TLDR

⚡ MARKET RECAP → The S&P 500 (VOO) fell on Thursday as private credit stocks and geopolitical risks weighed on the major averages.

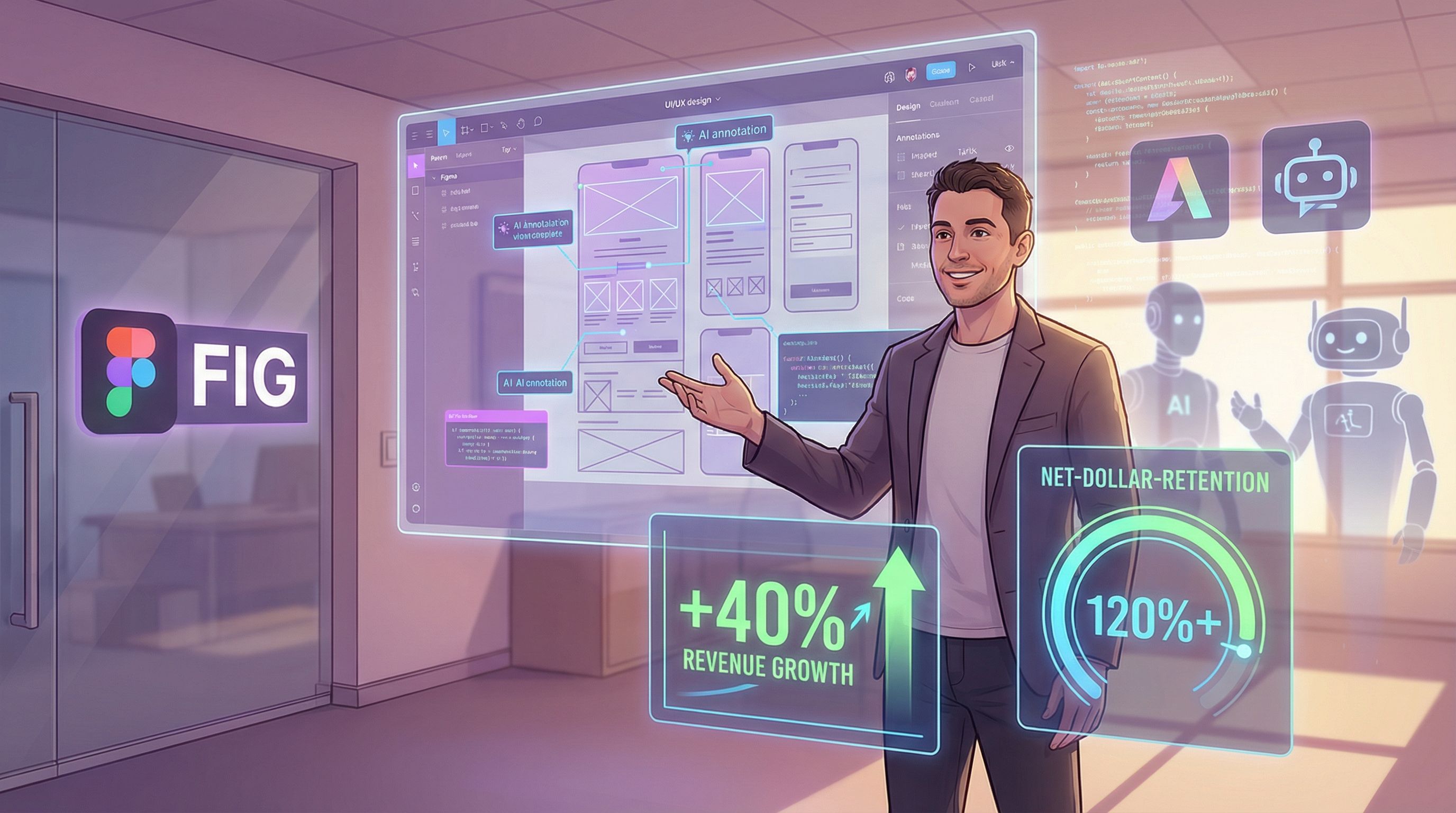

🤖 FIGMA’S AI CROSSROADS → Figma (FIG) reported a standout quarter with ~40 % revenue growth — enough to lift the stock — but analysts are calling out structural AI disruption risks that could reshape its design-platform future, blending short-term momentum with long-term uncertainty.

