TLDR

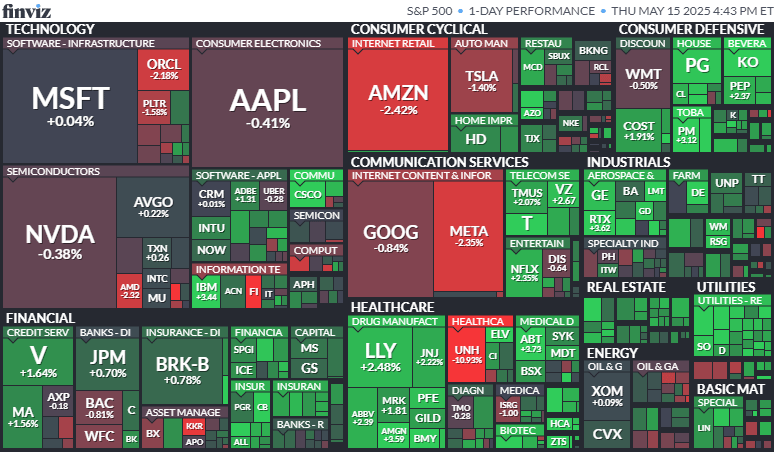

MARKET RECAP → The S&P 500 (VOO) rose for its fourth consecutive trading day, building on the momentum of easing tariff concerns.

CAVA'S Q1 EARNINGS BEAT EXPECTATIONS → 📈 Cava (CAVA) reported Q1 2025 earnings that exceeded expectations, with revenue up 25% year-over-year and same-store sales growth of 18%, driven by strong customer demand and new store openings.

U.S. AND UAE FORGE AI PARTNERSHIP →🤝 The United States and the United Arab Emirates have finalized a technology framework agreement to enhance collaboration in artificial intelligence and data infrastructure. This deal includes provisions for the UAE to import 500,000 of Nvidia's (NVDA) advanced AI chips annually starting in 2025. The agreement aims to bolster the UAE's position as a global AI hub while ensuring technology security commitments from both nations.

Cash Tag Mentions: $SPX ( ▲ 0.69% ), $CAVA ( ▲ 2.44% ), $NVDA ( ▲ 1.02% )

Was this email forwarded to you? Sign up for free here.

Earn rewards by referring friends. Scroll to the bottom to learn more! 👇

TODAY’S TOP NEWS

Cava's Q1 Earnings Beat Expectations

📈 Mediterranean fast-casual chain Cava (NYSE: CAVA) reported Q1 2025 earnings that surpassed analyst expectations, driven by robust same-store sales growth and successful new store openings.

🍽️ The company's revenue increased by 25% year-over-year, reaching $259 million, while same-store sales grew by 18%. Cava opened 15 new locations during the quarter, bringing its total to over 300 restaurants nationwide.

💰 Net income for the quarter was $12 million, or $0.12 per share, compared to $4 million, or $0.04 per share, in the same period last year. The company attributed its strong performance to increased customer demand for healthy, customizable dining options.

TODAY’S TOP NEWS

U.S. and UAE Forge AI Partnership

DALL-E

🤝 The United States and the United Arab Emirates have finalized a technology framework agreement to enhance collaboration in artificial intelligence and data infrastructure. This deal includes provisions for the UAE to import 500,000 of Nvidia's (NVDA) advanced AI chips annually starting in 2025. The agreement aims to bolster the UAE's position as a global AI hub while ensuring technology security commitments from both nations.

🏗️ Under the agreement, Emirati tech firm G42 will receive 100,000 chips per year, with the remainder allocated to U.S. companies like Microsoft and Oracle, which may also build data centers in the UAE. The deal stipulates that for every data center G42 constructs in the UAE, a comparable facility must be built in the United States, promoting bilateral infrastructure development.

🌐 This partnership reflects a strategic move by the U.S. to strengthen ties with the UAE amid global competition in AI development, particularly with China. By facilitating access to cutting-edge technology, the agreement positions the UAE as a potential third major player in the global AI landscape, alongside the U.S. and China.

KEEP READING

Coinbase Could Pay Customers Up to $400M for Data Breach (CoinDesk)

Trump heads to the Middle East with oil, trade and nuclear ambitions on the table (CNBC)

Walmart says it will hike some prices due to tariffs. Here’s what that means for shoppers (CNBC)

Enter for a chance to win 250K (ML)

How to Prepare Your Budget for Tariff Surcharges (ML)

Why You’ll Love the Money Master Challenge – Your Daily Finance Game! (ML)

WHAT WE’RE WATCHING

OUR FAVORITE TOOLS & RESOURCES

Polymarket — The world’s largest prediction market

Unusual Whales — Companion for uncovering unusual market activity

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

CME FedWatch Tool — Market-implied probabilities of future levels of interest rates

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

ChatGPT — Large language model-based chatbot powered by generative AI

Vimcal — Lightning-fast calendar and AI scheduling assistant

REFERRAL PROGRAM

WE WANT YOUR FEEDBACK

How would you rate today's newsletter?

Investment advisory services provided by ML Wealth LLC. Investment Accounts Are Not FDIC Insured • No Bank Guarantee • Investments May Lose Value. For important information and disclosures relating to the MoneyLion Investment Account, see Investment FAQs, Form ADV Brochure, and moneylion.com/investing. Funded managed investing accounts are subject to a monthly account fee of $1 (for accounts valued up to $5,000), $3 (for accounts valued over $5,000, and up to $25,000), or $5 (for accounts valued over $25,000).

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.