TLDR

⚡ MARKET RECAP → The S&P 500 (VOO) fell on Thursday as Microsoft’s (MSFT) earnings report left investors unimpressed, along with the rest of software sinking as AI disruption weighs on the once richly-valued category.

🤝 MUSK’S SPACEX AND xAI IN MERGER TALKS → Talks are underway to merge SpaceX with xAI before a blockbuster IPO, uniting rockets, satellites, AI tech and social media into a single Musk-engineered super-company.

🦈 AI EATS SOFTWARE → Software stocks are deep in bearish territory as AI disruption fears intensify, dragging ServiceNow, SAP and other legacy names sharply lower and putting pressure on the sector’s valuation narrative.

👮 TARIFFS WHO? → The U.S. trade deficit nearly doubled in November as imports surged and exports weakened — a stark reminder that tariffs alone haven’t tamed America’s trade imbalance.

Was this email forwarded to you? Sign up for free here.

MARKETS

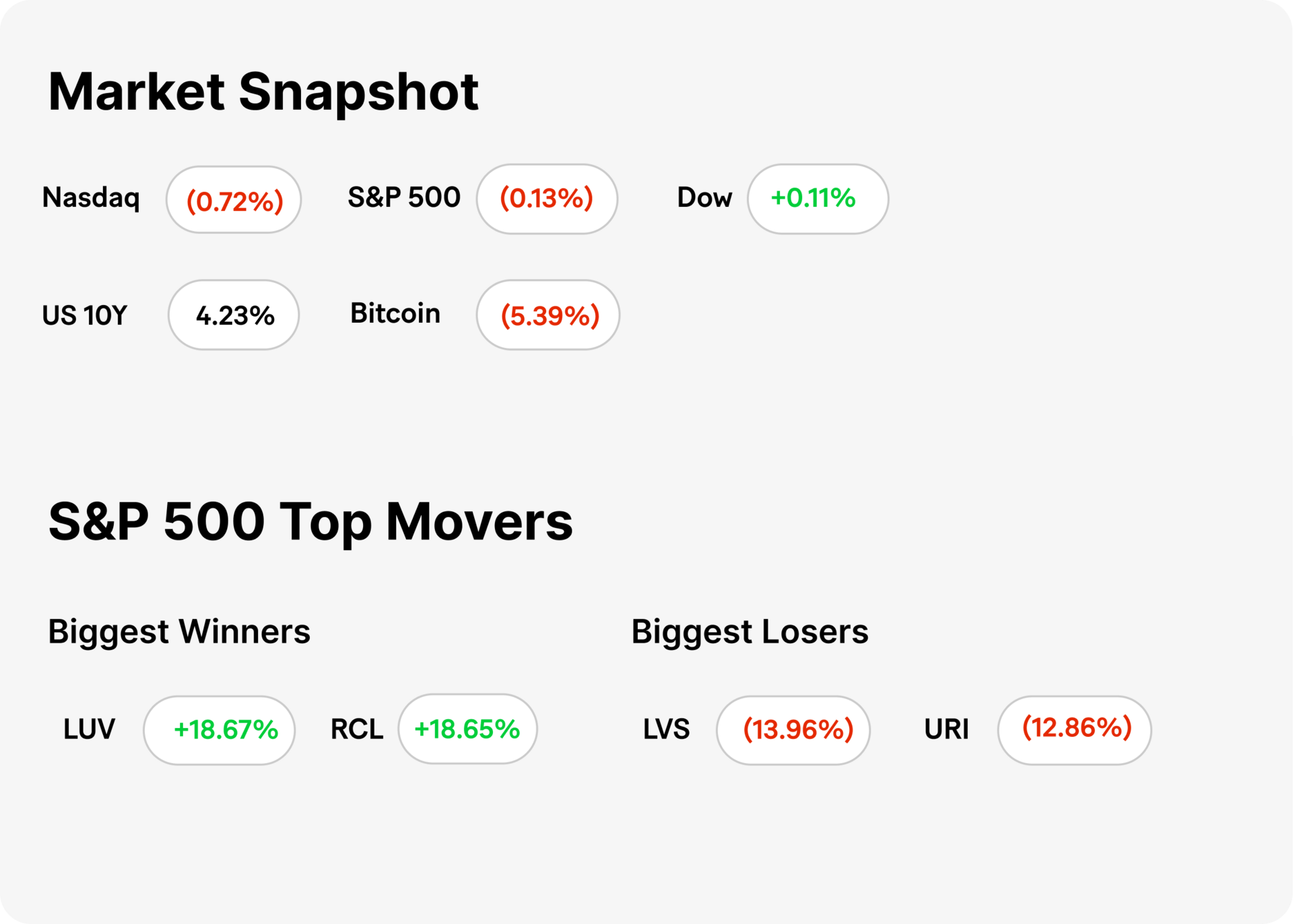

Market Snapshot

Today’s S&P 500 Heatmap

Notable Earnings

For the week beginning January 27, 2026

TECH

Musk’s SpaceX and xAI in Merger Talks Ahead of Planned IPO

Gemini

🚀 SpaceX is exploring a merger with xAI — Elon Musk’s private rocket and satellite giant SpaceX is in discussions about combining with his artificial-intelligence company xAI ahead of a proposed SpaceX initial public offering later in 2026. The talks are preliminary, and no definitive agreement has been signed.

🤝 Deal structure still fluid — Under the potential deal, xAI shareholders could receive SpaceX stock or possibly cash, and two new legal entities have been created in Nevada to facilitate the transaction. Bringing together SpaceX’s rockets, Starlink broadband, the X social media platform, and xAI’s Grok AI technology would create a broader Musk-led tech empire under one corporate umbrella.

🧠 Strategic rationale and ambitions — The merger, if it happens, is expected to bolster SpaceX’s push into space-based AI data centers, reducing costs with solar power and giving Musk a stronger position in both aerospace and AI infrastructure. xAI is building out major AI computing capacity, including its large Colossus supercomputer project, and has already drawn substantial investments from Tesla and others.

TECH

AI Eats Software

Gemini

📉 Software names slump on AI disruption fears — U.S. software stocks plunged sharply on January 29, with concerns mounting that rapid advances in AI are threatening traditional subscription-software models. The sell-off knocked the S&P 500 Software and Services Index down 8.7 %, hitting a nine-month low as investors weighed the risk that AI tools could displace legacy software services.