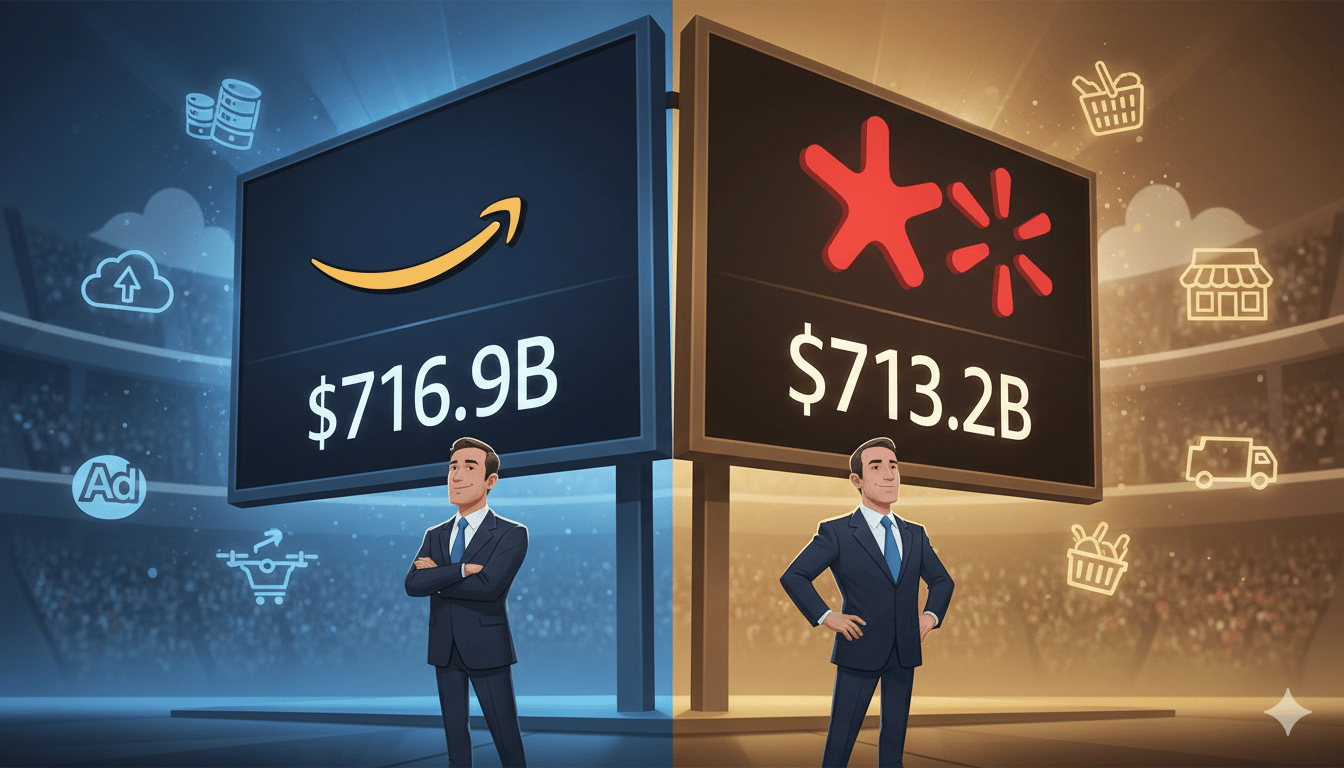

📊 AMAZON TOPS WALMART IN REVENUE → Amazon has surpassed Walmart in annual revenue for the first time in history — delivering about $716.9 billion to Walmart’s $713.2 billion — highlighting the increasing importance of cloud, marketplace, and digital services in the largest U.S. companies’ growth stories.

Was this email forwarded to you? Sign up for free here.

MARKETS

Market Snapshot

Today’s S&P 500 Heatmap

Notable Earnings

For the week beginning February 16, 2026

TECH

Figma’s AI Crossroads

Gemini

📈 Figma (FIG) crushed earnings and the stock jumped. The design-software platform reported about $303.8 million in Q4 revenue, roughly 40 % year-over-year growth that handily topped expectations, sending shares higher as investors cheered both the beat and upbeat guidance for 2026.

🤖 But analysts flagged AI risk on the horizon. Even with strong execution and expanding enterprise adoption, some Street voices warned that generative AI design tools could eventually commoditize Figma’s core workflow, potentially automating UI/UX tasks and eroding the collaborative design moat that made the company indispensable.

📊 Investors are stuck between execution and existential risk. On one hand, Figma’s net dollar retention and premium enterprise traction point to solid fundamentals; on the other, mounting competitive pressure from AI-native rivals and margin impact from AI infrastructure spend keep sentiment cautious. The narrative has shifted from “pure growth” to “growth with execution risk in an AI-first market.”

RETAIL

Amazon Tops Walmart In Revenue

Gemini

📊 A symbolic shift in U.S. corporate might: For the first time ever, Amazon’s annual revenue has eclipsed Walmart’s, with Amazon reporting about $716.9 billion versus Walmart’s roughly $713.2 billion in 2025 sales. That ends Walmart’s 13-year streak as the world’s largest company by revenue and marks a major milestone for the ecommerce-to-tech giant.

🛒 Different growth engines are at play: Amazon’s broader business model — combining ecommerce with high-growth segments like AWS cloud services, advertising and third-party marketplace fees — helped it inch past Walmart’s massive retail-heavy sales base. Walmart, meanwhile, continues to post record revenues and strong e-commerce growth, especially among higher-income shoppers, even as it loses the revenue crown.

📉 For investors, it’s growth narrative vs. legacy scale: The shift reflects broader trends in retail and tech: Amazon’s diversified digital and services stacks are growing faster than brick-and-mortar retail can keep pace, even with Walmart’s expansive store footprint and rising online sales. While the revenue milestone is mostly symbolic, it underscores how digital transformation is reshaping competitive dynamics in retail and corporate rankings.

KEEP READING

U.S. trade deficit totaled $901 billion in 2025 despite Trump’s tariffs (CNBC)

Mark Zuckerberg said he reached out to Apple CEO Tim Cook to discuss ‘wellbeing of teens and kids’ (CNBC)

King Charles’ brother Andrew arrested on suspicion of misconduct (CNBC)

NOTABLE POSTS

WHAT WE’RE WATCHING

Tools & Resources

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

AltIndex — Alternative datasets to uncover unique insights

GFR Smart Stock Selector — Filters stocks to help investor choices

WE WANT YOUR FEEDBACK

How would you rate today's newsletter?

Investment advisory services provided by ML Wealth LLC. Investment Accounts Are Not FDIC Insured • No Bank Guarantee • Investments May Lose Value. For important information and disclosures relating to the MoneyLion Investment Account, see Investment FAQs, Form ADV Brochure, and moneylion.com/investing. Funded managed investing accounts are subject to a monthly account fee of $1 (for accounts valued up to $5,000), $3 (for accounts valued over $5,000, and up to $25,000), or $5 (for accounts valued over $25,000).

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.