TLDR

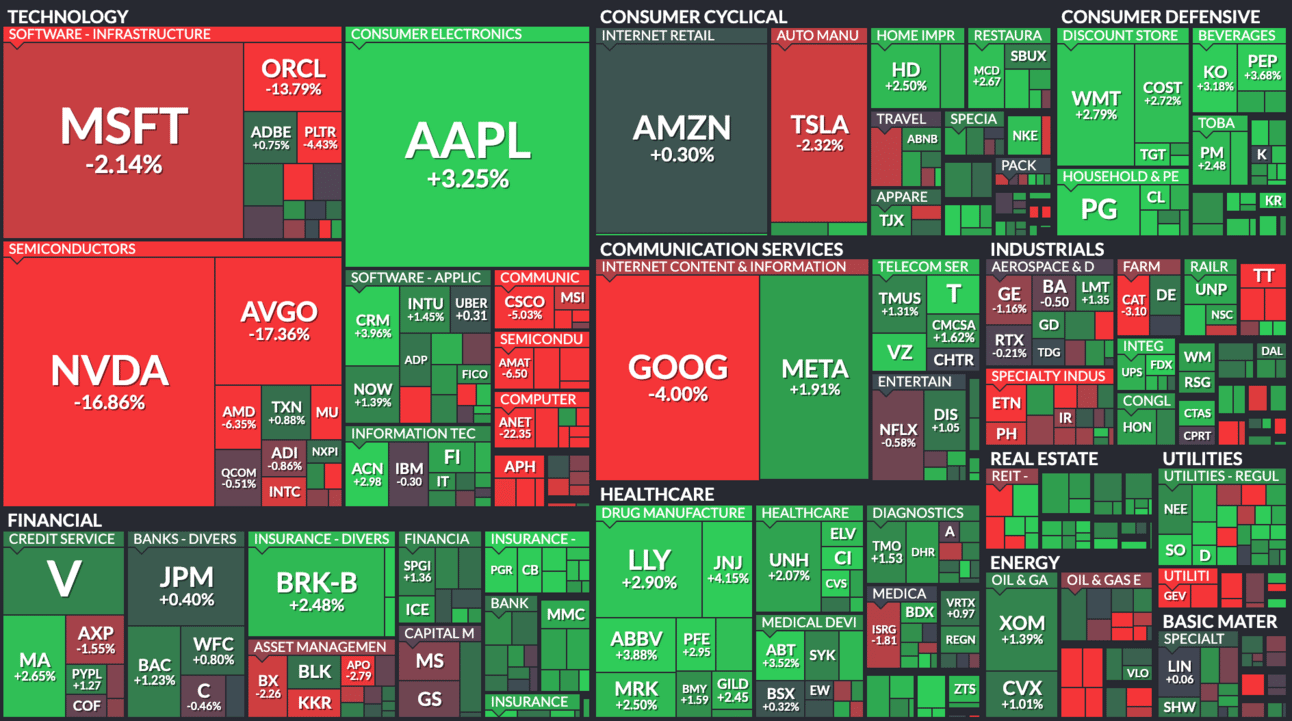

MARKET RECAP → The S&P 500 (VOO) and Nasdaq (QQQ) tumbled Monday amid fears of an AI stock bubble bursting, sparked by reports that Chinese startup DeepSeek may have developed a competitive AI model at a fraction of Silicon Valley's multi-billion-dollar costs.

DEEPSEEK'S AI MODEL SHAKES TECH STOCKS → 📉 Nvidia's (NVDA) stock plunged over 15% after China's DeepSeek introduced a cost-effective AI model, sparking a global tech sell-off and challenging the scale of U.S. AI investments.

APPLE TURNS ITS AI ON BY DEFAULT IN LATEST UPDATE → Apple's (AAPL) latest software update activates Apple Intelligence by default, marking a milestone in its AI rollout. It paused controversial news summarization features and introduced clearer AI notifications, showcasing its focus on reliability and innovation. 🚀

Was this email forwarded to you? Sign up for free here.

On the move? Subscribe to our daily podcast here.

TODAY’S TOP NEWS

DeepSeek's AI Model Shakes Tech Stocks

Nvidia Shares Plummet: 📉 Nvidia's (NVDA) stock dropped over 15% on Monday after Chinese startup DeepSeek unveiled an AI model comparable to Western counterparts but developed at a fraction of the cost.

Broader Market Impact: 🌐 The announcement triggered a global tech sell-off, with companies like Microsoft (MSFT), Meta (META), and ASML (ASML) experiencing significant declines.

Industry Implications: 🤖 DeepSeek's achievement raises questions about the necessity of massive investments in AI infrastructure by U.S. firms, as it developed its model using fewer resources and older Nvidia chips.

TODAY’S TOP NEWS

Apple Turns Its AI On By Default In Latest Software Update

🔍 Apple Intelligence Takes Center Stage: Apple (AAPL) released iOS 18.3, iPadOS 18.3, and macOS Sequoia 15.3, enabling its AI feature, Apple Intelligence, by default on supported devices. This marks a significant step toward broader adoption of the suite, which includes tools like text rewriting, image generation, and email summarization. Users can disable the feature via the settings menu.

⚠️ Rolling Back Controversial Features: The update disables Apple Intelligence for news and entertainment apps after errors in AI-generated notifications, such as misrepresenting sports headlines, sparked controversy. Notifications created by AI will now appear italicized to differentiate them from app-generated alerts, addressing transparency concerns.

📈 Strategic AI Expansion: Apple’s cautious rollout prioritizes reliability and server capacity while promoting the integration of AI as a unique selling point. Currently in beta and limited to select countries, Apple Intelligence continues to refine its features, with plans to reintroduce updated news summarization capabilities in a future release.

KEEP READING

CIA believes Covid-19 likely caused by lab leak, NBC News reports (CNBC)

Dimon, Dalio, Lagarde and more: Top CEOs and policymakers on what’s next for markets (CNBC)

U.S. and Colombia reach deal on deportations; tariffs and sanctions put on hold (CNBC)

MoneyLion has teamed up with Beast Games to give MoneyLion users a chance at game-changing cash (ML)

Financial Resolutions for Beginners: Start Your Money Journey Right in 2025 (ML)

Do Overdrafts Affect Credit Score? (ML)

WHAT WE’RE WATCHING

OUR FAVORITE TOOLS & RESOURCES

Unusual Whales — Companion for uncovering unusual market activity

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

CME FedWatch Tool — Market-implied probabilities of future levels of interest rates

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

ChatGPT — Large language model-based chatbot powered by generative AI

Vimcal — Lightning-fast calendar and AI scheduling assistant

The Bull vs. Bear Merchandise Promotion is a limited time campaign that begins on December 1, 2023 at 12:00 AM ET and ends on the date that there are no more Rewards. This Promotion is available to any registered MoneyLion user who is a legal resident of the 50 United States or the District of Columbia and who has reached the age of majority in their state as of the beginning of the Promotional Period. See terms and conditions here.

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.