TLDR

MARKET RECAP → This week’s stock market action is reminiscent of the euphoric, pandemic-induced, stimulus-fueled insanity that drove a momentous rally in shares of the once left-for-dead “Blockbuster of video games” stock, GameStop (GME). As @TheRoaringKitty returns from a nearly 3-year hiatus, his return proves that the “apes” are alive and well … and that they are back with a vengeance.

MEME STOCK MANIA RELOADED → 🎢 Fueled by "Roaring Kitty" and 15 million Redditors, the meme stock circus swings back into town, pulling an eclectic cast of stocks from crypto to AI into the spotlight, and proving once more that Wall Street is just as susceptible to social media sways.

AWS CHIEF SELIPSKY RESIGNS → 🔄 Amazon’s (AMZN) AWS CEO Adam Selipsky steps down to prioritize family, passing the reins to Matt Garman as he leaves the cloud giant in a strong position for continued innovation and growth.

BIDEN HIKES CHINA TARIFFS → 📈 President Biden sharply raises tariffs on Chinese imports like EVs and solar panels to 100% and 50% respectively, aiming to protect U.S. industries and assert a tough stance on China during Infrastructure Week.

Was this email forwarded to you? Sign up for free here.

TODAY’S TOP NEWS

Meme Stock Mania Reloaded

Reddit Rises Again 🚀 The resurgence of meme stock enthusiasm has seen "r/wallstreetbets" Reddit forum membership skyrocket to over 15 million, spurred by a viral post from "Roaring Kitty"—the catalyst behind 2021's meme stock frenzy. This revival has widened its scope, drawing in stocks beyond the usual suspects like GameStop and AMC (AMC).

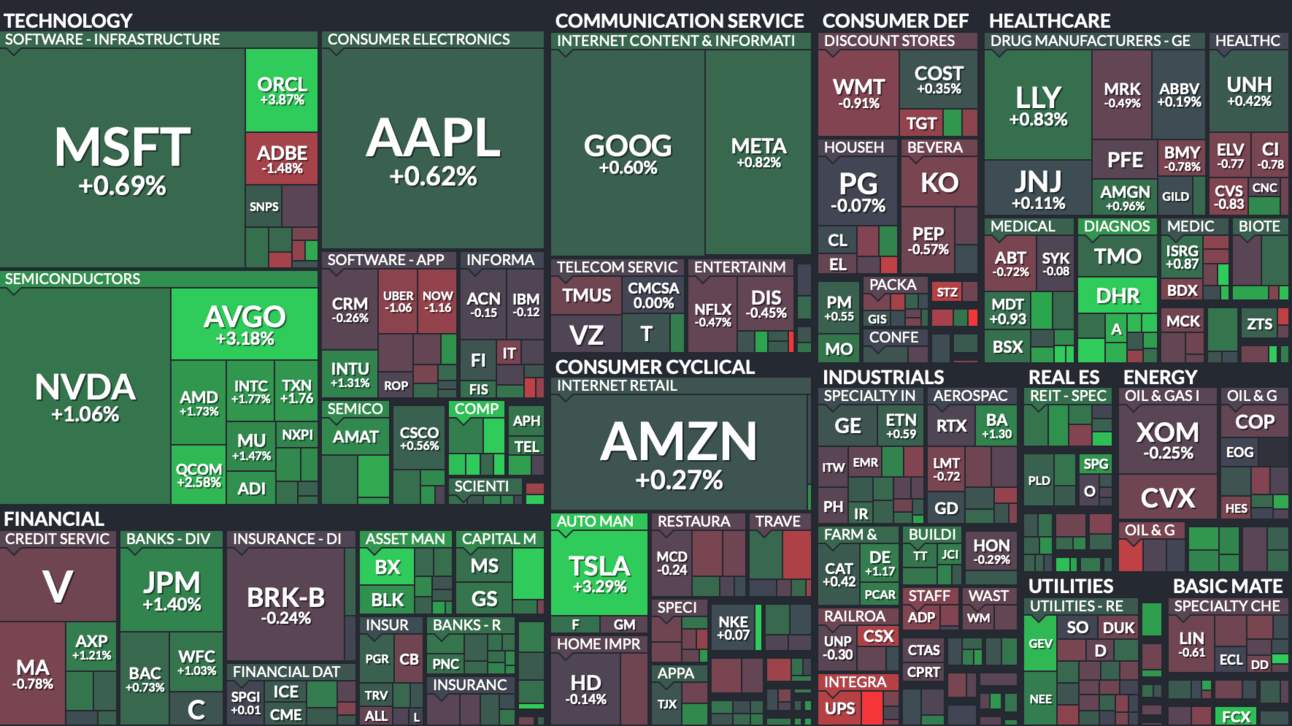

Analyzing the Hype 📊 Quiver Quantitative, leveraging alternative data analytics, developed a "WallStreetBets score" to gauge meme stock popularity on Reddit based on mentions over the past week. Additionally, they track the "fails-to-deliver" (FTD) score, indicating potential for short squeezes, which intensify when stocks experience sudden surges forcing short sellers to cover their positions.

