TLDR

MARKET RECAP → Stocks closed slightly lower on Monday as pressure mounted on key AI stocks.

📊 COPPER COULD HIT NEW HIGHS → Copper’s rally shows no signs of cooling as supply tightness, strategic demand drivers, and U.S. stockpiling lift prices toward historic levels — though volatility and policy shifts could still temper the run.

🧾 PEACE PUSH IN BERLIN → Ukraine peace talks in Berlin are making headway with proposals for NATO-style security guarantees and progress on most agenda items — but territorial disagreements and real-world combat persist as key hurdles

Was this email forwarded to you? Sign up for free here.

MARKETS

Market Snapshot

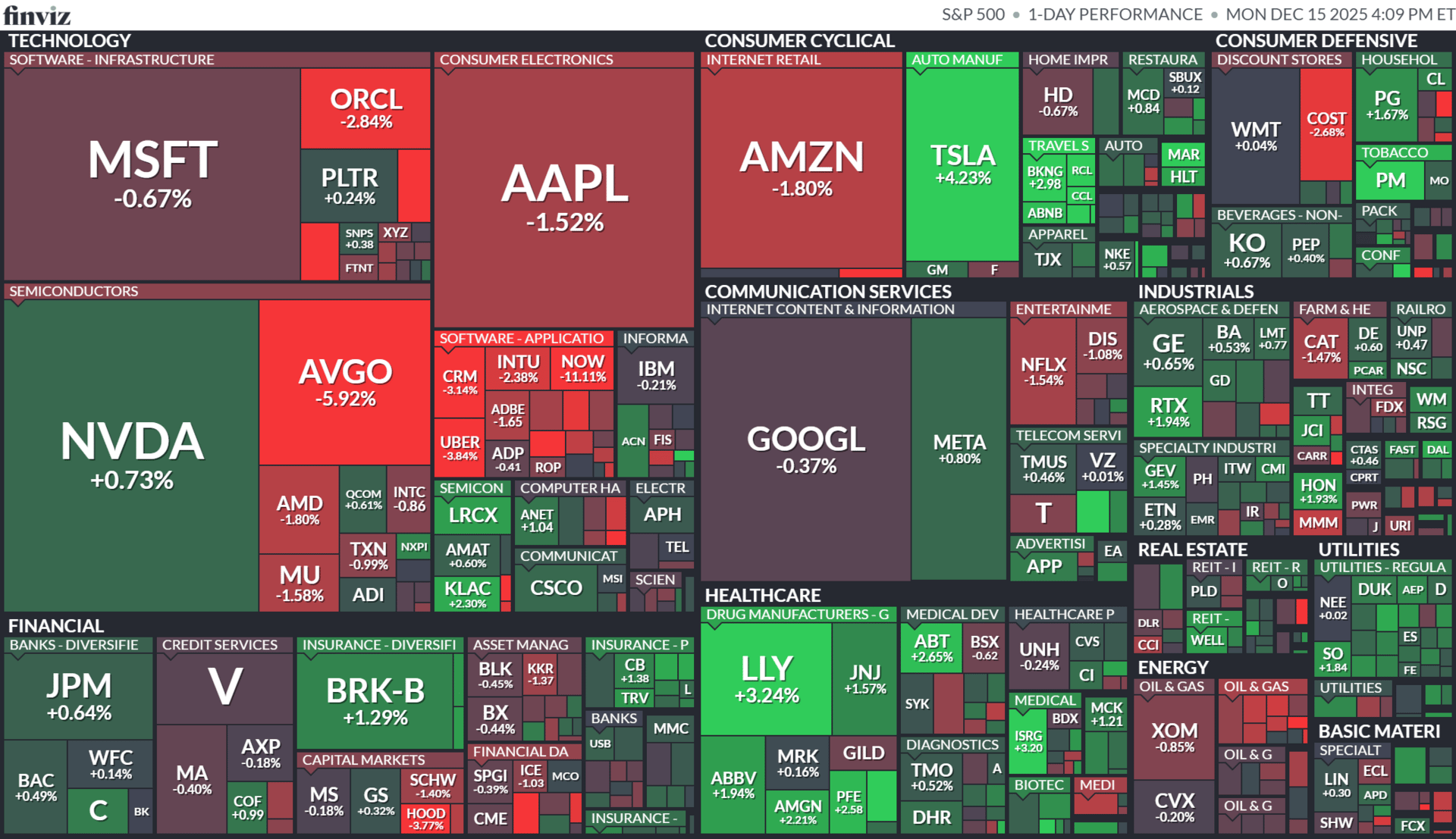

Today’s S&P 500 Heatmap

Notable Earnings

For the week beginning December 15, 2025

COMMODITIES

Copper Could Hit New Highs

Gemini

📈 Prices surge as traders load into U.S. markets: Copper prices are climbing toward record territory as traders rush to bring the metal into the United States, driven by tight global supply and robust demand from key sectors like renewable energy, EVs, and AI data-center infrastructure. Signs of strong short-position covering and elevated warehouse inventories in U.S. exchanges reflect speculative momentum and inventory buildup.

⚠️ Supply constraints meet demand boom: Structural supply issues — from mining disruptions to declining ore grades — are colliding with rising demand for electrification and data-heavy technologies. This imbalance has pushed copper to multi-year highs and could support elevated price levels if production doesn’t keep pace.

🇺🇸 U.S. imports and tariff dynamics matter: A combination of strong U.S. price signals and import flows — partly tied to tariff considerations and arbitrage opportunities — is drawing copper stocks into the U.S. market. That dynamic, coupled with weaker global economic data (notably in China), underscores how regional forces are shaping global copper pricing this season.

POLITICS

Peace Push In Berlin

Gemini

🤝 Negotiations Gaining Traction: Ukraine-Russia peace talks, hosted in Berlin with U.S. and European mediators, continue into a pivotal week as diplomats work to narrow differences. U.S. envoys led by Steve Witkoff and Jared Kushner have brokered progress on most issues, with about 90 % of a U.S.-drafted peace plan tentatively agreed among negotiators.

