TLDR

MARKET RECAP → Stocks extended their two-day relief rally on the heels of geopolitical tensions surfacing in Davos.

📈 INFLATION FED UP AT 2.8% → PCE data show inflation holding stubbornly above target, propping up consumer spending and pushing the Fed toward a cautious policy stance rather than aggressive rate cuts.

📉 INTEL BEAT, THEN BLEW IT → Intel topped Q4 forecasts but its weak Q1 guidance and structural challenges tempered the win — a classic beat-and-fade that leaves investors parsing growth drivers vs. near-term headwinds.

Was this email forwarded to you? Sign up for free here.

MARKETS

Market Snapshot

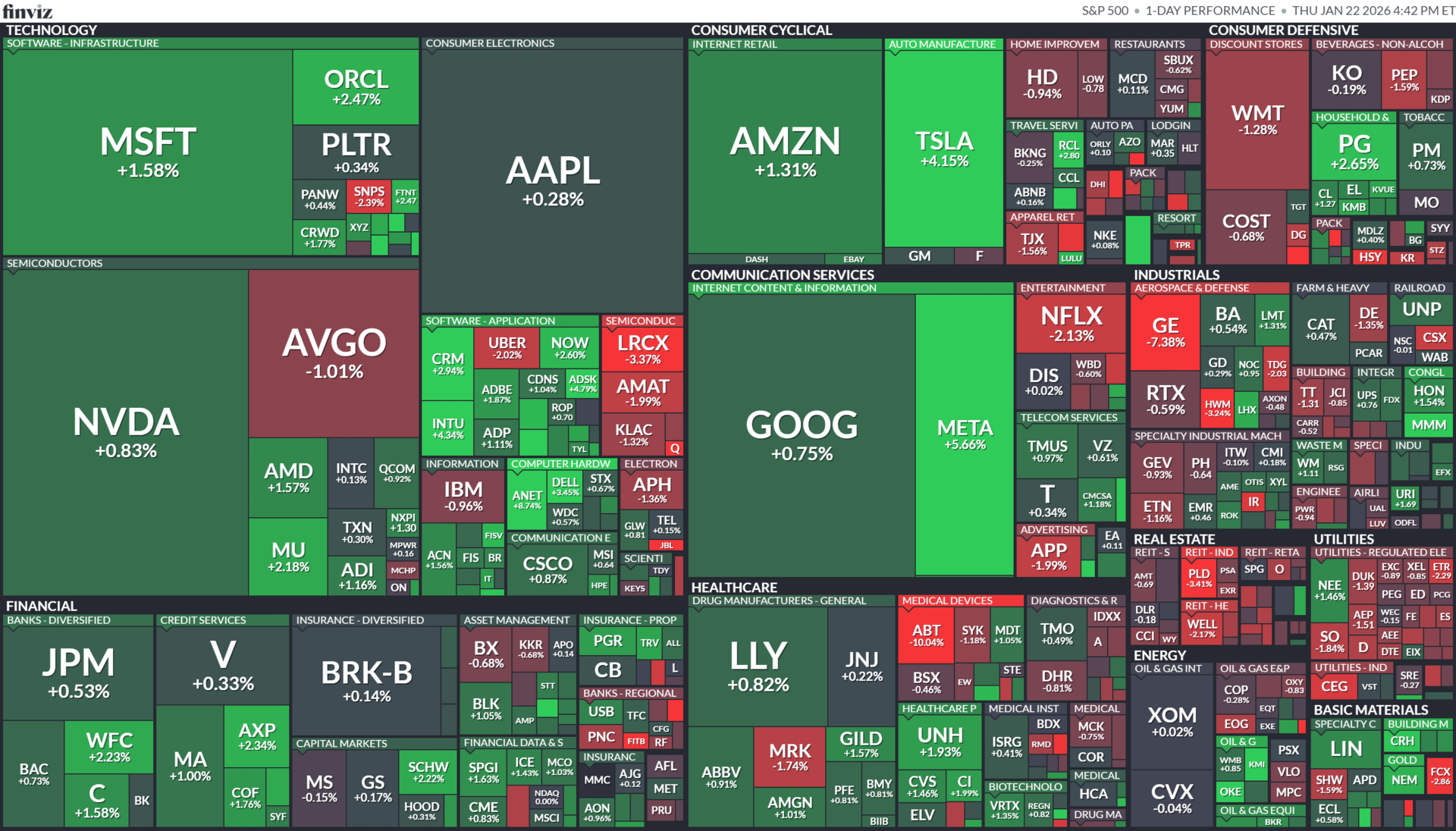

Today’s S&P 500 Heatmap

Notable Earnings

For the week beginning January 19, 2026

ECONOMICS

PCE Inflation Holds Above Target as Prices Ticked Up

Gemini

🔥 Core PCE remains stubborn: The Federal Reserve’s preferred inflation gauge — the Personal Consumption Expenditures (PCE) price index — showed inflation at about 2.8% year-over-year in November 2025, slightly above the Fed’s long-standing 2% target and a tick up from prior months. Both headline and core readings (excluding food and energy) remained elevated, signaling that price pressures have not eased as much as some economists hoped.

📊 Consumer spending keeps pressure on prices: U.S. consumer spending continued to grow — retail and services outpaced expectations — helping sustain inflation near these levels. Even with some cooling in goods prices, sticky shelter and services costs helped keep the overall inflation rate elevated.

🏦 Implications for the Fed and markets: Because November’s PCE readings are still above the Fed’s 2% goal, markets are now pricing a high probability of no near-term rate cuts at the upcoming Fed meeting, with policymakers likely to remain cautious before easing policy further. The persistent inflation picture also strengthens the argument that inflation isn’t collapsing fast, meaning the central bank’s pivot to rate cuts could be more measured.

TECH

Intel Q4 2025: Beats, But Outlook Worries Markets

Gemini

