TLDR

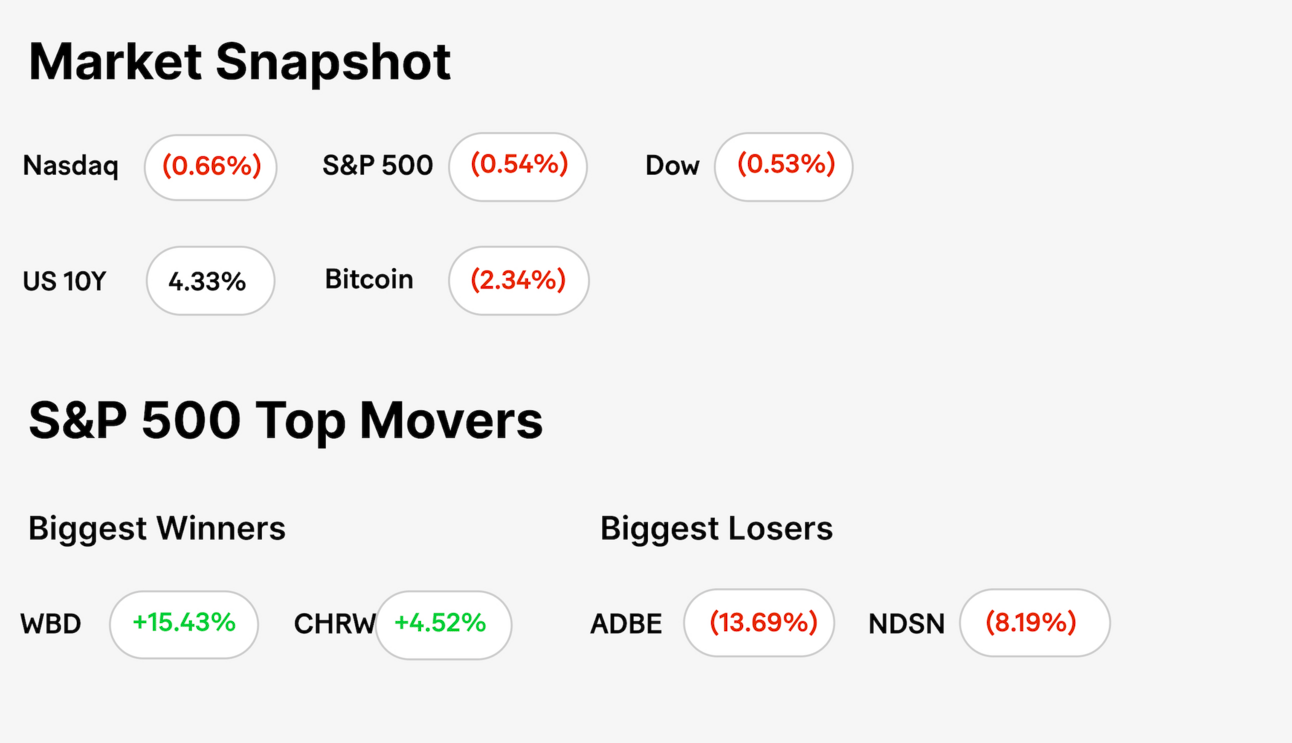

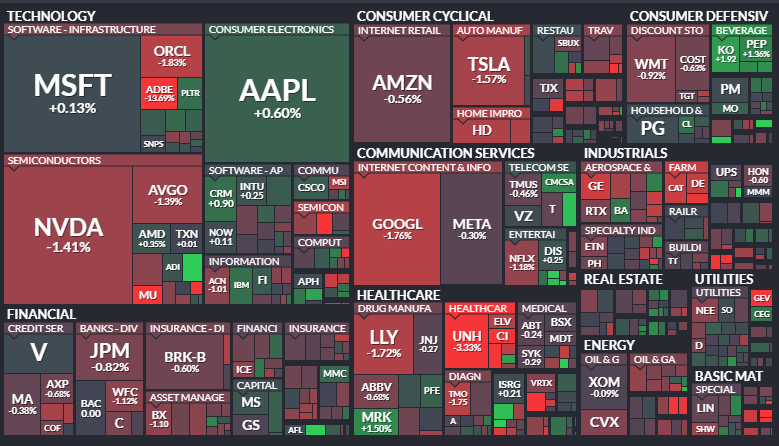

MARKET RECAP → Stocks dropped Thursday after a hotter-than-expected U.S. inflation report cooled the momentum in tech shares from earlier in the week.

