TLDR

MARKET RECAP → The S&P 500 (VOO) closed at a fresh high Monday as markets shrugged off the risk of the Federal Reserve’s independence from political influence.

⚖️ POWELL INVESTIGATION SPLITS GOP → A criminal investigation into Fed Chair Powell has drawn rare Republican opposition in Congress, with several GOP lawmakers warning that it undermines Federal Reserve independence and threatening to block future nominees until the matter is settled.

🍎 APPLE EYES GEMINI ASSIST → Apple (AAPL) considers bringing Google’s (GOOG) Gemini into Siri to speed up AI gains, signaling a pragmatic shift as the assistant wars intensify.

Was this email forwarded to you? Sign up for free here.

MARKETS

Market Snapshot

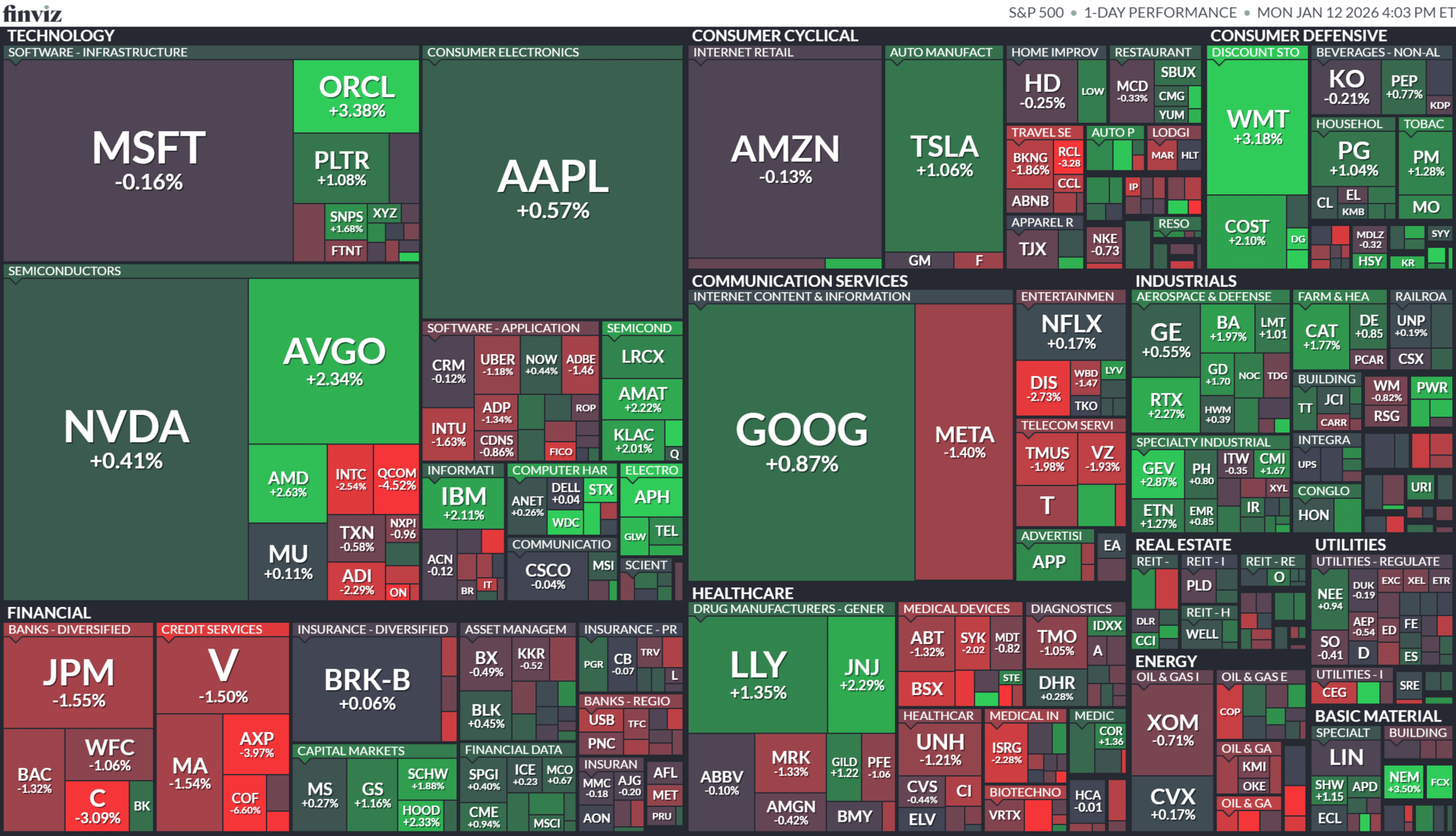

Today’s S&P 500 Heatmap

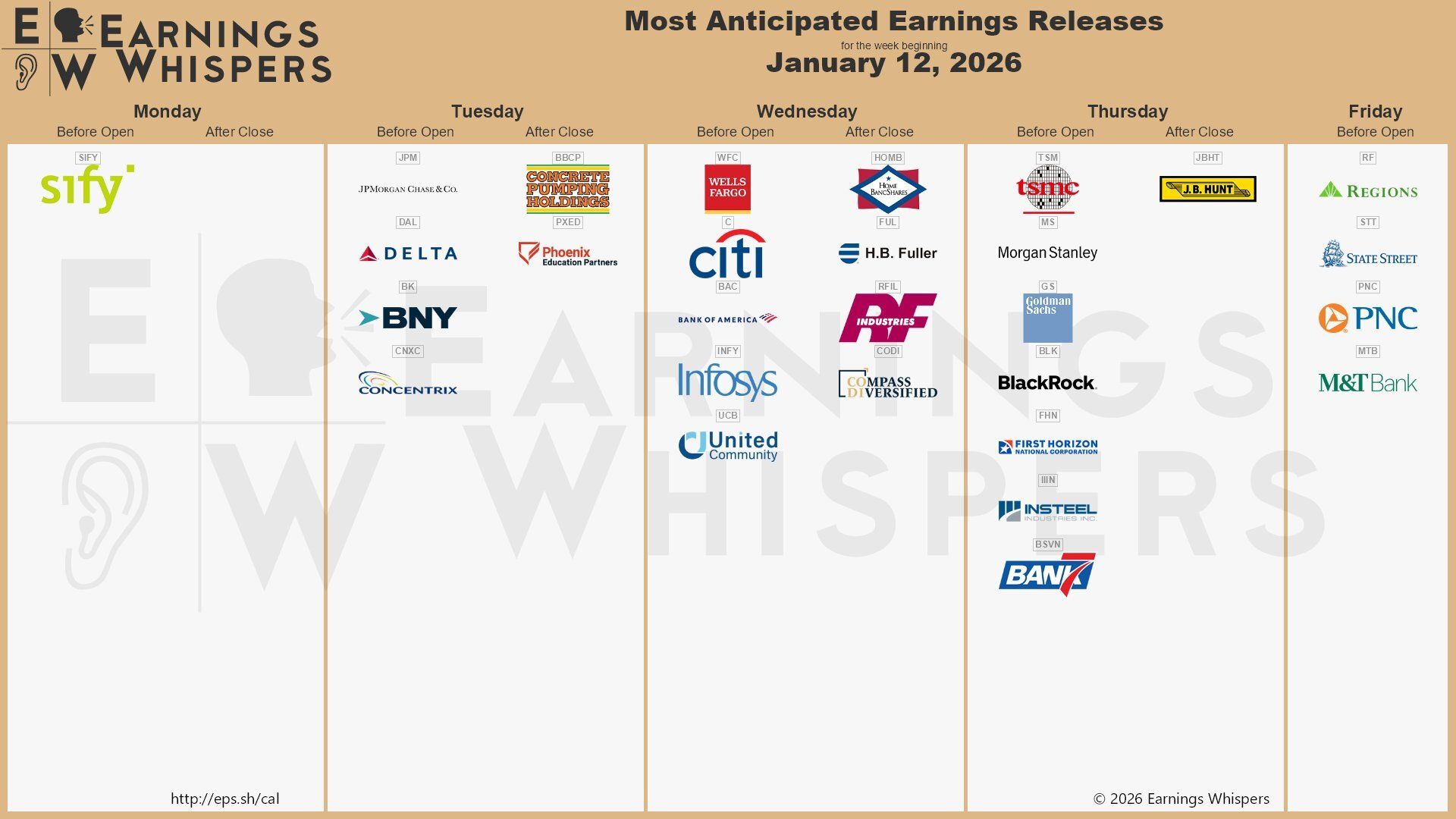

Notable Earnings

For the week beginning January 12, 2026

GOVERNMENT

Powell Investigation Splits GOP on the Hill

Gemini

⚖️ Criminal probe into Powell ignites rare backlash: The Justice Department’s investigation into Federal Reserve Chair Jerome Powell — centered on his congressional testimony and the renovation of the Fed’s headquarters — has triggered significant pushback from lawmakers. Even some Republicans are warning that the probe threatens the independence of the central bank, a principle long upheld to keep monetary policy insulated from political pressure.