📊 Quarterly results beat expectations — Intel (INTC) reported Q4 2025 revenue of about $13.7 billion, slightly above Street forecasts, and adjusted earnings of $0.15 per share, topping consensus (~$0.08). Despite a year-over-year revenue decline, Intel exceeded estimates on both the top and bottom lines for the quarter, reflecting progress in its turnaround under CEO Lip-Bu Tan.

📉 Guidance sours the mood — Investors were less enthused about Intel’s first-quarter 2026 outlook, which forecasts revenue roughly below expectations and breakeven adjusted EPS, weaker than analysts’ projections. That outlook overshadowed the Q4 beat and triggered share weakness in after-hours and pre-market trading.

🤖 Underlying segment trends mixed — Intel’s Data Center & AI segment grew, while Client Computing Group revenue lagged, illustrating ongoing challenges in PC demand and competitive pressure from rivals like AMD and Nvidia. Intel also continues to navigate supply chain constraints even as it ramps new products such as its 18A process chips.

KEEP READING

Zelenskyy lays into ‘lost’ Europe for trying to ‘change’ Trump and not dealing with global threats (CNBC)

GM to move production of China-built Buick SUV to U.S. plant (CNBC)

Fed’s main gauge shows inflation at 2.8% in November, edging further away from target (CNBC)

NOTABLE POSTS

WHAT WE’RE WATCHING

Tools & Resources

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

AltIndex — Alternative datasets to uncover unique insights

GFR Smart Stock Selector — Filters stocks to help investor choices

WE WANT YOUR FEEDBACK

How would you rate today's newsletter?

Investment advisory services provided by ML Wealth LLC. Investment Accounts Are Not FDIC Insured • No Bank Guarantee • Investments May Lose Value. For important information and disclosures relating to the MoneyLion Investment Account, see Investment FAQs, Form ADV Brochure, and moneylion.com/investing. Funded managed investing accounts are subject to a monthly account fee of $1 (for accounts valued up to $5,000), $3 (for accounts valued over $5,000, and up to $25,000), or $5 (for accounts valued over $25,000).

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.