TLDR

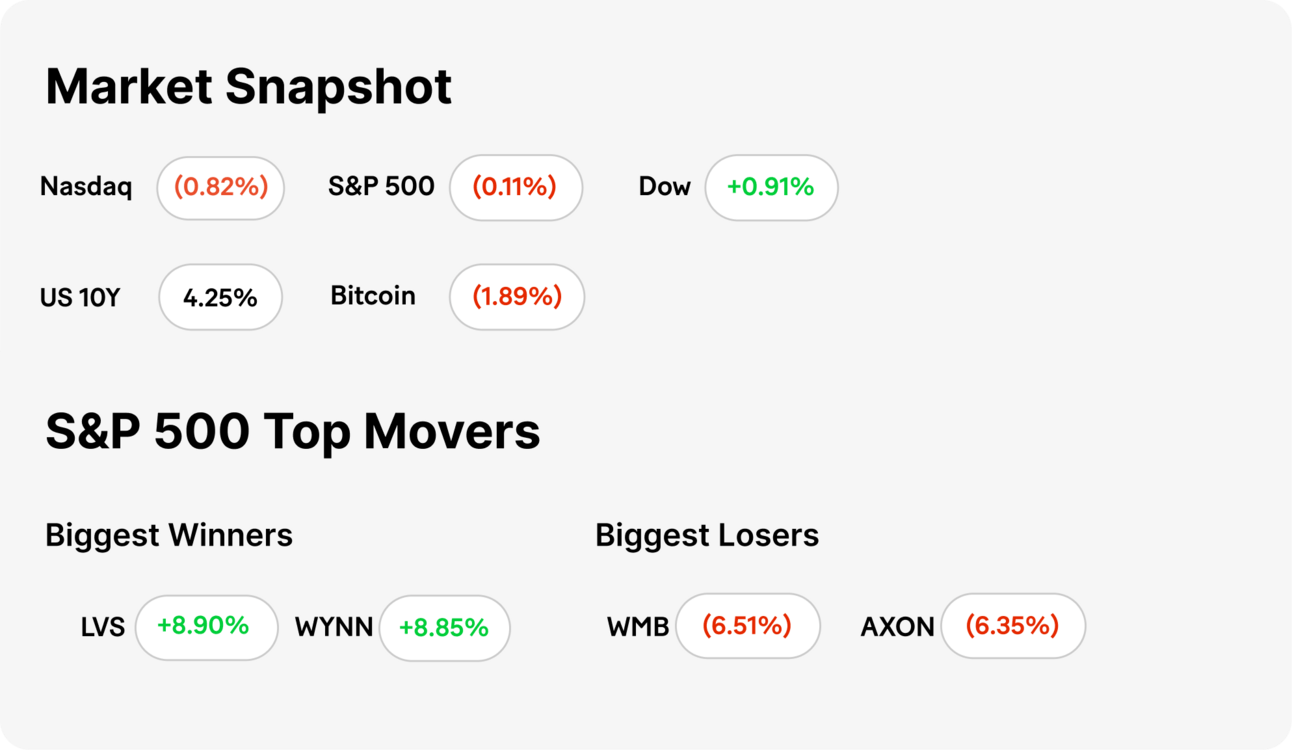

MARKET RECAP → Stocks saw mixed results on Tuesday as investors moved away from tech. The Dow Jones Industrial Average scaled up as the S&P 500 (VOO) and Nasdaq (QQQ) fell down a notch.

BIG BILL, BIGGER BETS→ Trump’s upcoming energy bill nods to solar and wind, but the real muscle is behind oil, gas, and nuclear. IRA tax credits survive—less from love, more from lobbying.

APPLE SUES FORMER EXECUTIVE → Apple (AAPL) is suing ex-vision leader Di Liu for allegedly stealing secret tech behind its Vision Pro headset to fuel his new startup. The lawsuit claims Liu poached staff and sensitive data, threatening Apple’s edge in spatial computing.