GEN Z BRINGS MALLS BACK → Gen Z revived malls with a $150B spending power, favoring in-person shopping for social vibes, instant gratification, and Instagram-worthy experiences. 🛍️

HOLIDAY SPENDING TRENDS REVEALED → 🛍️ Inflation left holiday budgets tight, with most shoppers spending cautiously, favoring online deals, and focusing on bargains over splurges.

Was this email forwarded to you? Sign up for free here.

On the move? Subscribe to our daily podcast here.

A MESSAGE FROM OUR PARTNER

Your daily AI dose

Mindstream is your one-stop shop for all things AI.

How good are we? Well, we become only the second ever newsletter (after the Hustle) to be acquired by HubSpot. Our small team of writers works hard to put out the most enjoyable and informative newsletter on AI around.

It’s completely free, and you’ll get a bunch of free AI resources when you subscribe.

TODAY’S TOP NEWS

Gen Z Brings Malls Back

🛍️ Gen Z shoppers defied expectations by flocking to malls for social connection, instant gratification, and Instagram-worthy moments. They outpaced millennials and Gen X in in-person shopping, with 63% planning to buy holiday gifts in stores.

📸 Retailers and malls adapted with selfie mirrors, pop-up concerts, and interactive exhibits. Brands like Princess Polly opened physical stores, while staples like Bath & Body Works added experiential features like "scent bars."

🎢 For Gen Z, malls are more than shopping—they're mini social hubs offering nostalgic vibes and unique experiences. With $150 billion in spending power, their mall revival is reshaping retail strategies.

TODAY’S TOP NEWS

Holiday Spending Trends Revealed

🛍️ Cautious Spending Continues: Only 16% of Americans planned to spend more this holiday season, citing inflation and tight budgets. Most shoppers aimed to spend the same or less, with average spending at $1,014 per person, down from last year's spike.

💻 Online Shopping Dominates: A majority (61%) preferred online-only sites like Amazon, followed by big-box stores and local shops. Younger shoppers and wealthier demographics leaned more heavily on online platforms, while social media influencers guided bargain hunters.

🎁 Inflation’s Lingering Impact: Despite a modest CPI rise of 2.7%, many Americans remained focused on elevated price levels from the pandemic era. Inflation and shorter shopping windows further shaped cautious consumer behavior this season.

KEEP READING

Federal Aviation Administration head Michael Whitaker to step down Jan. 20 (CNBC)

Trump rings bell at NYSE to cheers of ‘USA’ as Wall Street CEOs, business leaders look on (CNBC)

Biden to commute sentences of 1,500 ‘non-violent’ offenders, in the biggest single-day act of clemency to date (CNBC)

Tesla shares close at record high, boosted by 69% pop since Trump election victory (CNBC)

Tech giants like Meta, Google to be forced to pay for Australian news (CNN)

Warner Bros. Discovery stock surges as it restructures its business (CNN)

When Were Credit Cards Invented? Unpacking The History (ML)

How to Retire Early: 10 Steps to Achieve Financial Independence (ML)

Is a 900 Credit Score Possible? (ML)

WHAT WE’RE WATCHING

OUR FAVORITE TOOLS & RESOURCES

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

CME FedWatch Tool — Market-implied probabilities of future levels of interest rates

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

ChatGPT — Large language model-based chatbot powered by generative AI

Vimcal — Lightning-fast calendar and AI scheduling assistant

The Bull vs. Bear Merchandise Promotion is a limited time campaign that begins on December 1, 2023 at 12:00 AM ET and ends on the date that there are no more Rewards. This Promotion is available to any registered MoneyLion user who is a legal resident of the 50 United States or the District of Columbia and who has reached the age of majority in their state as of the beginning of the Promotional Period. See terms and conditions here.

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.