TLDR

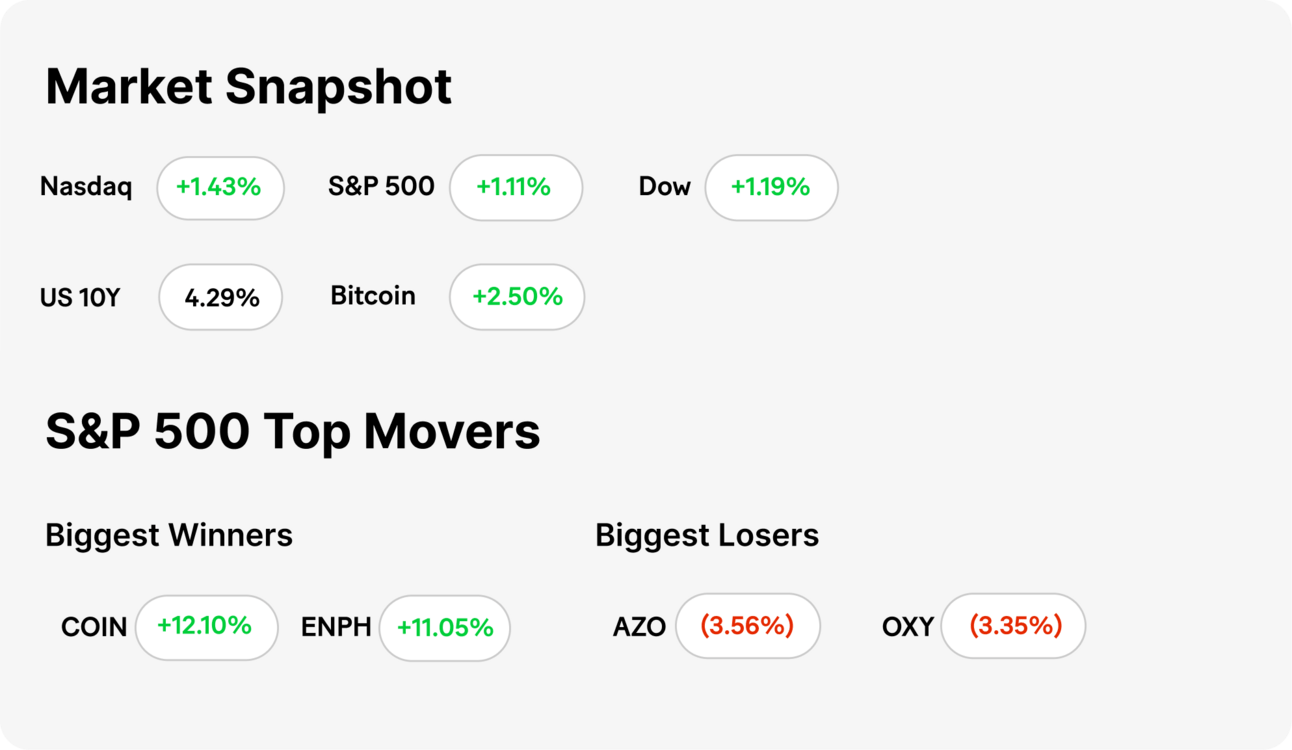

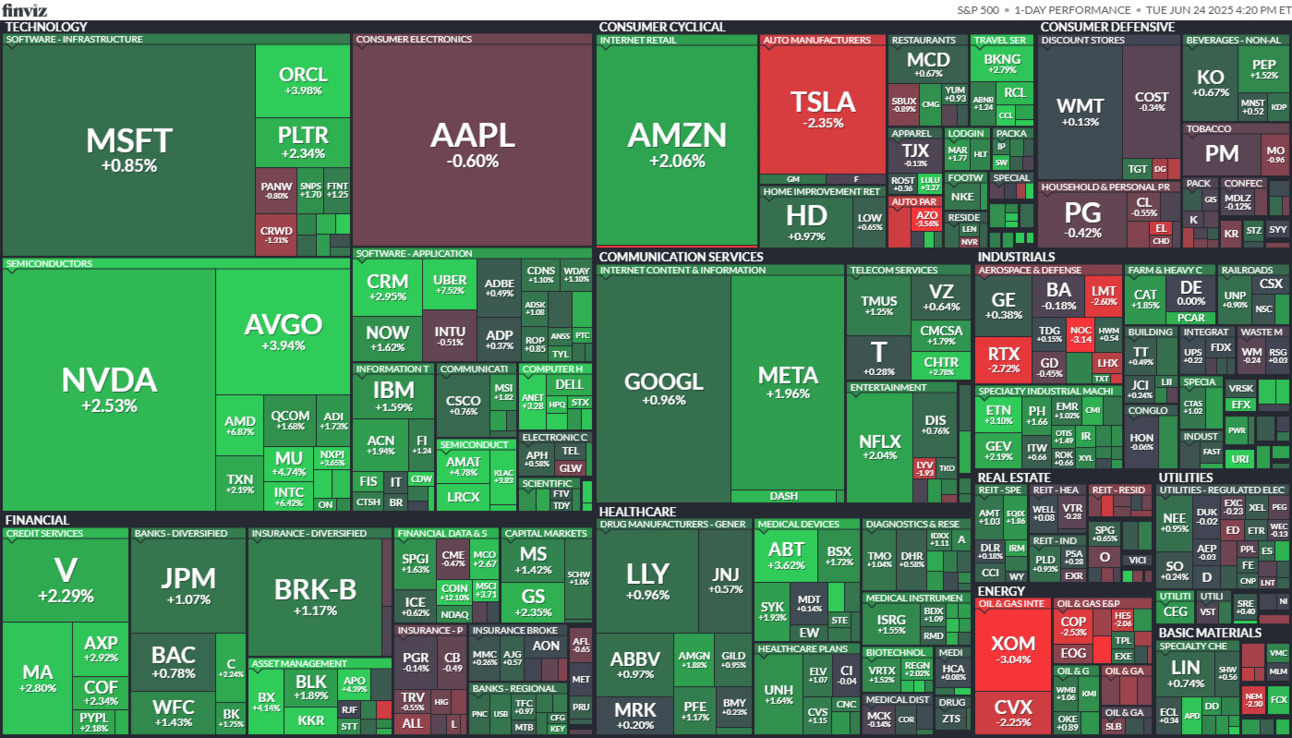

MARKET RECAP → Stocks on Tuesday jumped while oil prices took another tumble as investors expect that the ceasefire between Israel and Iran will hold steady. In the crypto-verse Bitcoin (BTC) rose to $105k following similar logic to stocks. $BTC.X ( ▲ 0.88% )

ISRAEL‑IRAN CEASEFIRE → A Trump-brokered ceasefire kicked in on June 24, but early violations and mutual blame underscore the fragile state of peace.

REDDIT’S IDENTITY GAMBLE → Reddit is considering using Sam Altman’s Worldcoin iris-scanning Orbs to verify users and fight bots. While the idea aims to tackle spam and AI-generated accounts, it’s already triggering privacy concerns from watchdogs. Will this sci-fi solution save Reddit—or land it in hot water?

Was this email forwarded to you? Sign up for free here.

POLL OF THE DAY

Would you trust a government-regulated stablecoin more than a traditional bank?

Politics

Israel‑Iran Ceasefire

source DALL-E

Trump Declares a Pause: After nearly 12 days of escalating strikes—including Israel’s June 13 offensive on Iranian nuclear sites and Iran’s retaliatory missile barrage—U.S. President Trump announced a "complete and total" ceasefire late on June 23, expected to take effect by June 24. Iran’s foreign minister, however, quickly denied any formal agreement, stating Iran would only halt actions if Israel did first.

Ceasefire in Name Only: Initially, Iranian strikes reportedly ceased—for the most part—though limited missile launches occurred, and Israel resumed airstrikes, citing Iranian violations. Trump expressed frustration at both nations "not knowing what the f*** they're doing" and warned Israel against further aggression. As of June 24, the ceasefire is technically in place, though its durability remains in doubt.

Markets Cheer, Cautiously: The announcement sent oil sharply lower and U.S. futures climbed. Israel relaxed civil-defense alerts, though some areas near Gaza remain on guard. International pressure now hangs on both sides to uphold the truce and shift toward diplomatically resolving the nuclear issue.

Tech

Reddit’s Identity Gamble

source DALL-E

Reddit is exploring iris-scanning tech developed by Sam Altman’s Worldcoin to verify users and curb bots: The platform’s leaders are reportedly in talks to deploy Worldcoin’s futuristic Orb hardware, which scans users’ eyes to confirm they’re human. This move comes as Reddit faces mounting pressure to protect its forums from spam, fake accounts, and AI-generated content.

