TLDR

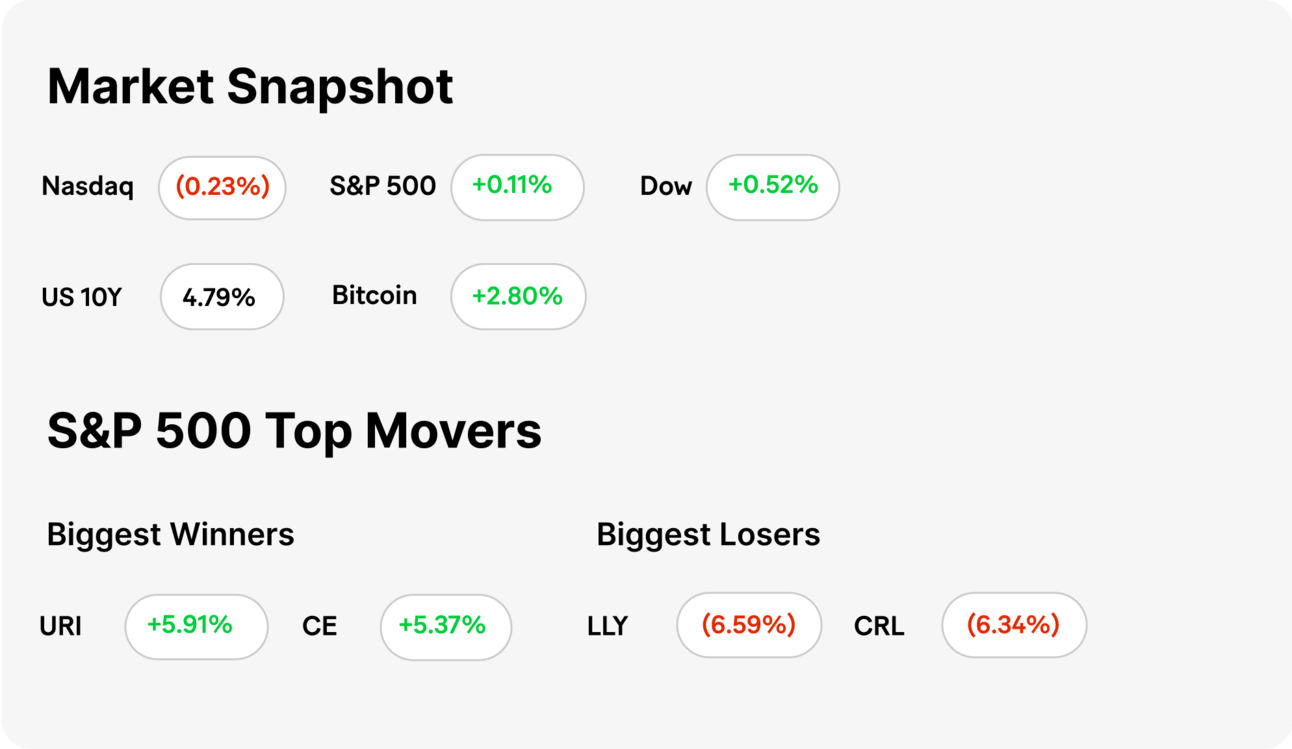

MARKET RECAP → The Dow (DIA) led the major averages higher again on Tuesday as investors welcomed a lighter-than-expected December Producer Price Index (PPI) report. This is one measure of inflation, and signs of cooling prices were taken as a positive for stocks ahead of tomorrow's Consumer Price Index (CPI) report, which tends to shake the market, too. Buckle up! 💺

CHINA CONSIDERS SELLING TIKTOK'S U.S. OPERATIONS → 💼 Beijing is exploring a sale of TikTok’s U.S. operations to Elon Musk as a contingency plan amid national security concerns and potential bans.

DECEMBER 2024 PRODUCER PRICE INDEX REPORT → 📈 The December 2024 PPI rose by 0.3%, with a year-over-year increase to 3.4%, indicating persistent inflation above the Fed's target.

Was this email forwarded to you? Sign up for free here.

On the move? Subscribe to our daily podcast here.

TODAY’S TOP NEWS

China Considers Selling TikTok's U.S. Operations

Potential Sale Discussed: 💼 Chinese officials are weighing a sale of TikTok’s U.S. operations to Elon Musk if the app faces a ban, though they prefer to maintain ByteDance ownership.

National Security Pressure: 🔒 The U.S. government cites national security risks, claiming TikTok’s Chinese ownership could enable Beijing to access American user data, prompting a Supreme Court review.

Musk's Possible Role: 🚀 A potential deal could see Musk’s social platform X acquiring TikTok’s U.S. operations, though discussions remain preliminary and uncertain.

TODAY’S TOP NEWS

December 2024 Producer Price Index Report

PPI Increase: 📈 The Producer Price Index (PPI) for December 2024 rose by 0.3%, following a 0.4% increase in November, indicating persistent inflationary pressures.

Annual Growth: 📅 Year-over-year, the PPI climbed to 3.4% from 3.0% in November, suggesting that inflation remains above the Federal Reserve's 2% target.

Core PPI Trends: 🛠️ Excluding food and energy, the core PPI advanced by 0.2% in December, matching November's pace, with an annual increase accelerating to 3.8% from 3.4%.

A MESSAGE FROM OUR PARTNER

The Sleep App That Forbes Rated 5 Stars 😱

The app Forbes said helps "users achieve high-quality sleep by creating and maintaining effective sleep routines” is back with new sounds and features!

Now featuring over 300 unique sounds to fall asleep to, a personalized sleep tracker and more. It’s no wonder over 65 million people have downloaded this app for better sleep.

Try it tonight 👇

KEEP READING

Who are the bond vigilantes and are they back? (Reuters)

U.S. Small Business Employment and Revenue Declined in 2024 with Signs of Recovery, finds Intuit QuickBooks Small Business Annual Index Report (Intuit)

JPMorgan Chase exec Daniel Pinto, longtime No. 2 to Jamie Dimon, will step down in June (CNBC)

Klarna scores global payment deal with Stripe to expand reach ahead of blockbuster U.S. IPO (CNBC)

MoneyLion has teamed up with Beast Games to give MoneyLion users a chance at game-changing cash (ML)

Financial Resolutions for Beginners: Start Your Money Journey Right in 2025 (ML)

Do Overdrafts Affect Credit Score? (ML)

Cuddly Cute Chaos: Ridiculous Lessons in Money Episode 4 (ML)

OUR FAVORITE TOOLS & RESOURCES

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

CME FedWatch Tool — Market-implied probabilities of future levels of interest rates

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

ChatGPT — Large language model-based chatbot powered by generative AI

Vimcal — Lightning-fast calendar and AI scheduling assistant

The Bull vs. Bear Merchandise Promotion is a limited time campaign that begins on December 1, 2023 at 12:00 AM ET and ends on the date that there are no more Rewards. This Promotion is available to any registered MoneyLion user who is a legal resident of the 50 United States or the District of Columbia and who has reached the age of majority in their state as of the beginning of the Promotional Period. See terms and conditions here.

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.