TLDR

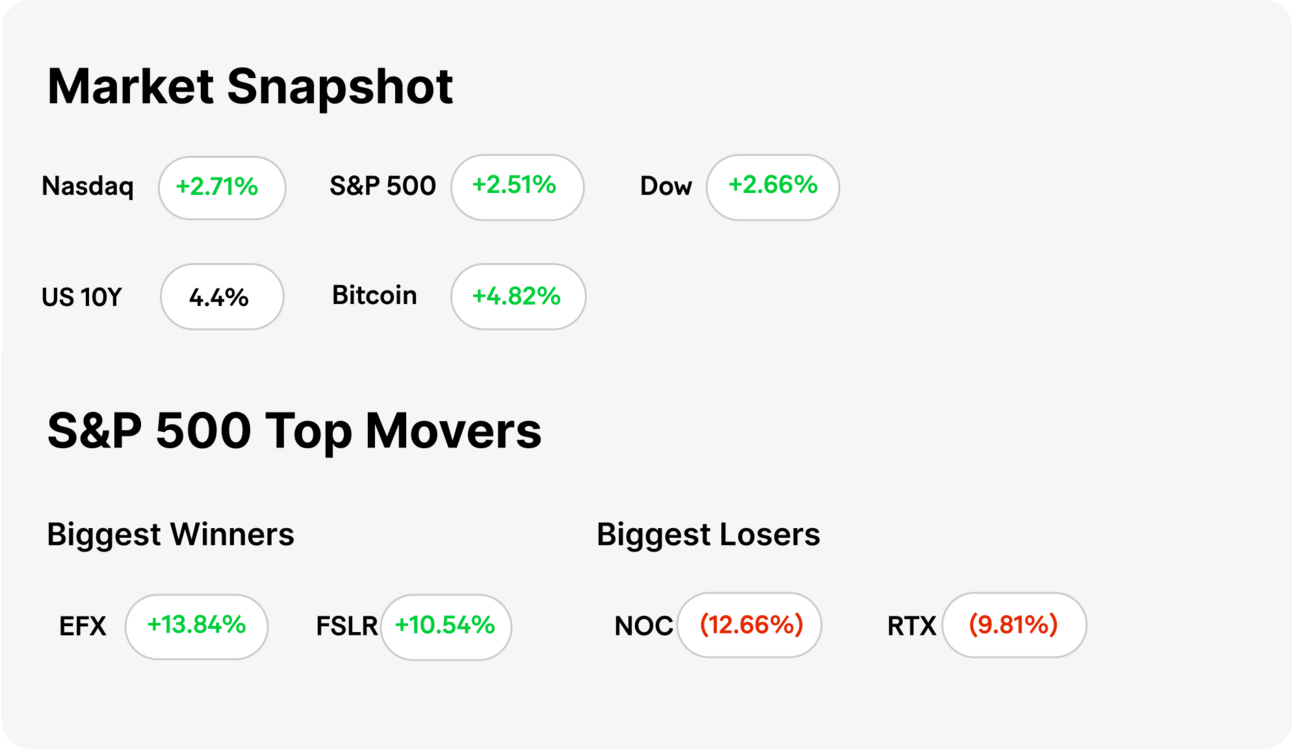

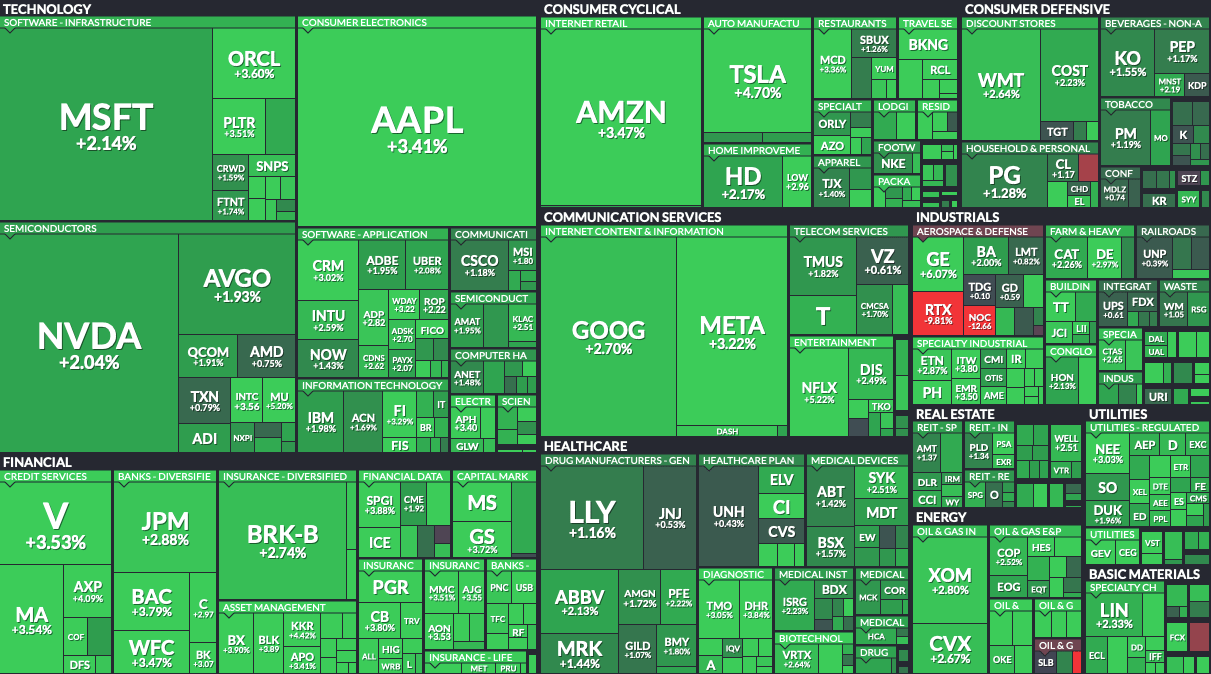

MARKET RECAP → Stocks bounced back Tuesday as investors bet on a potential thaw in U.S.-China trade tensions, following Monday’s sharp sell-off.

AMAZON HITS PAUSE ON DATA CENTER DEALS → Amazon (AMZN) put some data center lease talks on ice, citing “routine capacity management” — but with AI demand booming and tariffs looming, investors aren’t buying the chill vibe. 📉

FRUITIST’S JUMBO BET PAYS OFF → Fruitist tripled jumbo blueberry sales, topped $400M in revenue, and drew $1B in funding — proving there’s serious money in better berries. 🍇

Was this email forwarded to you? Sign up for free here.

Earn rewards by referring friends. Scroll to the bottom to learn more! 👇

TODAY’S TOP NEWS

Amazon Hits Pause On Data Center Deals

🛑 Amazon (AMZN) paused some international data center lease talks, according to Wells Fargo (WFC), signaling tighter capital discipline despite CEO Andy Jassy’s earlier assurance that expansion plans were intact.

💸 The move mirrors Microsoft’s (MSFT) recent caution, as both cloud giants respond to economic uncertainty and rising costs from Trump’s proposed tariffs, even as they race to fuel AI growth with massive infrastructure investments.

📉 Amazon and Microsoft stocks regained some of their losses on Tuesday, though both stocks are down over 10% for the year. AWS said the pause is just “routine capacity management,” not a fundamental shift.

TODAY’S TOP NEWS

Fruitist’s Jumbo Bet Pays Off

🔵 Fruitist, formerly Agrovision, tripled jumbo blueberry sales in the past year, surpassing $400 million in annual revenue and attracting over $1 billion in funding — including backing from Ray Dalio’s family office. The vertically integrated berry brand is eyeing an IPO as early as this year.

