TLDR

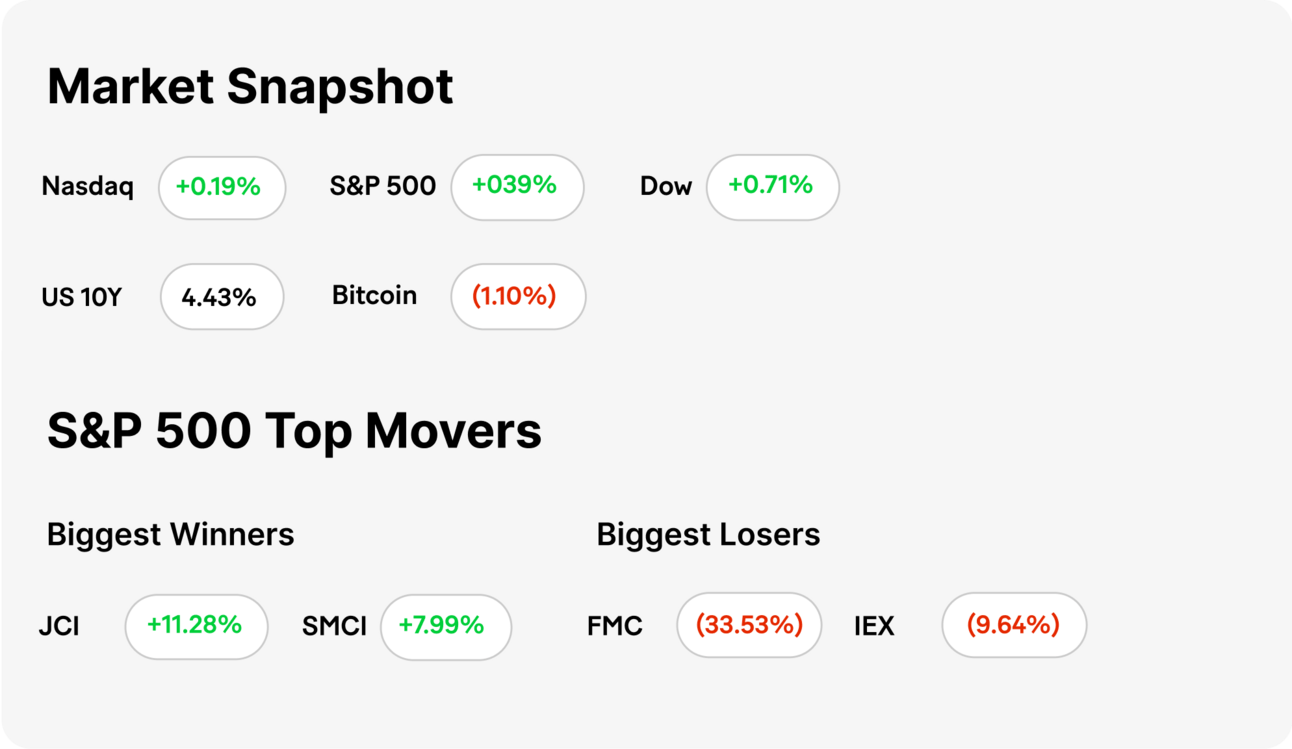

MARKET RECAP → Stocks surged on Wednesday, marking a second consecutive day of gains for the Dow Jones (DIA) and S&P 500 (VOO), as investors shrugged off earlier trade concerns that had pressured the market.

HOMEBUYER MORTGAGE DEMAND DROPS FURTHER → Mortgage applications fell 4% last week, with demand flat compared to a year ago, despite a slight dip in rates.

TOYOTA MOTOR POSTS NEARLY 28% DROP IN THIRD-QUARTER OPERATING PROFIT→ Toyota’s profit tumbled 28%, missing forecasts, while revenue edged higher. The automaker announced plans for a new Lexus EV and battery plant in China, aiming to catch up in the EV race. Despite weaker sales, Toyota raised its full-year earnings forecast and kept dividends steady. 🚗

Was this email forwarded to you? Sign up for free here.

On the move? Subscribe to our daily podcast here.

MONEYLION NATION: SUPERBOWL POLL

Source: Created using OpenAI's DALL·E via ChatGPT (2025).

Who is going to win Super Bowl LIX?

TODAY’S TOP NEWS

Homebuyer Mortgage Demand Drops Further

📉 Buyer hesitation grew as mortgage applications fell 4% last week despite more homes hitting the market. Demand remained flat year over year, while home sales lingered near a 30-year low.

🏡 Rates dipped slightly to 6.97%, but home prices stayed stubbornly high. More sellers offered price cuts, yet competition kept most listing prices firm. Refinancing activity ticked up 12% due to lower rates, but overall demand remained weak.

⏳ Housing supply increased 25%, but homes sat on the market longer. The average time to sell reached 54 days—the longest since early 2020—while inventory remained well below pre-pandemic levels.

TODAY’S TOP NEWS

Toyota’s Profit Slump and EV Pivot

📉 Profit Drop, Revenue Up: Toyota’s operating profit fell nearly 28% year-over-year to 1.22 trillion yen, missing estimates of 1.39 trillion yen. However, revenue increased to 12.39 trillion yen, exceeding expectations. Net income surged to 2.19 trillion yen from 1.37 trillion yen a year ago.

🌏 China EV Expansion: In a bid to catch up in the EV race, Toyota announced a new wholly-owned company in Shanghai to develop and produce Lexus battery electric vehicles (BEVs) and batteries. Production is set to begin in 2027.

🚙 Sales Dip, Dividend Holds: Toyota’s vehicle sales declined to 2.44 million units from 2.55 million a year prior. Despite this, the company maintained its full-year dividend forecast at 90 yen and raised its operating income forecast by 400 billion yen to 4.7 trillion yen. Shares rose 1% in Tokyo.

KEEP READING

White House crypto czar David Sacks says first priority is stablecoin legislation (CNBC)

USPS temporarily suspends some inbound packages from China, Hong Kong (CNBC)

AMD reports profit beat, but misses on data center revenue (CNBC)

MoneyLion has teamed up with Beast Games to give MoneyLion users a chance at game-changing cash (ML)

Ready to Take 2025 by Storm? (ML)

How to Financially Prosper this Chinese New Year: Year of the Wood Snake (ML)

OUR FAVORITE TOOLS & RESOURCES

RiskReversal Media — Expert-led content redefining financial media - NEW

Unusual Whales — Companion for uncovering unusual market activity

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

CME FedWatch Tool — Market-implied probabilities of future levels of interest rates

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

ChatGPT — Large language model-based chatbot powered by generative AI

Vimcal — Lightning-fast calendar and AI scheduling assistant

REFERRAL PROGRAM

WE WANT YOUR FEEDBACK

How would you rate today's newsletter?

The Bull vs. Bear Merchandise Promotion is a limited time campaign that begins on December 1, 2023 at 12:00 AM ET and ends on the date that there are no more Rewards. This Promotion is available to any registered MoneyLion user who is a legal resident of the 50 United States or the District of Columbia and who has reached the age of majority in their state as of the beginning of the Promotional Period. See terms and conditions here.

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.