TLDR

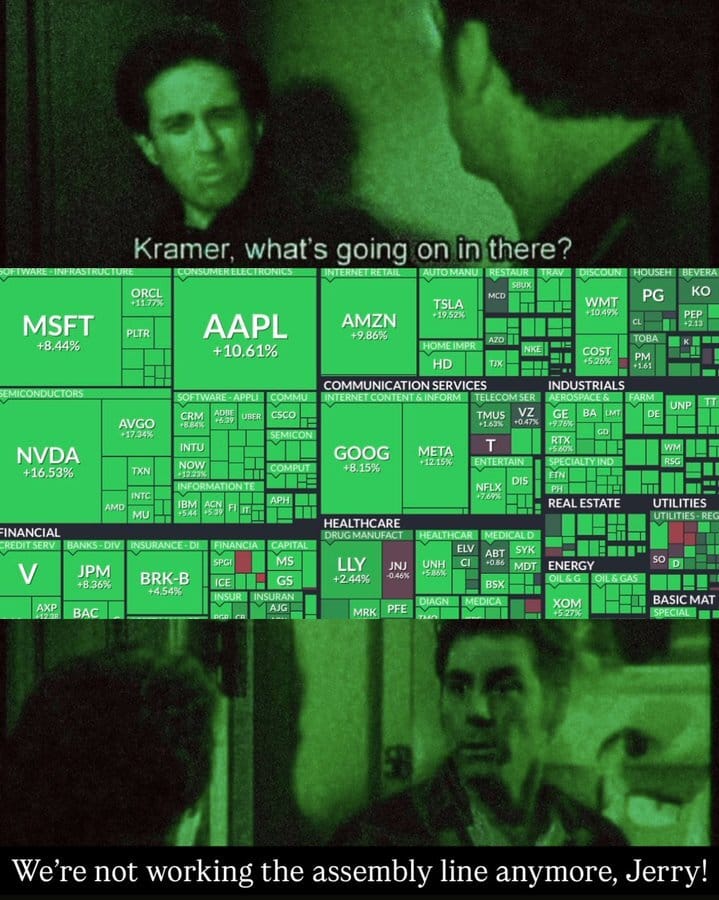

MARKET RECAP → The stock market staged one of its largest rallies ever after President Donald Trump hit pause on parts of his "reciprocal" tariff plan, triggering a massive rebound in a market that had spent the past week under intense pressure.

MAIN STREET’S TURN TO SHINE? →📉 Treasury Secretary Scott Bessent said it's time for small businesses to lead the economy — just as Trump’s tariffs sparked a stock market tumble and recession fears, putting Main Street in the spotlight and Wall Street on edge.

INVESTORS FLEE TO GERMAN BONDS AS TRUMP TARIFFS SPARK TREASURY SELL-OFF → 🇩🇪 As Trump’s tariffs rattled markets and sent U.S. Treasury yields surging, investors rushed to German bunds as a safer bet — flipping the usual script and turning Europe into the new flight-to-quality destination.

Was this email forwarded to you? Sign up for free here.

Earn rewards by referring friends. Scroll to the bottom to learn more! 👇

TODAY’S TOP NEWS

Main Street’s Turn To Shine?

💼 Treasury Secretary Scott Bessent declared it was “Main Street’s turn” after 40 years of Wall Street dominance, emphasizing that the Trump administration’s economic agenda aims to shift growth and investment toward small businesses and workers — even as tariffs stir recession fears.

📉 Trump’s steep tariffs triggered a market nosedive earlier this week, with the S&P 500 nearly 19% off its February high. While the wealthy dominate stock ownership, Bessent noted that Main Street’s financial fate is increasingly tied to equities via 401(k)s and IRAs.

🧾 Bessent outlined pro-growth reforms to stave off a downturn: preserving Trump’s tax cuts, bringing back 100% depreciation, and introducing tax breaks on tips, overtime, and Social Security. Still, Wall Street execs like Jamie Dimon warned the tariff storm may already be tipping the U.S. toward recession.

TODAY’S TOP NEWS

Investors Flee To German Bonds As Trump Tariffs Spark Treasury Sell-Off

📉 U.S. Treasurys sold off as Trump’s initial tariff rollout and China’s retaliation jolted markets, driving 10-year yields up 12 basis points. With volatility rising, investors bailed on traditional safe havens like Treasurys, shifting the global bond narrative.

🇩🇪 Germany emerged as the surprise shelter, with yields on its 2-year bonds falling 12 basis points as investors sought stability. Analysts pointed to Berlin’s clear fiscal path and the eurozone’s more predictable rate outlook as key draws.

💥 Economists compared the surge in U.S. borrowing costs to the UK’s 2022 “mini-budget” debacle, warning that tariffs risk becoming a capital destroyer. With bond hedging power eroding, this isn’t your classic 60/40 portfolio environment anymore.

KEEP READING

GM axing Cadillac XT6 crossover, extending production of another vehicle in Tennessee (CNBC)

Delta CEO says Trump tariffs are hurting bookings as airline pulls 2025 forecast (CNBC)

Trump Tariffs Explained: Your Complete 2025 Guide (ML)

Why You’ll Love the Money Master Challenge – Your Daily Finance Game! (ML)

MoneyLion and Mastercard New ‘Health is Wealth’ Report Uncovers the Hidden Physical Costs of Financial Stress (ML)

8 Fun Ways to Maximize Your MoneyLion Experience — and Get Control of Your Finances (ML)

OUR FAVORITE TOOLS & RESOURCES

Polymarket — The world’s largest prediction market

Unusual Whales — Companion for uncovering unusual market activity

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

CME FedWatch Tool — Market-implied probabilities of future levels of interest rates

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

ChatGPT — Large language model-based chatbot powered by generative AI

Vimcal — Lightning-fast calendar and AI scheduling assistant

REFERRAL PROGRAM

WE WANT YOUR FEEDBACK

How would you rate today's newsletter?

Investment advisory services provided by ML Wealth LLC. Investment Accounts Are Not FDIC Insured • No Bank Guarantee • Investments May Lose Value. For important information and disclosures relating to the MoneyLion Investment Account, see Investment FAQs, Form ADV Brochure, and moneylion.com/investing. Funded managed investing accounts are subject to a monthly account fee of $1 (for accounts valued up to $5,000), $3 (for accounts valued over $5,000, and up to $25,000), or $5 (for accounts valued over $25,000).

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.