TLDR

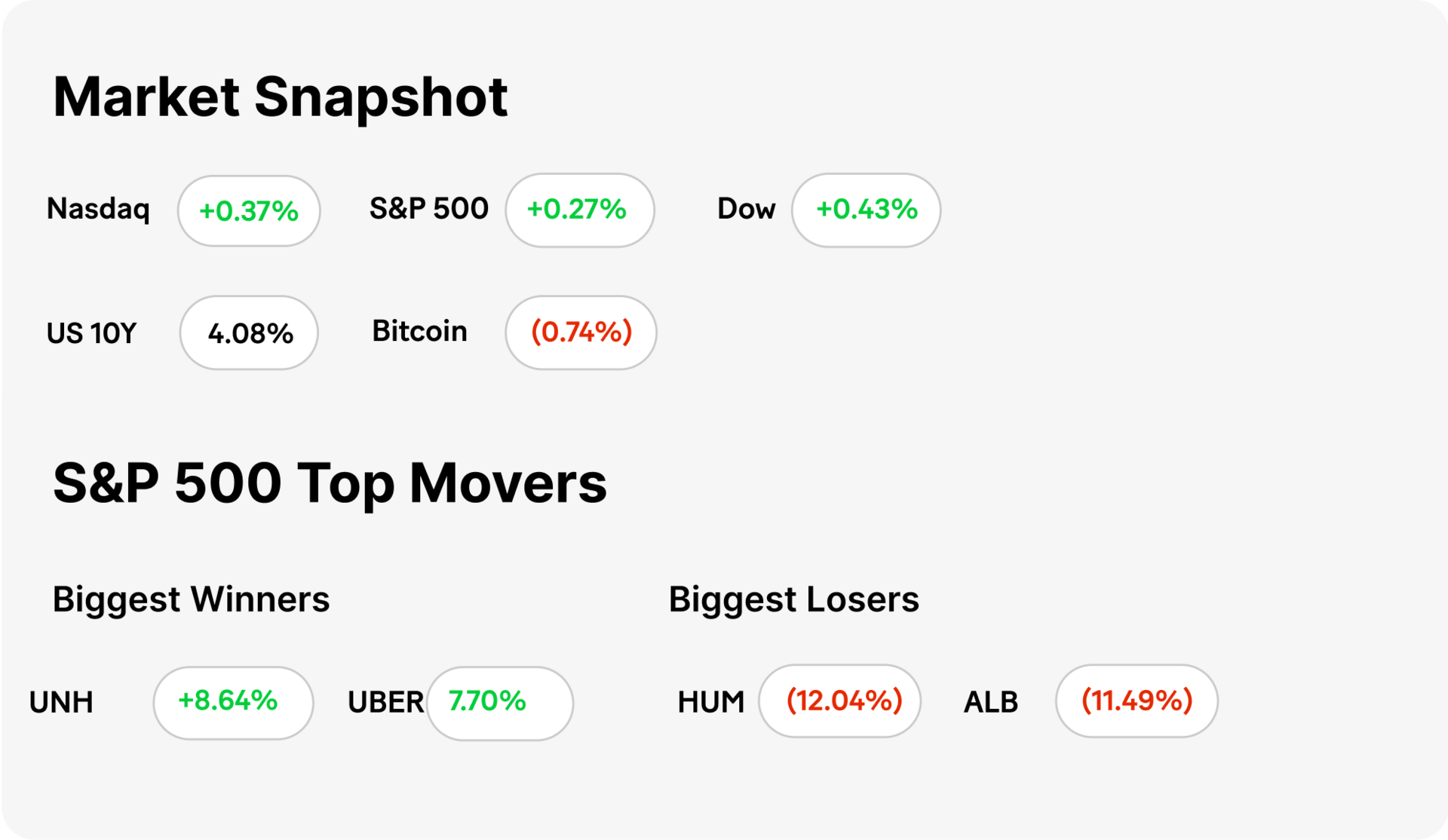

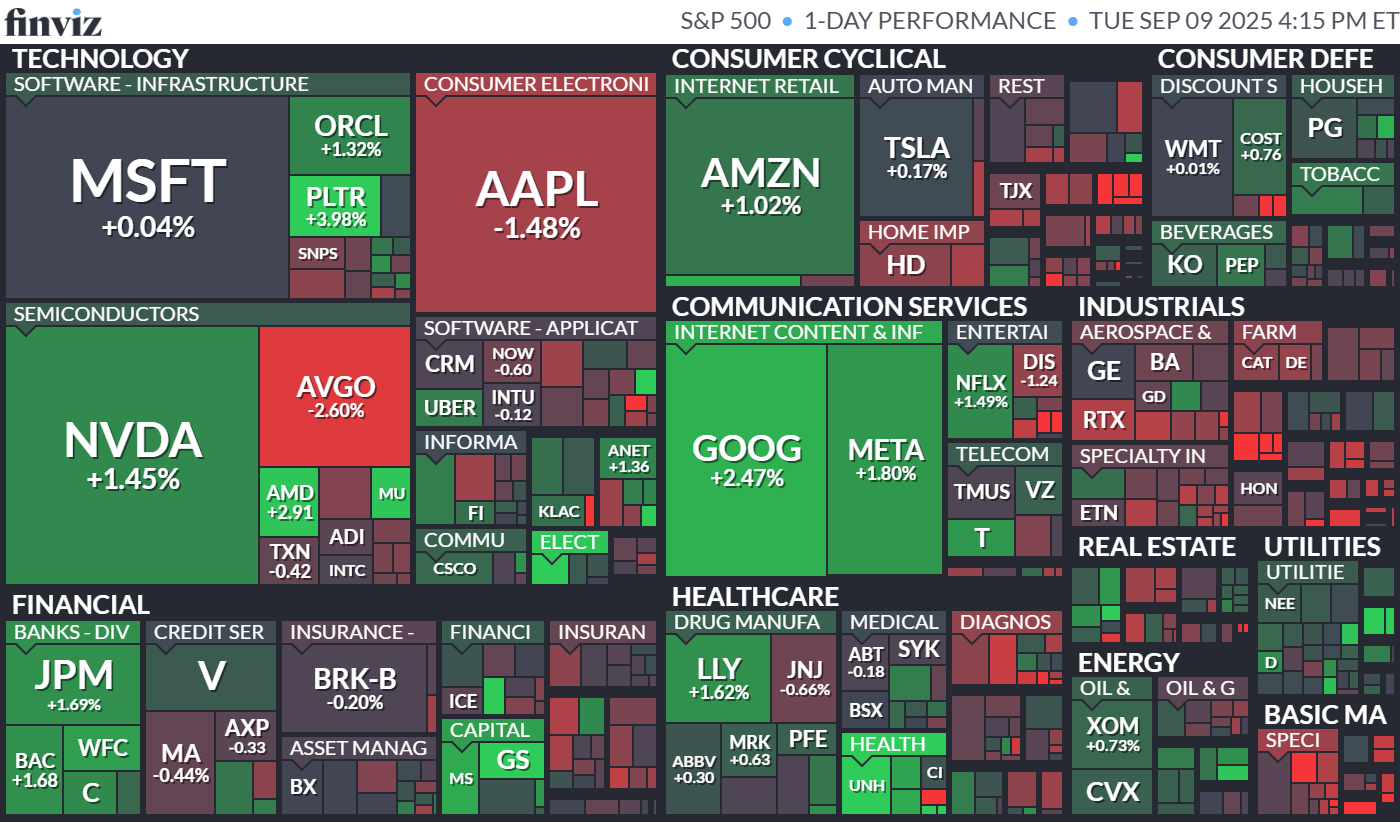

MARKET RECAP → Stocks rose Tuesday despite jobs data concerns and looming inflation reports. Mega-cap tech stocks led the way, pushing the Nasdaq (QQQ) to another fresh record high.

🪄 APPLE AWE-DROPPING → Apple (AAPL) unveiled the ultra-thin iPhone 17 Air, next-gen AirPods with real-time translation, Apple Watch upgrades, and iOS 26 launching September 12 with shipments from September 19.

🆘 DIMON FLAGS ECONOMIC SOFTENING → JPMorgan’s (JPM) Jamie Dimon says the economy is weakening after big job revisions, recession odds are unclear, and Fed rate cuts may not be enough to save growth.

Was this email forwarded to you? Sign up for free here.

TECH

Apple Awe-Dropping

Gemini

📱 iPhone 17 steals the stage. Apple (AAPL) unveiled its thinnest-ever iPhone lineup, led by the iPhone 17 Air, which crams Pro-level performance into a featherweight frame. Preorders kick off September 12, with devices shipping September 19.

🎧 AirPods and Watch upgrades. The new AirPods Pro 3 boast real-time translation and sharper noise cancellation. Apple Watch Series 11 adds blood-pressure tracking, while the rugged Ultra 3 now comes with satellite SOS for the adventurous crowd.

🖥️ iOS 26 rollout. Apple confirmed iOS 26, iPadOS 26, macOS “Tahoe,” and watchOS 26 will launch mid-September, tightening ecosystem integration and giving developers fresh hooks into Apple’s software universe.

ECONOMICS

Dimon Flags Economic Softening

Gemini

🛑 Labor market cracks widened. Jamie Dimon, CEO of JPMorgan (JPM), warned the U.S. economy is weakening after the government slashed job growth estimates by 911,000 for April 2024–March 2025. The revisions reveal a far softer labor market than first thought, raising questions about momentum heading into year-end.

📉 Recession is a coin toss. Dimon said it’s unclear if the slowdown tips into a recession or just a weaker expansion. He stressed that while conditions are softening, calling the next move with certainty is impossible — a rare admission from Wall Street’s most seasoned bank chief.

🏦 Rate cuts may fall flat. Dimon expects the Federal Reserve to cut rates but doubts that monetary easing will fully counteract underlying weakness. Translation: cheaper borrowing might not be enough to reignite growth if jobs and confidence keep sliding.

SHARE OUR NEWSLETTER FOR SWAG!

KEEP READING

Job growth revised down by 911,000 through March, signaling economy on shakier footing than realized (CNBC)

U.S. economy is worse than thought with 1.2 million fewer jobs — what that means for the Fed (CNBC)

CEO: I’ve interviewed over 500 candidates—these 3 subtle habits scream ‘red flag’ in job interviews (CNBC)

WHAT WE’RE WATCHING

OUR FAVORITE TOOLS & RESOURCES

Generated Assets — Turn any idea into an investable index

Polymarket — The world’s largest prediction market

Unusual Whales — Companion for uncovering unusual market activity

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

CME FedWatch Tool — Market-implied probabilities of future levels of interest rates

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

ChatGPT — Large language model-based chatbot powered by generative AI

Vimcal — Lightning-fast calendar and AI scheduling assistant

AltIndex — Alternative datasets to uncover unique insights

GFR Smart Stock Selector — Filters stocks to help investor choices

WE WANT YOUR FEEDBACK

How would you rate today's newsletter?

Investment advisory services provided by ML Wealth LLC. Investment Accounts Are Not FDIC Insured • No Bank Guarantee • Investments May Lose Value. For important information and disclosures relating to the MoneyLion Investment Account, see Investment FAQs, Form ADV Brochure, and moneylion.com/investing. Funded managed investing accounts are subject to a monthly account fee of $1 (for accounts valued up to $5,000), $3 (for accounts valued over $5,000, and up to $25,000), or $5 (for accounts valued over $25,000).

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.