Diverse Meme Stock Spread 📈 The meme stock phenomenon has expanded to sectors like crypto and AI, with companies like Marathon Digital (MARA) and SoundHound AI gaining traction (SOUN). Super Micro Computer (SMCI), notable for its role in AI infrastructure, joined the S&P 500 (VOO) after a significant rally, demonstrating the broadening impact and appeal of meme stocks in the market.

TODAY’S TOP NEWS

AWS Chief Selipsky Resigns

👋 Leadership Change Announced: Adam Selipsky, CEO of Amazon (AMZN) Web Services, will resign from his position next month after almost two decades with the company. He plans to focus more on his family and personal well-being after years of steering AWS’s expansive growth.

🔄 Succession Plan in Place: Matt Garman, currently senior vice president of sales and marketing at AWS, has been named as Selipsky's successor. This transition marks a significant shift in leadership but is expected to be smooth given Garman's deep involvement in AWS operations.

📈 Bright Outlook for AWS: In his farewell memo, Selipsky expressed confidence in the future of AWS, citing the strong state of the business and its leadership team. His departure is timed to allow for personal rejuvenation while leaving the company in capable hands during a period of continued growth and innovation.

TODAY’S TOP NEWS

Biden Hikes China Tariffs

🚗 Steep Tariff Increases: President Joe Biden announced significant tariff increases on $18 billion worth of Chinese imports, including a jump from 25% to 100% on electric vehicles, and from 25% to 50% on solar cells. The move is part of a broader effort to counteract China’s competitive pricing and protect American industries from unfair competition.

🔋 Targeted Economic Defense: The tariffs, which also affect semiconductors and various medical and industrial goods, are designed to shield burgeoning U.S. industries, especially in clean energy and technology sectors. The administration asserts that these tariffs are specifically aimed and will not cause broad inflationary impacts, contrasting sharply with broader tariff measures seen in the past.

⚖️ Strategic Political Timing: This tariff escalation coincides with Biden's "Infrastructure Week," highlighting his administration's substantial investments in infrastructure and clean energy. It also aligns with Biden's reelection campaign, emphasizing his tough stance on China, a key issue also highlighted by his likely election opponent, Donald Trump.

KEEP READING

Alibaba shares fall 5% in premarket trading after posting 86% profit drop (CNBC)

Home Depot misses on revenue, as high interest rates hurt sales (CNBC)

How the Fed’s quest for transparency made markets more volatile (CNBC)

Michael Cohen resumes Trump trial testimony with House Speaker Johnson watching (CNBC)

Walmart to reportedly lay off hundreds of corporate staff and relocate others (CNBC)

McDonald’s, Apple and Tesla can’t bet on making a fortune in China anymore (CNN)

This ALS patient has a brain implant that translates his thoughts to computer commands(CNN)

Kremlin critic Kara-Murza wins Pulitzer Prize for columns written from prison cell(CNN)

MoneyLion: On a Mission to Become the Expedia of Financial Services (PYMNTS)

WHAT WE’RE WATCHING

OUR FAVORITE TOOLS & RESOURCES

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

CME FedWatch Tool — Market-implied probabilities of future levels of interest rates

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

ChatGPT — Large language model-based chatbot powered by generative AI

Notion AI — Notion AI is a writing assistant that can help you write, brainstorm, edit, summarize, and more

Vimcal — Lightning-fast calendar and AI scheduling assistant

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

How would you rate today's newsletter?

The Bull vs. Bear Merchandise Promotion is a limited time campaign that begins on December 1, 2023 at 12:00 AM ET and ends on the date that there are no more Rewards. This Promotion is available to any registered MoneyLion user who is a legal resident of the 50 United States or the District of Columbia and who has reached the age of majority in their state as of the beginning of the Promotional Period. See terms and conditions here.

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice.