TLDR

🧾MARKET RECAP → Stocks were little changed on Thursday as investors braced for the Fed’s interest rate decision next week.

💻 GOOGLE TAKES ON ‘VIBE CODING’ → Google (GOOG) enters conversational coding with a Replit-style tool, raising the stakes in AI-first software development and pressuring startups as the space begins to consolidate.

🔍 CATHIE TRIMS PALANTIR → ARK cuts its PLTR stake again as valuation heats up, showing even favorite AI names get trimmed when sizing rules and frothy sentiment collide.

🔥 PARAMOUNT FIRES SHOT AT WARNER DEAL → Paramount (PARA) alleges bias in Warner’s (WBD) sale process, raising the stakes in the Hollywood bidding war — and shining a harsh light on corporate governance and the risks of media consolidation.

Was this email forwarded to you? Sign up for free here.

MARKETS

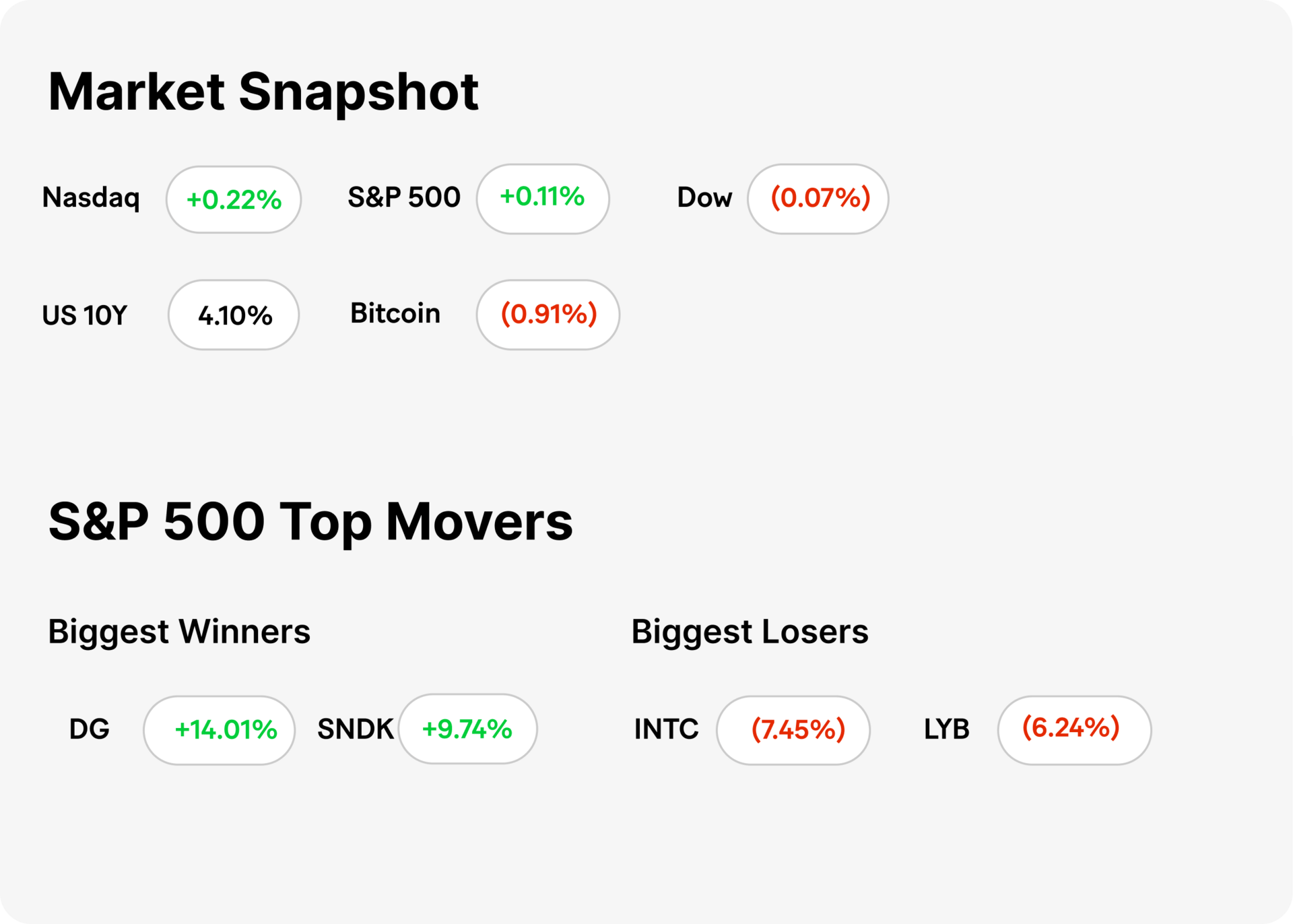

Market Snapshot

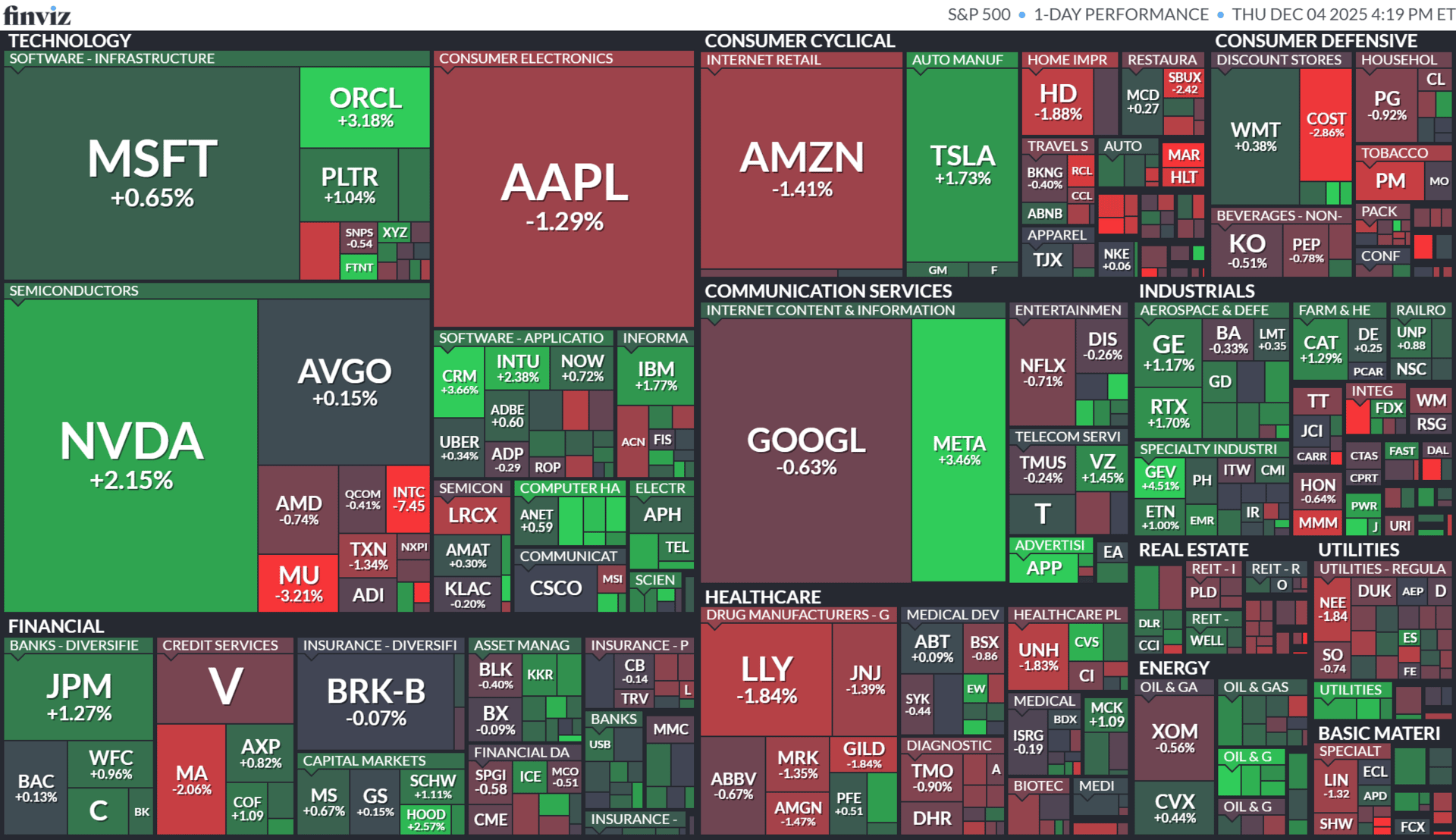

Today’s S&P 500 Heatmap

Notable Earnings

For the week beginning December 01, 2025

AI

Google Takes On ‘Vibe Coding’

