TLDR

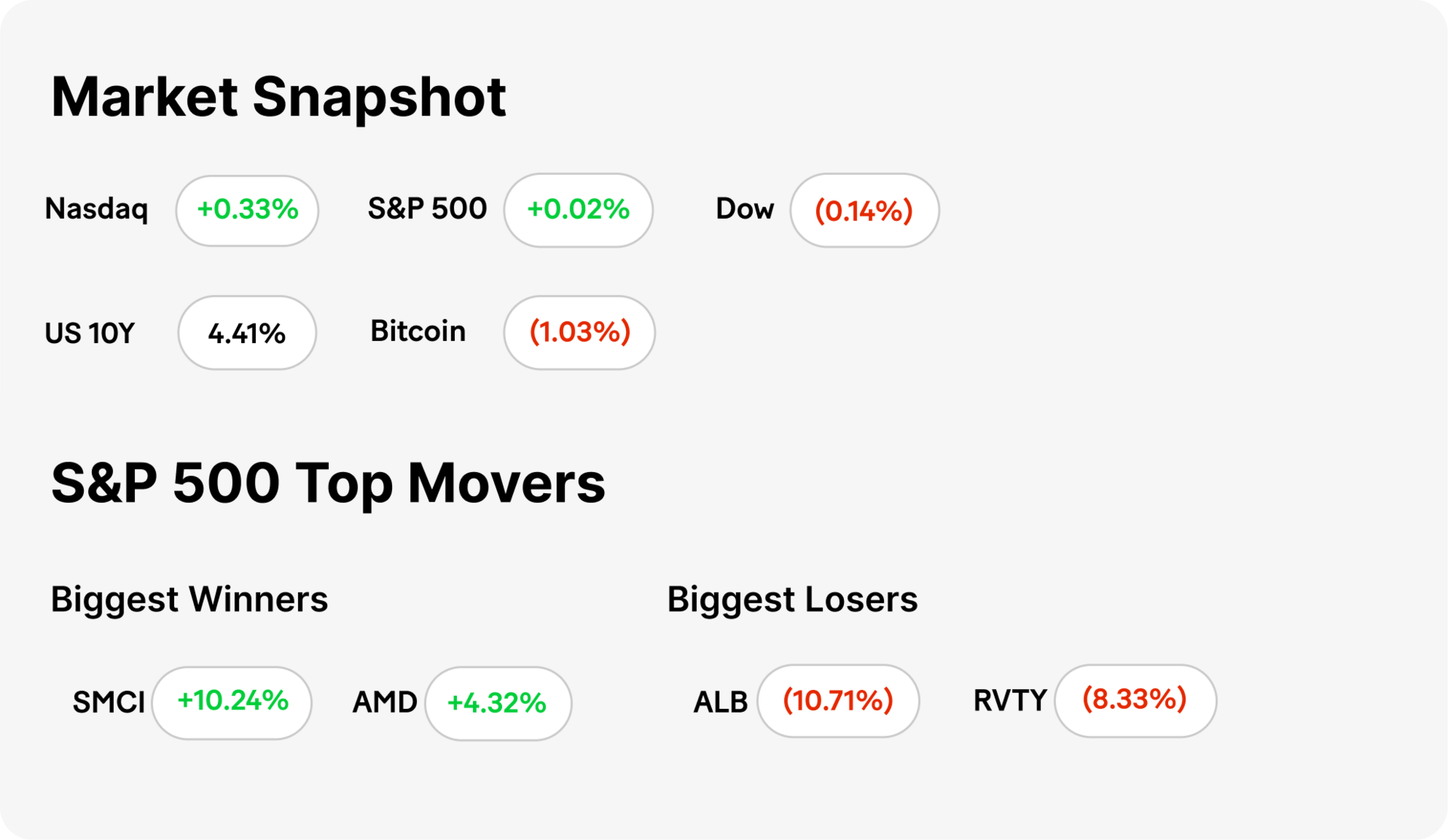

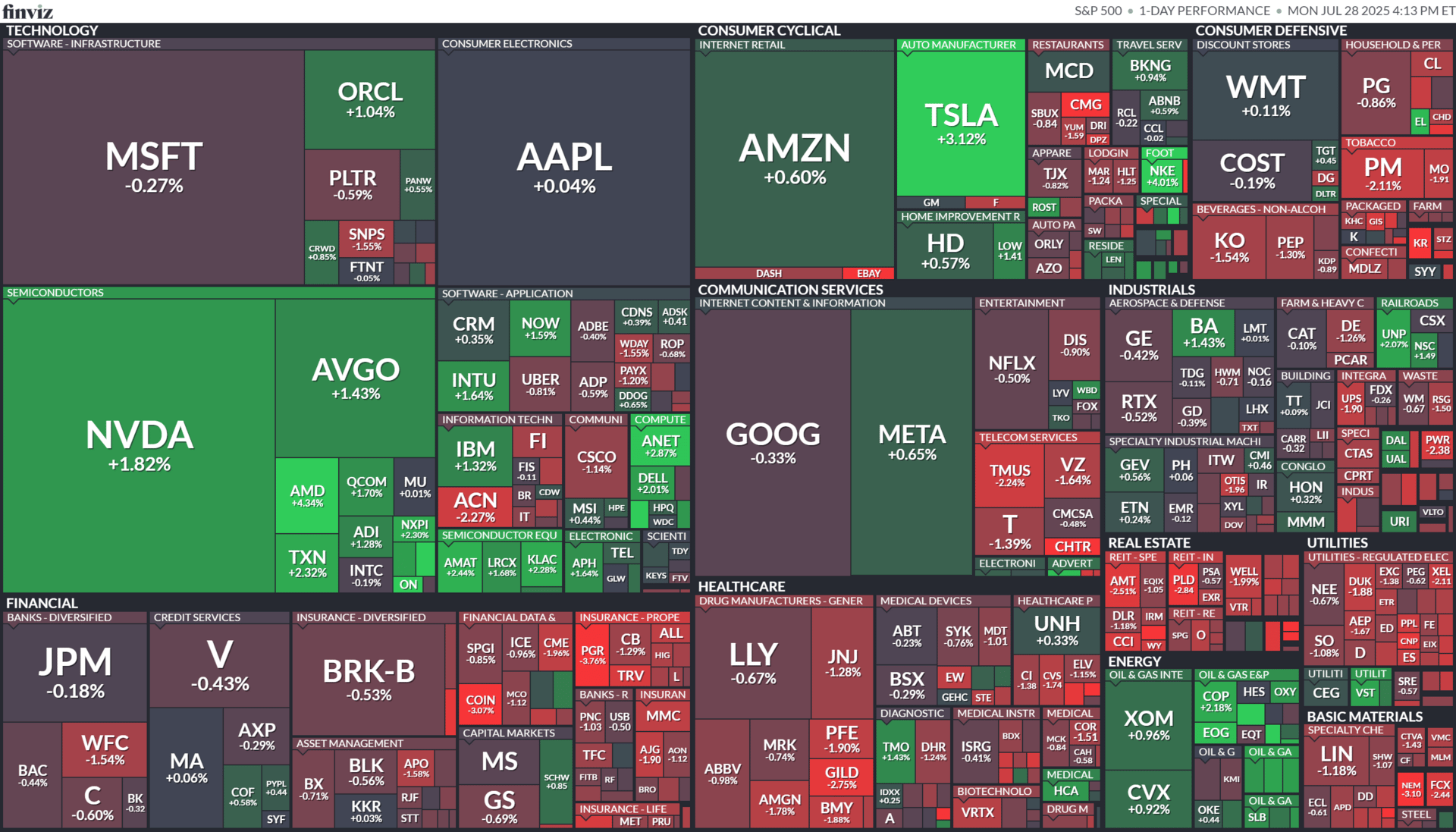

MARKET RECAP → Markets saw mixed results on Monday as traders shake fears after recent trade deals, turning focus towards earnings and the FED rate decision. The S&P 500 (VOO) closed near the flatline after hitting a record high shortly after open. The Dow Jones Industrial Average fell as the Nasdaq Composite (QQQ) gained, hitting a fresh record.

WALL STREET SHRUGS AT TRADE WAR → Wall Street’s fears are fading as Trump inked deals with the EU and Japan at 15% tariffs, corporate earnings beat estimates, and inflation cooled. However, frothy valuations and investor exuberance suggest a correction could be coming.