The proposal sparks privacy alarm bells: Critics argue that using iris biometrics for identity could endanger user privacy and set a worrisome precedent for mass data collection. Even with assurances that data is anonymized, digital rights groups are raising red flags over potential misuse, security breaches, and surveillance creep.

A bold gamble or a PR headache: The plan highlights Reddit’s struggle to balance innovation with user trust in the age of AI spam wars. Whether this high-tech solution will win over skeptics—or fuel new backlash—remains to be seen as the company weighs its next steps.

KEEP READING

Uber, Waymo robotaxi service opens to passengers in Atlanta (CNBC)

Polymarket to close a $200 million fundraise at a $1 billion valuation (The Block)

Powell emphasizes Fed’s obligation to prevent ‘ongoing inflation problem’ despite Trump criticism (CNBC)

Home price hikes are slowing more than expected (CNBC)

Nvidia CEO Huang sells $15 million worth of stock, first sale of $873 million plan (CNBC)

What is a Money Order? How a Money Order Works (ML)

WHAT WE’RE WATCHING

OUR FAVORITE TOOLS & RESOURCES

Deribit — Crypto Futures and Options Exchange

Generated Assets — Turn any idea into an investable index

Polymarket — The world’s largest prediction market

Unusual Whales — Companion for uncovering unusual market activity

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

CME FedWatch Tool — Market-implied probabilities of future levels of interest rates

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

ChatGPT — Large language model-based chatbot powered by generative AI

Vimcal — Lightning-fast calendar and AI scheduling assistant

WE WANT YOUR FEEDBACK

How would you rate today's newsletter?

Investment advisory services provided by ML Wealth LLC. Investment Accounts Are Not FDIC Insured • No Bank Guarantee • Investments May Lose Value. For important information and disclosures relating to the MoneyLion Investment Account, see Investment FAQs, Form ADV Brochure, and moneylion.com/investing. Funded managed investing accounts are subject to a monthly account fee of $1 (for accounts valued up to $5,000), $3 (for accounts valued over $5,000, and up to $25,000), or $5 (for accounts valued over $25,000).

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.