TLDR

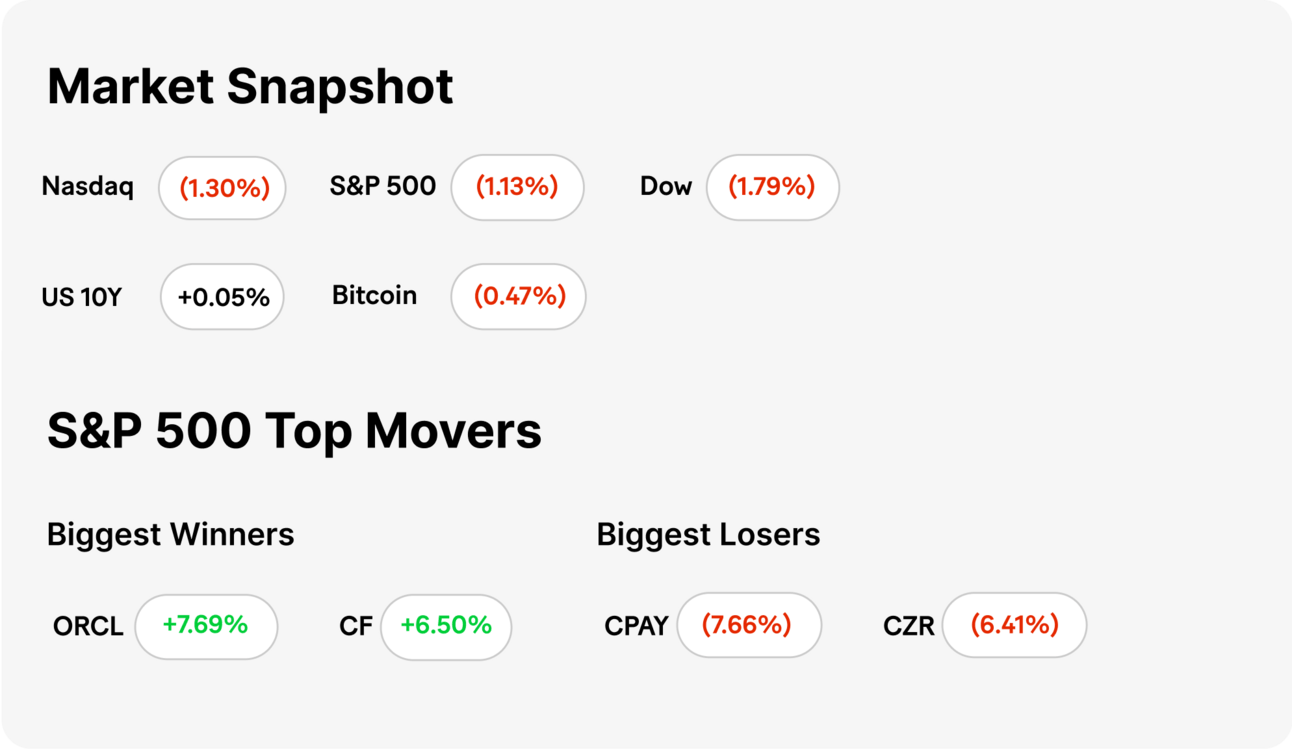

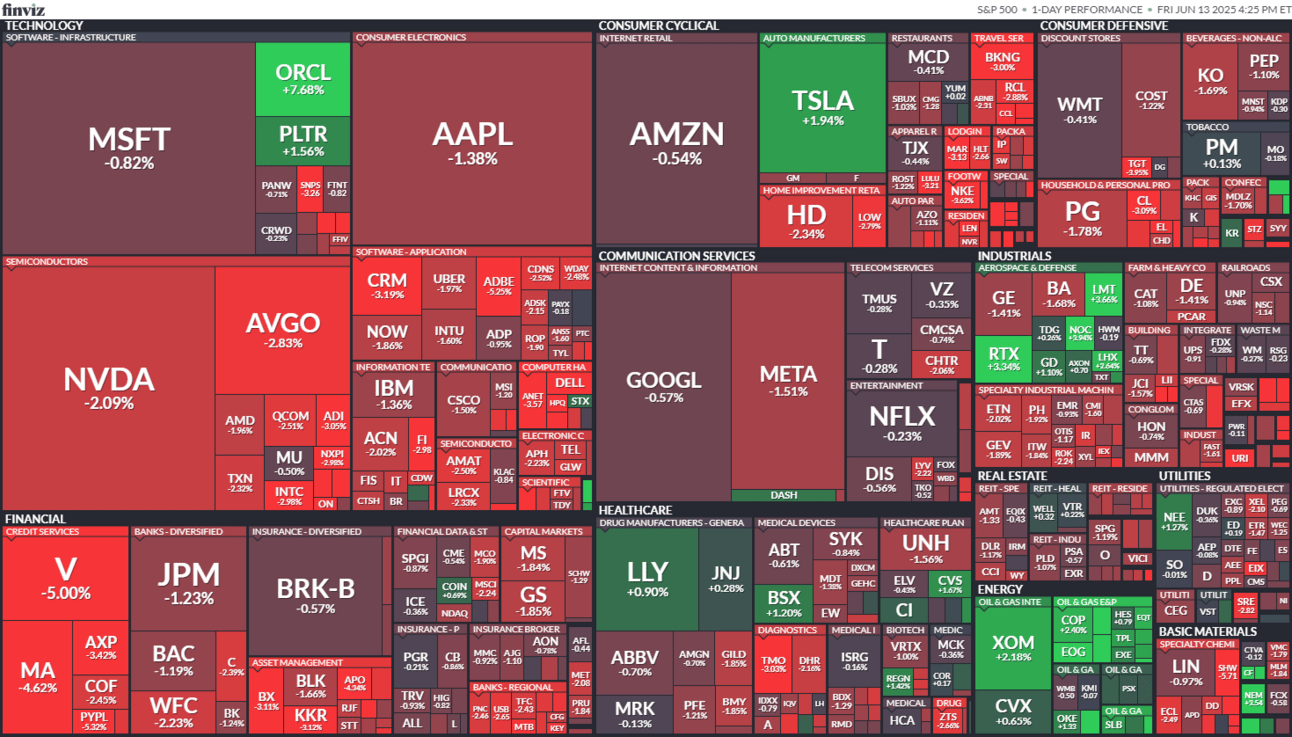

MARKET RECAP → Stocks closed lower Friday as investors weighed fresh economic data and cautious Fed signals against a backdrop of lingering rate uncertainty. In the crypto environment Bitcoin (BTC) continued downward pressured by trending headlines. $BTC.X ( ▲ 0.15% )

Markets Stumble on Middle East Shock → Markets nosedived as Israel bombed Iran and oil spiked, sparking safe-haven rallies and defense stock surges. Meanwhile, payment giants took a hit on stablecoin disruption threats from Walmart and Amazon.

AMAZON'S HEALTH CARE SHAKEUP → Amazon (AMZN) is merging its pharmacy and virtual care units after key execs quit, aiming to cut complexity and get health ambitions back on track. So far, Amazon’s health push has sputtered, struggling against entrenched rivals. The shakeup might help — or it might just be more corporate whack-a-mole.

Was this email forwarded to you? Sign up for free here.

Earn rewards by referring friends. Scroll to the bottom to learn more! 👇

POLL OF THE DAY

Which headline would most shake up the stock market?

FINANCE

Markets Stumble on Middle East Shock

source DALL-E

🛑 Markets Crater on Middle East Escalation. The Dow plunged 800 points Friday after Israel launched major airstrikes on Iran, igniting regional retaliation and rattling global investors. Oil surged 6%, defense stocks soared, and tech darlings like Nvidia (NVDA) slid as traders fled risk assets.

📈 Safe Havens and Oil Boom. Brent and WTI crude shot up as fears over Middle East oil supply intensified. Gold hit a near two-month high, and defense names like Lockheed Martin (LMT) and RTX (RTX) climbed 3–5% on heightened conflict exposure. Meanwhile, Palantir (PLTR) bucked the tech sell-off with a 1% gain, riding its defense credibility.

📉 Consumer Confidence Surges, But Market Ignores It. The University of Michigan’s consumer sentiment index jumped nearly 16% to 60.5 in June—well ahead of forecasts—but was swiftly overshadowed by geopolitical chaos. Investors remained fixated on oil-driven inflation risks and global uncertainty.

TECH

Amazon's Health Care Shakeup

source DALL-E

🩺 Amazon (AMZN) is reshuffling its health care deck. Following the sudden departure of two senior leaders, Amazon is folding its virtual care and pharmacy units into a single business under Neil Lindsay, senior VP of health services. The move aims to streamline operations as Amazon tries to solidify its health care ambitions amid fierce competition and high-profile stumbles.