🛡️Security Guarantees vs. Territory Dispute: One of the biggest developments is a proposition to offer Ukraine legally binding security guarantees similar to NATO’s Article 5, aimed at assuring Kyiv’s defense without full alliance membership — a potential compromise that could reshape European security dynamics. At the same time, major sticking points remain, particularly territorial control of the Donetsk region, which U.S. officials have suggested Ukraine must address for a final deal.

🗳️ Domestic & International Stakes: The diplomatic balancing act reflects deep domestic resistance in Ukraine to territorial concessions, and ongoing conflict on the ground continues with air and drone strikes even as leaders negotiate. European leaders, including German Chancellor Friedrich Merz, underscore the importance of a lasting peace supported by robust security guarantees.

KEEP READING

Trump admin to hire 1,000 specialists for ‘Tech Force’ to build AI, finance projects (CNBC)

An options strategy that could tap Netflix’s value no matter what happens with Warner Bros. deal (CNBC)

CNBC Daily Open: Investors sell off tech despite steady Broadcom numbers (CNBC)

NOTABLE POSTS

WHAT WE’RE WATCHING

Tools & Resources

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

AltIndex — Alternative datasets to uncover unique insights

GFR Smart Stock Selector — Filters stocks to help investor choices

WE WANT YOUR FEEDBACK

How would you rate today's newsletter?

Investment advisory services provided by ML Wealth LLC. Investment Accounts Are Not FDIC Insured • No Bank Guarantee • Investments May Lose Value. For important information and disclosures relating to the MoneyLion Investment Account, see Investment FAQs, Form ADV Brochure, and moneylion.com/investing. Funded managed investing accounts are subject to a monthly account fee of $1 (for accounts valued up to $5,000), $3 (for accounts valued over $5,000, and up to $25,000), or $5 (for accounts valued over $25,000).

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.