SAMSUNG’S 16.5B CHIP SHOT → Samsung landed a $16.5 billion chip contract with Tesla (TSLA) to produce AI chips using its 4nm and 2nm tech. The deal bolsters Samsung’s foundry comeback and Tesla’s AI ambitions while reflecting a strategic shift in chip sourcing.

Was this email forwarded to you? Sign up for free here.

POLL OF THE DAY

Can Markets Keep Rallying?

Economy

Wall Street Shrugs at Trade War

source DALL-E

Markets Shake Off Tariff Fears: Despite President Donald Trump's tariff-heavy trade agenda, Wall Street is showing signs of resilience. Investors who once braced for economic fallout are now betting the damage may be more bark than bite. As equities keep climbing, markets appear to be discounting the severity of a global trade war.

A new status quo emerges: The Trump administration’s trade threats, initially seen as destabilizing, are increasingly viewed as political strategy rather than imminent economic rupture. Business leaders, policymakers, and traders are adapting to the pattern of aggressive rhetoric followed by selective deal-making. Markets are now treating the tariffs as negotiating tools, not structural shifts in U.S. trade policy.

Rally with risk beneath the surface: While major indexes are hitting new highs, underlying risks persist. Some economists caution that investor confidence may be fragile, especially if tariff threats escalate without resolution. Although recent deals have calmed markets, sectors like autos and agriculture remain exposed, and any reversal could lead to renewed volatility.

Tech

Samsung’s $16.5B Chip Shot

source DALL-E

Tesla inks major AI silicon buy: Samsung Electronics has secured a massive $16.5 billion contract to supply advanced AI chips to Tesla (TSLA), a clear signal of Tesla’s deepening investment in custom hardware for autonomous driving and AI training. The multiyear deal is one of Samsung’s biggest ever and a major win in the global chip war.

Next-gen tech, high-stakes rivalry: The chips will be produced using Samsung’s 4-nanometer and next-gen 2-nanometer processes, core to its effort to compete with TSMC and Intel (INTC) in cutting-edge fabrication. For Samsung’s foundry unit, the deal is a validation of its tech roadmap and ability to meet demanding AI workloads.

Strategic supply shift amid global tension: With geopolitical risks looming over Taiwan, Tesla’s choice of Samsung, with fabs in South Korea and Texas, reflects a calculated move to diversify its chip supply chain. The deal positions Samsung as a go-to partner for firms seeking high-performance AI silicon without TSMC dependency.

KEEP READING

PayPal says it will allow businesses to accept payments in over 100 cryptocurrencies (CBS)

Judge rejects bid by Trump ally to open Fed interest rate meeting to the public (CNBC)

DeFi Sector TVL Hits 3-Year High of $153B as Investors Rush to Farm Yields (CoinDesk)

Markets hope for one thing from US-China tariff talks: Another 90-day extension (Yahoo Finance)

20 national security experts urge Trump administration to restrict Nvidia H20 sales to China (TechCrunch)

How to Change Your Money Mindset: 9 Tips for Abundance Thinking (ML)

WHAT WE’RE WATCHING

OUR FAVORITE TOOLS & RESOURCES

Deribit — Crypto Futures and Options Exchange

Generated Assets — Turn any idea into an investable index

Polymarket — The world’s largest prediction market

Unusual Whales — Companion for uncovering unusual market activity

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

CME FedWatch Tool — Market-implied probabilities of future levels of interest rates

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

ChatGPT — Large language model-based chatbot powered by generative AI

Vimcal — Lightning-fast calendar and AI scheduling assistant

AltIndex — Alternative datasets to uncover unique insights

GFR Smart Stock Selector — Filters stocks to help investor choices

WE WANT YOUR FEEDBACK

How would you rate today's newsletter?

Investment advisory services provided by ML Wealth LLC. Investment Accounts Are Not FDIC Insured • No Bank Guarantee • Investments May Lose Value. For important information and disclosures relating to the MoneyLion Investment Account, see Investment FAQs, Form ADV Brochure, and moneylion.com/investing. Funded managed investing accounts are subject to a monthly account fee of $1 (for accounts valued up to $5,000), $3 (for accounts valued over $5,000, and up to $25,000), or $5 (for accounts valued over $25,000).

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.