🏛️ GOP leaders push back and threaten resistance: Key Republican figures, including Sen. Thom Tillis and Sen. Lisa Murkowski, criticized the investigation and pledged to oppose future Federal Reserve nominations until the legal matter is resolved, arguing that it could undermine both the Fed’s and the Justice Department’s credibility. Other Republican lawmakers have echoed concerns that the inquiry represents coercion rather than legitimate oversight.

📊 Political stakes and market unease: Powell’s public statements — framing the probe as pressure over interest-rate decisions — have amplified tensions between the Federal Reserve and the Trump administration. Critics across the aisle, including Democrats like Sen. Elizabeth Warren, have also condemned the investigation as an encroachment on the Fed’s independence. The dispute adds political uncertainty to economic policy at a time when markets are sensitive to central bank credibility.

AI

Apple Eyes Gemini Assist

Gemini

🤖 Apple weighs Google’s Gemini for Siri: Apple (AAPL) is reportedly exploring a deeper integration of Google’s (GOOG) Gemini AI into Siri, signaling openness to outside models to accelerate its AI roadmap. The move underscores urgency: Apple wants best-in-class generative capabilities now, not after years of in-house catch-up.

🔁 Pragmatism over purity: Tapping Gemini doesn’t mean Apple is abandoning its own AI ambitions; it’s a hedge. By blending third-party models with Apple’s on-device strengths and privacy controls, Cupertino can ship smarter features faster while continuing to build its proprietary stack behind the scenes.

