TLDR

MARKET RECAP → Stocks soared on Wednesday as the latest consumer price index report revealed an unexpected slowdown in core inflation for December, boosting major U.S. markets.

CORE INFLATION EASES TO 3.2% IN DECEMBER, SPARKING MARKET OPTIMISM → Inflation cooled to 3.2%, slightly below forecasts, as shelter prices softened and energy costs surged. Markets cheered the news, boosting stocks and tilting Fed rate cut expectations for later this year. 📉

TIKTOK PREPARES FOR U.S. SUNDAY SHUTDOWN AMID BAN DEADLINE → TikTok plans to shut down for U.S. users Sunday unless the Supreme Court intervenes, while ByteDance fights a looming federal ban and estimates a third of its U.S. users could quit within a month. 📱

Was this email forwarded to you? Sign up for free here.

On the move? Subscribe to our daily podcast here.

TODAY’S TOP NEWS

Core Inflation Rate Slows to 3.2% in December, Less Than Expected

📉 Core CPI cooled slightly: December’s core inflation rate slowed to 3.2% annually, down from the prior month and slightly below forecasts, signaling modest progress in controlling price pressures. Energy prices surged 2.6% for the month, driven by gasoline, while food prices edged up 0.3%.

🏠 Shelter prices softened: Shelter costs, which heavily influence the CPI, rose 0.3% monthly and 4.6% annually—marking the smallest yearly increase since January 2022. Despite mixed details like jumps in auto insurance and vehicle costs, moderating trends in key areas offered hope for easing long-term inflation.

💹 Markets reacted optimistically: Stock futures climbed, and Treasury yields fell following the report, reflecting relief from investors. While the Fed is expected to hold rates steady at its upcoming meeting, the CPI data fueled expectations for potential rate cuts later in the year, assuming inflation continues its gradual decline.

TODAY’S TOP NEWS

TikTok Prepares For U.S. Shutdown Amid Legal Deadline

📱 Shutdown Looms: TikTok plans to disable app access for U.S. users on Sunday unless the Supreme Court blocks the federal ban. The app intends to redirect users to a website explaining the situation and allow them to download their personal data.

💼 Legal & Political Clash: The shutdown aligns with a federal law requiring TikTok’s parent, ByteDance, to sell its U.S. assets by Jan. 19, 2025, or face a nationwide ban. Efforts to delay the ban, citing First Amendment concerns, have yet to gain traction.

🔍 Wide Impact: TikTok estimates a third of its 170 million U.S. users could leave the platform if the ban persists for a month. ByteDance, with over 7,000 U.S. employees, remains under pressure as political negotiations unfold under the incoming administration.

A MESSAGE FROM OUR PARTNER

Learn how to make AI work for you

AI won’t take your job, but a person using AI might. That’s why 1,000,000+ professionals read The Rundown AI – the free newsletter that keeps you updated on the latest AI news and teaches you how to use it in just 5 minutes a day.

KEEP READING

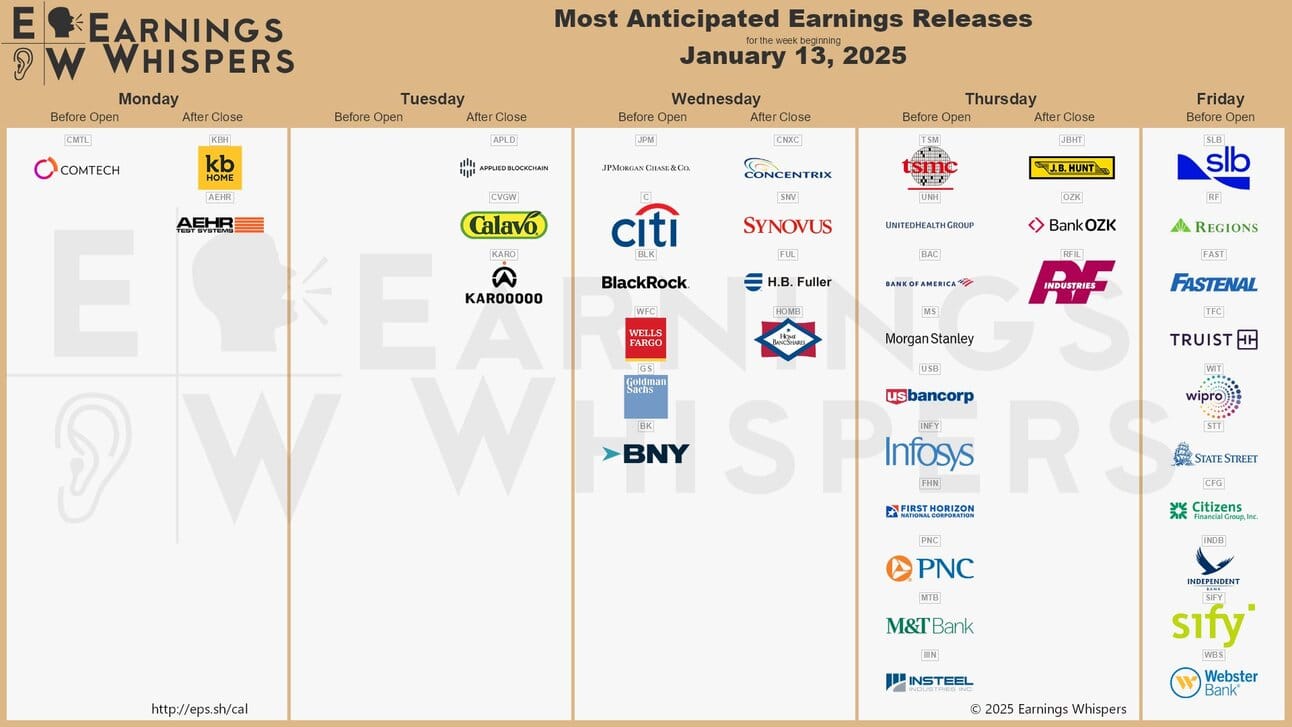

JPMorgan Chase posts record profit as the bank’s massive scale pays off (CNBC)

Microsoft launches consumption-based 365 Copilot Chat option for corporate users (CNBC)

Citigroup swings to fourth-quarter profit, tops estimates on investment banking strength (CNBC)

Firefly Aerospace kicks off first moon mission after SpaceX launch (CNBC)

Wells Fargo shares jump after earnings beat, strong 2025 guidance (CNBC)

MoneyLion has teamed up with Beast Games to give MoneyLion users a chance at game-changing cash (ML)

Financial Resolutions for Beginners: Start Your Money Journey Right in 2025 (ML)

Do Overdrafts Affect Credit Score? (ML)

Cuddly Cute Chaos: Ridiculous Lessons in Money Episode 4 (ML)

WHAT WE’RE WATCHING

OUR FAVORITE TOOLS & RESOURCES

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

CME FedWatch Tool — Market-implied probabilities of future levels of interest rates

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

ChatGPT — Large language model-based chatbot powered by generative AI

Vimcal — Lightning-fast calendar and AI scheduling assistant

The Bull vs. Bear Merchandise Promotion is a limited time campaign that begins on December 1, 2023 at 12:00 AM ET and ends on the date that there are no more Rewards. This Promotion is available to any registered MoneyLion user who is a legal resident of the 50 United States or the District of Columbia and who has reached the age of majority in their state as of the beginning of the Promotional Period. See terms and conditions here.

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.