TLDR

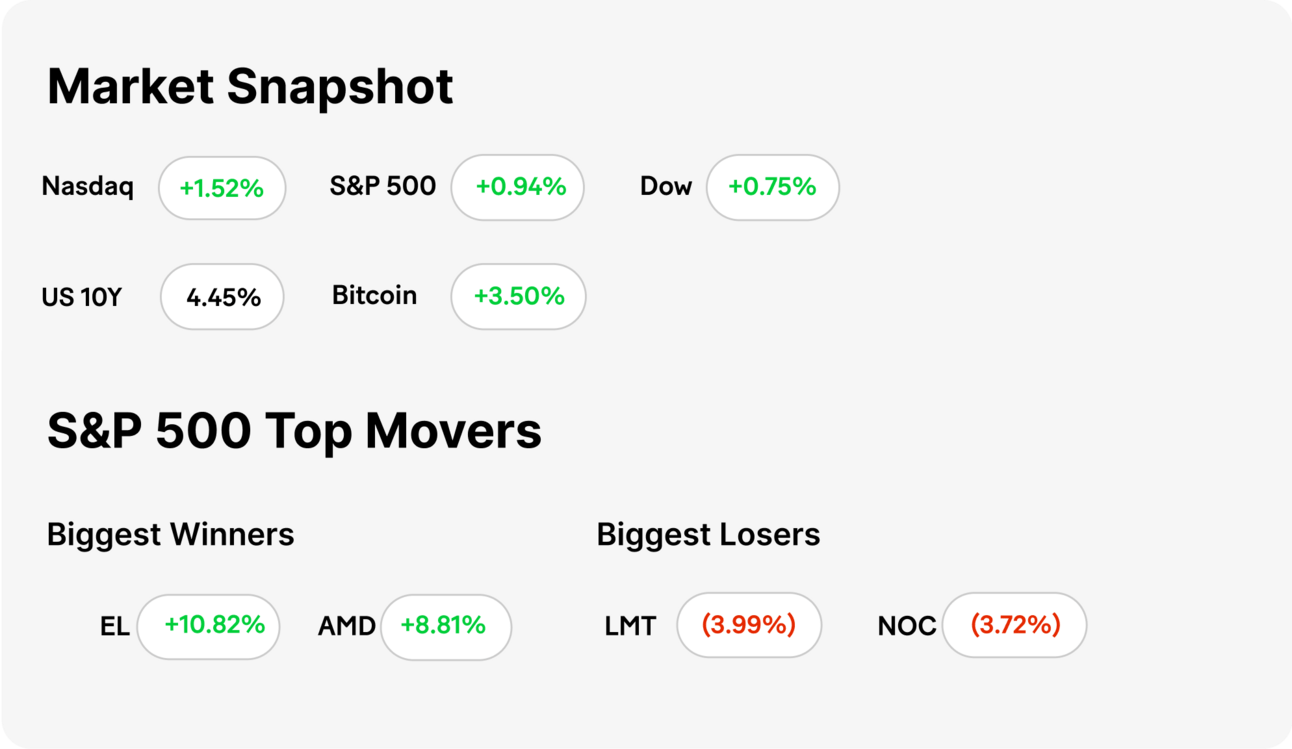

MARKET RECAP → Stocks rose on Monday as investors put less weight on regional conflicts and lean optimistic about upcoming fed announcements. On the crypto side of things Bitcoin (BTC) saw a strong increase trending back towards its all time high of around $111k. $BTC.X ( ▲ 0.88% )

WALL STREET SHAKES OFF TENSIONS → Stocks started the week on a positive note as investors bet on potential Fed rate cuts after cooling inflation data. Markets brushed off ongoing Israel-Iran tensions, focusing instead on monetary policy optimism. Oil futures fell on demand concerns, adding another layer of complexity to the risk-on mood.

