TLDR

🥵 MARKET RECAP → Stocks closed their worst day in over a month as the tech and AI-related sell-off intensified on Thursday.

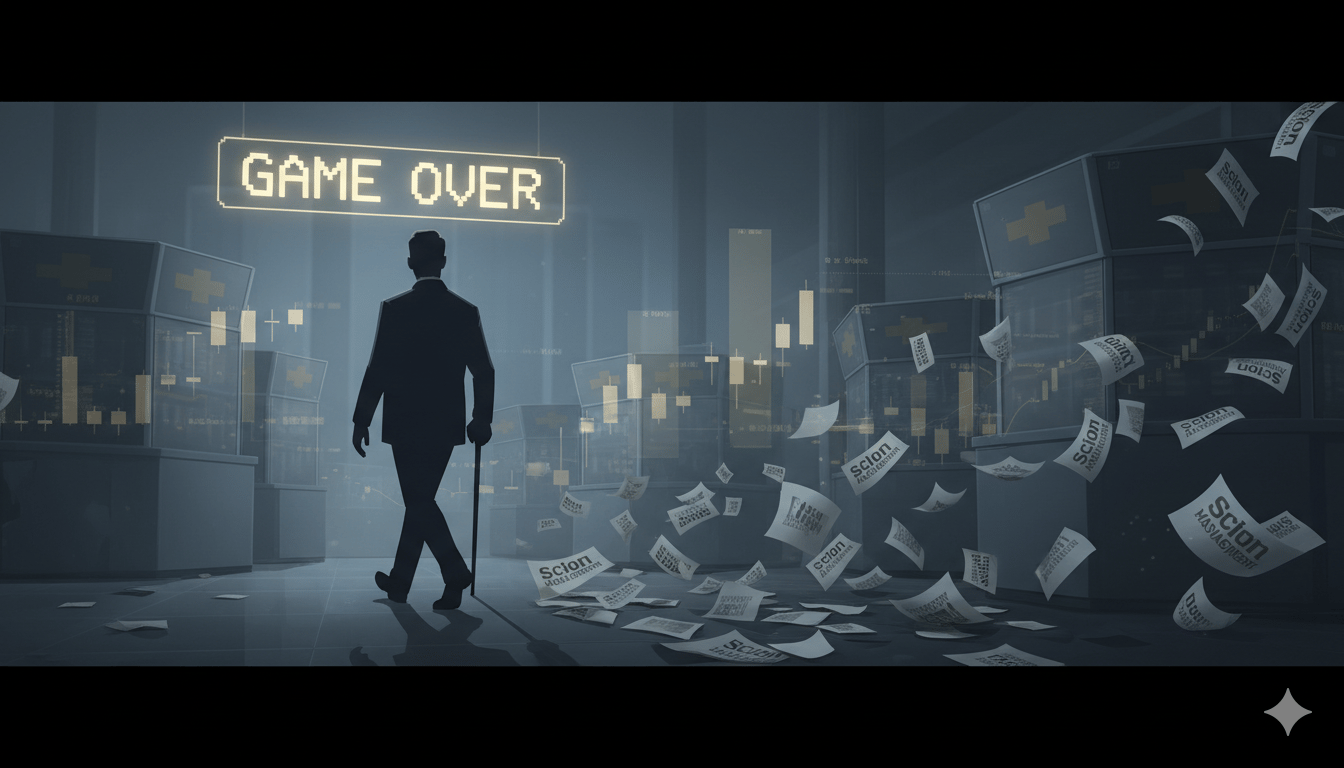

💼 BURRY BOWS OUT → “Big Short” legend Michael Burry closed Scion Asset Management, ending an era of contrarian bets that often shook markets but recently missed the AI boom.

💰 BIGGER 401(K) BUCKETS → 401(k) contribution limits will rise to $24,500 in 2026, with total savings for older workers hitting $32,000 as the IRS nudges retirement thresholds higher.

Was this email forwarded to you? Sign up for free here.

MARKETS

Market Snapshot

Today’s S&P 500 Heatmap

Notable Earnings

For the week beginning November 10, 2025

MARKETS

Burry Bows Out

Gemini

💼 Scion shuts down. “Big Short” investor Michael Burry has deregistered Scion Asset Management, effectively closing his hedge fund after nearly a decade of high-profile contrarian bets. The filing means Scion will no longer manage outside capital or report holdings to the SEC.

📉 From fame to fade. Burry, best known for predicting the 2008 housing crash, made headlines with bearish positions in recent years—including shorting Tesla (TSLA) and the broader market—but his fund underperformed during the AI-fueled rally.

🧩 Legacy of a skeptic. While Burry’s exit marks the end of Scion, his cautionary stance on market exuberance remains influential among retail traders and hedge fund peers alike.

TAXES

Bigger 401(k) Buckets

Gemini

💰 Limits rise for 2026. The IRS announced that workers can contribute up to $24,500 to their 401(k) plans in 2026, a $500 increase from 2025, thanks to modest inflation adjustments.

👵 Catch-ups unchanged. The $7,500 catch-up limit for savers age 50+ remains the same, meaning older workers can stash up to $32,000 next year. IRA contribution limits also rise to $7,500.

📊 Slow but steady boost. While the bump is smaller than past inflation-era jumps, financial planners say even incremental increases can meaningfully lift long-term retirement balances—especially with employer match boosts.

KEEP READING

Congressional hemp restrictions threaten $28 billion industry, sending companies scrambling (CNBC)

IRS announces 2026 401(k) contribution limits, raises savings cap (CNBC)

This fintech stock is on fire this year. How to bet on more gains, while hedging, using options (CNBC)

Oppenheimer raises Nvidia price target ahead of earnings report (CNBC)

Tools & Resources

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

AltIndex — Alternative datasets to uncover unique insights

GFR Smart Stock Selector — Filters stocks to help investor choices

WE WANT YOUR FEEDBACK

How would you rate today's newsletter?

Investment advisory services provided by ML Wealth LLC. Investment Accounts Are Not FDIC Insured • No Bank Guarantee • Investments May Lose Value. For important information and disclosures relating to the MoneyLion Investment Account, see Investment FAQs, Form ADV Brochure, and moneylion.com/investing. Funded managed investing accounts are subject to a monthly account fee of $1 (for accounts valued up to $5,000), $3 (for accounts valued over $5,000, and up to $25,000), or $5 (for accounts valued over $25,000).

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.