TLDR

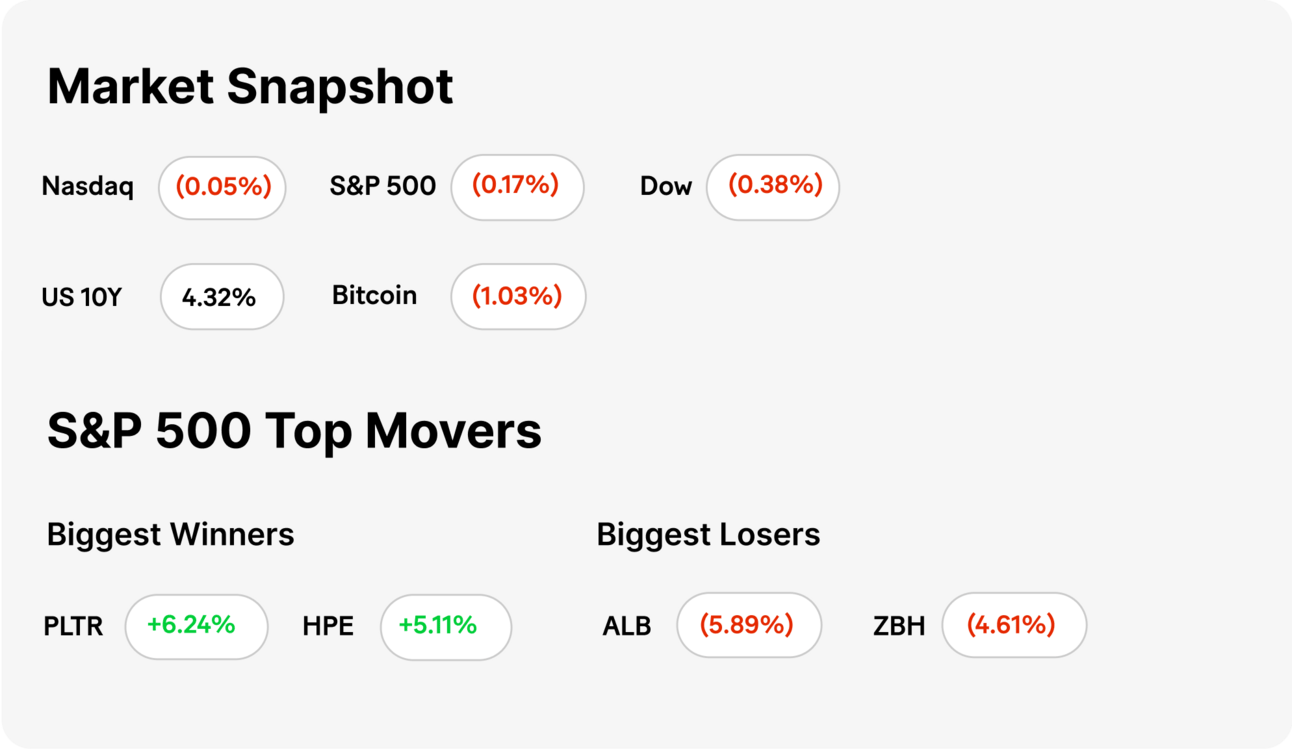

MARKET RECAP → Stocks ticked modestly lower on Tuesday as markets began to accept the new normal of the tariff drama roiling markets since the beginning of April.

OPENAI EXPLORES LAUNCHING AI-POWERED SOCIAL NETWORK →🧪 OpenAI is developing a social media platform similar to X, focusing on AI-assisted content creation, potentially intensifying competition with Elon Musk's X and Meta (META).

CHINA'S RARE EARTH CURBS SPARK U.S. DEFENSE ALARMS → 📉 China’s rare earth chokehold just became a national security headache, and the U.S. isn’t even close to mining a solution.

Was this email forwarded to you? Sign up for free here.

Earn rewards by referring friends. Scroll to the bottom to learn more! 👇

TODAY’S TOP NEWS

OpenAI Explores Launching AI-Powered Social Network

Early-Stage Development: 🧪 OpenAI is in the early stages of developing a social media platform akin to X (formerly Twitter). The internal prototype focuses on ChatGPT's image generation capabilities and includes a social feed. CEO Sam Altman is seeking external feedback, though it's unclear whether the platform will be a standalone app or integrated into ChatGPT.

Potential Market Impact: 📊 This initiative could position OpenAI in direct competition with Elon Musk's X and Meta's upcoming AI-driven social features. Both competitors leverage vast user data to train their AI models, and OpenAI's platform could provide similar real-time data advantages.

Strategic Objectives: 🤖 The envisioned platform aims to utilize AI to assist users in creating more engaging content, potentially enhancing user interaction and content quality.

TODAY’S TOP NEWS

China: Rare Earths Supply Is Huge

🔋 China turned off the tap: Amid Trump’s escalating tariffs, China restricted exports of seven critical rare earth elements. The move sent shockwaves through U.S. supply chains, with CSIS warning that Beijing’s dominance in processing these minerals puts national defense capabilities at risk.

🛠️ Defense disruption ahead: These elements are essential for fighter jets, missiles, and radar systems. The U.S. has zero current capacity for heavy rare earth separation, and though efforts are underway, CSIS said production will fall short of China’s for years.

🌎 Global mineral chessboard: With 16 U.S. defense firms now on China’s export control list, the pressure is on. Other nations like Australia and Brazil are scrambling to build supply chains, while CSIS cautioned that China’s leverage over critical minerals is becoming a powerful geopolitical tool.

KEEP READING

Bank of America tops analysts’ estimates on better-than-expected interest income, trading (CNBC)

Apple airlifted iPhones worth a record $2 billion from India in March as Trump tariffs loomed (CNBC)

Citigroup results exceed analysts’ estimates on gains in fixed income and equities trading (CNBC)

Will You Get a $1,400 Tax Stimulus Check? Here’s What You Need to Know (ML)

Trump Tariffs Explained: Your Complete 2025 Guide (ML)

Why You’ll Love the Money Master Challenge – Your Daily Finance Game! (ML)

WHAT WE’RE WATCHING

OUR FAVORITE TOOLS & RESOURCES

Polymarket — The world’s largest prediction market

Unusual Whales — Companion for uncovering unusual market activity

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

CME FedWatch Tool — Market-implied probabilities of future levels of interest rates

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

ChatGPT — Large language model-based chatbot powered by generative AI

Vimcal — Lightning-fast calendar and AI scheduling assistant

REFERRAL PROGRAM

WE WANT YOUR FEEDBACK

How would you rate today's newsletter?

Investment advisory services provided by ML Wealth LLC. Investment Accounts Are Not FDIC Insured • No Bank Guarantee • Investments May Lose Value. For important information and disclosures relating to the MoneyLion Investment Account, see Investment FAQs, Form ADV Brochure, and moneylion.com/investing. Funded managed investing accounts are subject to a monthly account fee of $1 (for accounts valued up to $5,000), $3 (for accounts valued over $5,000, and up to $25,000), or $5 (for accounts valued over $25,000).

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.