TLDR

💚 MARKET RECAP → Stocks rebounded Friday as New York Fed President John Williams suggested another rate cut might be on the table before year end.

📊 NVIDIA SHRUGS OFF BUBBLE → Nvidia’s (NVDA) latest earnings re-ignite the AI trade with huge beats and a fat order book, but stretched valuations and customer spending limits mean this is a name to size carefully, not hero-ball.

💉 ELI LILLY HITS $1 TRILLION → Lilly (LLY) has officially joined the $1 trillion market-cap club—the first healthcare firm to do so—driven by its obesity/diabetes drug boom and bold strategic positioning, but the high valuation brings new expectations and risks.

Was this email forwarded to you? Sign up for free here.

MARKETS

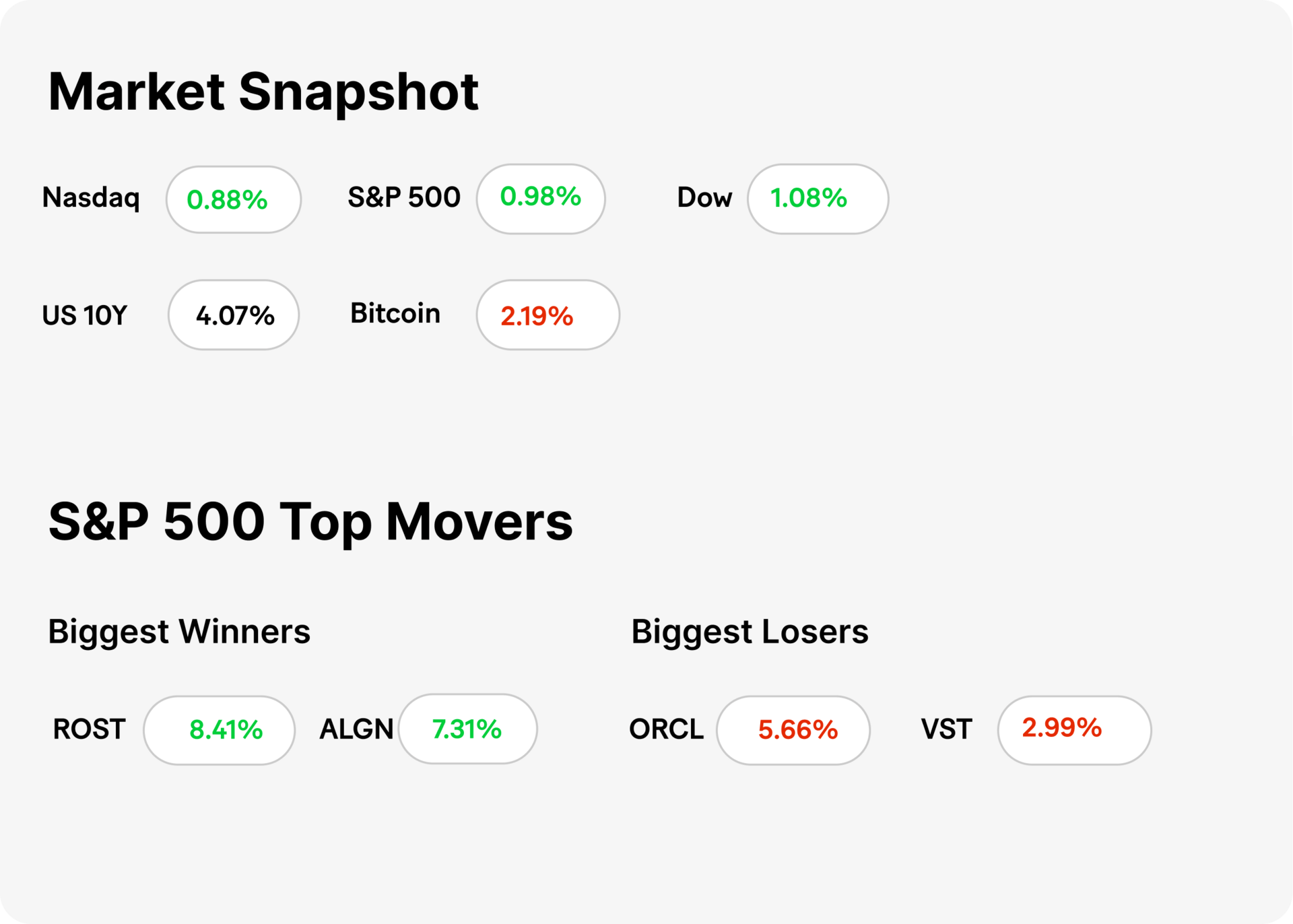

Market Snapshot

Today’s S&P 500 Heatmap

Notable Earnings

For the week beginning November 24, 2025

TECH

Robinhood’s Risk Hangover

Gemini

📉 Brutal week for Robinhood: Robinhood (HOOD) is limping into the weekend after a double-digit weekly decline, including about a 10% dump on Thursday alone. The slide has now chopped off more than a quarter of its market cap in November, turning a previously strong year into a harsh reminder of how quickly sentiment can flip.

🪙 When bitcoin and AI sneeze, HOOD catches the flu: The platform still lives and dies by retail’s favorite high-octane trades — crypto and AI stocks — and both unraveled this week. Bitcoin sank to multi-month lows and AI bellwethers like Nvidia (NVDA) lost momentum, exposing just how tightly Robinhood’s revenue engine is wired to risk-on speculation.

🧯 What it means for investors: HOOD doesn’t trade like a mature brokerage; it trades like a leveraged proxy for speculative appetite. If you’re long, you’re essentially betting on crypto volatility, meme-stock oxygen, and AI enthusiasm — so position sizes should be modest, drawdowns expected, and optimism hedged with something sturdier than vibes.

PHARMACEUTICAL

Eli Lilly Hits $1 Trillion

Gemini

