TLDR

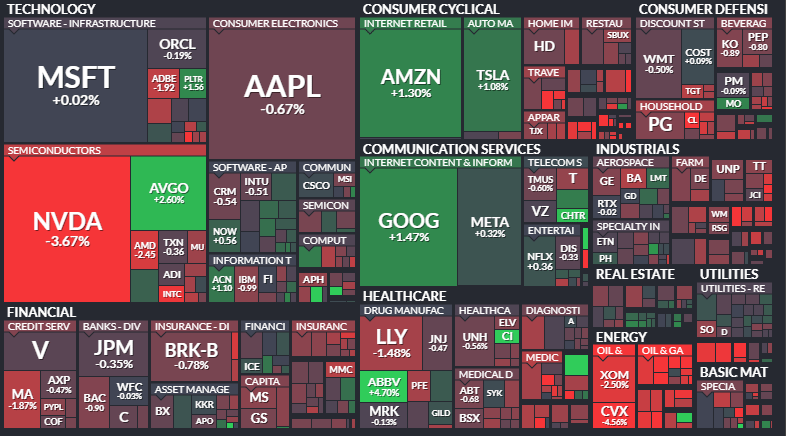

MARKET RECAP → The S&P 500 (VOO) fell Friday as news broke that the US would impose tariffs against major trading partners effective Saturday, February 1st.

TRUMP'S NEW TARIFFS SET TO BEGIN → The U.S. will impose 25% tariffs on imports from Canada, Mexico, and China starting Saturday, aiming to address concerns over illegal immigration and drug trafficking. Economists warn of potential higher consumer prices and strained relations with key allies.

DECEMBER PCE INFLATION SHOWS MODEST INCREASE → 📈 The PCE price index rose 0.4% in December, pushing the annual rate to 2.9%, slightly above expectations and indicating persistent inflationary pressures.

Was this email forwarded to you? Sign up for free here.

On the move? Subscribe to our daily podcast here.

TODAY’S TOP NEWS

Trump's New Tariffs Set to Begin

Tariffs Imposed on Key Trade Partners: The White House has announced that starting Saturday, the U.S. will implement 25% tariffs on imports from Canada, Mexico, and China, aiming to address concerns over illegal immigration and drug trafficking.

Potential Impact on Oil Imports: Canada and Mexico are significant suppliers of oil to the U.S., providing 3.9 million and 733,000 barrels per day, respectively, in 2023. The new tariffs could disrupt these imports, potentially affecting domestic oil prices.

Economic and Political Reactions: Economists warn that these tariffs may lead to higher consumer prices and strained relations with key allies. Canada and Mexico have signaled possible retaliatory measures, emphasizing the deep economic ties and the potential for significant disruption.

TODAY’S TOP NEWS

December PCE Inflation Shows Modest Increase

Slight Uptick in Inflation: 📈 The Personal Consumption Expenditures (PCE) price index, the Federal Reserve's preferred inflation measure, rose by 0.4% in December, bringing the annual rate to 2.9%. This increase was slightly above market expectations and indicates persistent inflationary pressures.

Core Inflation Remains Elevated: 🔍 Excluding volatile food and energy prices, the core PCE index increased by 0.2% for the month, with the annual core rate dipping marginally to 3.2% from 3.3% in November. This suggests that underlying inflation remains above the Fed's 2% target.

Market Reactions and Fed Outlook: 📉 Following the report, U.S. stocks surged, and Treasury yields declined as investors anticipated potential adjustments in Federal Reserve policy. Despite the uptick, Fed officials, including New York Fed President John Williams, emphasized the need for sustained progress toward the 2% inflation goal before considering further rate cuts.

KEEP READING

Google offers ‘voluntary’ buyouts to hardware and platform teams (CNBC)

FDA approves Vertex’s non-opioid painkiller, first new kind of pain medicine in decades (CNBC)

Crash investigators looking at altitude, communication and staffing before helicopter collision with plane (CNBC)

The Fed Hits Pause on Rate Cuts. Now What? (ML)

MoneyLion has teamed up with Beast Games to give MoneyLion users a chance at game-changing cash (ML)

Ready to Take 2025 by Storm? (ML)

How to Financially Prosper this Chinese New Year: Year of the Wood Snake (ML)

OUR FAVORITE TOOLS & RESOURCES

RiskReversal Media — Expert-led content redefining financial media NEW

Unusual Whales — Companion for uncovering unusual market activity

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

CME FedWatch Tool — Market-implied probabilities of future levels of interest rates

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

ChatGPT — Large language model-based chatbot powered by generative AI

Vimcal — Lightning-fast calendar and AI scheduling assistant

The Bull vs. Bear Merchandise Promotion is a limited time campaign that begins on December 1, 2023 at 12:00 AM ET and ends on the date that there are no more Rewards. This Promotion is available to any registered MoneyLion user who is a legal resident of the 50 United States or the District of Columbia and who has reached the age of majority in their state as of the beginning of the Promotional Period. See terms and conditions here.

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.