TLDR

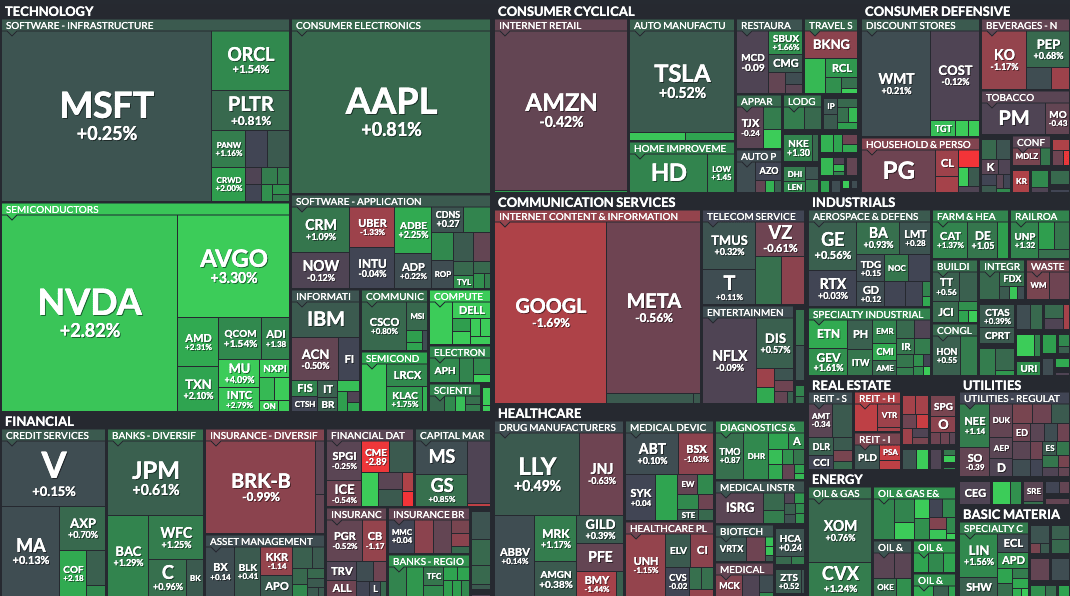

MARKET RECAP → The S&P 500 (VOO) edged up Tuesday, driven by a surge in Nvidia (NVDA), as investors looked ahead to updates on possible U.S. trade agreements. 🤷 $NVDA ( ▼ 2.21% )

META TAPS NUCLEAR POWER FOR AI AMBITIONS → 🔌 Meta (META) signed a 20-year deal with Constellation Energy (CEG) to purchase nuclear power, ensuring clean energy for its AI operations and supporting the continued operation of the Clinton plant. $META ( ▼ 1.55% ) $CEG ( ▲ 4.46% )

OECD SLASHES U.S. GROWTH FORECAST AMID TARIFF TURMOIL → 📉 The OECD cuts U.S. GDP growth forecast to 1.6% for 2025, citing Trump's tariffs as a key factor disrupting trade, inflating costs, and dampening global economic momentum.

Was this email forwarded to you? Sign up for free here.

Earn rewards by referring friends. Scroll to the bottom to learn more! 👇

TODAY’S TOP NEWS

Meta Taps Nuclear Power for AI Ambitions

DALL-E

🔌 Meta Secures 20-Year Nuclear Energy Deal: Meta Platforms (META) has entered into a 20-year agreement with Constellation Energy (CEG) to purchase 1.1 gigawatts of nuclear power from the Clinton Clean Energy Center in Illinois, starting in June 2027. This deal ensures the plant's continued operation beyond the expiration of its zero-emission credit and supports Meta's commitment to clean energy for its expanding AI infrastructure.

⚙️ Supporting Plant Upgrades and Relicensing: The agreement facilitates Constellation's efforts to relicense the Clinton plant and implement upgrades, including a 30-megawatt capacity expansion. While the plant's output will continue to feed the regional grid, Meta will receive renewable energy credits to offset its carbon footprint, aligning with its sustainability goals.

📈 Boost to Nuclear Energy Sector: Following the announcement, Constellation Energy's stock surged approximately 14%, reflecting investor optimism. The deal is seen as a model for how tech companies can support existing nuclear facilities, with Constellation's CEO indicating ongoing discussions with other potential partners across the country.

TODAY’S TOP NEWS

OECD Slashes U.S. Growth Forecast Amid Tariff Turmoil

DALL-E

📉 U.S. Growth Forecast Cut to 1.6%: The OECD has downgraded its U.S. GDP growth projection for 2025 from 2.8% to 1.6%, attributing the decline to President Trump's aggressive tariff policies. The average U.S. import tariff rate has surged to 15.4%, the highest since 1938, leading to increased costs for consumers and manufacturers.

🌍 Global Economic Impact: Global growth is now expected to slow to 2.9% in both 2025 and 2026, down from 3.3% in 2024. The OECD warns that the widespread tariffs are disrupting global trade, eroding business confidence, and stifling investment.

💸 Inflation and Policy Uncertainty: U.S. inflation is projected to approach 4% by the end of 2025, potentially delaying Federal Reserve rate cuts. The OECD emphasizes that the unpredictability of trade policies is exacerbating economic uncertainty, further hindering growth prospects.

A MESSAGE FROM OUR PARTNER

Looking for unbiased, fact-based news? Join 1440 today.

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

KEEP READING

Donald Trump Jr. hosting NYC investor event for ‘Amazon of guns’ — aims to ring NYSE bell for ‘PEW’ in June (NY Post)

4-time NBA champion Stephen Curry says even he suffers from impostor syndrome (CNBC)

DHS says FEMA head was joking when he said he wasn’t aware of hurricane season (CNBC)

Dutch government collapses after far-right party leaves coalition over immigration proposals (CNBC)

When Should You Refinance a Car Loan? 7 Signs It’s Time (ML)

Financial Stress: Ways to Cope and Regain Control (ML)

Summer Travel Trends 2025: 10 Ways Smart Travelers Are Saving Money and Avoiding Crowds (ML)

WHAT WE’RE WATCHING

OUR FAVORITE TOOLS & RESOURCES

Generated Assets — Turn any idea into an investable index

Polymarket — The world’s largest prediction market

Unusual Whales — Companion for uncovering unusual market activity

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

CME FedWatch Tool — Market-implied probabilities of future levels of interest rates

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

ChatGPT — Large language model-based chatbot powered by generative AI

Vimcal — Lightning-fast calendar and AI scheduling assistant

REFERRAL PROGRAM

WE WANT YOUR FEEDBACK

How would you rate today's newsletter?

Investment advisory services provided by ML Wealth LLC. Investment Accounts Are Not FDIC Insured • No Bank Guarantee • Investments May Lose Value. For important information and disclosures relating to the MoneyLion Investment Account, see Investment FAQs, Form ADV Brochure, and moneylion.com/investing. Funded managed investing accounts are subject to a monthly account fee of $1 (for accounts valued up to $5,000), $3 (for accounts valued over $5,000, and up to $25,000), or $5 (for accounts valued over $25,000).

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.