value. For important information and disclosures relating to the MoneyLion Investment Account, see Investment FAQs, Form ADV Brochure, and moneylion.com/investing. Funded managed investing accounts are subject to a monthly account fee of $1 (for accounts valued up to $5,000), $3 (for accounts valued over $5,000, and up to $25,000), or $5 (for accounts valued over $25,000).

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.