⚔️ Big implications for the AI arms race: A Gemini-powered Siri would mark a rare détente between rivals and reshape competitive dynamics across assistants. For investors, it highlights a broader trend: platform owners will mix-and-match AI models to win users, making distribution and integration as important as raw model quality.

KEEP READING

Stocks making the biggest moves midday: Citigroup, Abercrombie, Vistra, Duolingo and more (CNBC)

‘Sell America’ trade: Dollar drops, gold surges as Trump’s Fed pressure campaign raises fears about U.S. system (CNBC)

The Apple-Google AI deal is a massive win for investors in both tech giants (CNBC)

NOTABLE POSTS

WHAT WE’RE WATCHING

Tools & Resources

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

AltIndex — Alternative datasets to uncover unique insights

GFR Smart Stock Selector — Filters stocks to help investor choices

WE WANT YOUR FEEDBACK

How would you rate today's newsletter?

Investment advisory services provided by ML Wealth LLC. Investment Accounts Are Not FDIC Insured • No Bank Guarantee • Investments May Lose Value. For important information and disclosures relating to the MoneyLion Investment Account, see Investment FAQs, Form ADV Brochure, and moneylion.com/investing. Funded managed investing accounts are subject to a monthly account fee of $1 (for accounts valued up to $5,000), $3 (for accounts valued over $5,000, and up to $25,000), or $5 (for accounts valued over $25,000).

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.