🍓 The company tackled the infamous "berry roulette" by owning its entire supply chain — from farms in Mexico to cold storage in Oregon — and using machine learning to harvest at peak freshness. Their jumbo berries last up to three weeks and are now in 12,500+ retailers like Costco and Whole Foods.

🌎 Despite Trump-era tariffs, Fruitist expects minimal impact due to year-round domestic farming and global diversification. With cherries next on the menu and a fresh MLS sponsorship deal, the berry startup is scaling snackable fruit into a full-blown global business.

KEEP READING

IMF slashes 2025 U.S. growth forecast to 1.8%, citing trade tensions (CNBC)

Lockheed Martin’s quarterly profit rises on resilient defense demand (CNBC)

Harvard sues federal government after Trump administration slashed billions in funding (CNBC)

Trump Tariffs Explained: Your Complete 2025 Guide (ML)

Why You’ll Love the Money Master Challenge – Your Daily Finance Game! (ML)

WHAT WE’RE WATCHING

OUR FAVORITE TOOLS & RESOURCES

Polymarket — The world’s largest prediction market

Unusual Whales — Companion for uncovering unusual market activity

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

CME FedWatch Tool — Market-implied probabilities of future levels of interest rates

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

ChatGPT — Large language model-based chatbot powered by generative AI

Vimcal — Lightning-fast calendar and AI scheduling assistant

REFERRAL PROGRAM

WE WANT YOUR FEEDBACK

How would you rate today's newsletter?

Investment advisory services provided by ML Wealth LLC. Investment Accounts Are Not FDIC Insured • No Bank Guarantee • Investments May Lose Value. For important information and disclosures relating to the MoneyLion Investment Account, see Investment FAQs, Form ADV Brochure, and moneylion.com/investing. Funded managed investing accounts are subject to a monthly account fee of $1 (for accounts valued up to $5,000), $3 (for accounts valued over $5,000, and up to $25,000), or $5 (for accounts valued over $25,000).

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.