Was this email forwarded to you? Sign up for free here.

POLL OF THE DAY

Best Finance Movie Ever?

Finance

Big Bill, Bigger Bets

source DALL-E

Trump softens tone on clean energy: President Donald Trump is now telling donors he plans to support solar and wind as part of a “big, beautiful” energy bill if reelected. While he’s previously mocked renewables, aides say this shift is about positioning, not policy—a strategic play to avoid alienating red-state clean energy jobs and lobbyists.

IRA tax credits likely to survive: Trump advisers told CNBC that the proposed energy bill would not repeal the core clean energy tax credits in the Inflation Reduction Act (IRA). These credits—especially those for solar and wind—are viewed as politically untouchable due to their popularity in red states and backing from major energy donors.

Fossil fuels still dominate the draft: The bill’s centerpiece remains boosting fossil fuels and nuclear energy. It aims to streamline permitting, expand LNG terminals and pipelines, and “unleash American energy.” Solar and wind were added late in the drafting process, reportedly after lobbying from billionaire donors and clean energy trade groups.

Tech

Apple Sues Former Executive

source DALL-E

Apple targets ex-vision leader: Apple (AAPL) has filed a lawsuit against former executive Di Liu, accusing him of stealing trade secrets tied to its Vision Pro headset. Liu, who previously led teams working on Apple’s secretive spatial computing division, left in 2023 to launch a startup called Optic. Apple alleges the startup is built on confidential technologies taken from the company.

AI startup battle heats up: The lawsuit claims Liu downloaded thousands of proprietary files, including sensor designs, product roadmaps, and supplier information. His company, Optic, focuses on AI-driven headsets that directly compete with Apple's mixed-reality ambitions—raising the stakes in the rapidly growing spatial computing market.

Snap ties add intrigue: Apple also alleges Liu poached multiple employees from Apple, some with previous ties to Snap (SNAP), where Liu had worked before Apple. The complaint suggests this was not ordinary recruiting but a coordinated attempt to replicate Apple’s innovations outside its ecosystem. The legal battle highlights Apple’s aggressive stance on protecting its intellectual property in the competitive world of AI and spatial computing.

KEEP READING

Powell confirms that Fed would have cut by now were it not for tariffs (CNBC)

What the Senate Republican tax and spending bill means for your money (CNBC)

Cluely, a startup that helps ‘cheat on everything,’ raises $15M from a16z (TechCrunch)

SEC Approves Grayscale ETF That Includes BTC, ETH, SOL, XRP, ADA (CoinDesk)

Sam Altman Slams Meta’s AI Talent-Poaching Spree: ‘Missionaries Will Beat Mercenaries’ (Wired)

What is a Money Order? How a Money Order Works (ML)

WHAT WE’RE WATCHING

OUR FAVORITE TOOLS & RESOURCES

Deribit — Crypto Futures and Options Exchange

Generated Assets — Turn any idea into an investable index

Polymarket — The world’s largest prediction market

Unusual Whales — Companion for uncovering unusual market activity

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

CME FedWatch Tool — Market-implied probabilities of future levels of interest rates

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

ChatGPT — Large language model-based chatbot powered by generative AI

Vimcal — Lightning-fast calendar and AI scheduling assistant

AltIndex — Alternative datasets to uncover unique insights

GFR Smart Stock Selector — Filters stocks to help investor choices

WE WANT YOUR FEEDBACK

How would you rate today's newsletter?

Investment advisory services provided by ML Wealth LLC. Investment Accounts Are Not FDIC Insured • No Bank Guarantee • Investments May Lose Value. For important information and disclosures relating to the MoneyLion Investment Account, see Investment FAQs, Form ADV Brochure, and moneylion.com/investing. Funded managed investing accounts are subject to a monthly account fee of $1 (for accounts valued up to $5,000), $3 (for accounts valued over $5,000, and up to $25,000), or $5 (for accounts valued over $25,000).

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.