Gemini

🧠 Google moves in on Replit’s turf: Google (GOOG) quietly launched its own “vibe coding” tool — a conversational, AI-assisted coding environment meant to compete directly with Replit, Anthropic-backed Claude Code, and VC-darling Cursor. The tool lets developers iterate ideas, generate prototypes, and debug through natural dialogue rather than traditional IDE workflows.

⚙️ Why vibe coding matters: Instead of writing strict syntax, users describe what they want, and the AI fills in structure, edits, and fixes. This lowers the barrier to entry for beginners while speeding up iteration for pros. With Google entering the arena, the space shifts from scrappy startup innovation to big-tech platform stakes.

📊 Implications for devs and rivals: For developers, more competition means faster improvements and lower switching costs across tools. For Replit, Cursor, and Anthropic, Google’s distribution advantage is a threat — especially if the tool becomes integrated tightly into Search, Android, or Workspace. The future of coding looks increasingly conversational, and now the biggest player is fully in the game.

MEDIA

Paramount Fires Shot at Warner Deal

Gemini

📝 Paramount calls foul on Warner Bros. Discovery: Paramount (PARA) claims that the ongoing sale process for Warner (WBD) is unfairly skewed toward Netflix (NFLX) — alleging lack of independence in evaluation and demanding clarification that an unbiased special committee is reviewing bids.

💵 Bidding war intensifies — but trust erodes: As Netflix and Comcast (CMCSA) submit revised offers for Warner’s studio/streaming assets, Paramount sweetened its own full-takeover bid, raising the proposed breakup fee to $5 billion — a signal of confidence, but also escalating the tension and scrutiny around the process.

⚠️ What this means for media consolidation and investors: The public dispute shines a spotlight on corporate governance, regulatory risk, and the stakes of big-media consolidation. For investors, the conclusion of this bid process could reshape streaming, cable and studio ownership — but the path is now more uncertain, with legal friction and potential political pressure muddying what was supposed to be a straightforward auction.

TECH

Cathie Trims Palantir

Gemini

💼 Cathie Wood keeps selling PLTR: ARK Invest offloaded more Palantir (PLTR) shares, continuing a multi-week trim despite the stock’s strong run. Wood has been reducing exposure as Palantir’s valuation stretches and the position grows oversized relative to her portfolio’s risk limits.

📊 Fundamentals vs. froth: Palantir’s government and AI-commercial pipelines remain solid, but the stock has been trading more on narrative than numbers. With multiples elevated and momentum-driven inflows cooling, trimming is a classic ARK move — take gains, reduce concentration, and reallocate to earlier-stage innovation plays.

🔄 What investors should take from this: A Cathie Wood sale doesn’t mean she’s bearish; it usually means the name violated her sizing rules. But it does signal that even high-conviction AI beneficiaries can become too crowded. For the average investor, it’s a reminder to revisit position sizing when hype runs hotter than fundamentals.

KEEP READING

Microsoft will raise prices of commercial Office subscriptions in July (CNBC)

Meta stock climbs 4% on report of planned metaverse cuts (CNBC)

WHAT WE’RE WATCHING

Tools & Resources

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

AltIndex — Alternative datasets to uncover unique insights

GFR Smart Stock Selector — Filters stocks to help investor choices

WE WANT YOUR FEEDBACK

How would you rate today's newsletter?

Investment advisory services provided by ML Wealth LLC. Investment Accounts Are Not FDIC Insured • No Bank Guarantee • Investments May Lose Value. For important information and disclosures relating to the MoneyLion Investment Account, see Investment FAQs, Form ADV Brochure, and moneylion.com/investing. Funded managed investing accounts are subject to a monthly account fee of $1 (for accounts valued up to $5,000), $3 (for accounts valued over $5,000, and up to $25,000), or $5 (for accounts valued over $25,000).

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.