💊 Amazon Pharmacy faces growing pains. Despite its big bet on pharmacy and virtual care, Amazon has struggled to gain significant market share. The company’s health efforts, including Amazon Clinic and Amazon Pharmacy, have faced regulatory hurdles, execution challenges, and an inability to break consumer loyalty to established players like CVS (CVS) and Walgreens (WBA).

📈 What’s next for Amazon Health? The reorganization is pitched as a way to sharpen Amazon’s focus on delivering integrated, affordable health solutions. But with executive turnover and operational resets, questions linger about whether Amazon can truly disrupt the sector or if it’s destined for more trial and error.

KEEP READING

Iran launches ballistic missiles at Israel: ‘Hard Retaliation Operation has begun,’ Tehran says (CNBC)

Politics U.S. judge blocks State Department’s planned overhaul, mass layoffs (CNBC)

Bitcoin and ether fall as tensions between Israel and Iran intensify: CNBC Crypto World (CNBC)

Air India crash: What to know about the first fatal Boeing Dreamliner tragedy (CNBC)

Why summer Fridays — workers’ most desired perk — are increasingly rare (CNBC)

Fast Credit Repair Tips with Our Credit Monsters (ML)

Summer Spending: What Americans Are Budgeting For, Cutting Back On, and Winging This Year (ML)

WHAT WE’RE WATCHING

OUR FAVORITE TOOLS & RESOURCES

Deribit — Crypto Futures and Options Exchange

Generated Assets — Turn any idea into an investable index

Polymarket — The world’s largest prediction market

Unusual Whales — Companion for uncovering unusual market activity

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

CME FedWatch Tool — Market-implied probabilities of future levels of interest rates

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

ChatGPT — Large language model-based chatbot powered by generative AI

Vimcal — Lightning-fast calendar and AI scheduling assistant

REFERRAL PROGRAM

WE WANT YOUR FEEDBACK

How would you rate today's newsletter?

Investment advisory services provided by ML Wealth LLC. Investment Accounts Are Not FDIC Insured • No Bank Guarantee • Investments May Lose Value. For important information and disclosures relating to the MoneyLion Investment Account, see Investment FAQs, Form ADV Brochure, and moneylion.com/investing. Funded managed investing accounts are subject to a monthly account fee of $1 (for accounts valued up to $5,000), $3 (for accounts valued over $5,000, and up to $25,000), or $5 (for accounts valued over $25,000).

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.