TLDR

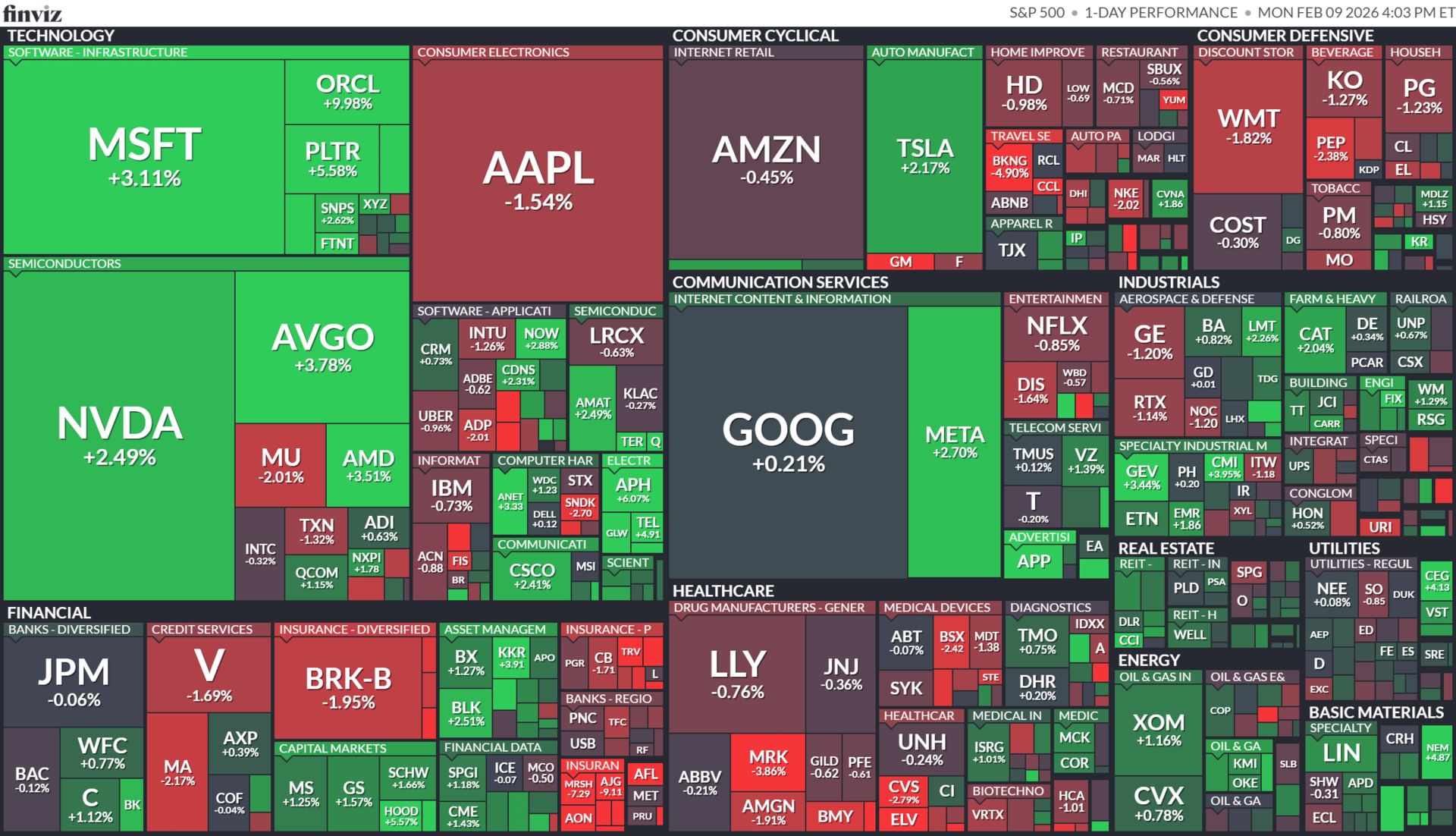

⚡ MARKET RECAP → The S&P 500 (VOO) closed higher Monday as tech stocks rebounded.

📺 WEGOVY AD WARNING →The FDA called a TV ad for Novo Nordisk’s Wegovy weight-loss pill “false or misleading” for implying superior benefits versus other GLP-1 drugs. Novo is responding to the agency’s letter as its stock reaction moderates.