📉 Heavyweights under pressure — ServiceNow’s shares tumbled ~11 % despite solid subscription guidance, while fellow major players such as Salesforce, Adobe, Datadog, Atlassian, HubSpot and Microsoft also saw steep declines as markets reassessed valuations amid tech sector fears. Analysts describe prolonged malaise in software sentiment, with depressed valuations and investors pricing in worst-case scenarios for legacy software amid AI disruption.

🧠 AI feeding differentiation — Even as some companies pivot to embed AI into offerings, the market’s view remains cautious: heavy AI spending and uneven returns — especially from cloud growth slowdowns and high capex — have intensified pressure. At the same time, chip and memory stocks are benefiting from AI infrastructure boom narratives.

ECONOMICS

Tariffs Who?

Gemini

🇺🇸 U.S. trade deficit nearly doubled in November — The U.S. trade gap surged 94.6 % month-over-month in November 2025, widening to $56.8 billion, the largest monthly jump in nearly 34 years. This rise occurred even though policymakers had touted tariff efforts as a tool to shrink trade imbalances.

📦 Imports climbed while exports lagged — Imports rose 5.0 % overall — led by capital goods like computers and semiconductors tied to AI investment — while exports fell 3.6 %, including key categories like industrial supplies and consumer products. The imbalanced swing suggests heavy domestic demand for tech and investment goods is outpacing foreign sales.

📊 Tariff effectiveness questioned — The deficit increase comes against the backdrop of persistent tariff policy intended to support trade balance improvements. Despite earlier temporary troughs in the deficit, the rebound — both monthly and year-over-year — highlights the challenges of using tariffs alone to control wide macro trade dynamics when capital goods and investment flows dominate import trends.

KEEP READING

Meta and Microsoft are making big moves in opposite directions after earnings (CNBC)

Senate begins voting on critical funding measure with shutdown looming (CNBC)

Denmark lauds constructive talks with U.S. over Greenland: ‘Now we are back on track’ (CNBC)

WHAT WE’RE WATCHING

Tools & Resources

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

AltIndex — Alternative datasets to uncover unique insights

GFR Smart Stock Selector — Filters stocks to help investor choices

WE WANT YOUR FEEDBACK

How would you rate today's newsletter?

Investment advisory services provided by ML Wealth LLC. Investment Accounts Are Not FDIC Insured • No Bank Guarantee • Investments May Lose Value. For important information and disclosures relating to the MoneyLion Investment Account, see Investment FAQs, Form ADV Brochure, and moneylion.com/investing. Funded managed investing accounts are subject to a monthly account fee of $1 (for accounts valued up to $5,000), $3 (for accounts valued over $5,000, and up to $25,000), or $5 (for accounts valued over $25,000).

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.