🚀 Milestone Moment for Pharma: Eli Lilly & Co. (LLY) became the first healthcare company to reach a $1 trillion market valuation, driven by the explosive growth of its obesity and diabetes treatments Zepbound and Mounjaro. The stock has surged more than 35% this year as the company overtook competitor Novo Nordisk A/S in U.S. prescriptions and commanded one of the richest valuations in big pharma (~50× expected earnings).

📊 Why It Happened & What It Reflects: The boom in GLP-1 and similar drugs has transformed Lilly’s portfolio — the obesity-treatment market itself is projected to reach upwards of $150 billion globally. Lilly’s strategic deals (including a pricing pact with the U.S. government) and an anticipated pipeline including an oral version of its obesity drug (Orforglipron) boosted investor confidence.

🧐 Key Risks & Investor Considerations: Despite the milestone, analysts remain cautious: sustaining growth will require managing pricing pressure, margin erosion, and looming biosimilar competition. The “trillion-dollar club” status signals a shift more typical of tech companies than traditional pharma.

KEEP READING

Amazon cut thousands of engineers in its record layoffs, despite saying it needs to innovate faster (CNBC)

Eli Lilly hits $1 trillion market value, a first for a health-care company (CNBC)

Robinhood shares head for brutal weekly loss as bitcoin, AI stocks are hit hardt (CNBC)

Google must double AI compute every 6 months to meet demand, AI infrastructure boss tells employees (CNBC)

WHAT WE’RE WATCHING

Tools & Resources

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

AltIndex — Alternative datasets to uncover unique insights

GFR Smart Stock Selector — Filters stocks to help investor choices

WE WANT YOUR FEEDBACK

How would you rate today's newsletter?

Investment advisory services provided by ML Wealth LLC. Investment Accounts Are Not FDIC Insured • No Bank Guarantee • Investments May Lose Value. For important information and disclosures relating to the MoneyLion Investment Account, see Investment FAQs, Form ADV Brochure, and moneylion.com/investing. Funded managed investing accounts are subject to a monthly account fee of $1 (for accounts valued up to $5,000), $3 (for accounts valued over $5,000, and up to $25,000), or $5 (for accounts valued over $25,000).

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.