✈️ CUBA RUNS OUT OF JET FUEL→ Cuba says it will run out of jet fuel from Feb. 10 to March 11, forcing airlines to refuel abroad or cancel services. The crisis — blamed on U.S. sanctions and oil supply cuts — threatens aviation, tourism, and broader energy services with global political and economic ramifications.

Was this email forwarded to you? Sign up for free here.

MARKETS

Market Snapshot

Today’s S&P 500 Heatmap

Notable Earnings

For the week beginning February 9, 2026

PHARMACEUTICAL

WEGOVY AD CONTROVERSY

Gemini

🚨 FDA Flags Misleading Commercial: The U.S. Food and Drug Administration has deemed a television advertisement for Novo Nordisk’s (NYSE: NVO) Wegovy weight-loss pill “false or misleading.” The agency sent an untitled letter dated February 5 asserting that the ad improperly implies the pill offers unique advantages over other GLP-1 drugs and suggests emotional or lifestyle benefits not supported by evidence.

📉 Marketing Claims Under Scrutiny: The FDA said certain phrases like “live lighter” and “a way forward” could mislead consumers into believing the Wegovy pill delivers superior weight loss or psychological benefits compared with competitor treatments—claims not backed by data. The letter also noted discrepancies between on-screen text and audio in the ad, violating promotional rules under the Federal Food, Drug, and Cosmetic Act.

💊 Novo’s Response and Market Impact: Novo Nordisk acknowledged receiving the FDA letter and said it is addressing the agency’s concerns and will respond appropriately. Shares of Novo Nordisk pared earlier gains after the news, reflecting investor caution around regulatory pressures and the broader competitive landscape for GLP-1 weight-loss medications.

POLITICS

CUBA JET FUEL CRISIS

Gemini

⛽Jet Fuel Shortage Forces Airline Changes: Cuba warned international airlines that jet fuel will not be available at its airports from Feb. 10 through March 11, meaning carriers will need to arrange refueling stops elsewhere or risk grounding flights. This impacts flights at major hubs including Havana and several provincial airports. Airlines such as Air Canada have already suspended flights due to the shortage.

⚡U.S. Pressure and Oil Supply Cut: The fuel shortfall stems from an energy crisis made worse by U.S. sanctions and pressure on Cuba’s oil suppliers, especially after Venezuela — Cuba’s largest fuel source — stopped shipments under U.S. influence, and Trump threatened tariffs on countries that sell oil to Havana. Havana blames the U.S. “blockade” for choking off vital petroleum supplies

✈️ Broader Impact & International Response: Anthropic — already backed by Amazon and Alphabet — is pushing deeper into enterprise with a model explicitly tuned for knowledge work just as it gears up for a potential IPO in the ~$300–350 billion valuation range. That’s bullish for AI infra names and cloud partners feeding Claude’s compute habit, but it reinforces the bear case that some traditional software and data vendors become “skins” on top of increasingly capable AI, not the main event.

KEEP READING

White House launches direct-to-consumer drug site TrumpRx. Here’s what to know (CNBC)

Amazon plunges 9%, continues Big Tech’s $1 trillion wipeout as AI bubble fears ignite sell-off (CNBC)

India is reportedly ‘ready’ to buy up to $80 billion in Boeing aircraft following trade deal with U.S. (CNBC)

NOTABLE POSTS

WHAT WE’RE WATCHING

Tools & Resources

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

AltIndex — Alternative datasets to uncover unique insights

GFR Smart Stock Selector — Filters stocks to help investor choices

WE WANT YOUR FEEDBACK

How would you rate today's newsletter?

Investment advisory services provided by ML Wealth LLC. Investment Accounts Are Not FDIC Insured • No Bank Guarantee • Investments May Lose Value. For important information and disclosures relating to the MoneyLion Investment Account, see Investment FAQs, Form ADV Brochure, and moneylion.com/investing. Funded managed investing accounts are subject to a monthly account fee of $1 (for accounts valued up to $5,000), $3 (for accounts valued over $5,000, and up to $25,000), or $5 (for accounts valued over $25,000).

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.