🚀 OPENAI’S TALENT SPRINT IS ON → Facing breakneck growth and fierce competition, OpenAI is scaling up recruitment like never before—seeking not just top-tier engineers, but true believers in its mission to shape the future of AI.

Was this email forwarded to you? Sign up for free here.

Earn rewards by referring friends. Scroll to the bottom to learn more! 👇

POLL OF THE DAY

If you had to put $10,000 to work today, where would you invest?

FINANCE

Wall Street Shakes Off Tensions

source DALL-E

📈 Markets Rise On Fed Hopes. U.S. stocks opened higher as investors bet the Federal Reserve may soon pivot toward rate cuts. Softer inflation readings fueled optimism, helping the Dow , S&P 500, and Nasdaq post gains. Treasury yields eased, signaling growing confidence in a friendlier monetary policy path.

🌍 Geopolitical Tensions Linger. Israel-Iran conflict concerns loomed, but they failed to derail the market’s upward move. Traders kept a wary eye on headlines out of the Middle East, though Fed-driven optimism remained the dominant force for now.

🛢️ Oil Prices Slide Despite Mideast Risks. Crude futures fell as demand worries outweighed geopolitical tensions. The decline in oil pressured energy stocks and underscored investor focus on global growth trends over regional conflict—for the moment.

TECH

OpenAI’s Talent Sprint

source DALL-E

🧠 Hiring pressure hits historic highs. OpenAI’s new recruiting chief says the company is under “unprecedented pressure” to scale, as it scrambles to meet soaring demand across research, infrastructure, and enterprise products. The urgency reflects OpenAI’s race to keep its AI edge in a market that’s moving at breakneck speed.

💼 It’s not just recruiting—it’s a moonshot. The company is operating without a rulebook, building teams for products that didn’t exist a year ago. With investor expectations mounting and rival labs like Anthropic and Google DeepMind nipping at its heels, hiring has become a mission-critical priority.

🌎 Mission meets manpower. Unlike typical Silicon Valley unicorns, OpenAI sees its mission as existential. That ethos permeates its hiring strategy—screening for talent that aligns with both technical rigor and its controversial long-term vision of AI for humanity. Translation: this isn’t just about jobs, it’s about joining a movement.

KEEP READING

Minnesota murder suspect visited four lawmakers’ homes the day of shootings, officials say (CNBC)

Citadel’s Ken Griffin says playing defense almost always guarantees losses even in turbulent times (CNBC)

Federal Reserve is likely to hold interest rates steady this week. Here’s what that means for your money (CNBC)

Purdue Pharma $7.4 billion opioid settlement wins broad support from U.S. states (CNBC)

EchoStar soars 50% after report Trump urged EchoStar, FCC chair to reach deal on licenses (Reuters)

TSA PreCheck Cost Guide: Benefits & Is It Worth It? (ML)

How Much is Paramount Plus? 2025 Plans and Pricing Guide (ML)

WHAT WE’RE WATCHING

OUR FAVORITE TOOLS & RESOURCES

Deribit — Crypto Futures and Options Exchange

Generated Assets — Turn any idea into an investable index

Polymarket — The world’s largest prediction market

Unusual Whales — Companion for uncovering unusual market activity

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

CME FedWatch Tool — Market-implied probabilities of future levels of interest rates

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

ChatGPT — Large language model-based chatbot powered by generative AI

Vimcal — Lightning-fast calendar and AI scheduling assistant

REFERRAL PROGRAM

WE WANT YOUR FEEDBACK

How would you rate today's newsletter?

Investment advisory services provided by ML Wealth LLC. Investment Accounts Are Not FDIC Insured • No Bank Guarantee • Investments May Lose Value. For important information and disclosures relating to the MoneyLion Investment Account, see Investment FAQs, Form ADV Brochure, and moneylion.com/investing. Funded managed investing accounts are subject to a monthly account fee of $1 (for accounts valued up to $5,000), $3 (for accounts valued over $5,000, and up to $25,000), or $5 (for accounts valued over $25,000).

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.